This report was written by Tiger Research, examining how tokenization lowers investment barriers in the pre-IPO equity market through case studies of Ventuals, Jarsy, and PreStocks.

TL;DR

Despite offering high returns, the private equity market remains largely inaccessible to retail investors, favoring institutions and high-net-worth individuals.

Tokenization could address limitations of the traditional financial system—particularly around liquidity, access, and convenience—but significant legal and technical constraints remain.

Projects like Ventures, Zoshi, and FreeStock are exploring different approaches to tokenizing private equity. While still in early stages, these efforts signal the potential to reduce structural barriers in the market.

1. The Allure of Private Equity—But Not for You

How can someone invest in SpaceX or OpenAI? As private companies, they’re off-limits to most investors. Retail access is virtually nonexistent—investment opportunities typically arise only post-IPO.

The key issue is exclusion from the substantial returns generated in the private market. Over the past 25 years, private markets have created roughly three times more value than public markets.

Two structural factors explain this. First, capital raising is a highly sensitive process for private firms. Regardless of investor qualifications, deals tend to go to well-known institutional investors. Second, the growth of private capital markets has expanded financing options. Many firms can now raise billions without going public.

OpenAI exemplifies both dynamics. In October 2024, it raised $6.6 billion from major investors including Thrive Capital, Microsoft, Nvidia, and SoftBank. By March 2025, it secured an additional $40 billion in what became the largest private funding round in history, led by SoftBank with participation from Microsoft, Coatue, and Altimeter.

This illustrates a system where only a select group of institutional investors gain access, while a well-developed private capital infrastructure gives companies alternatives to public listings.

As a result, today's investment landscape is increasingly exclusive—deepening inequality in access to high-growth opportunities.

2. Equal Access—Can Tokenization Address Structural Barriers?

Can tokenization offer a real solution to structural inequality in private equity markets?

On the surface, the model is appealing: real-world assets are converted into digital tokens, enabling fractional ownership and facilitating 24/7 trading in global markets. But in essence, tokenization simply repackages existing assets—like pre-IPO equity—into a new format. Solutions for improving access already exist within traditional finance.

