This report was written by Tiger Research, analyzing the tokenized stock market's evolution from $500M to a potential $1.34T by 2030, examining key players.

TL;DR

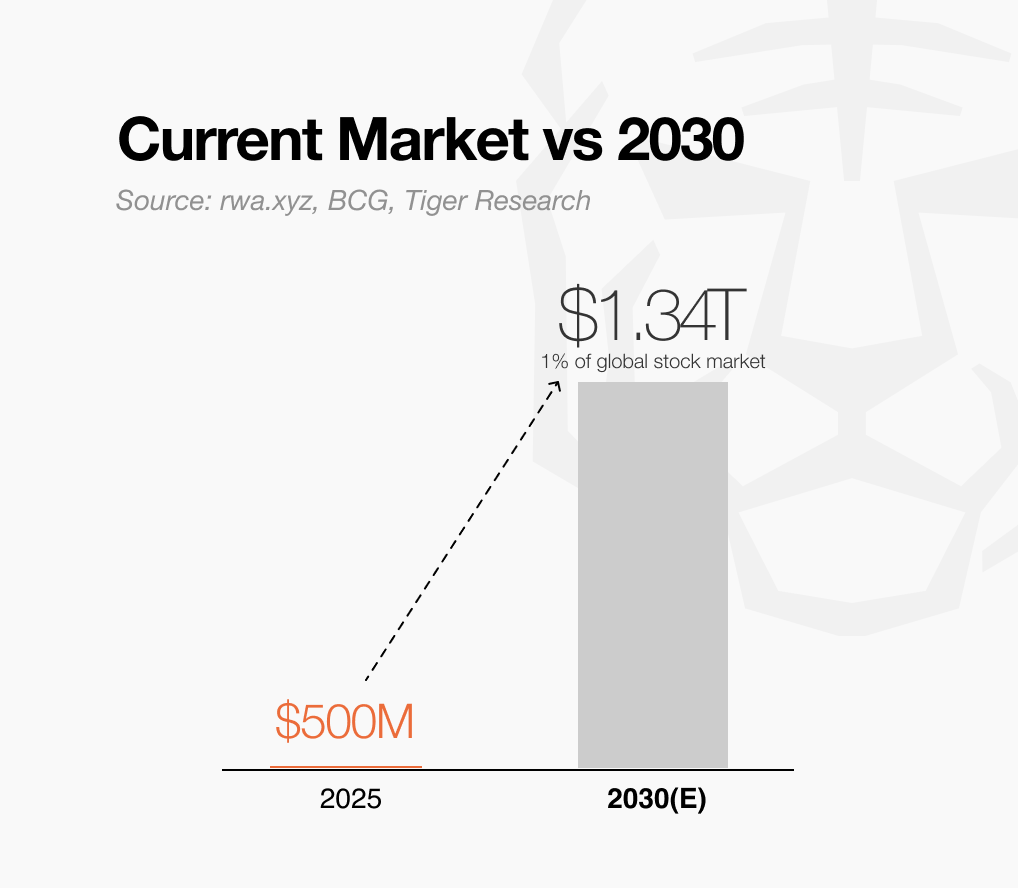

Market Opportunity: The tokenized stocks market is currently $500M but could reach $1.34T by 2030 if just 1% of global stocks get tokenized. This represents a potential 2,680x growth driven by regulatory clarity and infrastructure maturity converging in 2025.

