This report analyzes the resurgence of public token sales and examines the strategies of four major launchpad platforms: Legion, BuidlPad, Sonar, and Kaito.

TL;DR

Public sales are re-emerging in new forms since the 2017 ICO boom. Various launchpads such as Legion, Buidlpad, Sonar, and Kaito are leading market trends.

Most platforms require KYC and comply with regulations. Each platform differentiates itself through unique participant selection criteria and token allocation methods.

Short-term hype around public launchpads may cool down. However, public launchpads are expected to persist due to structural demand. They serve as a tool for projects to secure early users and liquidity.

1. The Return to Public Sales from Private Sales

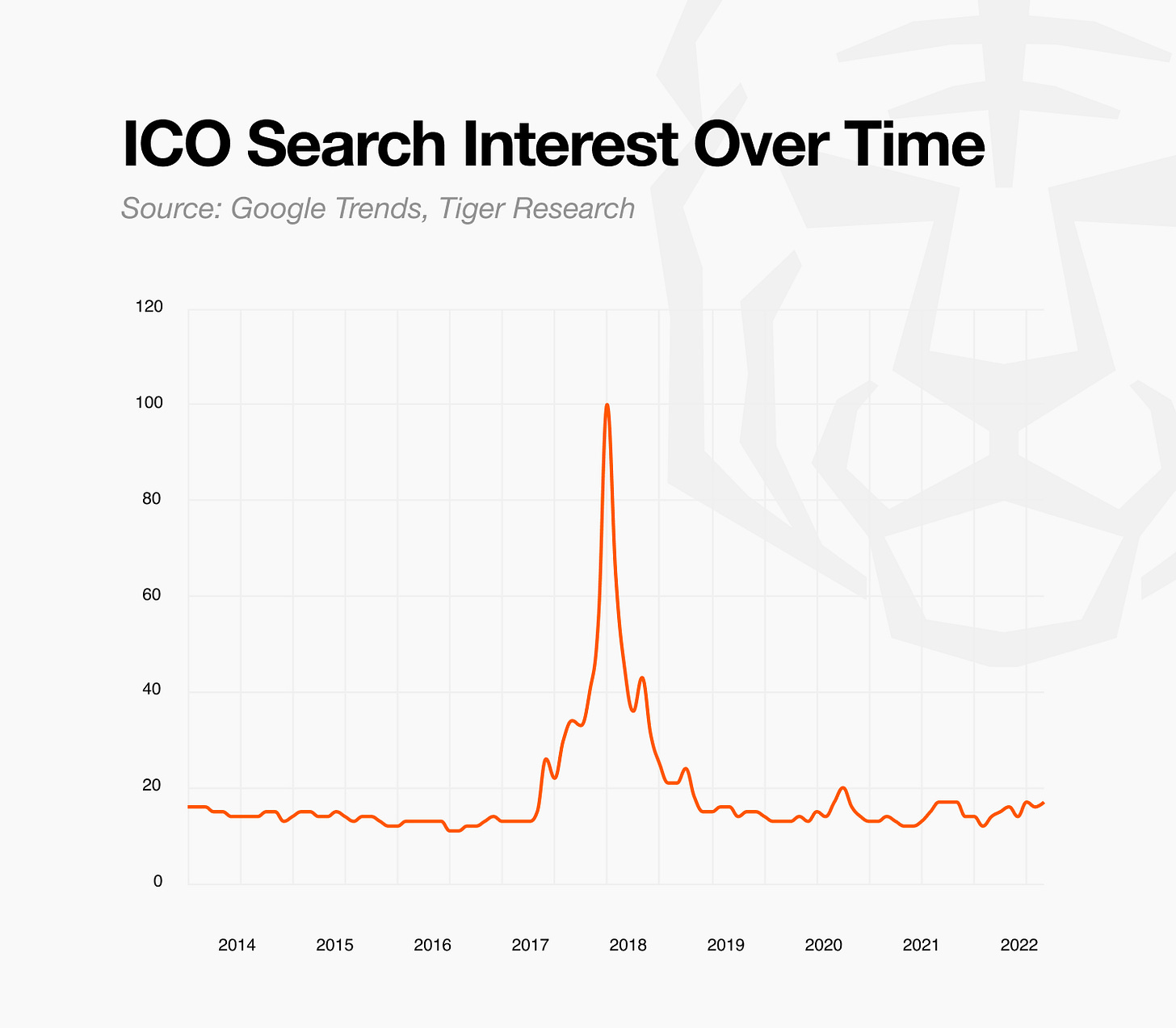

The ICO (Initial Coin Offering) boom peaked in 2017 but rapidly contracted as it lost credibility due to fraud and opaque information. The market subsequently shifted to private sales. Early participation opportunities for retail investors diminished significantly. However, public sales are recently resurging in new forms. This revival follows the emergence of various launchpad platforms that address past ICO problems.