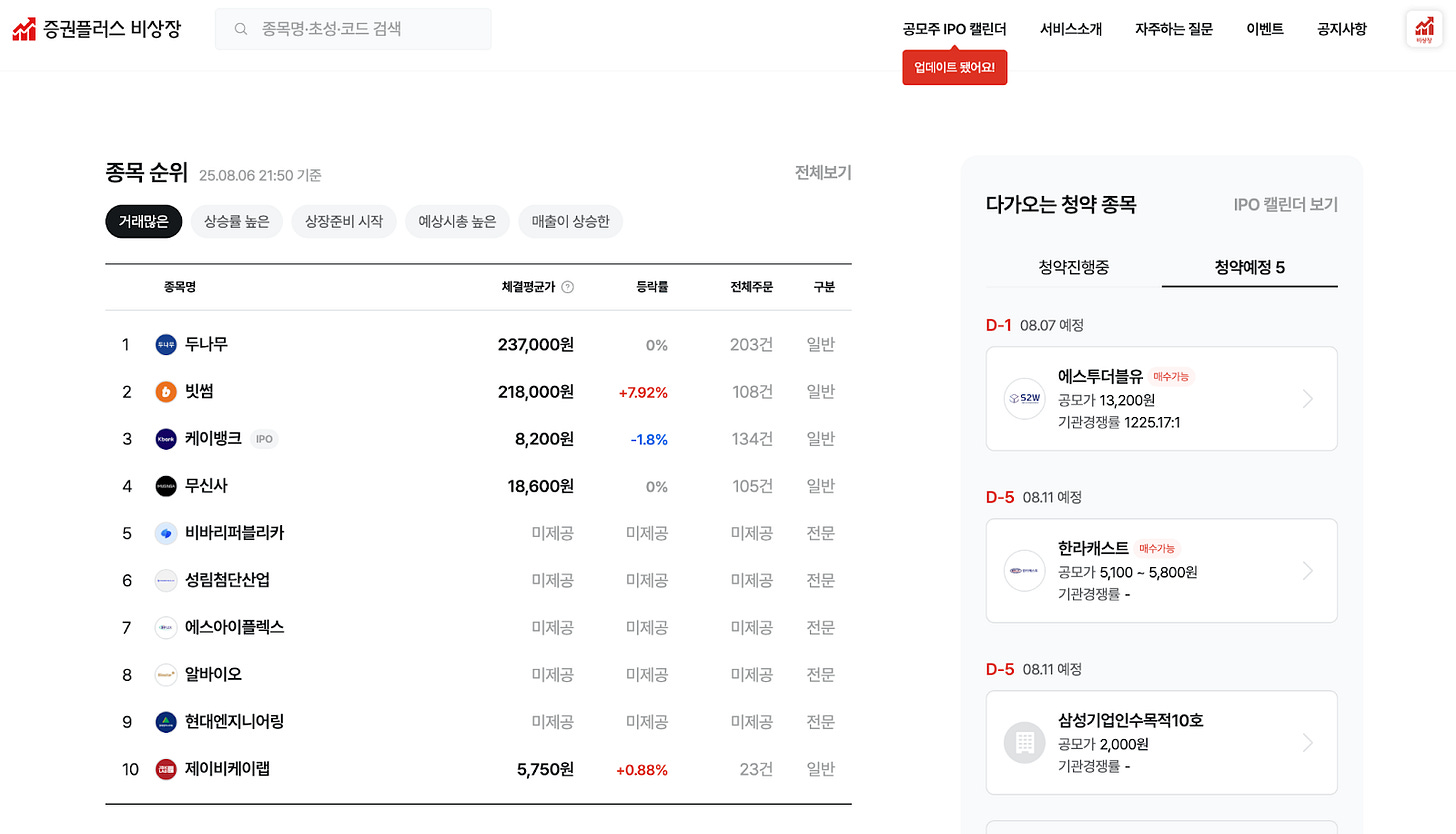

For instance, platforms such as Dunamu’s Ustockplus in Korea, and Forge or EquityZen in the U.S., allow retail investors to access private shares within existing regulatory frameworks.

So, what differentiates tokenization?

The key distinction lies in market structure. Traditional platforms operate on a peer-to-peer (P2P) matching basis—buyers must respond to sell orders. Without a counterparty, transactions can’t be completed. This model suffers from low liquidity, limited price discovery, and unpredictable execution timelines.

Tokenization has the potential to address these structural constraints. If tokenized assets are listed on CEX or DEX, liquidity pools or market makers can provide continuous counterparties, improving execution and pricing efficiency. Beyond reducing friction, this approach redefines the market architecture.

Additionally, tokenization enables financial features not feasible in traditional systems. Smart contracts can automate dividends, enforce conditional trades, or enable programmable governance rights. These functions allow for entirely new types of financial instruments to emerge—ones that are both flexible and transparent by design.