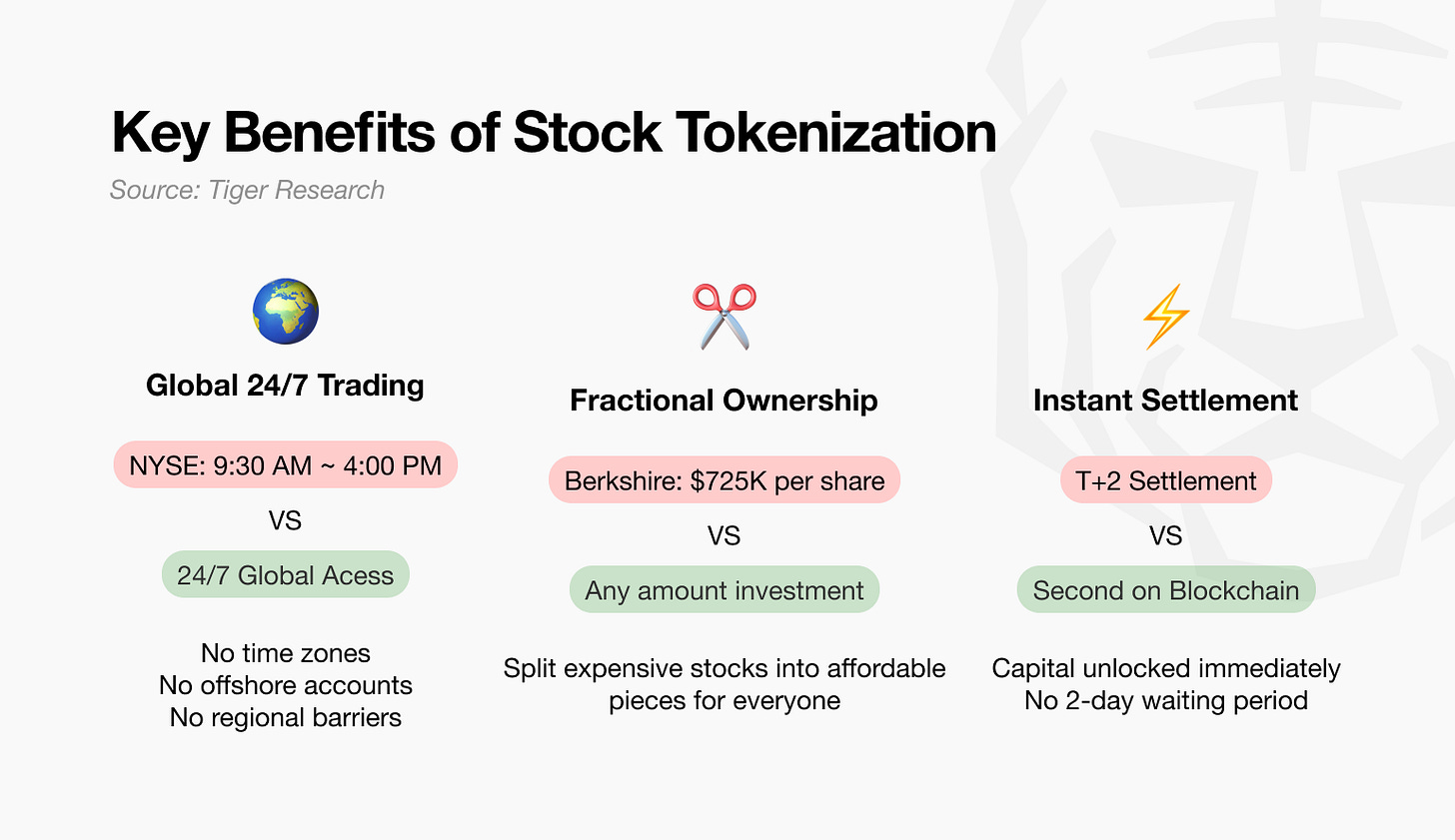

Value Proposition: Tokenized stocks enable 24/7 global trading with fractional share ownership. The key differentiator is DeFi integration, allowing investors to use stocks as collateral for lending and yield generation without selling.

Why It Will Win: Unlike other RWA experiments that must create demand from scratch, tokenized stocks tap into the proven $134T global stock market with clear friction points. The combination of existing demand plus addressable pain points makes this the most viable RWA category for mass adoption.

1. The Convergence of Two Worlds: Blurring Boundaries

Traditional finance and the crypto industry are moving toward each other.

On one side, institutions like Citigroup and Bank of America are preparing to issue stablecoins. On the other, projects such as Injective and Backed Finance are tokenizing stocks like Apple and Tesla on blockchain networks.

As traditional institutions adopt crypto and Web3 projects tokenize stocks, the boundary between the two sectors is steadily eroding.

