This report was written by Tiger Research, analyzing Bitcoin's DeFi protocol layer, examining how lending, staking, and trading applications are transforming Bitcoin from a passive store of value into productive collateral within the BTCFi ecosystem.

TL;DR

The Protocol Layer is BTCFi’s front line: turning Bitcoin from a passive store of value into productive collateral through lending, staking, and user-friendly apps.

Lending & Credit are surging: protocols like Maple and IXS bring institutional-grade, regulated credit markets to Bitcoin, offering real yield and safer liquidity access.

Staking & Restaking create the BTCFi flywheel: Babylon enables base staking, Solv/Lombard issue liquid staking tokens, and SatLayer unlocks restaking — stacking yields and expanding Bitcoin’s role in DeFi.

1. Why the Protocol Layer Is BTCFi’s Front Line

Bitcoin’s DeFi infrastructure has rapidly matured from sidechains and rollups to wrapped BTC and cross-chain bridges, but those are only the pipes of the system. Capital doesn’t flow without user-facing applications.

Just as Ethereum’s 2020 “DeFi Summer” was catalyzed by protocols like Compound, Maker, and Aave turning static ERC-20s into yield-bearing assets, BTCFi now needs its own ‘killer apps’ to activate Bitcoin’s liquidity.

Without these killer apps, Bitcoin’s infrastructure would remain underutilized. In practical terms, this “front line” is where BTC holders actually engage: depositing BTC to earn interest, swapping assets, or staking BTC for yield.

As of 2025, this structure is beginning to materialize. After years of infrastructure buildout, Bitcoin’s ecosystem now supports a functional DeFi stack, with early applications already in operation.

2. Lending & Credit: Unlocking Bitcoin’s Liquidity

Lending protocols are foundational to capital efficiency in BTCFi, enabling Bitcoin holders to access liquidity without liquidating their assets. In traditional finance, credit markets connect borrowers and lenders to allocate capital productively. BTCFi seeks to replicate this function on Bitcoin’s infrastructure.

Two primary models are emerging. The first is overcollateralized lending, such as borrowing stablecoins against BTC collateral. The second is undercollateralized credit extended to vetted institutions. With Bitcoin itself yielding 0% when idle, these markets convert static holdings into productive capital, allowing holders either to earn yield or to unlock liquidity for redeployment.

2.1. Maple Finance: Institutional Credit on Bitcoin

Maple Finance is purpose-built for institutions and plays a central role in channeling professional capital into the BTCFi ecosystem. It operates curated, permissioned liquidity pools that extend loans to vetted corporate borrowers, similar to the model used by traditional asset managers and banks. Loan terms are set through rigorous credit assessments that evaluate borrower risk and collateral quality.