3. Projects Attempting to Tokenize Pre-IPO Equity

3.1. Ventuals

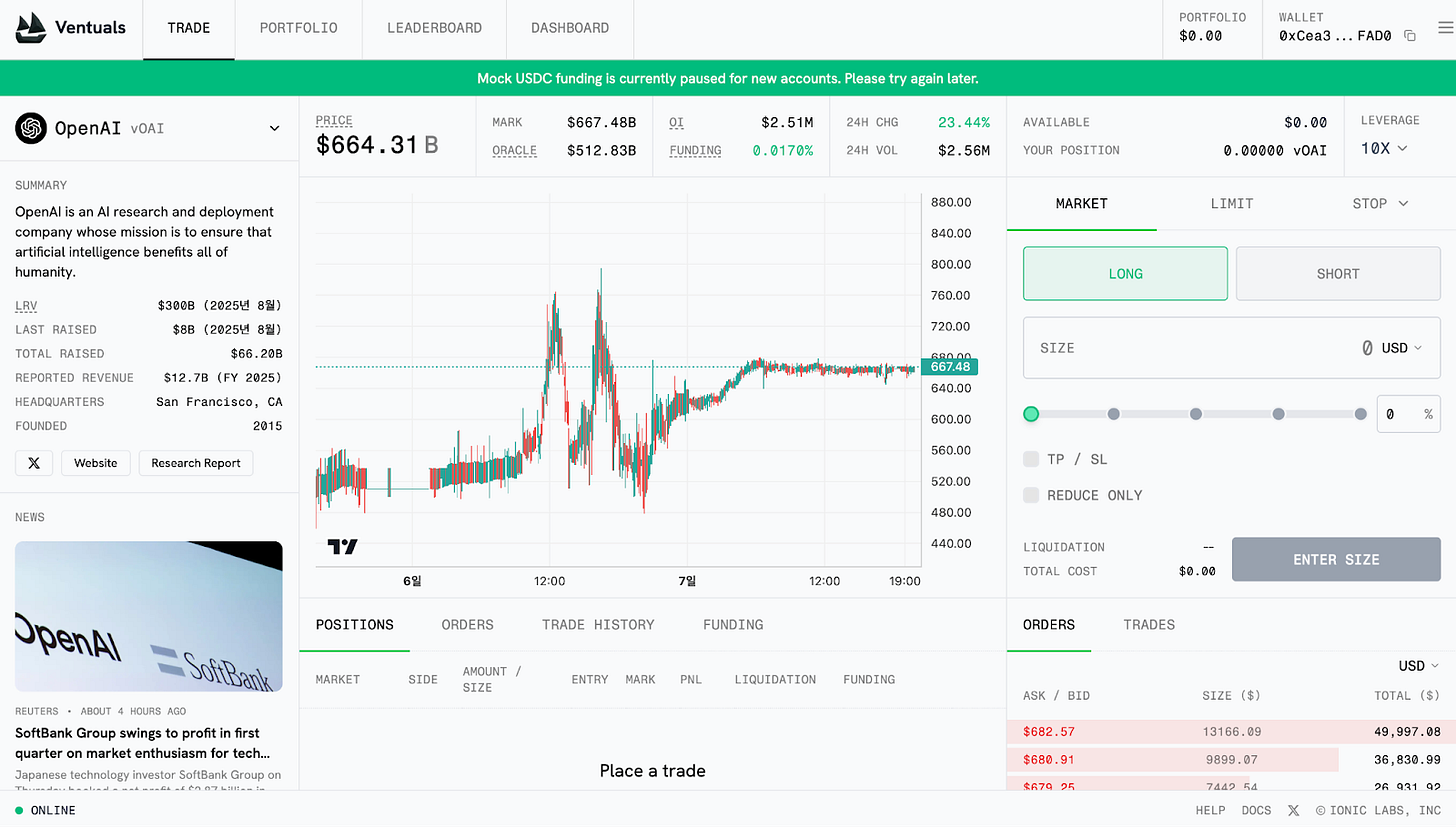

Ventuals is built on a perpetual futures structure. Its core advantage lies in enabling derivative trading without requiring ownership of the underlying asset. This allows the platform to list a wide range of pre-IPO stocks quickly, bypassing typical regulatory requirements such as identity verification or accredited investor status.

The perpetual futures are implemented via Hyperliquid’s HIP-3 standard. However, this standard currently operates only on testnet, and Ventuals remains in a pre-launch phase.

Its pricing model is also unconventional. Instead of using share price or actual market transactions, token prices are calculated by dividing the company’s total valuation by one billion. For example, if OpenAI is valued at $35 billion, the price of one vOAI token would be $350.

This ease of access, however, comes with structural challenges—most notably, oracle dependency. Valuation data for private companies is inherently opaque and updated infrequently. Derivatives based on such incomplete information can exacerbate informational asymmetries in the market.

