This report is prepared by Tiger Research and analyzes Coinbase's strategic expansion from exchange to cryptocurrency empire and its implications.

TL;DR

Coinbase evolves from a simple exchange to build a cryptocurrency full-stack ecosystem through Base Chain and The Base App.

The company simultaneously expands its influence across the cryptocurrency industry like Google through various cryptocurrency startup acquisitions and a powerful network of Coinbase alumni.

Coinbase's strategic moves will clearly contribute to cryptocurrency industry adoption. However, they create new centralized structures and leave the challenge of finding balance with decentralization values.

1. Coinbase: Ambitions Beyond the Exchange

Coinbase became the first cryptocurrency exchange to list on a stock exchange in April 2021. The company went public on Nasdaq through a direct listing. This represents more than just a single company's IPO. It marks a symbolic turning point that signals the cryptocurrency industry's entry into the mainstream financial system.

The company name is also symbolic. 'Coinbase' derives from Bitcoin's 'Coinbase Transaction,' which refers to the first transaction recorded when creating a new block. This represents the moment cryptocurrency enters the world. The company name reflects a firm commitment to serve as the starting point of the cryptocurrency ecosystem.

Coinbase's symbolic meaning extends beyond just naming. The company expands its business scope based on its foundational exchange operations and now builds a massive ecosystem. The company launched Base, an Ethereum Layer 2 chain, and recently unveiled The Base App (TBA) at its 'A New Day One' event. These developments show Coinbase completing an ecosystem that approaches a cryptocurrency full-stack spanning from infrastructure to applications.

This report examines how Coinbase evolved from an exchange to build an empire encompassing the entire cryptocurrency ecosystem. It also explores what these changes mean for the cryptocurrency industry.