Clearer regulations drive this change. Europe’s Markets in Crypto-Assets (MiCA) law created a clear licensing system for issuers and fundraising platforms. This provided legal grounds for selling tokens to qualified participants. Some Asian regions and several Middle Eastern hubs now allow KYC-based token sales under local licenses. These developments created an environment where public sales can operate legally within regulatory frameworks.

This report examines the features and strategies of emerging launchpad platforms in this changing environment. It also explores future directions for the public launchpad market.

2. Four Launchpads, Four Different Approaches

New launchpad platforms continue to emerge and diversify public sale methods. They all require compliance measures like KYC as a baseline. However, their approaches to participant selection and token distribution differ significantly across platforms. This report examines four representative launchpads to explore these differences in detail.

2.1. Legion: Merit-Based Crypto Launchpad Platform

Legion is a public sale platform that selects investors who can genuinely contribute to project development and provides them with fair investment opportunities. The goal is not simply to find investors for fundraising purposes. Legion connects participants who can add real value to projects to maximize long-term value.

Legion operates a proprietary merit-based system called the ‘Legion Score’ for this purpose. The score is calculated quantitatively by combining various on-chain and off-chain data including on-chain activity history, social media influence, and GitHub activity scores. Additionally, investors must write cover letters when participating in investment rounds to explain how they can contribute to the project. This allows qualitative assessment of subjective factors that are difficult to quantify (primarily evaluated using LLM). This approach comprehensively judges investor capability to contribute to the ecosystem rather than simply their financial capacity.

The recent Yield Basis sale demonstrates how this method works in practice. Over 67,000 people applied for this sale. Legion used the Legion Score as the foundation but applied a relative evaluation approach rather than absolute evaluation. The platform considered multiple factors including whether applicants tweeted about Yield Basis, on-chain activity in related protocols, and for developers, GitHub contribution history. Manual review complemented this process for final selection.