This convergence has accelerated following the U.S. "Crypto Week," a period of regulatory activity focused on digital assets. The passage of the GENIUS Act has brought stablecoins under a federal regulatory framework. Rather than competing, Wall Street and DeFi are increasingly positioned as collaborators.

Traditional finance has clear incentives to integrate crypto. Beyond potential innovation, crypto markets have demonstrated profitability, while established financial brands can supply the trust the industry still lacks. But the rationale in the other direction—why crypto platforms are tokenizing stocks—is less obvious. The market is still emerging, and motivations remain varied and speculative.

This report examines that question by analyzing the structure of the tokenized stock market and profiling its key players.

2. What Is the Tokenized Stock Market?

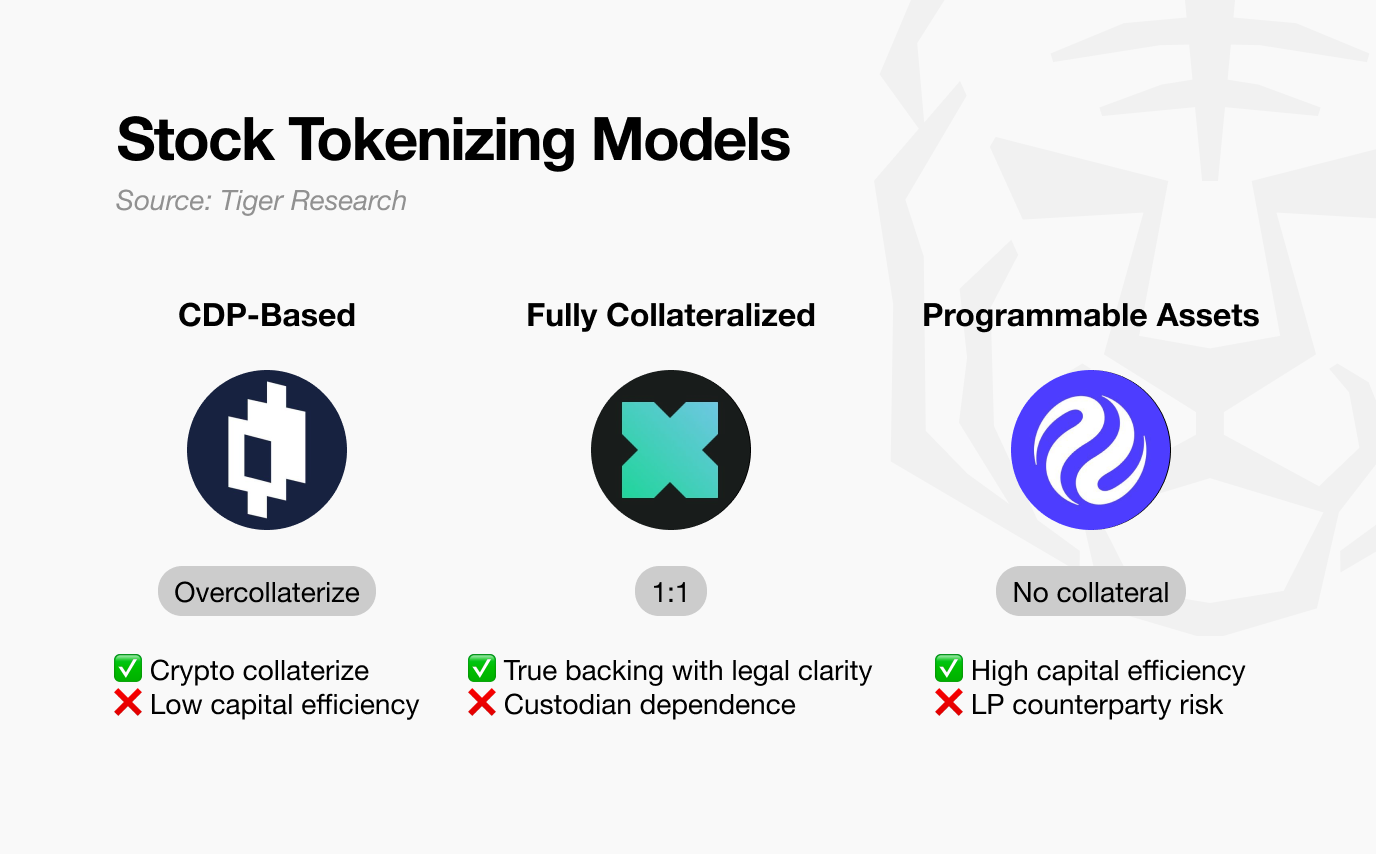

The tokenized stock market refers to the conversion of traditional stocks into digital tokens on a blockchain. These tokens are designed to mirror the value of the underlying stocks but typically do not carry shareholder rights. Most are structured as derivatives rather than direct stock holdings.

While the first wave of tokenized stocks emerged in 2021, most early models as Mirror Protocol, failed to scale due to inefficiencies and systemic risks—particularly within ecosystems like Terra. More recent approaches have introduced improved mechanisms with stronger capital dynamics and compliance frameworks, led by Injective and xStocks.

Interest in tokenized stocks has grown sharply in line with the broader RWA (real-world asset) trend, which has become a key narrative in crypto markets.

Beyond these immediate benefits, tokenized stocks enable new use cases through composability. Because they exist outside conventional regulatory silos, they can serve as collateral in lending protocols or generate yield in DeFi applications.

For example, an investor in Indonesia who wants exposure to Tesla stock traditionally must open a foreign brokerage account, navigate paperwork, and pay currency conversion fees—all within limited market hours. With tokenized stocks, the same investor can buy fractional Tesla tokens instantly via a smartphone and deploy them across DeFi protocols—for borrowing, liquidity provision, or yield generation.

3. A Viable Scenario: Reaching 1% Tokenization of Global stocks