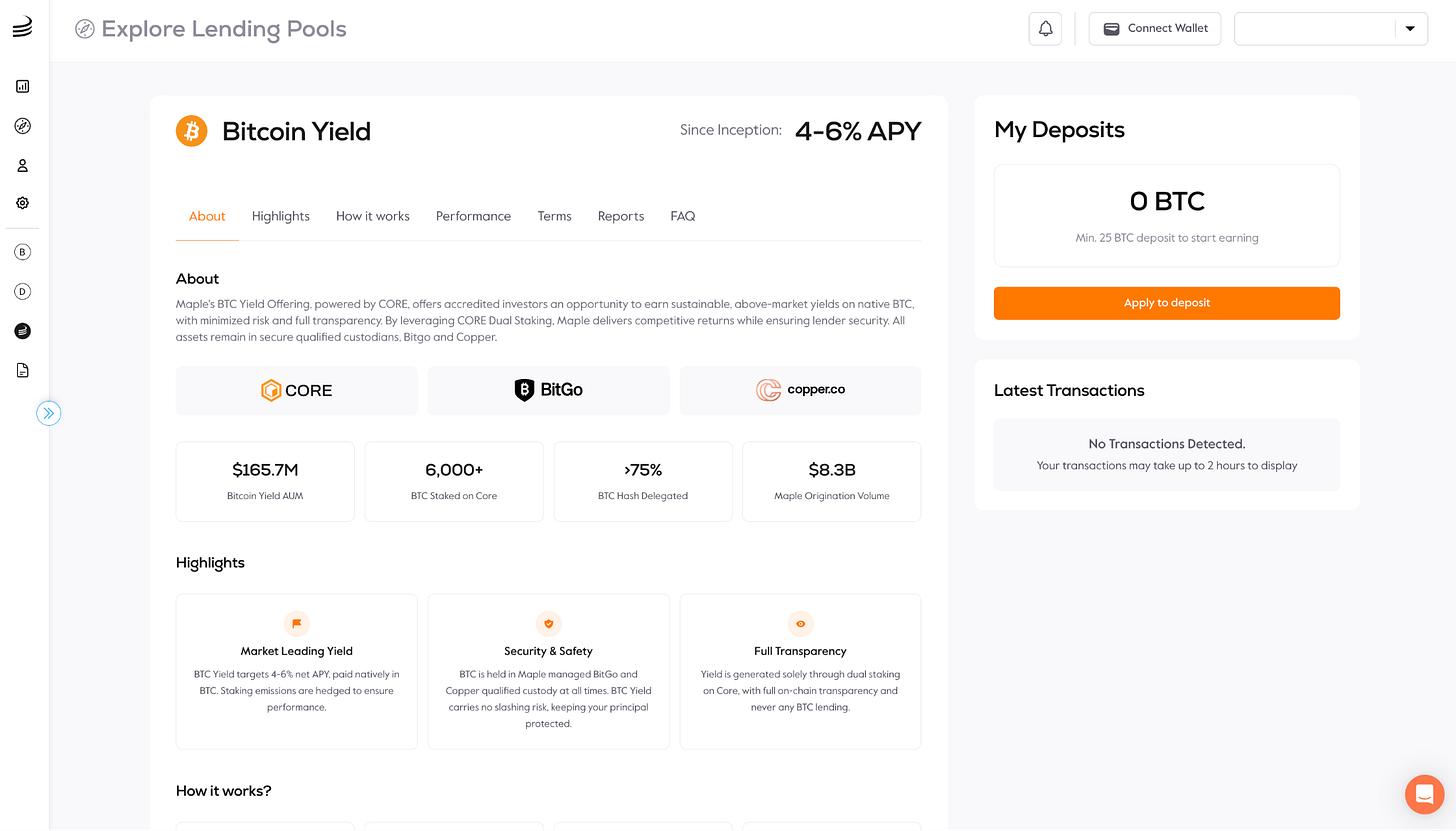

In 2025, Maple expanded this model to Bitcoin. Through a partnership with the Bitcoin Layer 2 network Core DAO, it introduced yield-generating BTC products that allow institutions to earn returns while holding Bitcoin.

This approach reflects a broader trend of institutional adoption, where Bitcoin is managed not as an idle reserve but as a strategic asset deployed across diversified use cases.

2.2. IXS: Regulated BTC Yield

IXS (Institutional eXchange Settlement layer) takes a distinctive approach by combining DeFi structures with regulated finance. Licensed under the Bahamas’ DARE Act, IXS launched its “BTC Real Yield” product, designed to let Bitcoin holders earn returns without liquidating their BTC positions.

The structure is straightforward. Investors deposit BTC as collateral, and IXS uses that collateral to mint stablecoins, which are then invested in tokenized real-world assets (RWAs) such as U.S. Treasuries and money market funds. This allows investors to gain exposure to RWA yields while retaining Bitcoin ownership.

Credibility is reinforced through partnerships with institutional-grade custodians such as Fireblocks, along with the regulatory framework underpinning operations. The result is a model that illustrates how regulated BTCFi protocols can channel institutional adoption and extend Bitcoin’s role within compliant investment structures.

3. DEXs: Where Bitcoin Meets Liquidity

A mature BTCFi ecosystem requires more than lending and yield generation. Decentralized trading infrastructure is essential for Bitcoin holders to transact, swap, and access liquidity without depending on centralized exchanges. Such protocols preserve Bitcoin’s core principles of self-custody, censorship resistance, and trust minimization.