3.2. Jarsy

Jarsy uses a 1:1 asset-backed tokenization model. Its core mechanism involves directly acquiring pre-IPO shares and issuing one token for each share held. For instance, if Jarsy holds 1,000 shares of SpaceX, it mints 1,000 JSPAX tokens. While investors do not hold the underlying shares themselves, they are entitled to all associated economic rights—including dividends and price appreciation.

This model is made possible by Jarsy acting as an asset management entity. The platform first gauges investor demand through a pre-sale token, then uses the pooled capital to acquire actual shares. If the purchase is successful, pre-sale tokens convert into formal tokens; otherwise, funds are refunded. All assets are held in SPV, and real-time verification is available through a Proof of Reserve page.

The platform also lowers the entry barrier significantly, with a minimum investment of just $10. There are no accreditation requirements for investors outside the U.S., expanding global accessibility. All transaction records and asset holdings are stored on-chain, ensuring auditability and transparency.

However, the model faces structural limitations. The most pressing issue is liquidity, which stems from the limited scale of assets held per company. For example, Jarsy's current holdings total approximately $350,000 for X.AI, $490,000 for Circle, and $670,000 for SpaceX. In such thin markets, even modest sell orders from large holders can trigger significant price swings. Given the opaque and illiquid nature of private equity, price discovery is also inherently difficult, further amplifying volatility.

Moreover, while asset-backed tokenization offers stability, it constrains scalability. Each new token offering requires actual share acquisition—a process that involves negotiation, regulatory coordination, and potential sourcing delays. This hampers the platform's ability to respond to fast-moving market trends.

That said, Jarsy remains in its early phase, having launched just over a year ago. With a growing user base and increasing AUM, the liquidity issue may diminish over time. As the platform scales, broader coverage and deeper pools of tokenized equity could naturally lead to more stable and efficient markets.