The tokenized stock market remains in its early stages. According to data from rwa.xyz, the current market size is approximately $500 million. In comparison to the $134 trillion global stock market, this represents just 0.0004%. However, if only 1% of global stocks were tokenized over the next decade, the market could grow to $1.34 trillion—a 2,680-fold increase from today.

3.1. A Turning Point in 2025

The second half of 2025 is likely to mark a key turning point. Though still early, tokenized stock volume within the Solana ecosystem surged from $15 million to $100 million in just one month—a 566% increase.

More significant is the entry of regulated players. Major fintech firms are expanding tokenization services globally, with Robinhood announcing its launch in Europe. As the market spreads from North America to Europe and Asia, regulatory clarity will become a catalyst. In particular, once stock tokenization begins under the EU’s MiCA framework, the market is expected to scale rapidly.

3.2. Conditions for Success by 2030

Reaching 1% tokenization of the global stock market by 2030 requires clear justification. Investors must have strong incentives to shift from traditional systems to tokenized platforms. This transition will only occur if four key conditions work in combination.

First, cost savings must be demonstrated.

Theoretical reductions of 50–70% in brokerage, settlement, and administrative fees need to be validated in practice. If tokenization significantly lowers foreign exchange and cross-border transaction costs, it could offer a compelling alternative for global investors.

Second, the utility of 24/7 trading must be proven.

Tokenized stocks should support continuous trading across Asia, Europe, and the U.S. By removing the time constraints of traditional exchanges, they can provide greater liquidity and enable real-time responses to global events—improving overall trading efficiency.

Third, DeFi-based secondary yield generation must become a core feature.

Tokenized stocks must serve not only as tradeable assets but also as foundational components in DeFi protocols. If investors can use them for collateralized lending, AMM-based options, liquidity provision, and automated portfolio strategies, they gain the ability to earn additional yield without selling. As these mechanisms mature, they will reinforce the primary benefits of tokenization—cost efficiency, accessibility, and continuous trading—making the transition away from legacy systems increasingly attractive.

