This report is written by Tiger Research and presents our Q1 2026 Bitcoin outlook, targeting $185,500.

Key Takeaways

Macro Firm, Momentum Slows: Fed cuts and M2 growth stay on track. But $4.57 billion in ETF outflows hit short-term moves. The CLARITY Act may draw in big banks.

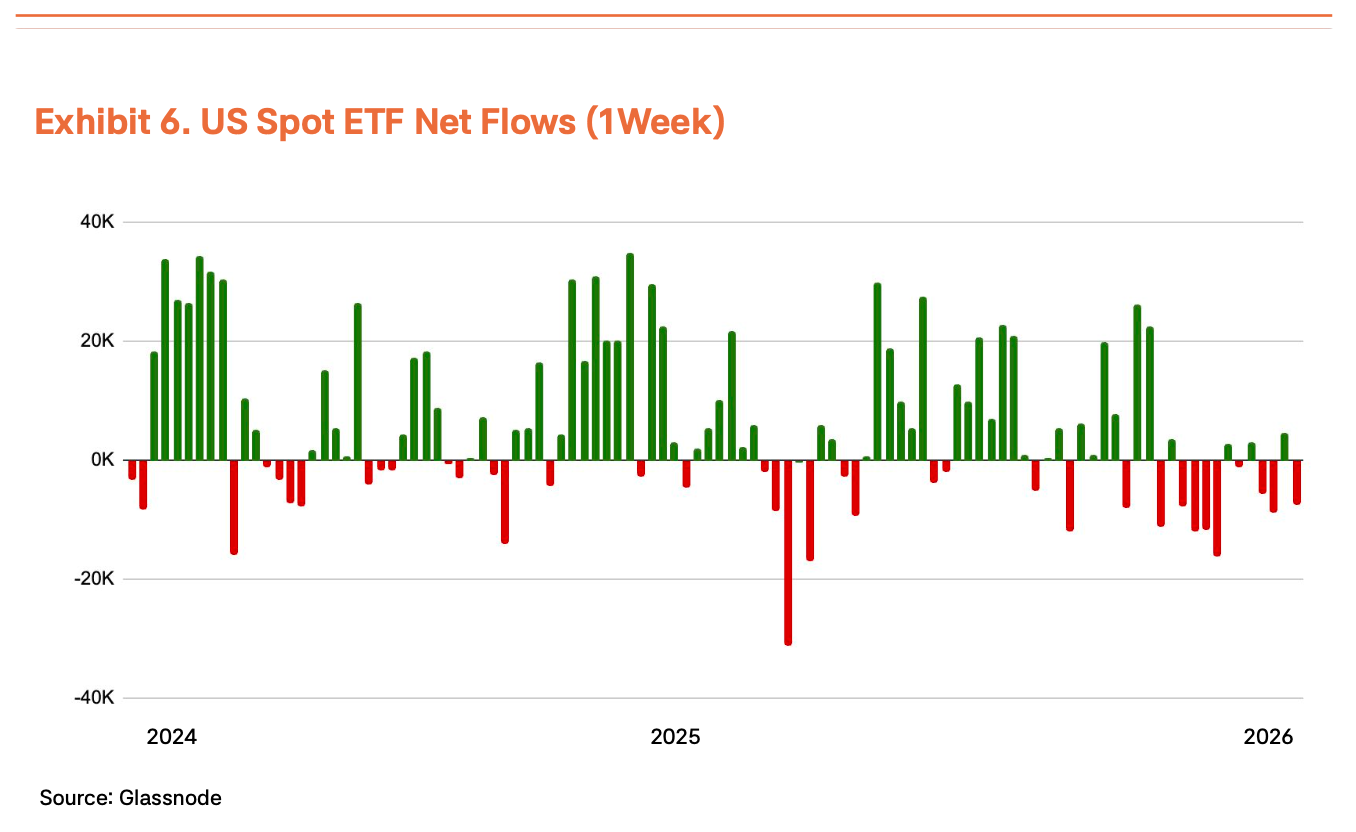

On-chain Shifts to Neutral: Buy demand at $84,000 forms a floor. The $98,000 mark is the cost for short-term holders and acts as a cap. MVRV-Z and other keys show the market is now in a fair state.

Target at $185,500, Bull View Holds: We set the target at $185,500. This uses a $145,000 base and a +25% macro factor. This shows 100% upside from here.

Macro Easing Holds, Momentum Fades

BTC trades near $96,000, down 12% since our last report on Oct 23, 2025. Despite this, the macro backdrop stays firm for Bitcoin.

Fed Path Remains Dovish

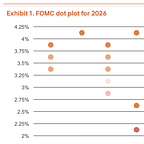

The Federal Reserve cut rates by 25 bps three times from Sep to Dec 2025. The rate now stands at 3.50%–3.75%. The Dec dot plot sees a 3.4% rate by year-end 2026. Sharp cuts of 50 bps or more are unlikely this year. However, the Trump administration may appoint a more dovish replacement once Powell’s term ends in May. This should keep the easing trend in place.

