This report was written by Tiger Research, analyzing the trading mechanism of project points in point markets through case studies of Whales Market and SOTC.

TL;DR

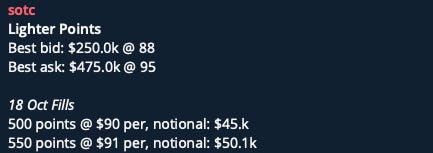

The trading of Lighter Points at around $100 each drew significant attention, establishing a new pre-market structure that enables the trading of project points before token issuance.

Points are transferred by updating ownership records within the project’s internal database. However, the transaction details are recorded on-chain, serving as proof of ownership for TGE.

The point market serves as an indicator of early project performance expectations, introducing a new investment avenue where investors can establish strategic positions before TGE.

1. From Rewards to Market: The Implications of Lighter Point Trading

In October 2025, Lighter points traded near $100 per unit on point market platforms, drawing significant market attention. This event highlighted the rapid rise of point markets—exchanges that enable trading of airdrop reward points before a project’s Token Generation Event (TGE).

Platforms such as Whales Market and SOTC are leading this new model. Unlike traditional approaches where participants waited months for token issuance, projects integrated with point markets allow users to trade their earned points immediately.

The waiting period between participation and liquidity effectively disappears, transforming early engagement into an instantly tradable asset.

This innovation raises a critical question: how can points recorded only within a project’s internal database be traded externally? The answer lies in how point markets authenticate, standardize, and bridge internal project data with external trading infrastructure—a mechanism that defines the market’s credibility and sustainability.

