This report is written by Tiger Research and presents our Bitcoin price forecast for Q3 2025, targeting $190,000 based on record global liquidity, institutional adoption acceleration, and the structural shift to institution-led markets.

Key Takeaways

Bitcoin's Institutional Adoption Accelerates - U.S. 401(k) investment unlocked, ETFs and corporate entities continue large-scale accumulation

Best Environment Since 2021 - Global liquidity at all-time highs, major countries in rate-cutting mode

Shift from Retail to Institutional-Led Market - Despite overheating signals, institutional buying firmly supports downside

Global Liquidity Expansion, Institutional Accumulation, and Regulatory Tailwinds Drive Bitcoin's Adoption

Three core drivers currently power the Bitcoin market: 1) expanding global liquidity, 2) accelerating institutional capital inflows, and 3) a crypto-friendly regulatory environment. These three factors work simultaneously, creating the strongest upward momentum since the 2021 bull market. Bitcoin has risen approximately 80% year-over-year, and we see limited factors that could disrupt this upward momentum in the near to medium term.

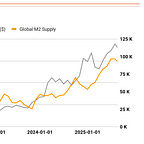

On the global liquidity front, what stands out is that major economies' M2 money supply has surpassed $90 trillion, hitting an all-time high. Historically, M2 growth rates and Bitcoin prices have shown similar directional patterns, and if current monetary expansion continues, there remains substantial room for further appreciation (Exhibit 1).

Additionally, President Trump's pressure for rate cuts and the Fed's dovish stance open pathways for excess liquidity to flow into alternative assets, with Bitcoin emerging as the prime beneficiary.

Simultaneously, institutional Bitcoin accumulation proceeds at unprecedented pace. U.S. spot ETF holdings of 1.3 million BTC represent approximately 6% of total supply, while Strategy(MSTR) alone holds 629,376 BTC ($71.2 billion). The key point is that these purchases represent structural strategy rather than one-time trades. Strategy's continuous buying through convertible bond issuances particularly signals the formation of a new demand layer.

Furthermore, the Trump administration's August 7 executive order represents a game-changer. Opening 401(k) retirement accounts to Bitcoin investment creates potential access to an $8.9 trillion capital pool. Even a conservative 1% allocation would mean $89 billion—roughly 4% of Bitcoin's current market cap. Given 401(k) funds' long-term holding characteristics, this development should contribute not only to price appreciation but also to volatility reduction. This marks the definitive signal of Bitcoin's transition from speculative asset to core institutional holding.

