AI x Web3: Innovation or Bubble?

Potential Beyond Speculative Hype: The Future Created by AI and Web3

This report was written by Tiger Research, analyzing how the integration of Web3 and AI will evolve beyond speculative hype into a meaningful relationship.

TL;DR

Web3 and AI integration will evolve beyond initial speculative hype into a complementary relationship.

In the short term, AI will lower Web3's technical barriers, improve user experience, and create practical value through applications like DeFAI that automate investment decisions.

In the long term, AI will drive Web3 toward an agent-centered UI/UX paradigm, while decentralized Web3 infrastructure and cryptocurrencies will serve as essential foundations for autonomous AI agent operations.

1. Introduction

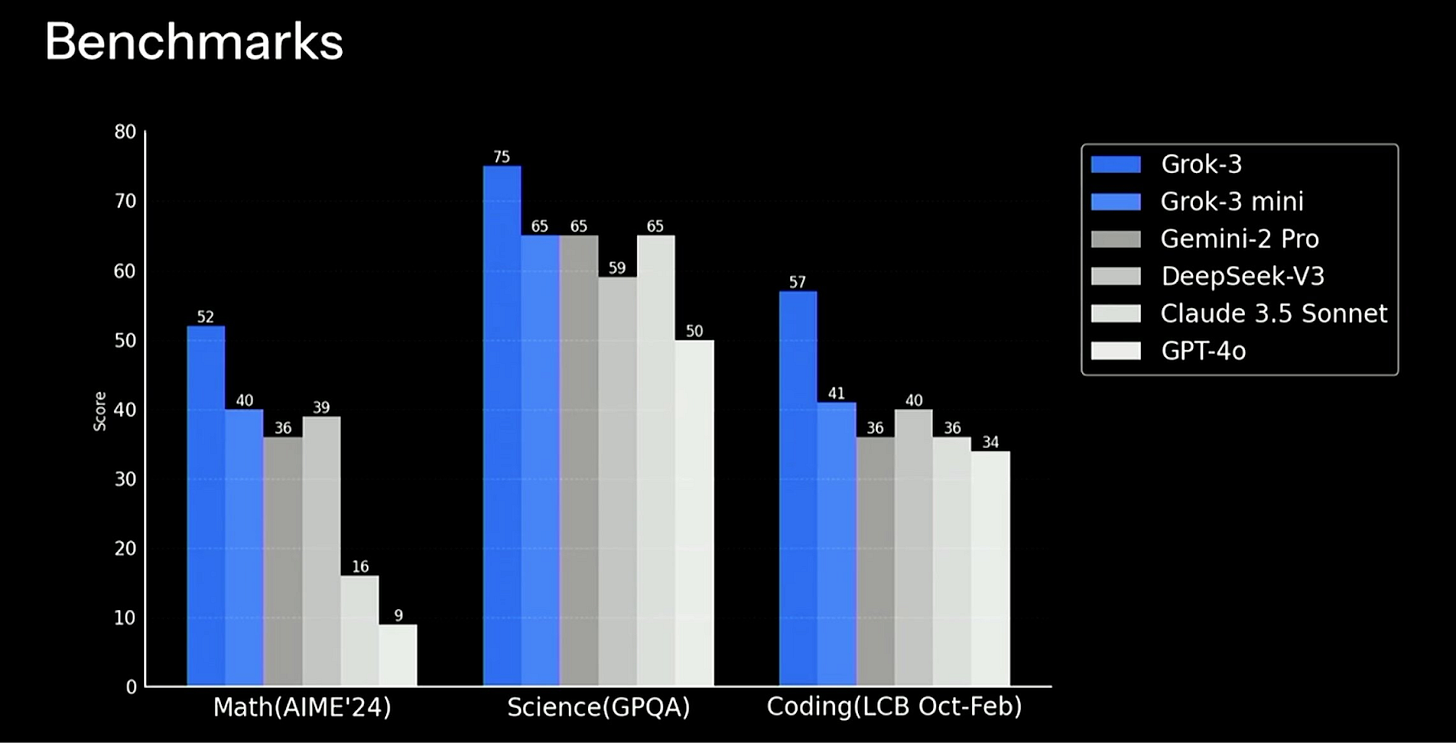

Artificial Intelligence (AI) expanded beyond corporate competition to become a national strategic priority. Global tech leaders like OpenAI, xAI, Google, and Meta compete fiercely on model performance, while governments increase funding and development initiatives to secure AI leadership.

The Web3 industry is exploring AI integration opportunities. This report examines the convergence of Web3 and AI technologies, particularly through AI agents, and analyzes their potential synergies.

2. Web3 AI: Possibilities Beyond Speculative Hype

AI agents have surged in popularity within Web3. These systems understand complex situations, make autonomous decisions, and perform sophisticated tasks beyond simple commands. Projects like Virtual Protocol and ElizaOS (formerly Ai16Z) gained attention for their agent capabilities, with related projects once reaching a combined $16 billion market cap.