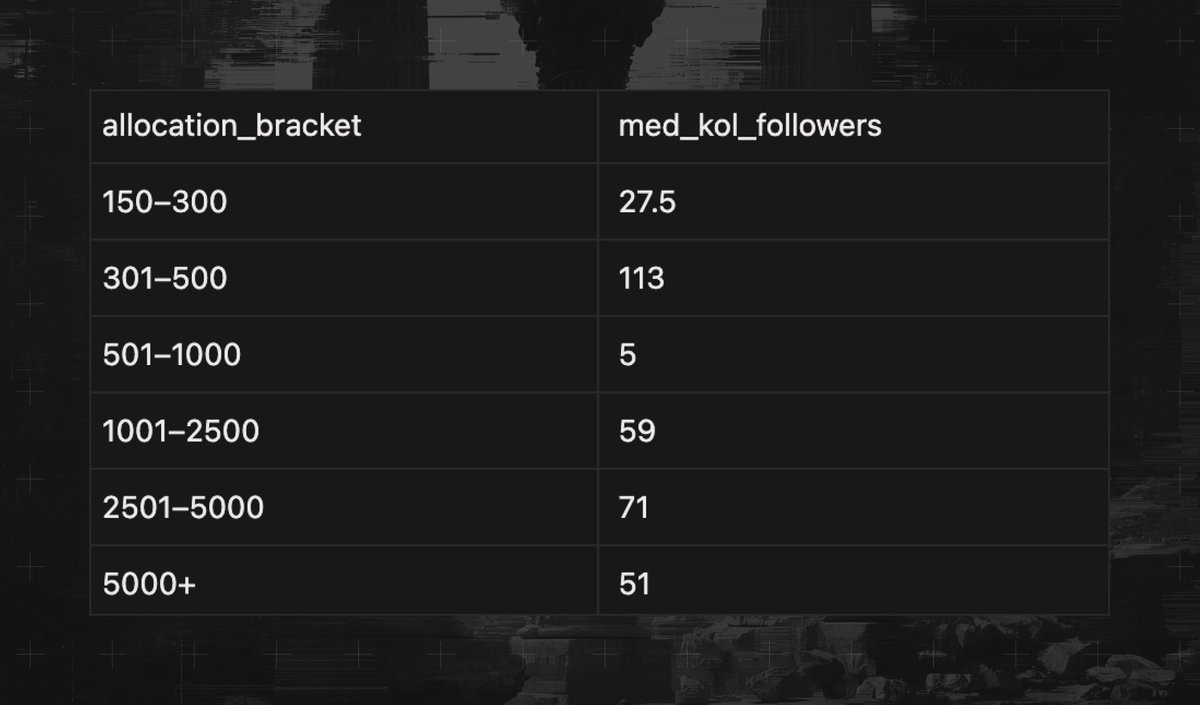

However, some controversy arose during this process. Some participants questioned whether allocations were excessively concentrated among a small number of influencers. Legion responded by publishing a transparency report that disclosed allocation criteria and actual distribution. However, this reveals a fundamental dilemma inherent in merit-based models. Qualitative judgment inevitably enters the selection process. The platform cannot fully disclose criteria for valuing different types of contributions. Publishing detailed evaluation criteria could allow participants to manipulate the system through fraudulent participation. Some level of opacity remains unavoidable. The model faces structural limitations in balancing complete objectivity with transparency.

Nevertheless, Legion’s approach holds significance. It presents a fundraising structure centered on contribution capability rather than simple capital power or first-come-first-served competition. This connects projects with suitable investors. The approach attempts to transform public sales from pure speculation into long-term community participation. It also represents an experiment in implementing the openness and accessibility that past ICOs pursued through new methods.