Institutions Drive Volume as Retail Activity Fades

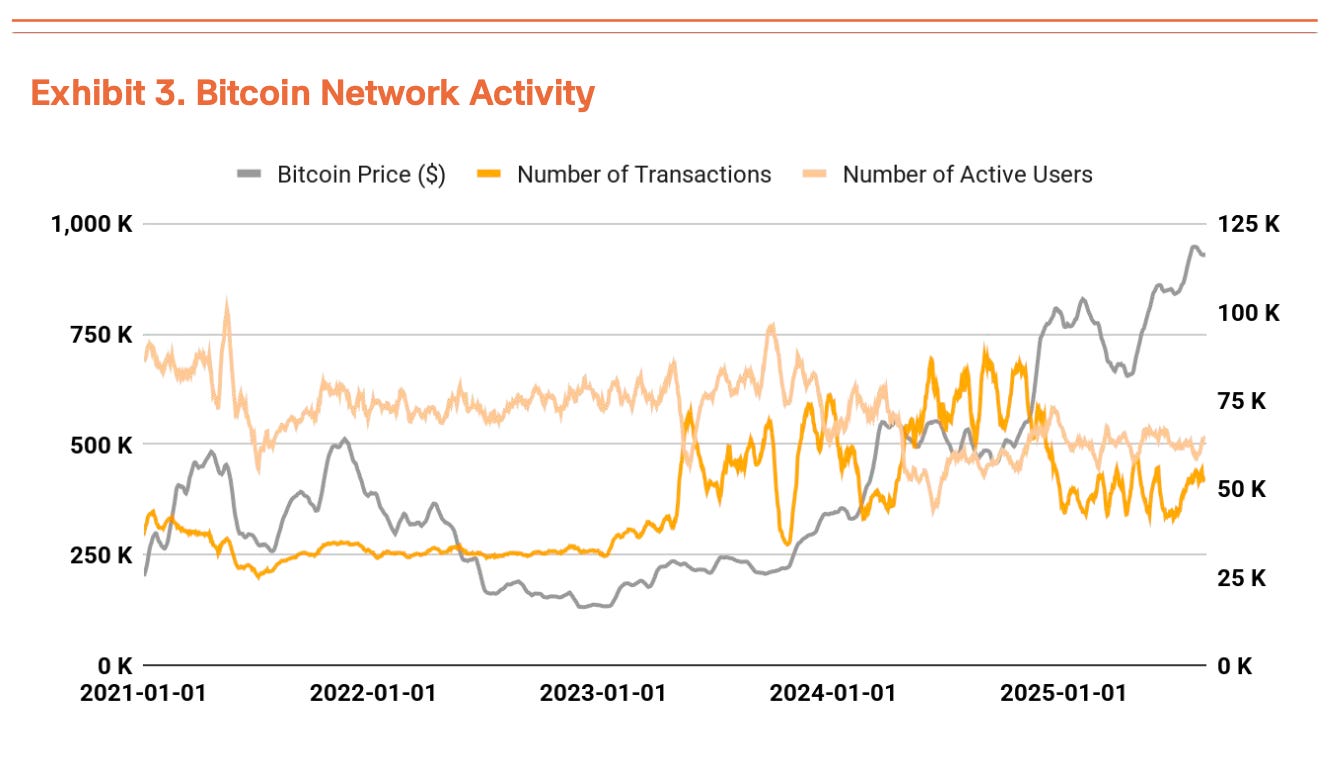

Bitcoin's network is currently undergoing restructuring around large investors. Daily average transaction count dropped 41% from 660k in October 2024 to 388k in March 2025, yet Bitcoin transfer volume per transaction actually increased. Growing high-value transactions from institutions like Strategy expanded average transaction size. This signals Bitcoin's network shift from 'small-frequent' to 'large-infrequent' transaction patterns (Exhibit 2).

However, fundamental metrics show unbalanced growth. While institutional restructuring clearly drives Bitcoin's network value higher, transaction count and active users remain unrecovered (Exhibit 3).

Fundamental improvement requires ecosystem activation through BTCFi (Bitcoin-based decentralized financial services) and other initiatives, but these remain early-stage developments requiring time to generate meaningful impact.