4. Key Players in the Tokenized Stock Market

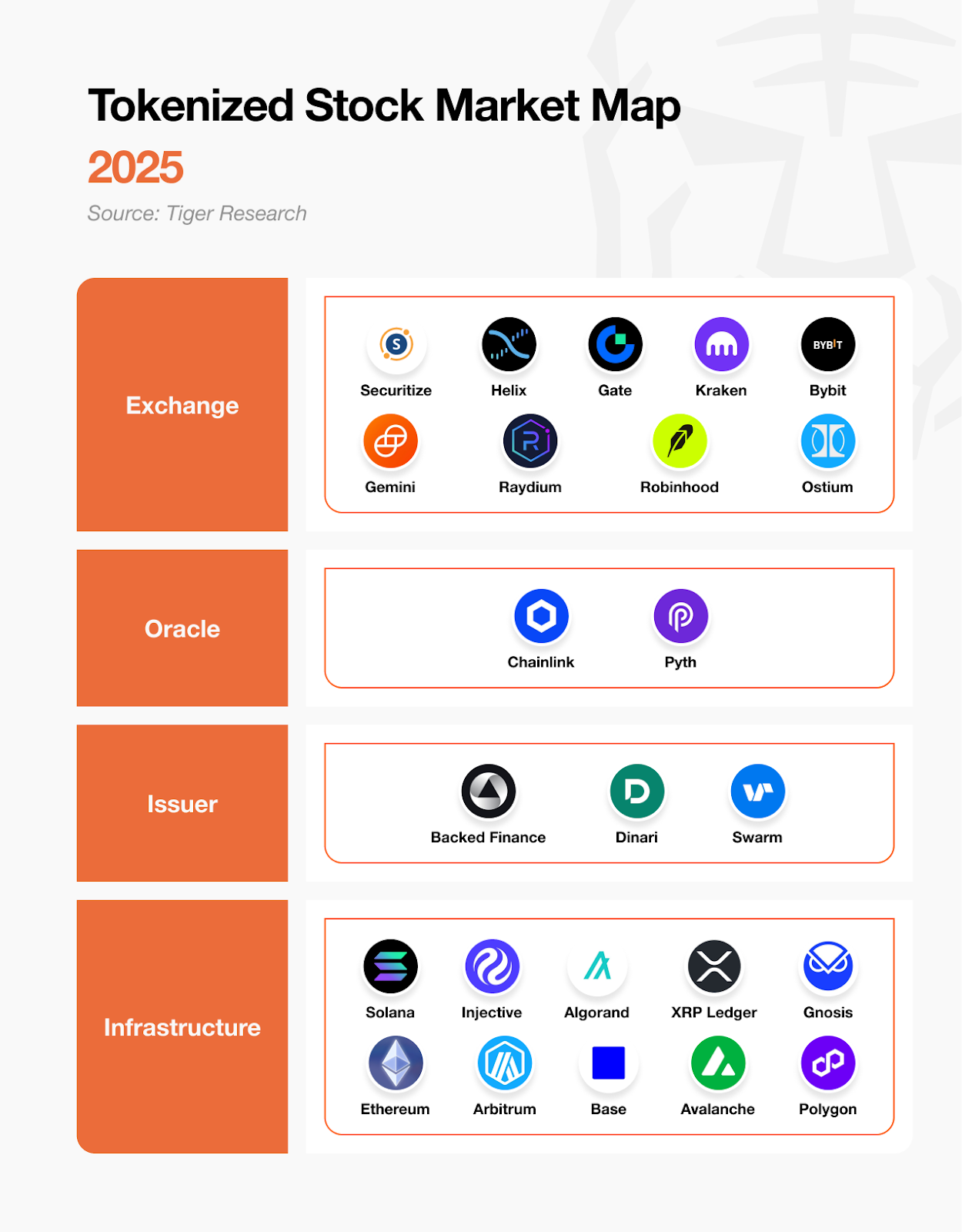

The tokenized stock market is built on four core layers that operate in coordination.

At the base is the infrastructure layer, which provides the blockchain networks where all transactions occur. On top of that are the issuers, responsible for creating tokenized representations of traditional stocks. To ensure accurate price tracking, oracles supply real-time market data and maintain links to the underlying assets. Finally, exchanges allow investors to buy and sell tokenized stocks.