Bitcoin’s base layer, however, was not designed for DeFi. It lacks native smart contract functionality, which complicates the construction of traditional DEXs. Early approaches such as atomic swaps demonstrated technical feasibility but were limited by poor user experience. A new generation of BTCFi trading platforms is now addressing these constraints and broadening Bitcoin’s utility.

These platforms follow different models. Some facilitate cross-chain atomic swaps, enabling trustless exchange of BTC for assets on networks such as Ethereum or Solana. Others enable trading within Bitcoin Layer 2s or sidechains that support smart contract execution. In both cases, Bitcoin remains central—whether as collateral, liquidity, or the final settlement layer.

By extending Bitcoin’s role in trading without compromising on security or custody, BTCFi protocols open new liquidity pathways. This allows participants to move more efficiently between assets, yield opportunities, and DeFi applications.

3.1. Portal: A Bitcoin-Native Cross-Chain DEX

Portal (Portal to Bitcoin) represents a leading example of Bitcoin-native trading innovation, designed to deliver what the industry has long lacked: a trustless, Uniswap-like DEX between Bitcoin and other major crypto ecosystems.

Portal is positioning itself as a key liquidity layer for BTCFi by making Bitcoin tradeable across ecosystems without custodians or wrapped assets. While most BTC liquidity today flows through centralized exchanges, Portal’s goal is to offer a trustless, user-friendly alternative that keeps Bitcoin at the center of settlement.

Unlike earlier attempts, Portal emphasizes performance and usability, aiming to match centralized platforms while preserving self-custody and censorship resistance. By integrating with Bitcoin’s scaling layers and enabling direct swaps into other ecosystems, it reduces friction for BTC holders accessing DeFi.

Crucially, Portal avoids the pitfalls of existing cross-chain solutions, which often obscure custodial risks or rely on centralized validators. In its design, the worst possible failure is censorship — not loss of funds. By eliminating wrapped assets and intermediaries, Portal ensures Bitcoin remains both the capital and consensus layer.

The project has not yet launched, but if successful, it could become the trading gateway that finally unlocks Bitcoin’s liquidity in a decentralized way.