Despite high expectations, many AI agents lacked meaningful Web3 integration, clear token utility, or value creation models. Most launched without whitepapers or tokenomics documentation. Rather than exploring meaningful AI-Web3 synergies, these projects primarily leveraged crypto market speculation for fundraising and marketing. This led to their perception as 'symbolic' assets like memecoins, driven by speculative investment seeking quick profits. This structure undermined sustainability, with many projects losing over 90% of their value during market downturns.

The integration of AI and Web3 still holds significant potential. Similar to other sectors, AI can enhance efficiency, improve accessibility, and create new value propositions within the Web3 ecosystem.

3. Paradigm Shifts Using Web3 AI

3.1. Functional Paradigm: Short-term Perspective

AI is advancing rapidly, accelerating "Intelligence as a Commodity." Open-source models like Meta's Llama and China's Deepseek are reducing AI adoption barriers. These accessible systems are driving AI implementation across multiple sectors, including Web3.

Web3 strengthens user sovereignty through decentralization but faces high technical barriers to entry. AI eliminates these limitations and maximizes Web3's potential. AI automates complex blockchain processes, dramatically improves user experience, and increases accessibility. This lowers technical barriers while attracting new users, driving Web3 mainstream adoption.

Herd's on-chain analysis agent "Sage" demonstrates intuitively how AI technology can transform the Web3 industry. Sage searches and analyzes smart contracts using natural language, helping users understand their structure easily. Developers increase efficiency when they shorten analysis time, while users with limited technical knowledge access Web3 services more easily.

Another example, DeFAI (DeFI + AI) emerges as a new narrative utilizing AI technology in the Web3 ecosystem. This financial system automates investment decision-making and analyzes vast amounts of real-time data in the 24/7 global crypto market. Traditional investing required investors to personally collect information and invest through complex DeFi protocols, demanding significant time and effort. DeFAI models instead employ AI agents to develop fast, efficient investment strategies and execute actual investments.

DeFAI models support sophisticated and efficient investment decisions by deploying multi-agent systems where different AI agents perform specialized roles. SNS analysis agents collect market reactions to specific tokens and projects from social platforms and conduct sentiment analysis. Macro analysis agents evaluate macroeconomic data like interest rate changes and policy trends to analyze market impacts. On-chain analysis agents track blockchain transactions in real-time, detect liquidity fluctuations and large fund movements, and enhance investment judgments. This AI-based investment process filters noise data and extracts meaningful patterns. It reduces the learning burden of complex DeFi models.

Challenges remain for DeFAI. AI lacks sufficient financial expertise and risks making incorrect decisions when learning from inaccurate data. Yet as AI-based automation grows increasingly sophisticated, DeFAI will likely improve Web3 financial accessibility and enhance investment efficiency.

3.2. Structural Paradigm: Long-term Perspective

AI technology will likely bring structural paradigm shifts across the Web3 industry. Innovation is expected particularly in user UI/UX. The industry will transition beyond browser-based dApp usage toward flow-based UI/UX centered on agent interactions. This transition will enable higher abstraction levels in the Web3 ecosystem, automate complex processes, and greatly improve accessibility.

This transformation resembles how app services evolved explosively during the shift from PC to mobile. Mobile devices provided convenient functions through GPS, cameras, and sensors. Similarly, the AI era will create new technological touchpoints that bring fresh possibilities and opportunities to Web3.

In an advanced AI landscape, agents acting on users' behalf may highlight limitations in traditional financial systems with their complex KYC procedures and centralized authentication. Cryptocurrencies offer a simplified, autonomous alternative. If AI agents directly manage Web3 wallets, agent-to-agent interactions and value exchanges could occur seamlessly on Web3 infrastructure without human intervention.

The demonstration of AI agents communicating via sound waves (ggwave) instead of natural language hints at the evolution beyond conventional interaction methods. This reveals the need for optimized systems that transcend human-centered interfaces.

This highlights cryptocurrencies as the optimal medium for autonomous AI agent operations. Programmable digital currencies and decentralized Web3 infrastructure may become essential for AI agents to independently conduct on-chain transactions and economic activities, driving integration toward a structural paradigm shift.

4. Closing Thoughts

AI agents and Web3 are evolving beyond technical integration into a symbiotic relationship. AI streamlines Web3's complex processes and enhances accessibility, while Web3 provides the infrastructure for autonomous AI operation.

Despite the faded speculative hype, practical applications like DeFAI show AI-Web3 integration increasingly becoming a reality. This convergence drives both Web3 ecosystem growth and broader AI adoption. New economic models and services emerging from these combined technologies will unlock diverse opportunities.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo(Black/White). If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.