The sharp decline in Bitcoin caught markets off guard. This report examines the drivers behind the sell-off and outlines potential recovery scenarios.

Key Takeaways

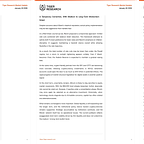

Bitcoin fell roughly 7%, dropping from $87,000 to $81,000 during the 29th.

Disappointing Microsoft earnings triggered a Nasdaq sell-off, breaking Bitcoin’s Active Realized Price support at $87,000.

Kevin Warsh Fed chair nomination speculation added downside pressure, though actual policy may prove more gradual than market fears

Regulatory agencies maintain a crypto-friendly stance, but a break below $84,000 leaves near-term downside risk in place

Bitcoin Left Behind in the Rebound

Bitcoin experienced two sharp declines in quick succession. Bitcoin began sliding from around $87,000 at approximately 9 a.m. EST on the 29th and fell to roughly $81,000 by 10 a.m. on the 30th, marking a decline of about 7%. The broader crypto market weakened as well, leading to a rapid deterioration in investor sentiment.

This move was not driven by a single negative factor. Instead, it reflected a combination of shocks from traditional financial markets and rising uncertainty around monetary policy. The first leg down was triggered by a big tech earnings shock, while the second stemmed from concerns over Federal Reserve leadership.

Underlying both moves was a decline in trading volume across Bitcoin spot and futures markets. In a low-liquidity environment, even modest shocks can lead to outsized price moves. While equities and commodities rebounded quickly after their initial declines, Bitcoin failed to recover.

Bitcoin is currently being shunned by the market. With shrinking volumes and persistent selling pressure, price rebounds have become harder to sustain.

First Shock: AI Bubble Concerns Spill Over Into Bitcoin

Bitcoin first came under pressure on the 29th, following a sharp decline in the Nasdaq. Microsoft’s fourth-quarter earnings missed expectations, reigniting concerns that AI-related investments may have become overheated. As fears of an AI bubble grew, investors reduced exposure to risk assets. Bitcoin saw a sharper reaction due to its high volatility.

The critical issue was the price level at which Bitcoin began to fall. During the decline, Bitcoin broke through a key structural support level: the Active Realized Price.

At the time, this level stood near $87,000. The Active Realized Price adjusts the average cost basis of tokens actively circulating in the market, excluding long-dormant holdings. In simple terms, it represents the breakeven level for investors who are currently trading. Once the price falls below this level, most active market participants move into a loss position. Bitcoin decisively broke below this support.

Second Shock: The Warsh Factor / The Warsh is Coming

Around 8 p.m. on the 29th, Bitcoin suffered another sharp drop, falling rapidly from $84,000 to $81,000. Bloomberg and Reuters reported that President Trump was preparing to nominate Kevin Warsh as the next Federal Reserve Chair, with an official announcement expected on the 30th.

Kevin Warsh is widely regarded as a hawkish figure. During his tenure as a Federal Reserve Governor from 2006 to 2011, he consistently opposed quantitative easing, warning that it would lead to inflation. When the Federal Reserve launched its second round of QE in 2011, Warsh stepped down from the Board.

Speculation over Warsh’s nomination was interpreted as running counter to Trump’s preference for lower rates, fueling concerns about tighter liquidity. Bitcoin reacted sensitively to this signal. Cryptocurrencies tend to perform well in environments with ample liquidity, where investors are more willing to allocate capital to higher-risk assets. The prospect of Warsh leading the Fed raised fears that liquidity conditions could tighten. In an already dry market, investors responded by selling.

A Temporary Correction, With Medium- to Long-Term Momentum Intact

Despite concerns about Warsh’s hawkish reputation, actual policy implementation may be less aggressive than markets fear.

In a Wall Street Journal op-ed, Warsh proposed a compromise approach: limited rate cuts combined with balance sheet reduction. This framework attempts to satisfy both Trump’s preference for lower rates and Warsh’s emphasis on inflation discipline. It suggests maintaining a hawkish stance overall while allowing flexibility in the rate trajectory.

As a result, the total number of rate cuts may be lower than under the Powell regime, but a return to outright tightening appears unlikely. Even if Warsh becomes Chair, the Federal Reserve is expected to maintain a gradual easing bias.

At the same time, crypto-friendly policies from the SEC and CFTC are becoming more concrete. Allowing cryptocurrency investments in 401(k) retirement accounts could open the door to as much as $10 trillion in potential inflows. The rapid progress of market structure legislation for digital assets is another positive signal.

In the short term, uncertainty remains. Bitcoin is likely to stay sensitive to equity market movements. With the $84,000 level already breached, further downside risk cannot be ruled out. However, if equities enter a consolidation phase, Bitcoin may once again be selected as an alternative investment. Historically, when technology stocks stagnate due to AI bubble concerns, capital has often rotated into alternative assets.

What remains unchanged is more important. Global liquidity is still expanding over the longer term, and the institutional policy stance toward cryptocurrencies remains supportive. Strategic accumulation by institutions continues, and the Bitcoin network itself has no operational issues. The current pullback reflects exaggerated short-term volatility driven by thin liquidity and does not undermine the medium- to long-term bullish trend.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

The Bitcoin valuation methodology presented in this document (hereinafter referred to as the “Methodology”) is intended solely for educational and academic research purposes. It does not constitute investment advice, a solicitation to buy or sell, or a recommendation to engage in any form of trading activity. The fair prices derived from this Methodology are theoretical outputs based on objective data and mathematical models. They should not be interpreted as guidance or endorsement for any specific investment action, including buying, selling, or holding Bitcoin.

This Methodology is designed as a research framework to offer one perspective on Bitcoin valuation. It is not intended to be used as the basis for actual investment decisions. The Methodology has been carefully reviewed to ensure it does not constitute any form of market manipulation, fraudulent trading, or other unfair trading practices as defined under Article 10 of the “Act on the Protection of Virtual Asset Users” (the “Virtual Asset User Protection Act”). All analysis uses only publicly available information, including on-chain blockchain data and officially released economic indicators. No material non-public or insider information has been used. All valuation outputs, including target prices, are based on reasonable assumptions and presented without misrepresentation or omission of material facts.

The authors and distributors of this Methodology fully comply with the conflict of interest disclosure requirements set forth in Article 10, Paragraph 4, Item 2 of the Virtual Asset User Protection Act. If the authors hold or intend to trade the relevant virtual asset (Bitcoin) at the time of writing or distribution, such interests will be transparently disclosed.

The indicators used in this Methodology—such as Base Price, Fundamental Indicator, and Macro Indicator—are derived from approaches the authors consider reasonable. However, they do not represent absolute truths or definitive answers. The Bitcoin market is highly volatile, operates 24/7, spans global jurisdictions, and is subject to significant regulatory uncertainty. As a result, there may be substantial and prolonged deviations between the valuation results of this Methodology and actual market prices.

This Methodology is based on historical data and information available at the time of writing. It does not guarantee or predict future performance. Past patterns or correlations may not persist, and unexpected market shocks, regulatory shifts, technical failures, or macroeconomic events could significantly undermine the predictive validity of this framework. Given the relatively short history and evolving nature of the crypto market, there are inherent limitations to the reliability of past data and its applicability to future projections.

All investment decisions should be made independently and under the investor’s sole responsibility. This Methodology should not serve as the sole or primary basis for any investment decision. Investors must carefully consider their financial situation, investment objectives, risk tolerance, and experience, and should seek independent financial or investment advice as needed. The authors, distributors, and any related parties bear no responsibility for any direct, indirect, consequential, special, or punitive losses or damages arising from investment decisions made with reference to this Methodology.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.