4. Staking & Restaking: Bitcoin’s Yield Stack

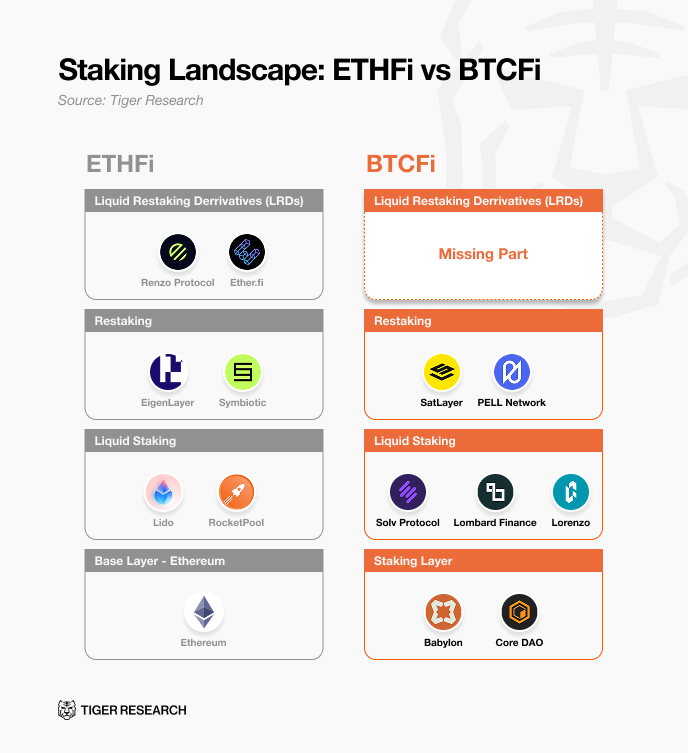

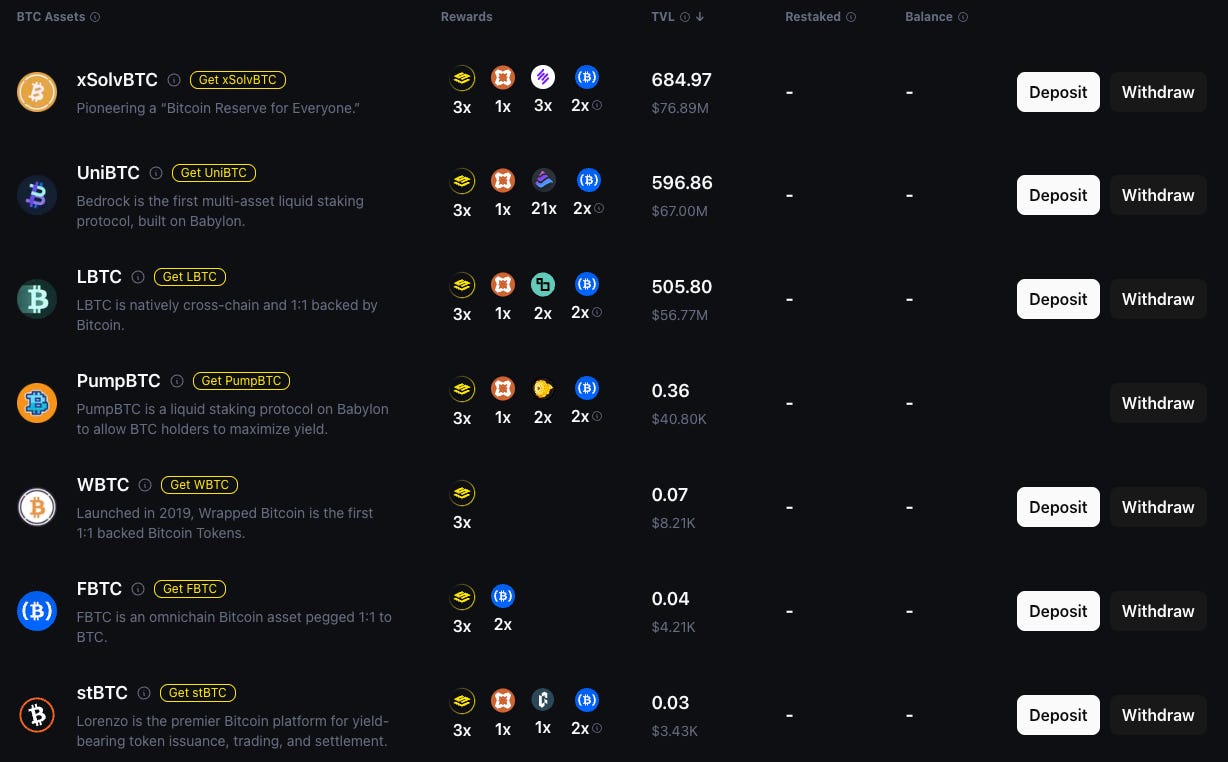

BTCFi’s staking stack is emerging as a way to transform idle BTC into a productive asset through three conceptual layers: a base staking layer (Babylon), a liquid staking token (LST) layer (e.g., Solv, Lombard), and a restaking layer (SatLayer).

In concept, this mirrors Ethereum’s stack: Ethereum has base ETH staking, liquid staking projects like Lido, EigenLayer for restaking, and the liquid restaking protocol like Renzo. In addition, while Ethereum already has liquid restaking derivatives, this component is still missing in BTCFi’s stack, highlighting an area for future development.

Unlike Ethereum, Bitcoin lacks native smart contracts or staking; BTCFi relies on an external chain like Babylon and clever use of Bitcoin’s primitives to enable staking without custody. Bitcoin’s base layer also can’t directly enforce slashing or multi-use of stake, so BTCFi must coordinate via Bitcoin-secured sidechains/L2s.