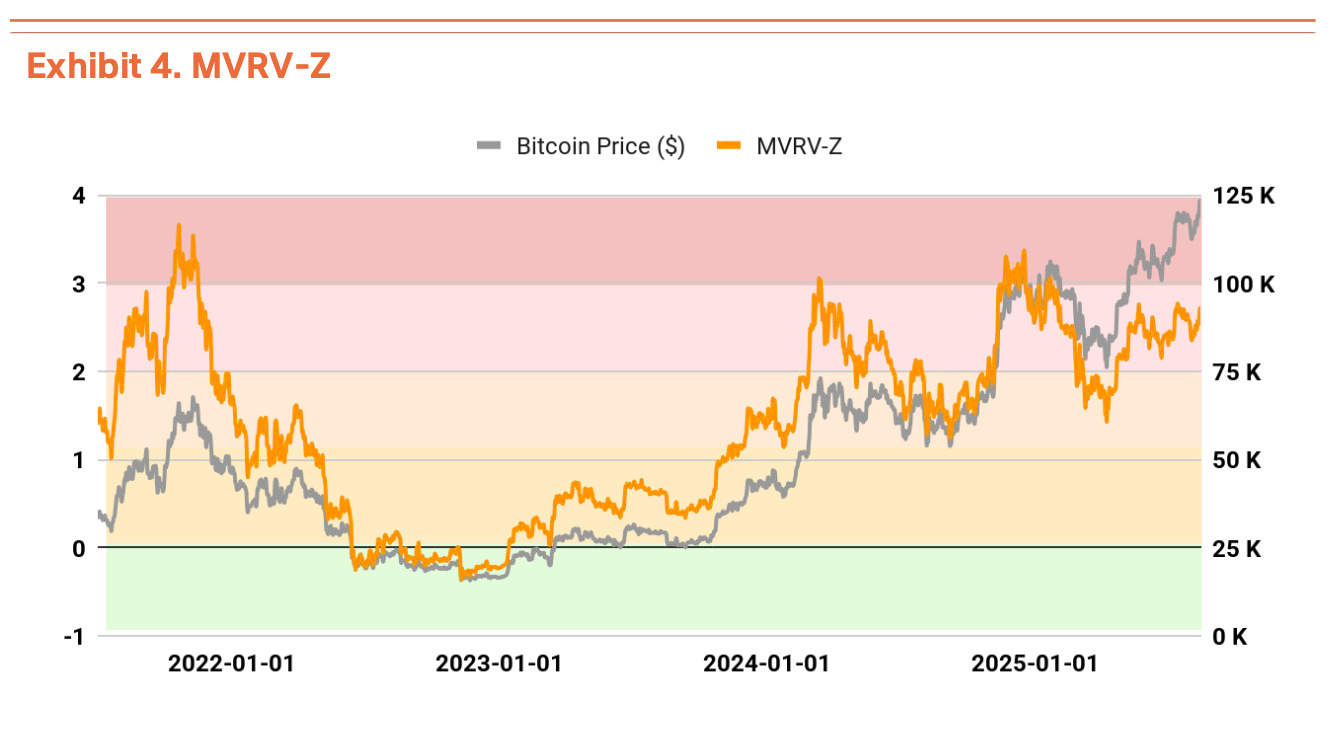

Overbought, But Institutions Provide Floor

On-chain metrics show some overheating signals, yet significant downside risk remains limited. The MVRV-Z indicator, which measures current price relative to investors' average cost basis, sits at 2.49 in overheated territory and recently spiked to 2.7, warning of potential near-term correction (Exhibit 4).