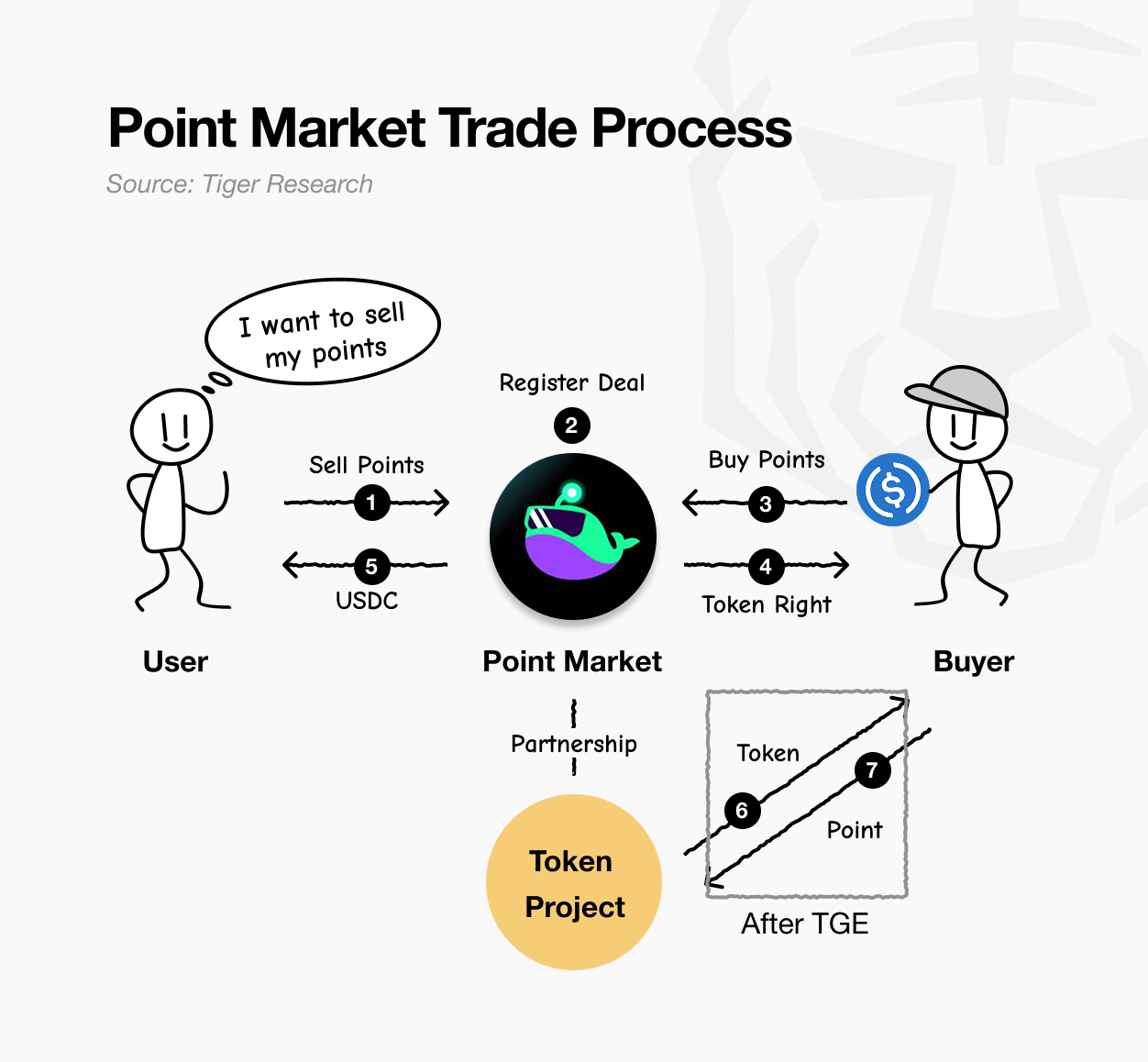

2. Point Trading Process

Users accumulate points by participating in testnets, contributing to the community, or executing transactions.

Unlike tokens, however, these points are not stored in on-chain wallets—they exist within the project’s off-chain database. To enable trading, these points must be represented and transacted outside that internal system.

Platforms such as Whales Market establish prior agreements with participating projects to facilitate this process. Through these agreements, the platform gains limited access or verification rights to the project’s off-chain point records, enabling points to be traded externally under controlled conditions.

In the following section, we examine Whales Market as a case study to understand how this structure allows off-chain points to be traded securely and transparently.

2.1. Step 1: Trading Points via the Platform

Users connect their wallets to a point market platform such as Whales Market and list their accumulated points for sale. These listings are made public on the platform, allowing potential buyers to browse available offers and initiate transactions for the points they wish to purchase.

2.2. Step 2: Transfer of Point Ownership

Once a trade is executed, the buyer pays through a smart contract, confirming the transaction. Notably, the points themselves do not move on-chain. Instead, ownership is updated within the project’s internal database—the holder address changes from the seller to the buyer. This database update constitutes the transfer of ownership.

Each completed trade generates two records:

On-chain record: a transaction hash stored on the blockchain, serving as verifiable proof of trade.

Off-chain record: once Whales Market validates the transaction and shares the data with the project, the project’s internal database updates ownership accordingly.

Through this dual-record system, buyers secure both blockchain-based proof of transaction and recognition of ownership within the project’s system.

2.3. Step 3: Conversion of Points into Tokens

When the project proceeds with its TGE (Token Generation Event), it typically opens a claim portal or airdrop page. Users with verified transaction histories on Whales Market and corresponding ownership records in the project database can then claim tokens according to their point holdings.

3. Projects Building Point Markets

Point market transactions require formal agreements between token projects that operate point systems and the point market platforms themselves. Once such an agreement is in place, all trades occur through the designated point market. This means token projects must rely on the platform’s transaction integrity and infrastructure.

From the project’s perspective, this dependency carries risk. Because pre-TGE point trading—a critical phase of community engagement and value formation—occurs externally, any malfunction or failure on the point market’s side could result in irreversible losses. Consequently, not every project can or should participate; only those that meet technical and operational standards set by the platform are typically accepted.