4.1. Babylon: Core Infrastructure for BTC Staking

Babylon has emerged as the foundational Bitcoin staking platform powering the BTCFi ecosystem. It enables BTC holders to stake directly into Proof-of-Stake networks without intermediaries or wrapped tokens, turning Bitcoin from a passive store of value into an active yield-bearing asset.

Launched in 2024, Babylon’s self-custodial design and reliance on Bitcoin finality quickly positioned it as the dominant BTC staking infrastructure. By mid-2025, over $5–6B in BTC is staked through Babylon, around 80% of total BTCFi TVL, underscoring its role as the de facto standard.

Strategically, Babylon acts as the core security layer for Bitcoin DeFi. PoS chains integrate with it to inherit Bitcoin’s economic weight and settlement assurances, with ecosystems like Cosmos projects and hybrid chains (e.g., BOB) adopting it as a Bitcoin Secured Network.

4.2. Solv: Bridging Bitcoin’s Liquidity to Multi-Chain Yield

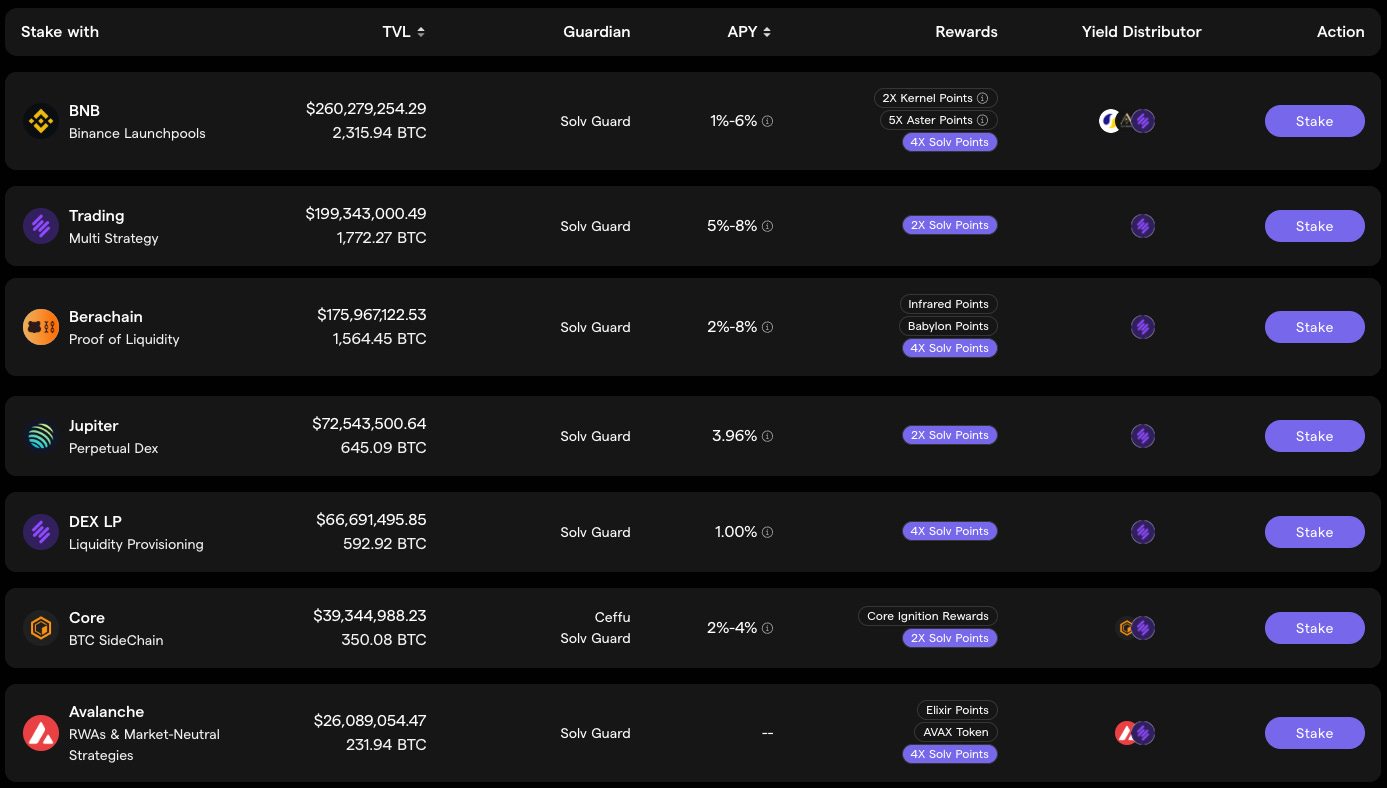

Solv takes a multi-chain approach to Bitcoin staking and yield aggregation, unlocking idle BTC through SolvBTC, a native token pegged 1:1 to Bitcoin. SolvBTC can move seamlessly across ecosystems, powering Solv’s yield strategies that span from staking to real-world assets. In 2025, Solv launched BTC+, an institutional yield vault combining decentralized, centralized, and traditional finance returns, explicitly targeting the $1T+ in dormant Bitcoin.

Positioned as a “BlackRock for Bitcoin,” Solv standardizes staking and yield through its Staking Abstraction Layer (SAL), allowing users to earn native yields via liquid staking tokens (SolvBTC.LSTs) and then redeploy them into protocols such as Babylon, EigenLayer, and Symbiotic. Behind the scenes, Solv automates allocation and yield distribution, offering a diversified, asset-management-like experience that blends crypto-native and traditional strategies, from DeFi yields to basis arbitrage and tokenized funds.

By mid-2025, Solv had attracted around $2.0B TVL, ranking among the top three BTCFi protocols. Backed by $25M in funding and rigorous security audits, Solv has gained traction as a secure, institution-ready platform. Its model aligns with broader market demand: financial giants like Coinbase and JPMorgan are moving into Bitcoin yield, while Solv offers a decentralized counterpart with comparable returns.