A functional tokenized stock ecosystem requires all four layers to be in place. Without any one of them, the system lacks the components necessary for secure issuance, pricing, and trading.

4.1. Tokenization in Practice

Consider an investor who wants to gain exposure to Apple ($AAPL) stock in tokenized form. They might trade iAAPL with up to 25x leverage on Helix, purchase $xAAPL spot tokens issued by Backed Finance on Kraken, or access U.S. stocks 24/7 as a European resident via Robinhood EU. Each exchange operates under different regulatory environments and trading models, meeting a range of investor needs.

For tokenized stocks to reflect the real stock price accurately, reliable market data is essential. Chainlink, for example, sources live Apple stock prices from Nasdaq and delivers them on-chain. It also provides Proof-of-Reserve, verifying that each token is backed 1:1 by the corresponding Apple shares. This ensures investors can trust the token’s price integrity.

Issuers convert traditional stocks into tokenized assets. Backed Finance holds actual Apple shares in custody at a Swiss bank and issues $xAAPL tokens at a 1:1 ratio. In contrast, Injective’s $iAAPL using iAssets without holding the underlying shares, using oracle data to synthetically track the price—enabling leveraged trading without physical settlement. Both represent different approaches to bridging traditional stocks with blockchain infrastructure.

All transactions and token transfers occur on blockchain networks. On Solana, Backed Finance’s xStocks trade with low latency and minimal fees. Injective supports high-performance, order book-based trading. On Ethereum and Arbitrum, Dinari dShares operate under U.S. regulatory compliance. Each chain offers different technical capabilities to meet the infrastructure needs of tokenized stock platforms.

4.2. Leading Players in the Tokenized Stock Market

Key players in the tokenized stock market are shaping the ecosystem based on distinct strategies and capabilities. Below is a summary of notable firms and their current positioning:

Injective: A leader in perpetual futures for tokenized stocks. As of H1 2025, cumulative trading volume surpassed $1 billion. Through its Helix DEX, it offers up to 25x leverage, driving liquidity in the derivatives segment.

xStocks (Backed Finance): Accounts for 80% of the top 10 tokenized stocks by market cap. Operates on a 1:1 backing model with custody at Swiss banks, and has seen broad adoption across the Solana ecosystem.

Robinhood: Expanded into Europe in 2025, offering over 200 tokenized U.S. stocks and private stocks. Provides zero-fee trading on Arbitrum with 24/5 availability.

Gemini: Partnered with Dinari Global to serve EU investors with over 60 tokenized stocks. Compliant with MiFID II, enabling access within the European regulatory framework.

Securitize: A leading player in tokenized real-world assets, including U.S. Treasury tokens like $BUDIL. Also offers stock tokenization products totaling $312 million, with the largest single-asset deployment on Algorand.

Chainlink: Provides critical data infrastructure, including real-time stock and ETF pricing feeds, as well as Proof-of-Reserve verification for asset backing.

5. The Role of Tokenized Stock in the RWA Market

5.1. A Limited but Most Viable Segment

Tokenized stocks represent just one segment within the broader real-world asset (RWA) market. Without regulatory clarity, their adoption would remain constrained. However, that barrier is already beginning to lift. Robinhood has announced tokenized stock offerings in Europe, and other major platforms are following suit. As more jurisdictions align with these developments, regulatory acceptance is likely to expand.

5.2. Proven Demand Meets Clear Friction

The strength of this market lies in its fundamentals. Equities are already widely traded assets with well-established demand. At the same time, the trading process has long faced inefficiencies—particularly around access, settlement speed, and geographic limitations. This combination of proven demand and addressable friction makes equities an ideal starting point for tokenization.

Unlike other RWA categories that must first generate demand, tokenized stocks build directly on a $134 trillion global equity base. The case for tokenization is strengthened by its tangible benefits: lower costs, broader access, 24/7 trading, and DeFi integration. As regulatory frameworks mature, these advantages position tokenized equities for accelerated adoption.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.