2. Crypto Full-Stack: Exchange, Infrastructure, and Consumer Apps

2.1. Exchange: Coinbase's Reliable Cash Cow

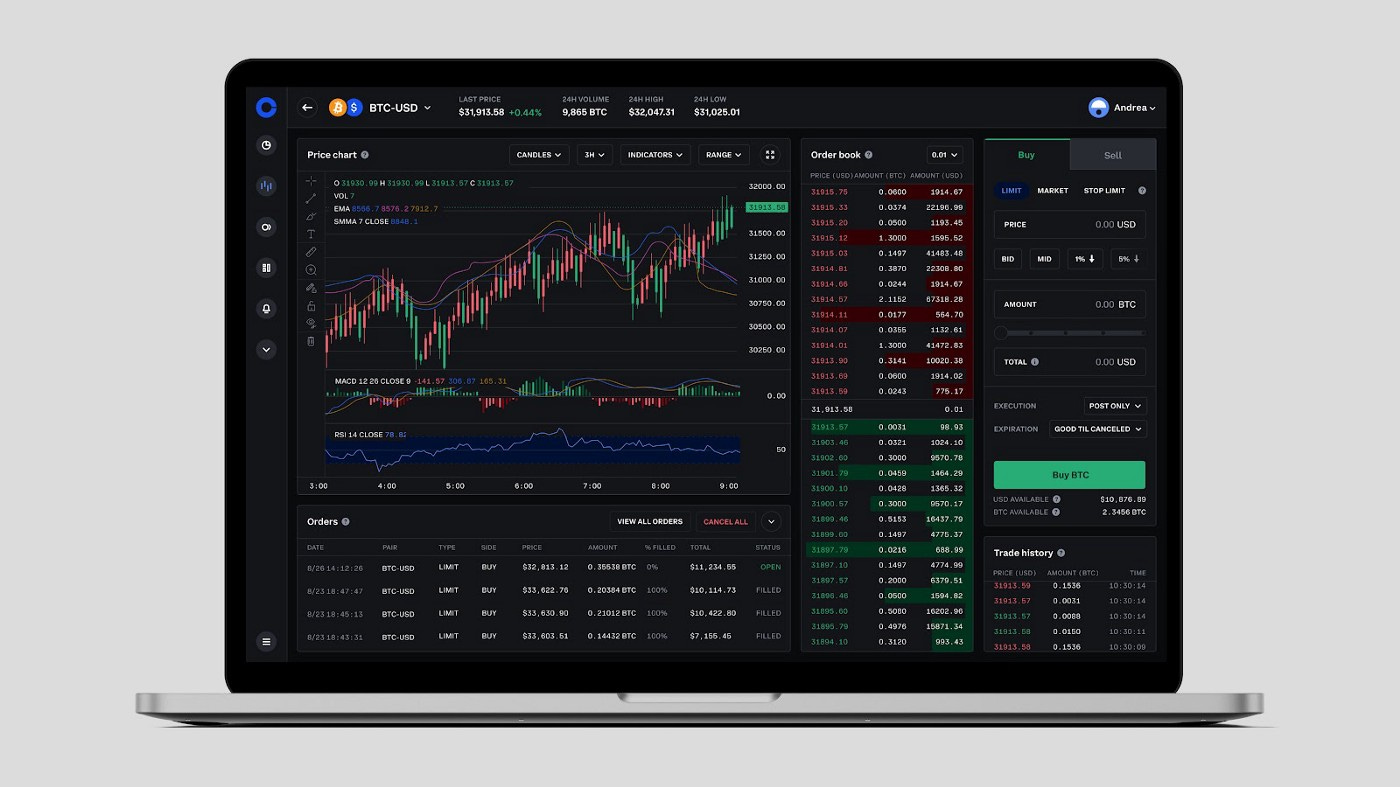

Coinbase's core business is undoubtedly its exchange. The company provides cryptocurrency trading services to various users from individuals to institutions. It generates revenue through trading fees. As of 2024, trading fee revenue accounts for approximately 60% of total revenue. This reaches about $4 billion in scale. The relatively stable trading fee revenue has become the foundation for Coinbase's new business ventures. This resembles how Amazon expanded multiple businesses based on AWS as its cash cow.

Moreover, the exchange's value extends to strategic scalability. The exchange serves as a core gateway for on-off ramps connecting fiat currency and cryptocurrency. It secures a large user base and trading data from this position. Based on this foundation, it acts as a strategic hub that can naturally draw users into a broader ecosystem. The exchange provides Coinbase with both financial stability and strategic scalability. It serves as the core foundation for ecosystem development.

2.2. Base Chain: Beyond Off-Chain to On-Chain

Base Chain is an Ethereum-based Layer 2 blockchain that Coinbase built directly. Through this chain, Coinbase enabled expansion beyond exchange business into the on-chain domain.

This expansion is necessary due to the structural characteristics of the cryptocurrency ecosystem. The cryptocurrency ecosystem is separated into off-chain and on-chain environments. Exchanges primarily provide trading services between fiat currency and cryptocurrency only in the off-chain environment.

However, the practical use of cryptocurrency occurs in the on-chain environment outside of Coinbase. This includes cryptocurrency-based collateral lending and governance participation. For example, users purchase cryptocurrency on Coinbase and then transfer it on-chain to participate in specific DeFi protocols. This means Coinbase faces structural limitations that force it to send users to other ecosystems.

Base Chain solves these constraints. Now users remain within Coinbase's ecosystem even when they purchase cryptocurrency on Coinbase and withdraw it. Just as Apple controls both hardware and software, Coinbase can now manage the entire user journey from exchange to infrastructure. This significance is substantial.

2.3. TBA: The Final Puzzle Piece for Completing the Crypto Ecosystem

In July 2025, Coinbase announced TBA, an on-chain super app, and moves toward a bigger vision. The strategy extends beyond securing users through the exchange. It provides an application layer that users can actually utilize through Base infrastructure. Many dApps exist based on Base, but they are all fragmented and difficult to find in one place. No matter how excellent Base Chain's performance is or how low its fees are, it struggles to have true meaning if general users cannot easily access it.

TBA integrates the core elements of the cryptocurrency ecosystem - exchange, infrastructure, and applications - into one platform to deliver a seamless user experience. Users can make cryptocurrency payments and transfers. They can also generate revenue from Farcaster-based social services and immediately use this for offline or online payments in a new on-chain experience. Multiple services come together to create powerful synergy and build one massive on-chain economic ecosystem. As a result, the barriers to participating in the on-chain economy are significantly lowered. This completes the final puzzle piece of the massive ecosystem that Coinbase has been building.

3. Coinbase Building a Crypto Empire

Coinbase is no longer just an exchange. The company builds blockchain infrastructure and consumer apps sequentially on top of its exchange foundation. It evolves into a massive empire that encompasses the entire cryptocurrency ecosystem. Moreover, it expands into even more diverse areas through aggressive merger and acquisition strategies. For example, the company acquired token management platform LiquiFi, zero-knowledge proof technology company Iron Fish, Web3 advertising platform Spindl, and cryptocurrency derivatives exchange Deribit. It extends its reach into all areas of the Web3 industry.

These movements read like attempts for Coinbase to secure all touchpoints related to cryptocurrency, much like an aircraft carrier. Additionally, the relationship with USDC stablecoin issuer Circle becomes even more interesting. Coinbase serves as a major shareholder of Circle and receives a certain percentage of USDC's interest revenue beyond simple equity investment. There are even provisions that transfer some USDC-related rights to Coinbase if Circle goes bankrupt or fails to fulfill its revenue distribution obligations. This shows that Coinbase controls the core infrastructure of the cryptocurrency ecosystem across almost all areas.