Institutional Outflows Meet Corporate Buys

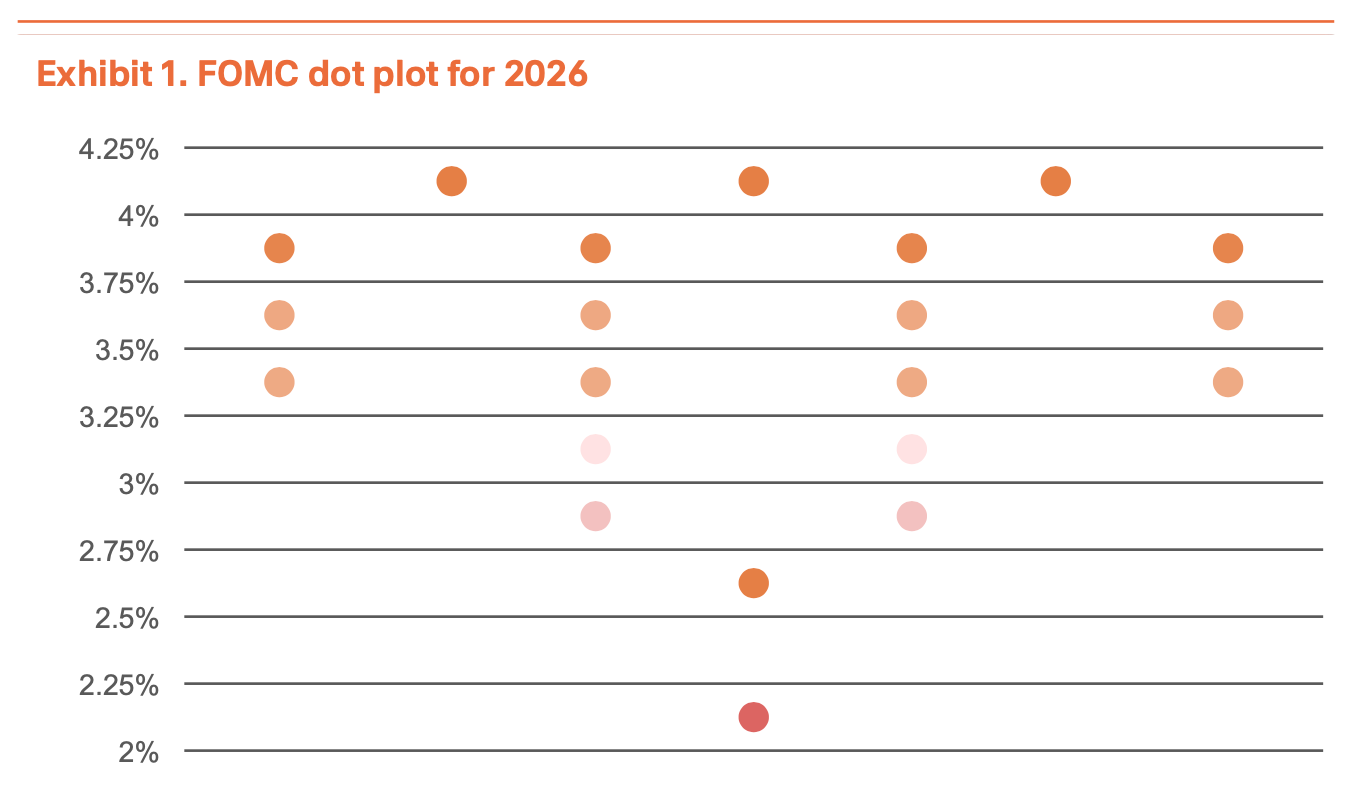

Institutional appetite is slow despite the macro shift. Spot ETFs saw $4.57B in outflows in Nov and Dec, the largest outflows since launch. Annual net inflows hit $21.4B, a 39% drop from $35.2B last year. Jan rebalancing is increasing inflows, but the sustainability of the rebound is unclear. Firms like MicroStrategy (673,783 BTC, 3.2% of supply), Metaplanet, and Mara have continued adding to holdings.

CLARITY Act as a Policy Catalyst

Regulatory developments are emerging as a potential driver amid stalled institutional demand. The House-passed CLARITY Act defines jurisdictional boundaries between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), while permitting banks to offer digital asset custody and staking services. The legislation also grants the CFTC oversight of digital commodity spot markets, providing a clear legal framework for exchanges and brokers to operate. A Senate Banking Committee markup is scheduled for Jan 15. A pass could prompt participation from traditional financial institutions that have remained on the sidelines.

Liquidity High, BTC Lags

Liquidity is another key variable alongside regulatory developments. Global M2 hit record highs in Q4 2024 and remains on an upward trend. Bitcoin has historically front-run liquidity cycles, often rallying ahead of M2 peaks, but typically consolidates during the peak phase.

Current indications point to further liquidity expansion, which suggests additional upside potential. As Bitcoin front-runs liquidity, it could draw inflows. If equity markets look stretched, capital may rotate into Bitcoin.