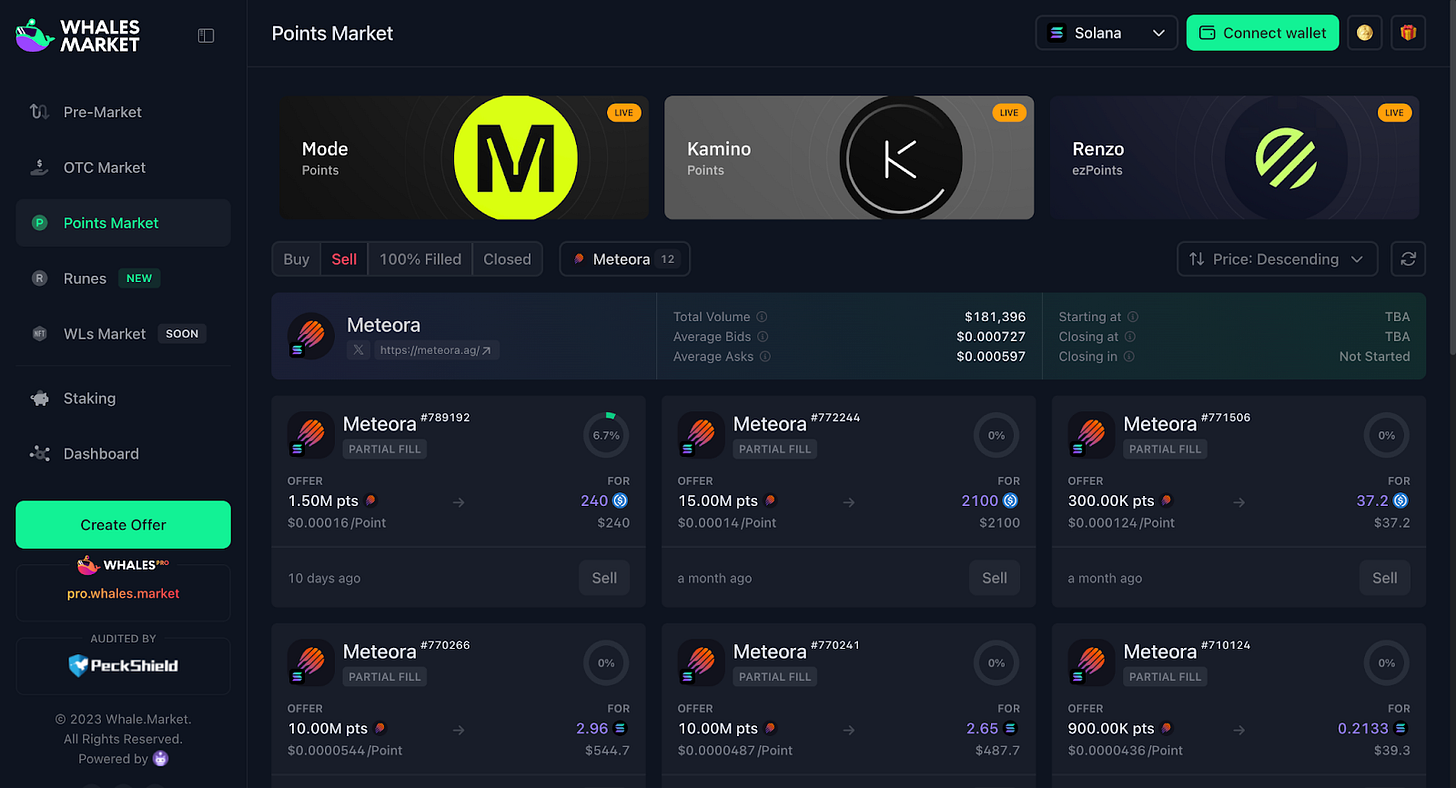

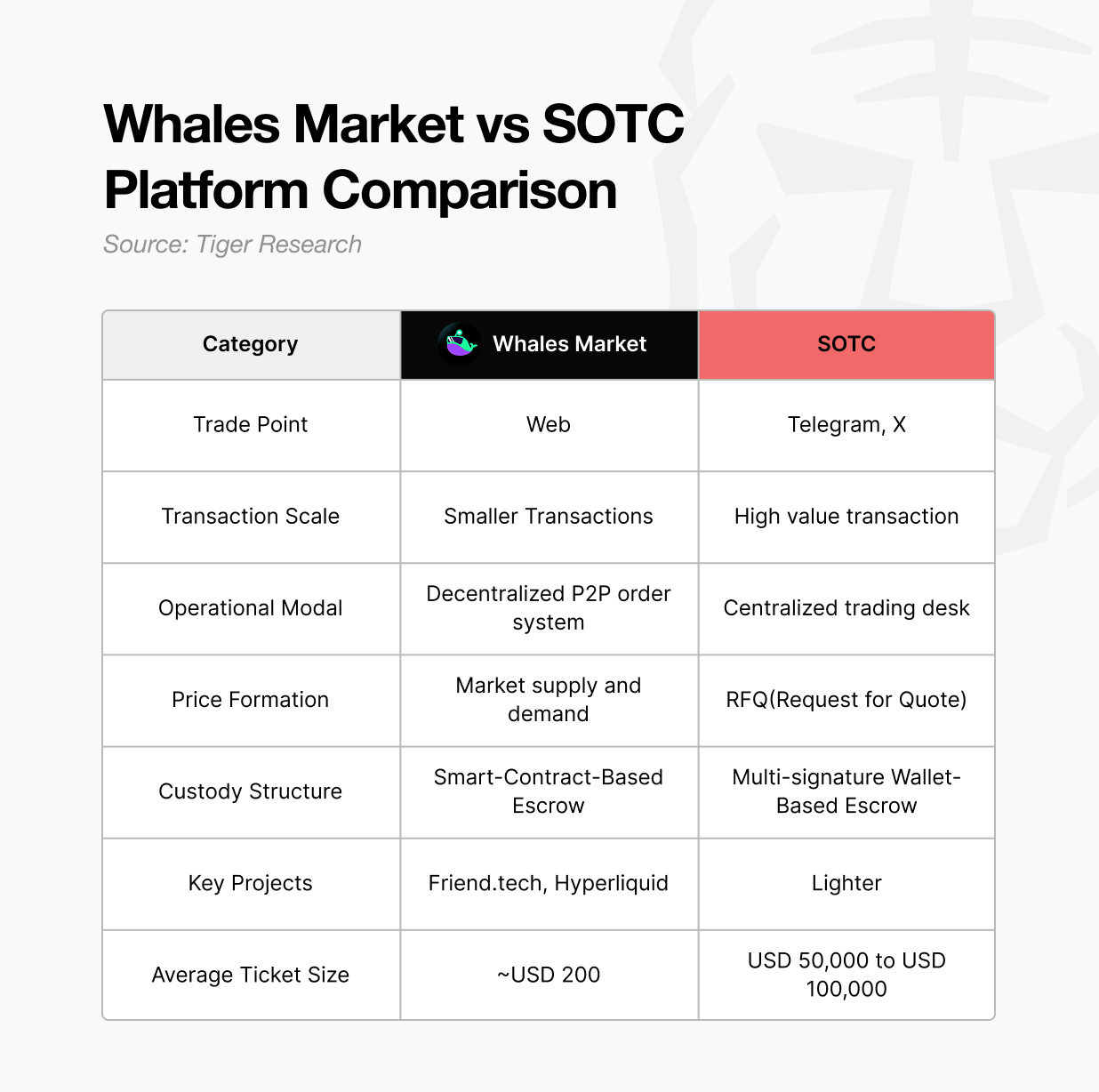

Currently, the point trading market is centered around two major platforms: Whales Market, which operates as an open and public marketplace, and SOTC, which runs as a closed, invitation-only platform.