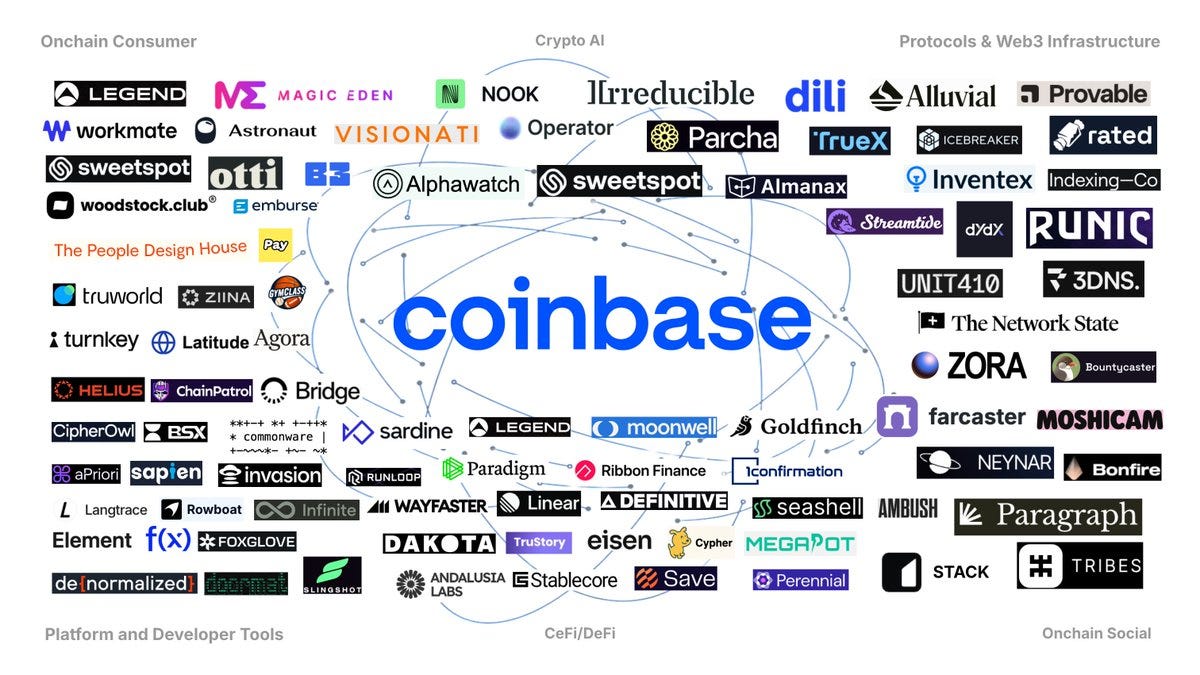

Coinbase's expansion strategy is not accomplished through mergers and acquisitions alone. Another core strategy involves Coinbase alumni spreading their influence throughout the cryptocurrency industry, similar to how the PayPal Mafia operated in the past. The company invests in over 40 Web3 startups founded by former Coinbase employees and establishes partnerships to continuously build a tight collaboration network. Notable examples include Olaf Carlson-Wee, Coinbase's first employee, who founded Polychain Capital. Major Web3 projects like dYdX, Farcaster, Zora, and B3 were all founded by Coinbase alumni.

We still know Coinbase as an exchange, but their actual operation resembles Google from the Web2 era. Just as Google started with search and dominated the entire digital ecosystem including advertising, cloud, and mobile, Coinbase also starts from exchange operations and builds a massive empire encompassing all areas of the cryptocurrency ecosystem.

4. Exchange-Centered Crypto Market: Good or Bad?

Coinbase builds a massive empire. The company's movement from exchange to Base Chain to TBA is clearly strategic. However, we need to think about their position amid these aggressive strategies.

Cryptocurrency championed decentralization but now returns to centralization while pursuing convenience. Users voluntarily enter the Coinbase ecosystem and see no reason to leave. We are essentially recreating structures similar to traditional finance.

This change is not entirely negative. Integrated platforms like TBA provide real benefits to users. Users can access all services in one app without complex wallet connections, the hassle of switching between platforms, or worrying about high gas fees. The process flows seamlessly from generating revenue through social activities to using it for actual payments. Coinbase's model clearly contributes to cryptocurrency adoption.

However, we must not overlook one important point. Cryptocurrency aimed for decentralization but now results in new forms of centralized structures while pursuing convenience. Users voluntarily stay within the Coinbase ecosystem and find no compelling reason to leave. This is essentially no different from the traditional centralized financial structures we tried to escape.

The market has already chosen convenience. Reversing this trend seems difficult. What matters now is finding the right balance between centralized convenience and the spirit of decentralization. The real challenge is building an ecosystem that protects user choice through healthy competition and continuous innovation while preserving cryptocurrency's core values.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.