3.3. PreStocks

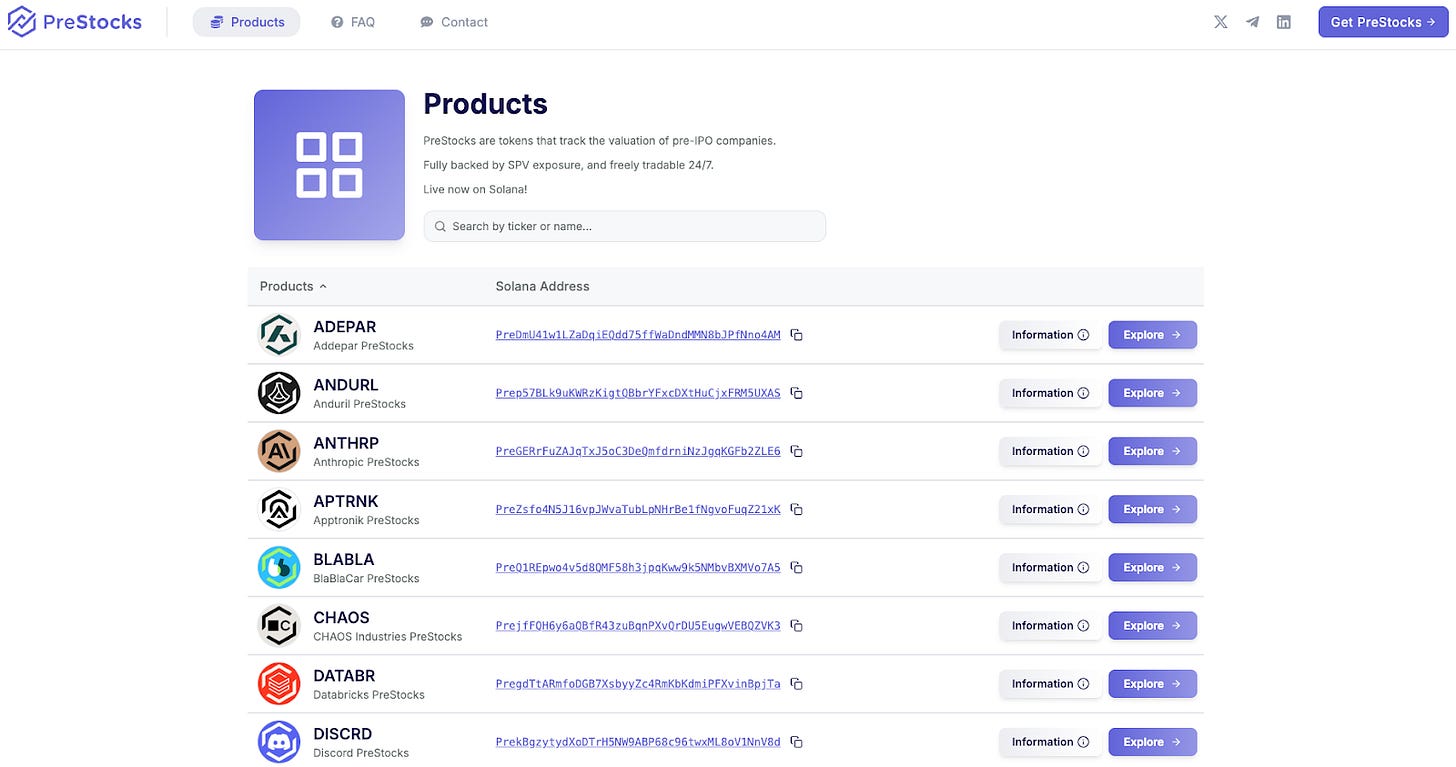

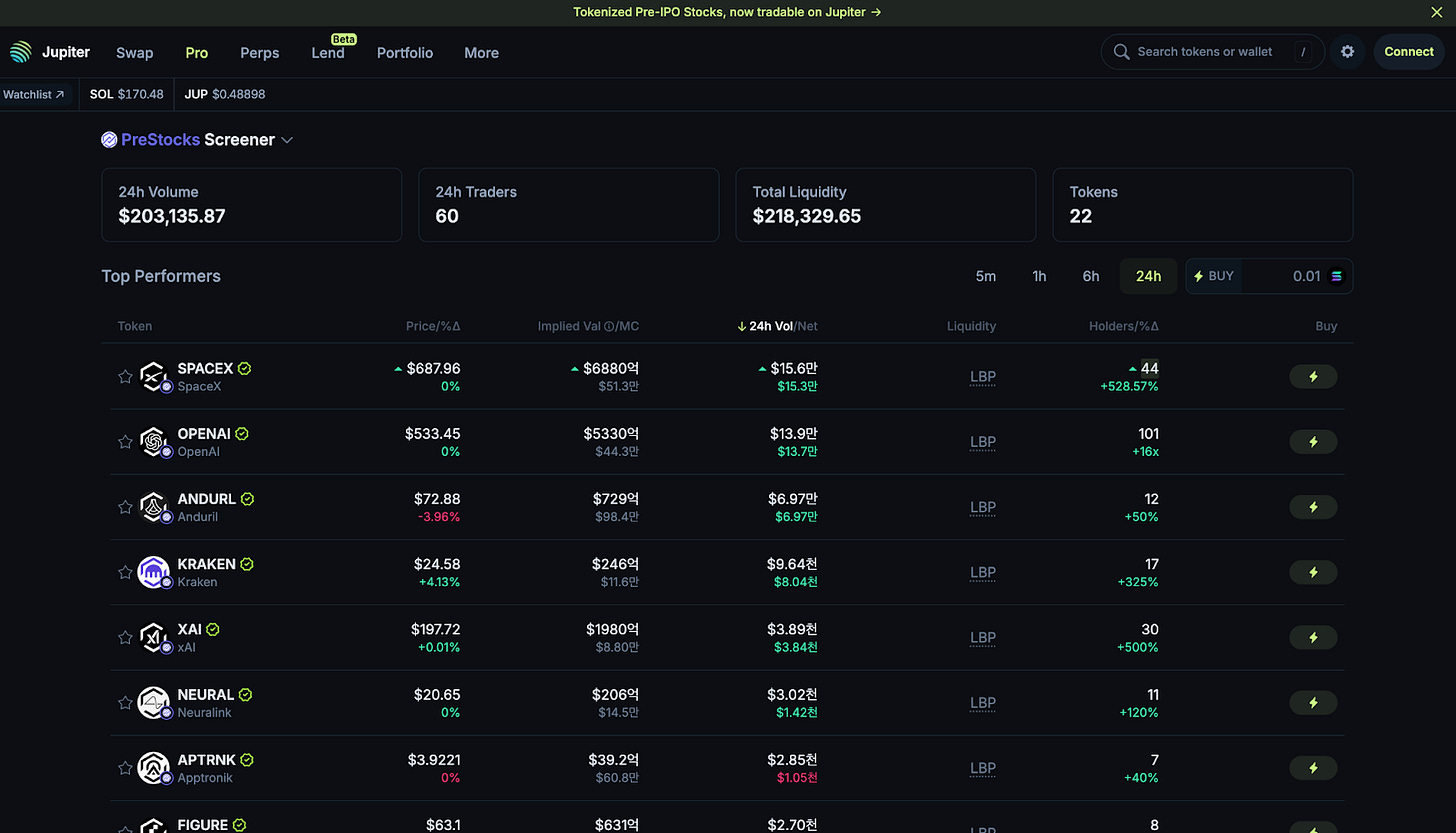

PreStocks adopts a similar model to Jarsy, purchasing shares of private companies and issuing tokens backed on a 1:1 basis. The platform currently supports trading for 22 pre-IPO stocks and recently launched its product to the public.

Built on the Solana blockchain, PreStocks enables trading through integrations with Jupiter and Meteora. It offers 24/7 trading with instant settlement and imposes no management or performance fees. There is no minimum investment requirement, and anyone with a Solana-compatible wallet can participate—lowering the barrier to entry.

However, certain limitations apply. The platform is not accessible to users in the U.S. and other major jurisdictions. Although all tokens are said to be fully collateralized by underlying shares, PreStocks has not publicly disclosed detailed documentation to verify each position. The team has stated that it will issue regular external audit reports and, upon request, provide individual verification for a fee.

Compared to Jarsy, PreStocks is more tightly integrated with decentralized exchanges (DEXs), which could allow for broader secondary use cases such as token-based lending. Within the Solana ecosystem, where tokenized public equities (e.g., xStock) already see active usage, PreStocks may benefit from ecosystem-level synergies.

4. Unresolved Barriers in the Tokenization of Pre-IPO Stocks

The market for tokenized equities is beginning to take shape. While platforms like Ventuals, Jarsy, and PreStocks are showing early momentum, significant structural challenges remain.

First, regulatory uncertainty is the most fundamental obstacle.