Macro Factor Cut to +25% on Firm Outlook

Overall macro direction remains unchanged from last quarter, with rate cuts and liquidity expansion still intact. However, we lowered our macro adjustment factor to +25% from +35%, reflecting slower institutional inflows, potential Fed leadership changes, and elevated geopolitical risks.

Despite the downgrade, a +25% weighting remains positive, and our assessment that regulatory progress and continued M2 expansion provide support for the medium- to long-term upside remains intact.

Support at $84,000, Resistance at $98,000

On-chain indicators provide additional signals alongside the macro backdrop. During the Nov 2025 correction, buy-the-dip demand clustered around the $84K level, establishing a well-defined support zone. BTC has since moved above this range. The $98K level corresponds to the average cost basis of short-term holders and serves as a near-term psychological resistance.

On-chain indicators suggest a transition from short-term fear toward a more neutral sentiment. Key market metrics — MVRV-Z (1.25), NUPL (0.39), and aSOPR (1.00) — have moved out of undervalued territory and into an equilibrium range. While outsized rallies typical of fear-driven phases appear less likely, the current setup still allows for profit generation. Taken together with the macro backdrop and regulatory progress discussed above, the statistical case for higher price levels over the medium to long term remains intact.

Market structure today differs meaningfully from prior cycles. The increased share of institutional and long-term capital reduces the likelihood of retail-driven panic sell-offs seen in earlier periods. Recent pullbacks have instead unfolded through a gradual rebalancing process. While short-term volatility persists, on-chain indicators and flow dynamics suggest the broader upside structure remains intact.

Target Cut to $185,500, Outlook Firm

Applying our TVM framework for Q1, we derive a neutral baseline valuation of $145,000, down from $154,000 in the prior report. Applying a 0% fundamental adjustment and a +25% macro adjustment, this sets our revised target price to $185,500.

We raise the fundamental adjustment factor to 0% from -2%. While network activity remains broadly unchanged from the prior report, renewed attention on the BTCFi ecosystem has helped offset both bullish and bearish signals.

Conversely, we reduce the macro adjustment to +25% from +35%. The broader macro backdrop remains supportive, driven by rate-cut expectations, M2 expansion, and the potential passage of the CLARITY Act. However, slower institutional inflows and elevated geopolitical uncertainty warrant a more conservative weighting.

The downward revision to our target price should not be interpreted as a bearish signal. Even after the adjustment, the model still implies upside of roughly 100%. The lower baseline primarily reflects near-term volatility, while Bitcoin’s intrinsic value continues to trend higher over the medium to long term. Recent pullbacks appear consistent with healthy rebalancing, and the medium- to long-term bullish outlook remains intact.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

The Bitcoin valuation methodology presented in this document (hereinafter referred to as the “Methodology”) is intended solely for educational and academic research purposes. It does not constitute investment advice, a solicitation to buy or sell, or a recommendation to engage in any form of trading activity. The fair prices derived from this Methodology are theoretical outputs based on objective data and mathematical models. They should not be interpreted as guidance or endorsement for any specific investment action, including buying, selling, or holding Bitcoin.

This Methodology is designed as a research framework to offer one perspective on Bitcoin valuation. It is not intended to be used as the basis for actual investment decisions. The Methodology has been carefully reviewed to ensure it does not constitute any form of market manipulation, fraudulent trading, or other unfair trading practices as defined under Article 10 of the “Act on the Protection of Virtual Asset Users” (the “Virtual Asset User Protection Act”). All analysis uses only publicly available information, including on-chain blockchain data and officially released economic indicators. No material non-public or insider information has been used. All valuation outputs, including target prices, are based on reasonable assumptions and presented without misrepresentation or omission of material facts.

The authors and distributors of this Methodology fully comply with the conflict of interest disclosure requirements set forth in Article 10, Paragraph 4, Item 2 of the Virtual Asset User Protection Act. If the authors hold or intend to trade the relevant virtual asset (Bitcoin) at the time of writing or distribution, such interests will be transparently disclosed.

The indicators used in this Methodology—such as Base Price, Fundamental Indicator, and Macro Indicator—are derived from approaches the authors consider reasonable. However, they do not represent absolute truths or definitive answers. The Bitcoin market is highly volatile, operates 24/7, spans global jurisdictions, and is subject to significant regulatory uncertainty. As a result, there may be substantial and prolonged deviations between the valuation results of this Methodology and actual market prices.

This Methodology is based on historical data and information available at the time of writing. It does not guarantee or predict future performance. Past patterns or correlations may not persist, and unexpected market shocks, regulatory shifts, technical failures, or macroeconomic events could significantly undermine the predictive validity of this framework. Given the relatively short history and evolving nature of the crypto market, there are inherent limitations to the reliability of past data and its applicability to future projections.

All investment decisions should be made independently and under the investor’s sole responsibility. This Methodology should not serve as the sole or primary basis for any investment decision. Investors must carefully consider their financial situation, investment objectives, risk tolerance, and experience, and should seek independent financial or investment advice as needed. The authors, distributors, and any related parties bear no responsibility for any direct, indirect, consequential, special, or punitive losses or damages arising from investment decisions made with reference to this Methodology.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.