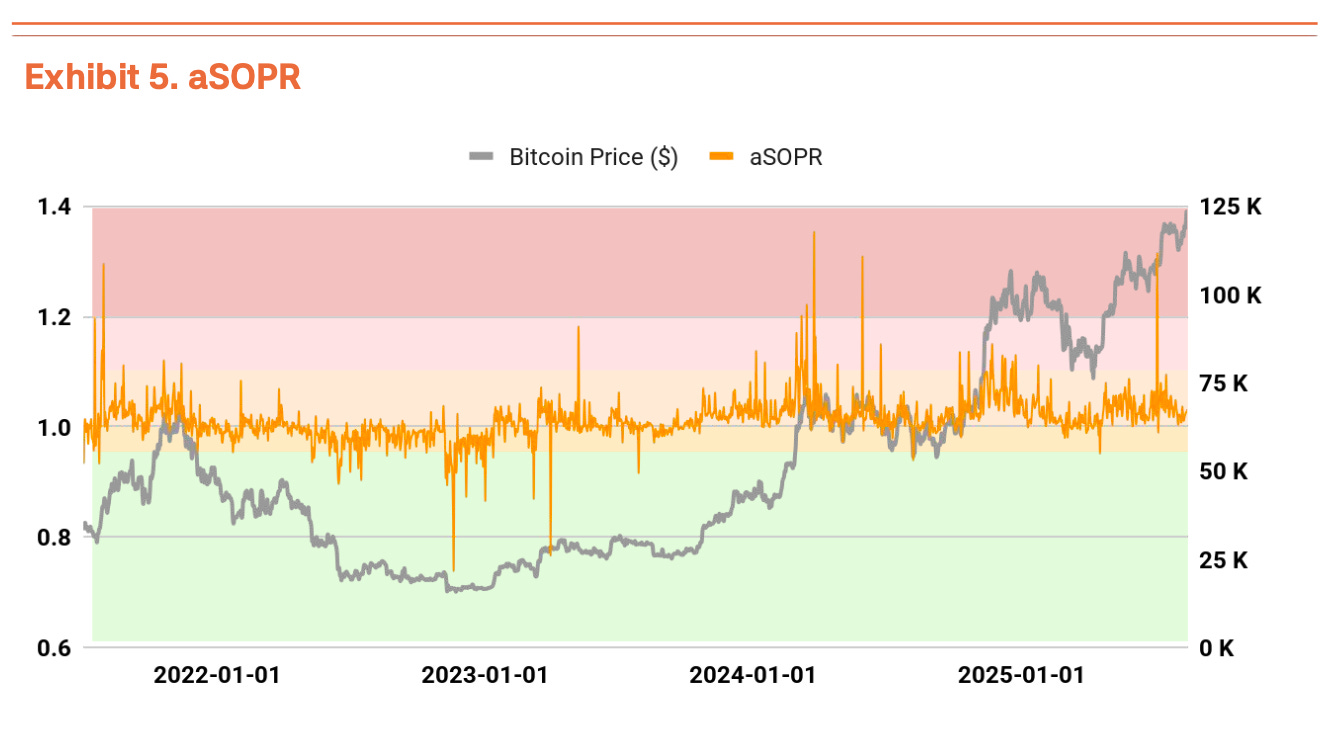

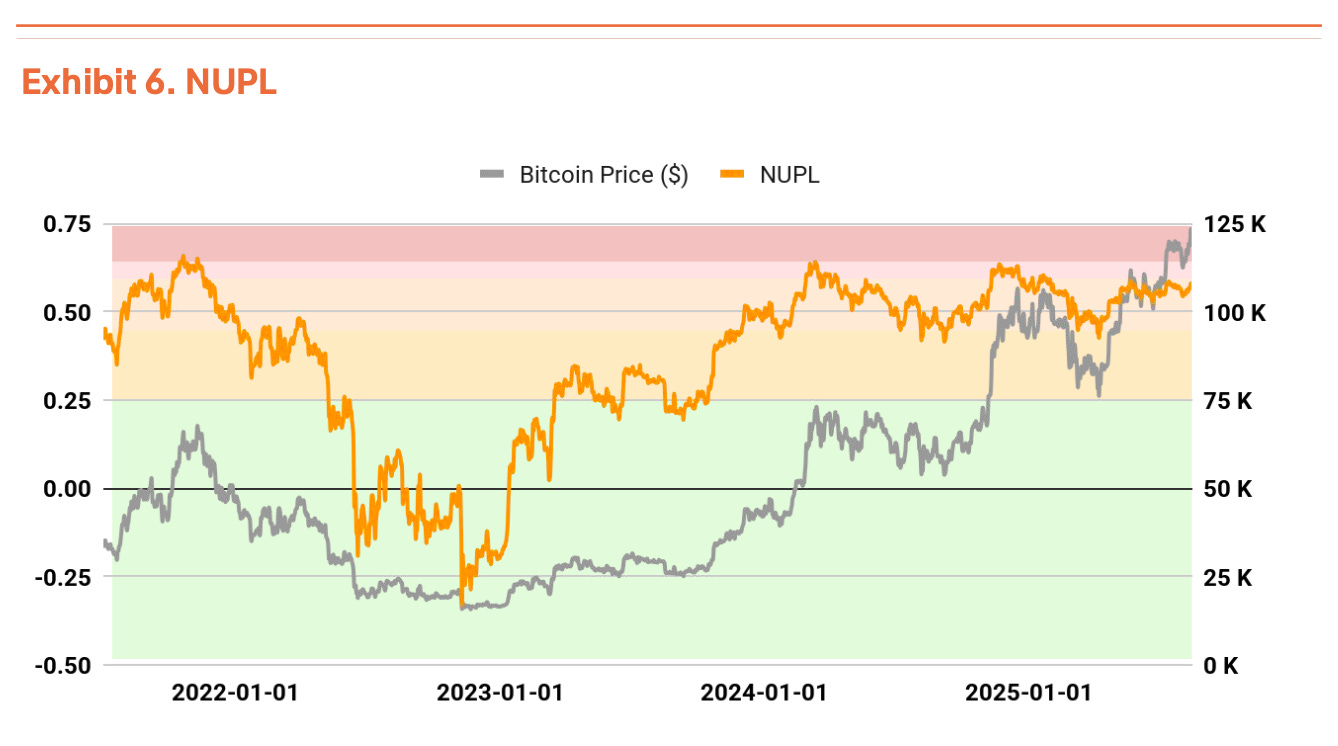

However, aSOPR (1.019), which tracks investors' realized profit/loss, and NUPL (0.558), which measures market-wide unrealized profit/loss, both remain in stable zones, signaling overall market health (Exhibits 5, 6).