Most jurisdictions still lack clear legal frameworks for tokenized securities. As a result, many platforms operate in regulatory gray zones, leveraging jurisdictional arbitrage to stay active without direct compliance.

Second, resistance from private companies remains a critical barrier.

In June 2025, Robinhood announced a new service offering tokenized exposure to companies like OpenAI and SpaceX for EU customers. OpenAI immediately issued a public objection, stating: “These tokens do not represent equity in OpenAI, and we have no partnership with Robinhood.”

This response highlights the unwillingness of private firms to relinquish control over cap tables and investor management—an essential function they tightly guard.

Third, the technical and operational complexity cannot be overlooked.

Maintaining a reliable linkage between real-world assets and tokens, navigating cross-border compliance, handling tax implications, and enabling shareholder rights enforcement are all nontrivial challenges. These issues can severely limit user experience and scalability.

Despite these constraints, market participants are actively pursuing workarounds. Robinhood, for example, has stated its intent to expand its token offerings to thousands of assets by year-end—despite public criticism. Platforms like Ventuals, Jarsy, and PreStocks are also pressing forward with differentiated approaches to tokenizing equity access.

In short, tokenization offers a promising path to improving access to private equity, but the space remains in its infancy. The current limitations are real, yet history in the crypto space suggests that technological breakthroughs and rapid market adaptation can—and often do—redefine what’s possible.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.