For institutions, Solv serves as a bridge between traditional capital and crypto, packaging Bitcoin yield opportunities across on-chain and off-chain markets into one accessible format. As BTCFi matures, Solv’s breadth and multi-pronged strategy position it to become a benchmark manager of institutional Bitcoin yield funds, channeling long-dormant BTC into productive capital.

4.3. SatLayer: Extending Bitcoin’s Reach through Restaking

SatLayer is the top of the BTCFi pyramid: a restaking protocol that reuses staked BTC or LSTs to secure off-chain services, or Bitcoin-Validated Services (BVSs). Like EigenLayer on Ethereum, SatLayer lets BTC holders deposit into vaults and delegate stake to node operators running service. If operators misbehave, their stake can be slashed.

Strategically, SatLayer positions itself as a universal Bitcoin yield layer, complementing rather than competing with core staking protocols. It integrates with dozens of blockchains and service protocols (e.g., Sui, Berachain, Bitlayer) to provide yield tied to real usage fees rather than inflationary emissions, an important distinction for institutions seeking sustainable returns.

Just as EigenLayer expanded Ethereum’s staking economy into a foundation for new services, SatLayer seeks to do the same for Bitcoin. In this sense, it could become to BTCFi what EigenLayer is to ETH DeFi: the critical layer that compounds utility on top of base staking.

5. The BTCFi Flywheel & Outlook

A typical BTCFi flow: a user stakes BTC via Babylon and receives LBTC or SolvBTC. That LST can be used in DeFi or deposited into SatLayer to earn BVS rewards. Original BTC secures BSNs and earns staking yield, while SatLayer rewards accrue in BTC or token form. Yield flows back to the BTC holder either via LST appreciation or direct token rewards.

This creates a flywheel: more staked BTC enables more services, generating more yield and attracting more BTC. Bitcoin, long passive, becomes a productive capital asset. Even 5–10% of Bitcoin’s supply entering staking would mean tens of billions in liquidity powering crypto markets. Ethereum’s LST sector is ~$38B; Bitcoin’s is ~$2.5B. The upside is immense.

Looking at the future, the next wave may include RWA platforms, stablecoins, or institutional ETFs built atop this stack. If it scales securely, BTCFi could turn Bitcoin’s dormant capital into a foundational force in decentralized finance.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.