2.2. Buidlpad: Participation-Based Crypto Launchpad Platform

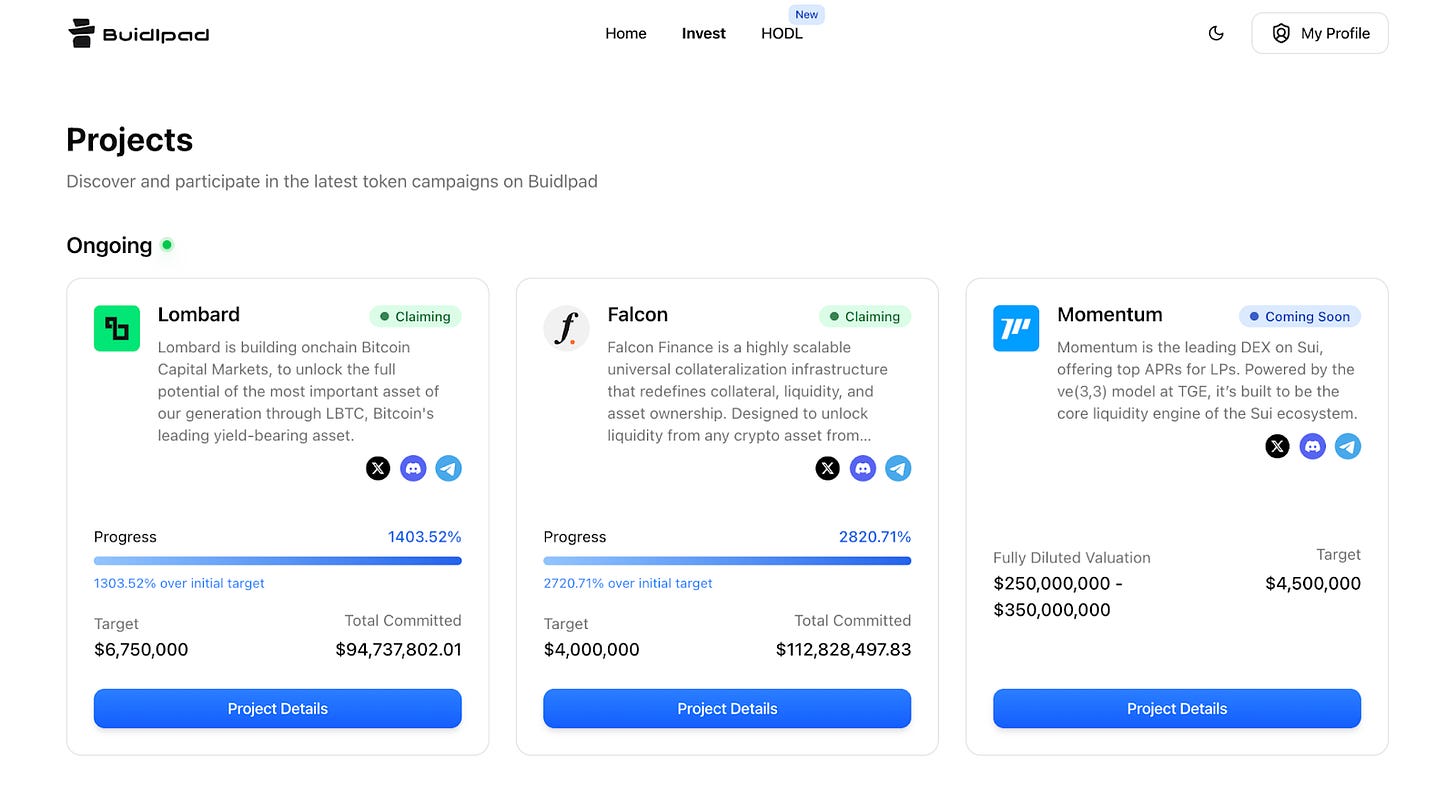

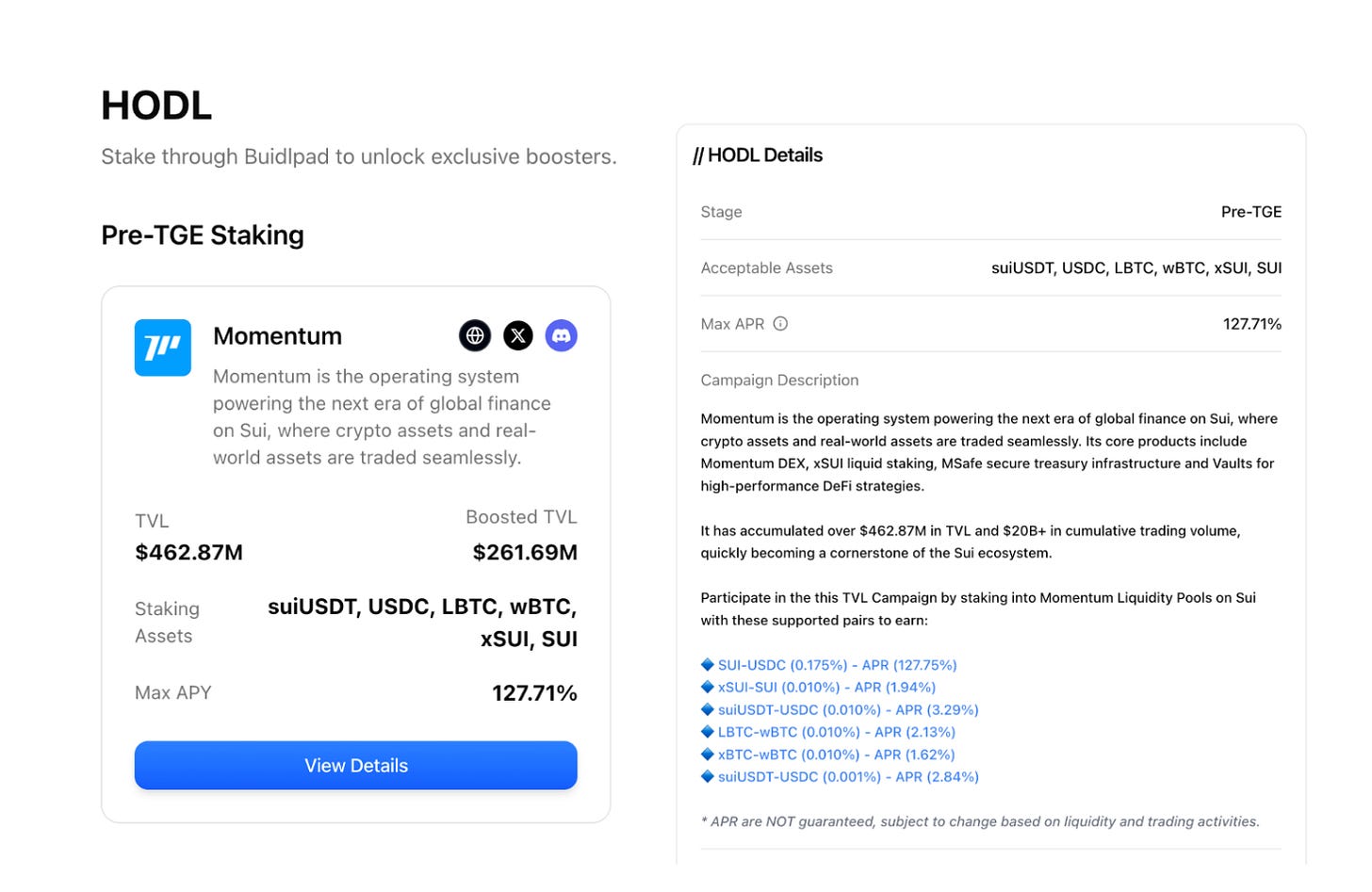

Buidlpad is a launchpad that takes a different approach from Legion. Both platforms allow anyone who completes KYC verification to participate, but participant selection criteria differ. While Legion uses merit scores, Buidlpad bases selection on liquidity provision to projects. Participants stake directly in their desired project pools in the Hodl section. Tier assignment depends on staking amounts. Higher tiers receive more favorable token purchase prices.

This approach has clear advantages and disadvantages. Anyone with capital can participate, creating low entry barriers. Projects can secure necessary liquidity in early stages. Projects like Momentum currently conducting sales on Buidlpad have secured substantial TVL (Total Value Locked). However, capital size becomes a prerequisite for participation. This limits opportunities for participants who could contribute through influence or technical skills like on Legion.

Buidlpad recently introduced the ‘Squad’ system to address limitations of this capital-centered structure. Squad adds gamification elements to the existing staking model. This attempts to move beyond simple capital provision. Participants can upload project-related content through social media content creation and community activities. They receive additional rewards based on content quality.

This structure forms active communities from the launchpad stage and incentivizes participation and contribution beyond capital. Projects can simultaneously secure liquidity and promotional effects needed for early bootstrapping. Buidlpad’s approach demonstrates how launchpads can evolve beyond simple fundraising channels into ecosystem bootstrapping tools.