3.1. Whales Market

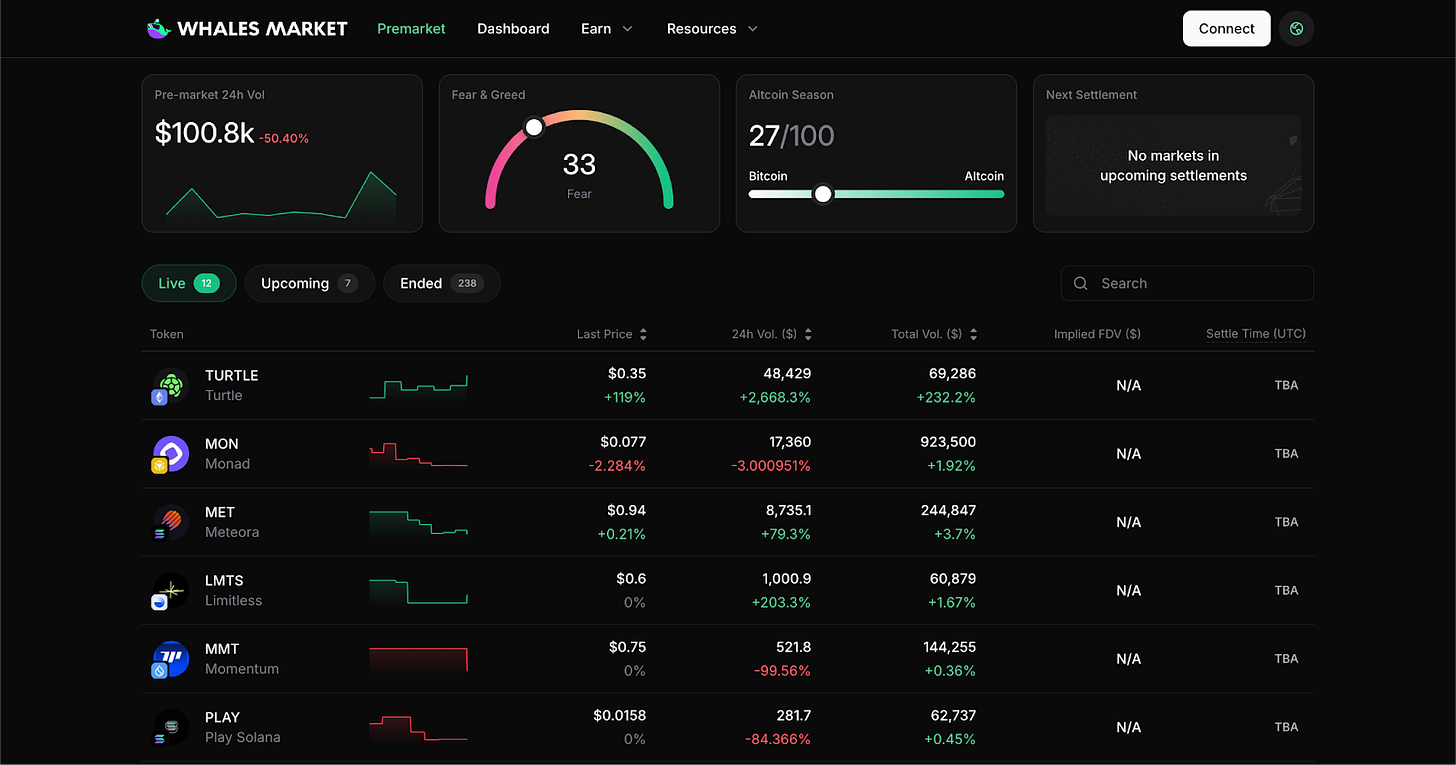

Whales Market currently sits at the center of the point market ecosystem, serving as the primary trading venue for major projects such as Hyperliquid, Friend.tech, and Blast. Despite its scale, user activity data suggests that most participants are small traders, typically operating with positions around $3,000, indicating a retail-driven market rather than institutional participation.

The platform operates on a peer-to-peer (P2P) order model. Users connect their wallets, list their points for sale, or purchase others’ listings directly. Prices are determined entirely by market demand and supply—there is no fixed benchmark and no administrative intervention. When buy and sell orders match, prices form organically through market dynamics.

Transactions are executed via smart contracts, with both the points and payment assets held in escrow until settlement conditions are met. Once matched, the trade is completed automatically, ensuring security even between anonymous participants. This structure exemplifies the decentralized design philosophy of the platform and is often cited as a model for trustless point exchange.

While Whales Market’s native token has faced significant price declines from its peak, this analysis focuses on the platform’s operational model rather than token performance.

3.2. SOTC

SOTC operates without a dedicated trading platform, using Telegram and X (formerly Twitter) as its main transaction channels. It gained attention when Lighter points reportedly traded at $95–100 per point, though this data comes from SOTC itself and cannot be independently verified.

SOTC follows an RFQ (Request for Quote) model similar to traditional finance. Sellers submit desired quantities and prices to an intermediary, who then matches them with potential buyers. Once both parties confirm, the settlement process begins.

Transaction security relies on a 2-of-3 multisignature escrow, requiring approval from any two of the three participants—the buyer, seller, and intermediary—for funds to move. Payments are held until the Token Generation Event (TGE), when tokens are delivered to buyers and collateral is returned after confirming completion.

However, transparency remains limited, as intermediaries control transaction data. While the multisig escrow mitigates risk, potential collusion between signatories could still compromise transaction integrity.

4. Point Market: An Emerging Market Model

The point market is not the only platform applicable before token issuance. Alternatives such as Pendle’s PT/YT structure and various token pre-market platforms already exist. However, the point market differs in both timing and market function.

Investors can already gauge project potential through Pendle’s YT implied yields or token pre-market prices. Yet point prices offer an even earlier and more sensitive success indicator. Pendle’s YT applies only to staking-based products, and token pre-markets require defined token parameters before trading can occur. In contrast, points are distributed as soon as campaigns begin, allowing them to serve as an earlier-stage leading signal of market confidence.

As a result, the point market represents both the first external connection between a project’s ecosystem and the broader market, and the initial mechanism for turning user participation data into tradable assets. Beyond price discovery, it also enables investors to deploy pre-token strategies—similar to how Pendle’s yield tokenization expanded pre-launch trading dynamics. As derivative structures proliferate, point-based products may become a new layer in crypto’s evolving market architecture.

The point market remains small in scale but significant in implication. It provides the earliest measurable indicator of project momentum and expands the range of strategic options available to investors. Nonetheless, challenges persist: trading requires direct agreements with each project; early-stage projects must decide whether to expose their progress transparently; and limited liquidity could constrain user experience. Sustained development will depend on how effectively point markets can balance transparency, accessibility, and market depth.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.