Korean Enterprises: A Deep Dive into Their Cryptocurrency Holdings

How Institutions Are Boosting Crypto Holdings

TL;DR

Although the Korean cryptocurrency market continues to decline, there is an uprise in cryptocurrency holdings by companies. In fact, 37 listed companies hold KRW 201 billion (roughly USD $160 million) worth of crypto assets.

The largest proportion is cryptocurrencies issued directly by the company for crypto-related business operations. They also hold assets such as stablecoins as investment reserves, or BTC and ETH which have been acquired for investment purposes.

In the future, disclosure of companies holding crypto assets will become mandatory, and a more transparent and secure investment environment is expected.

Introduction

While the Korean cryptocurrency market continues on a downward trend, corporate-oriented cryptocurrency holdings is on a rise. In fact, according to a survey by the Financial Services Commission as of June 2022, a total of 37 domestic listed companies have acquired and held crypto assets. In addition, the market value of third-party-issued crypto assets held by said companies is estimated to be around KRW 201 billion (roughly USD $160 million). These findings suggest that domestic companies are expanding their crypto-related businesses and are actively investing in the market as well.

Status of Korean listed companies with crypto assets

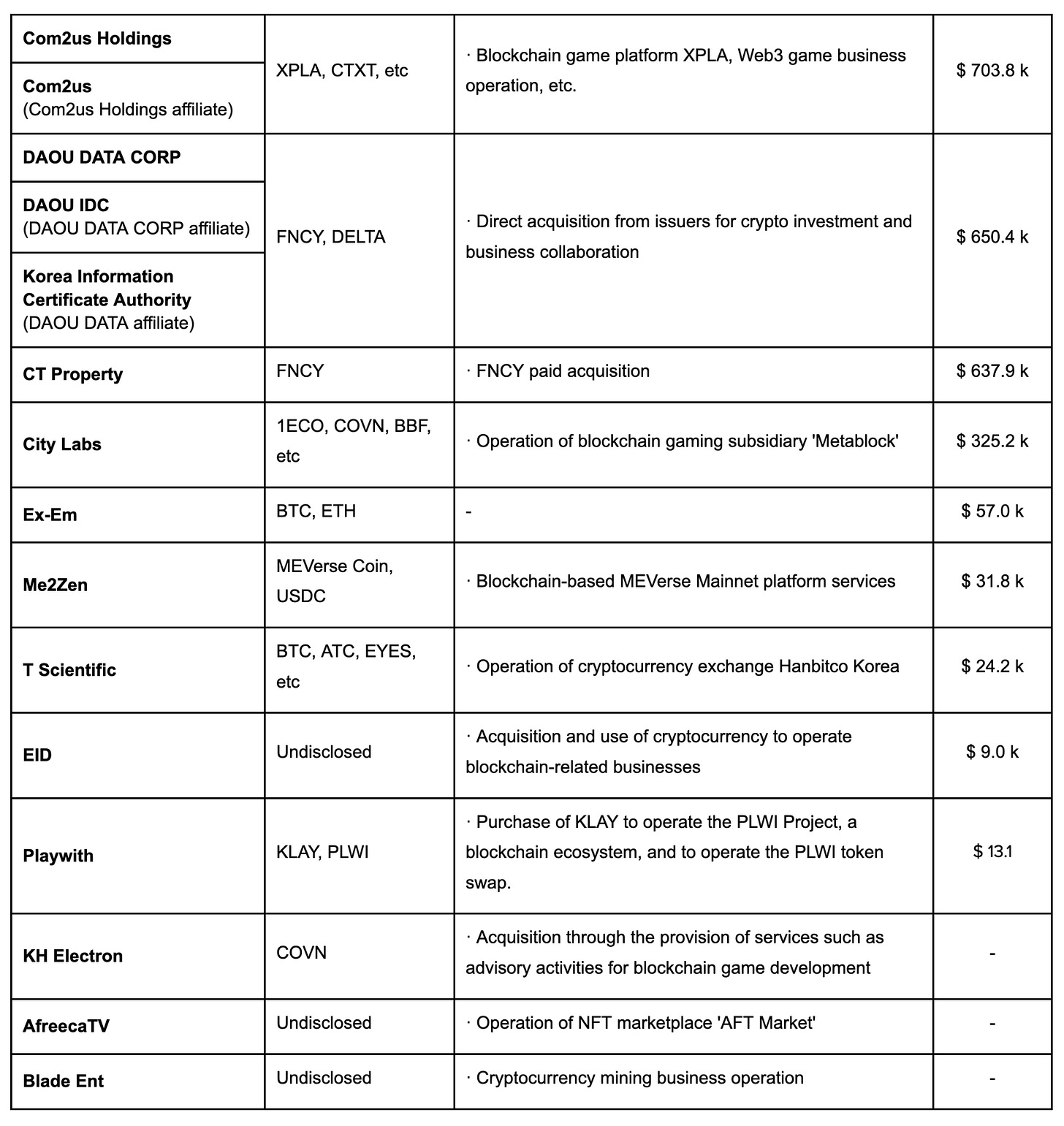

The Financial Services Commission's '2022 Survey on Cryptocurrency Holdings of Domestic Listed Companies' does not show detailed company names, making it difficult to determine which companies hold cryptocurrencies. We conducted our own research and found that various listed companies held crypto assets as of December 2022. Most of them were game companies such as Neowiz, WeMade, and Netmarble, or companies that operate payment and settlement businesses such as Danal and GalaxiaMoneyTree. The amount of virtual assets held was also quite large. Their cryptocurrency acquisition paths are as follows:

Paid Acquisition: Acquiring crypto through crypto exchanges, ICOs, private sales, etc.

Free Acquisition: Acquisition of crypto assets through self-development of cryptocurrency, airdrops, etc.

Exchange Acquisition: Acquisition of virtual assets through the exchange of tokens issued by third parties and tokens issued and held by the company.

Service Provision: Acquisition of virtual assets through labor provision such as consulting and development services (participation as a member of the governance council of each foundation and as a node validator)

Block Mining Reward: Direct acquisition of virtual assets through operating a virtual asset mining business, staking services, etc.

As such, listed companies have acquired and held crypto assets through various routes, mainly by directly issuing crypto assets through overseas subsidiaries to operate crypto-related businesses.

※ Note : The Financial Services Commission's '2022 Survey on Cryptocurrency Holdings of Domestic Listed Companies' is based on the results of the survey as of June 2022, while Tiger Research’s own research is based on the financial statements as of December 2022 for the confirmed 29 domestic listed companies. There may be differences in the overall Cryptocurrency holdings amounts.

Types of cryptocurrencies held by Korean listed companies

The top 10 types of cryptocurrencies held by publicly traded companies in Korea are shown below. There are three main characteristics of these companies:

They directly issue or acquire cryptocurrencies to conduct their own blockchain business. Blockchain game-related cryptocurrencies such as WEMIX, BORA, and NEOPIN, which are mainly issued in Korea, accounted for the largest amount of holdings.

About KRW 51.7b (roughly USD 39.8m) was invested in stablecoins such as USDC and USDT. These were either acquired as standby funds for funding blockchain projects through ICOs, or held for marketing and commission purposes.

We also found cases where major cryptocurrencies such as Bitcoin and Ethereum were acquired for investment purposes.

Types of cryptocurrencies held by private companies

It is confirmed that private companies also acquire and hold virtual assets and transparently disclose them through annual audit reports. Mainly, companies operating virtual asset exchange businesses such as Dunamu, Bithumb, Coinone, Cobit, and Gopax (Streamy) are confirmed to be holding large amounts of cryptocurrencies. In addition, there are cases where companies receive a certain amount of cryptocurrency through the onboarding of web3 games on gaming platforms such as Gurobal Games and XL Games. Cryptocurrency investment companies such as Uprise hold crypto as an investment asset such as Bitcoin or Ethereum, or as a fund for investment purposes such as USDT or USDC. Even among private companies, crypto assets are mainly held by companies that operate or plan to operate crypto-related businesses, such as game companies, investment companies, and IT-related companies. In addition, even if they do not directly operate cryptocurrency-related businesses, there are cases where they acquire cryptocurrencies by participating as validators in Klaytn and XPLA Mainnet.

Conclusion

Many Korean companies are acquiring and holding virtual assets, and are trying to disclose them transparently through public information. Despite these efforts, many companies are facing difficulties due to the ambiguity of the current accounting standards for virtual assets.

Morever, disclosure of virtual asset holdings is not yet mandatory. Many companies have not yet disclosed their virtual asset holdings or lacked explanations on how they acquired virtual assets, adding to investors' confusion. However, starting from next year, a new regulation will be established that will require crypto asset holders to disclose the following information. From then on, publicly listed companies will be able to disclose their crypto asset holdings more transparently and create a safer investment environment. The information expected to be disclosed is as follows:

General information about the virtual asset (name, characteristics, quantity, etc.)

Accounting policies applied to virtual assets (account classification, cost and revaluation model, etc.)

Information on the acquisition route, acquisition cost, carrying amount, and market value of the virtual asset at the end of the period

Information on the calculation of the market value of virtual assets (exchange name, calculation time, etc.) and the risk of price fluctuation

Information on the calculation of the market value of virtual assets (exchange name, calculation time, etc.) and the risk of price fluctuation

Information on the nature of risks associated with holding virtual assets

Participate in our 1-minute survey to help improve our weekly reports. As a thank you, you can download Tiger Research's original "2023 Country Crypto Matrix" spreadsheet, an all-in-one spreadsheet for the global virtual asset market analysis after finishing the survey.