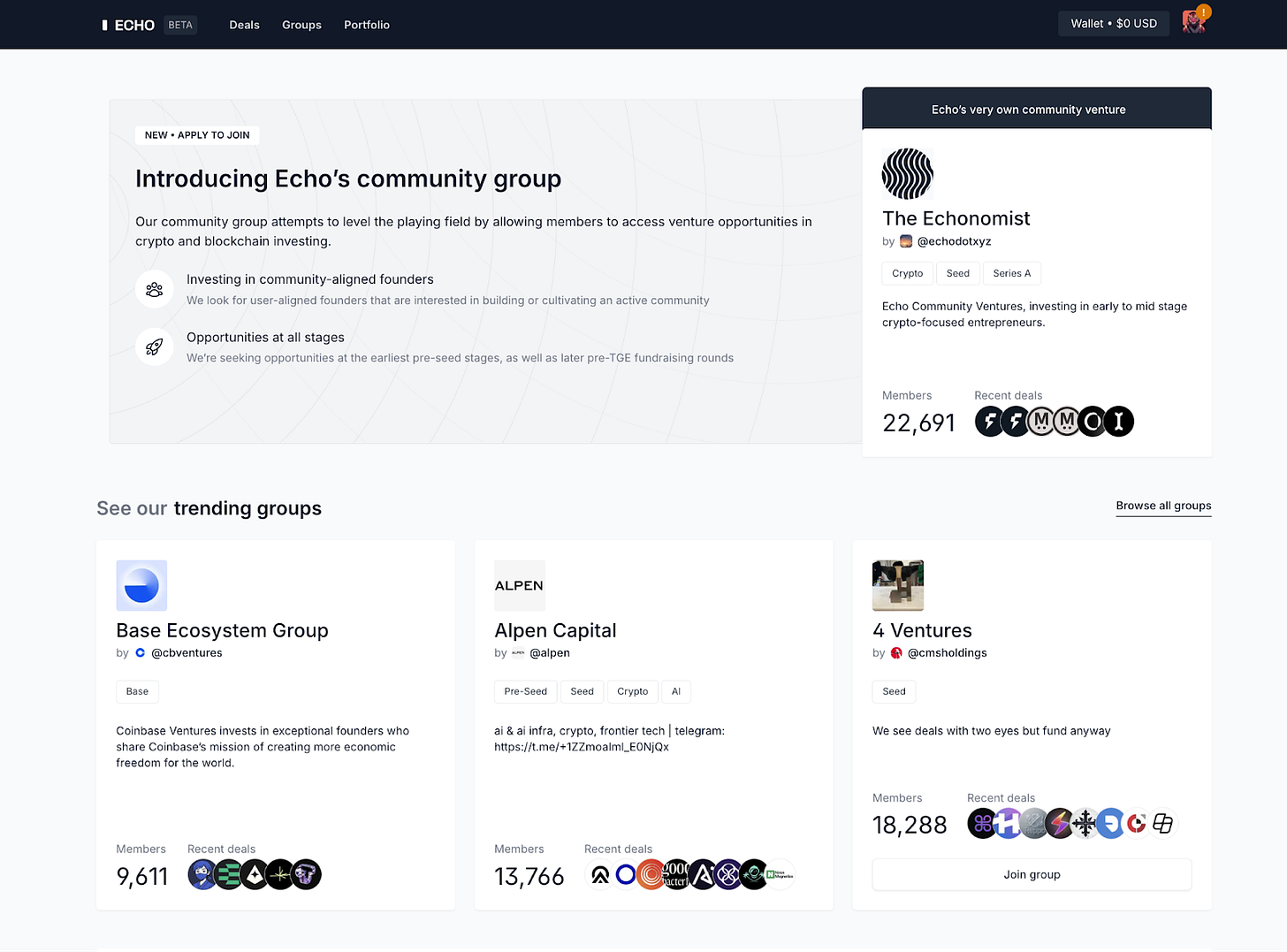

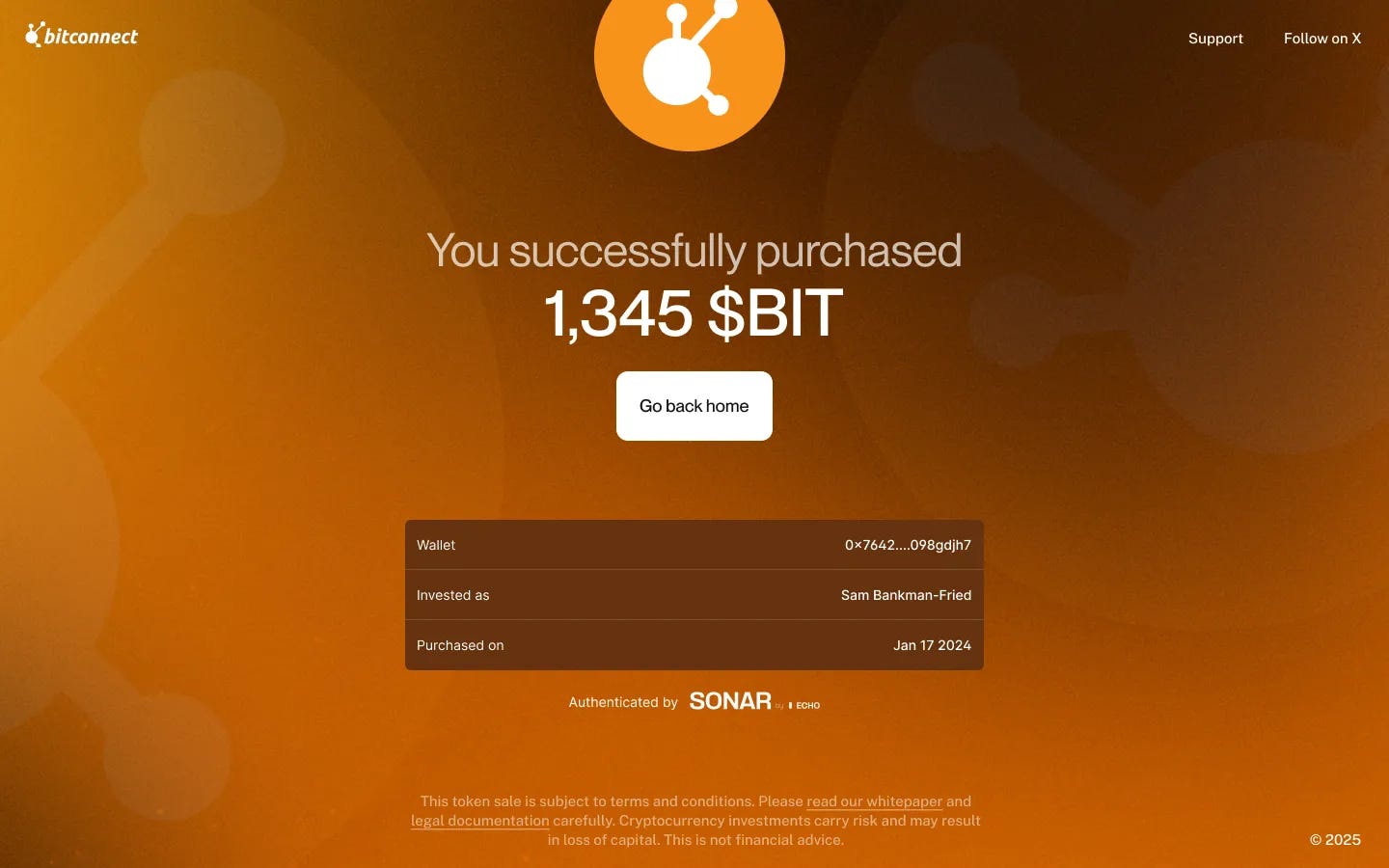

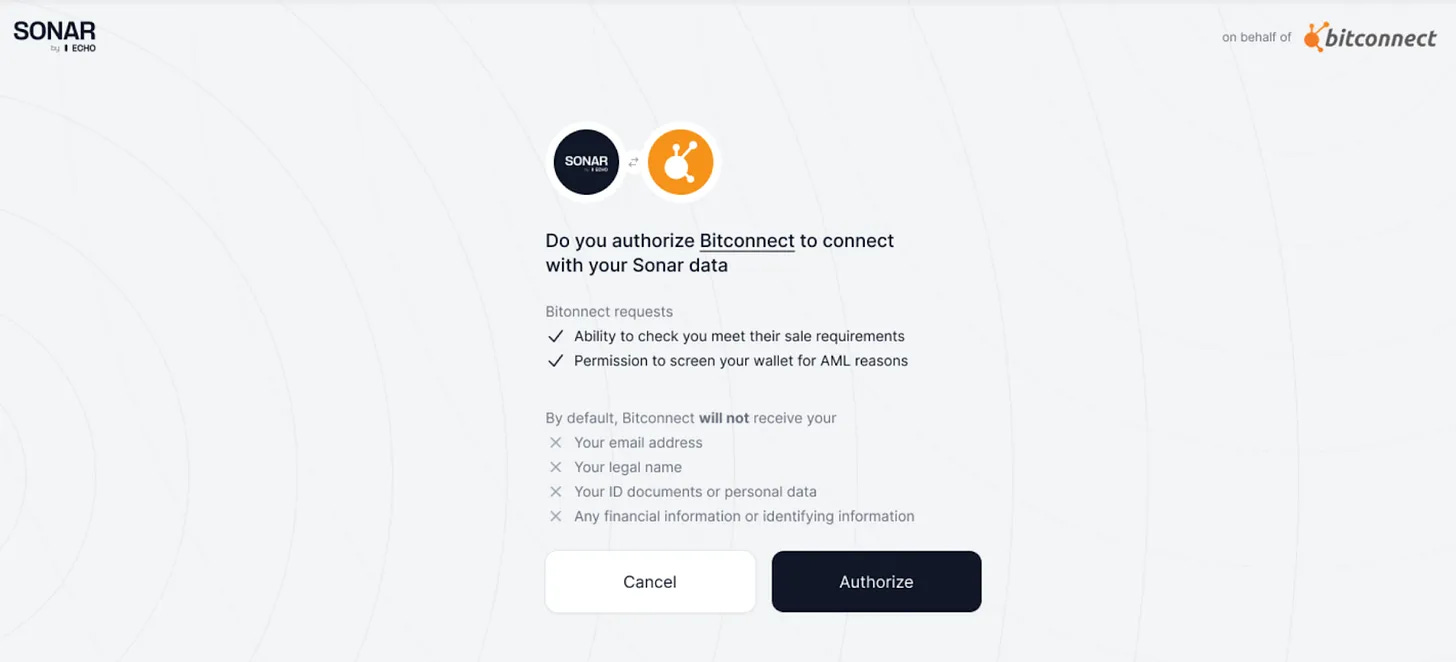

2.3. Sonar: Public Launchpad from Syndicate Platform Echo

Sonar is a public launchpad developed by syndicate investment platform Echo. Echo operates on an invite-only basis. Beyond KYC, the platform strictly selects participants based on investment experience and capability. This makes it a professional investor-only platform. This closed structure creates high entry barriers for retail investors. Sonar was created to address this gap and pursues a more open token sale model.