Simply put, while current price runs high relative to average cost basis (MVRV-Z), actual selling occurs at modest profit levels (aSOPR), and the overall market hasn't reached excessive profit territory (NUPL).

Supporting this dynamic, institutional buying outpaces retail. Consistent accumulation from ETFs and Strategy-type entities provides solid price support. Near-term corrections may occur, but trend reversal appears unlikely.

Price Target $190,000, 67% Upside Potential

Our TVM methodology generates a $190,000 price target through the following framework: We establish a base price of $135,000 (removing extreme fear and greed sentiment from current price), then apply a +3.5% fundamental indicator multiplier and +35% macro indicator multiplier.

The fundamental indicator multiplier reflects network quality improvements—higher transaction values despite lower transaction counts. The macro indicator multiplier captures three powerful forces: expanding global liquidity (e.g., M2 surpassing $90 trillion), accelerating institutional adoption (e.g., ETFs holding 1.3 million BTC), and improving regulatory environment (e.g., 401(k) eligibility unlocking $8.9 trillion).

From current levels, this implies 67% upside potential. While aggressive, this target reflects the structural shift underway as Bitcoin transitions from speculative asset to institutional portfolio allocation.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

The Bitcoin valuation methodology presented in this document (hereinafter referred to as the “Methodology”) is intended solely for educational and academic research purposes. It does not constitute investment advice, a solicitation to buy or sell, or a recommendation to engage in any form of trading activity. The fair prices derived from this Methodology are theoretical outputs based on objective data and mathematical models. They should not be interpreted as guidance or endorsement for any specific investment action, including buying, selling, or holding Bitcoin.

This Methodology is designed as a research framework to offer one perspective on Bitcoin valuation. It is not intended to be used as the basis for actual investment decisions. The Methodology has been carefully reviewed to ensure it does not constitute any form of market manipulation, fraudulent trading, or other unfair trading practices as defined under Article 10 of the “Act on the Protection of Virtual Asset Users” (the “Virtual Asset User Protection Act”). All analysis uses only publicly available information, including on-chain blockchain data and officially released economic indicators. No material non-public or insider information has been used. All valuation outputs, including target prices, are based on reasonable assumptions and presented without misrepresentation or omission of material facts.

The authors and distributors of this Methodology fully comply with the conflict of interest disclosure requirements set forth in Article 10, Paragraph 4, Item 2 of the Virtual Asset User Protection Act. If the authors hold or intend to trade the relevant virtual asset (Bitcoin) at the time of writing or distribution, such interests will be transparently disclosed.

The indicators used in this Methodology—such as Base Price, Fundamental Indicator, and Macro Indicator—are derived from approaches the authors consider reasonable. However, they do not represent absolute truths or definitive answers. The Bitcoin market is highly volatile, operates 24/7, spans global jurisdictions, and is subject to significant regulatory uncertainty. As a result, there may be substantial and prolonged deviations between the valuation results of this Methodology and actual market prices.

This Methodology is based on historical data and information available at the time of writing. It does not guarantee or predict future performance. Past patterns or correlations may not persist, and unexpected market shocks, regulatory shifts, technical failures, or macroeconomic events could significantly undermine the predictive validity of this framework. Given the relatively short history and evolving nature of the crypto market, there are inherent limitations to the reliability of past data and its applicability to future projections.

All investment decisions should be made independently and under the investor’s sole responsibility. This Methodology should not serve as the sole or primary basis for any investment decision. Investors must carefully consider their financial situation, investment objectives, risk tolerance, and experience, and should seek independent financial or investment advice as needed. The authors, distributors, and any related parties bear no responsibility for any direct, indirect, consequential, special, or punitive losses or damages arising from investment decisions made with reference to this Methodology.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.