Sonar’s defining feature is flexibility. Projects can freely configure sale schedules, prices, and distribution methods. Sonar only provides the software. Echo’s compliance framework remains intact throughout this process. Participants must undergo qualification screening including KYC. However, only eligibility attestations rather than personal information are transmitted to projects. This simultaneously satisfies legal requirements and privacy protection. Projects like Plasma and MegaEther have conducted sales through Sonar using this approach.

However, this flexibility creates uncertainty for investors. Sale structures differ across projects. Detailed criteria or responsible parties may not be clearly disclosed. When problems arise, accountability between platform and project may be unclear. This can create structural risks compared to centralized platforms that operate with clear rules.

2.4. Kaito Capital Launchpad: Social Data-Based Crypto Launchpad

Kaito Capital Launchpad is a merit-based public launchpad that selects participants based on reputation. It takes a similar approach to Legion but differentiates itself through focus on social influence. Kaito originally operated as an AI-based crypto information analysis platform. It provided market insights based on on-chain data and quantified social activity through the Yaps system. Kaito Capital Launchpad extends this data infrastructure into public sales.

Kaito Capital Launchpad scores user social influence through Yap points. It determines allocation priority by combining this with on-chain participation history, Kaito token holdings and staking amounts, past sale participation experience, and regional allocation limits. Yap points are not mandatory requirements. However, higher leaderboard positions increase chances of receiving larger allocations or rewards. Some projects grant priority to Yap point holders.

This structure provides clear advantages for projects. Projects can secure influential social media participants as early investors and gain natural promotional effects. This strategy proves particularly effective for projects where early-stage visibility matters. However, limitations exist. The structure centers on activity within the Kaito ecosystem and creates high entry barriers for outside participants. The evaluation criteria focus on social influence. This makes it difficult to fairly assess other types of contributors like developers.

3. Will Public Launchpads Remain Relevant in the Future?

Interest in public launchpads has surged recently. Projects launched through Buidlpad gained listings on major Korean exchanges like Upbit and Bithumb and recorded short-term price increases. These cases raised investor expectations. Returns are lower compared to the previous IDO cycle (Star Atlas’s 2021 IDO recorded hundreds of times returns). However, considering market conditions after prolonged downturn, these opportunities remain attractive.

This enthusiasm is unlikely to sustain. As high-return cases repeat, investor expectations rise to unrealistic levels. Not all projects can guarantee identical returns. When results fall short of expectations, disappointment spreads among participants and likely leads to market-wide fatigue. Overheating also burdens projects. When participants seeking only short-term profits flood in, community quality deteriorates. Long-term user conversion and ecosystem maintenance become difficult. As this pattern repeats, participation enthusiasm naturally subsides. Short-term overheating will likely moderate after certain points.

Nevertheless, public launchpads will likely remain as models based on structural demand rather than temporary trends. Today’s crypto market is far more complex than the past and will grow more complex. Countless projects emerge simultaneously. They need initial fundraising methods to form communities and secure user bases. However, conducting independent TGEs (Token Generation Events) involves high costs and risks. In environments rampant with bots and duplicate accounts, even identifying real users proves difficult. Public launchpads provide structured solutions to these problems. Through participant pools that undergo screening, projects can efficiently secure initial liquidity and communities.

For investors, public launchpads provide renewed access to ‘early investment opportunities’ that remained closed for some time. They offer individual investors excluded from venture capital-centered market structures a path to participate in early-stage projects through fairer and more transparent methods. Beyond simple profit realization, they function as new structures for direct participation in the starting point of token economies.

However, challenges remain. Openness of participation and efficiency of selection fundamentally conflict. Balancing the ideal that anyone should participate with the reality of selecting actual users proves difficult. Overly transparent criteria invite system exploitation. Opaque criteria weaken trust. Institutional and technical evolution remains necessary at this point.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.