This report, written by Tiger Research, analyzes the strategic approaches of key players in on-chain finance and their structural implications for the future of financial infrastructure.

TL;DR

JP Morgan issues deposit tokens on public blockchain and adds technology to existing order. Circle pursues trust bank establishment and creates new order on technology.

The notable point is that these players with different starting points now accept new technologies and institutions respectively. This approach blurs the boundaries between them.

However, ambiguous identities could weaken their inherent competitiveness as happened in the past fintech industry. Therefore, each player needs to clearly recognize their unfair advantages and find balance points between technology and institutions.

1. Competition for On-Chain Financial Infrastructure

Blockchain technology is emerging as a new foundation for global financial infrastructure. Traditional financial institutions and crypto-native companies are competing to secure leadership in next-generation financial systems. JP Morgan integrates blockchain technology into existing financial systems to enhance efficiency. Circle builds new financial infrastructure on blockchain to present alternatives to existing structures.

This trend recalls the past competition between traditional finance-centered FinTech and big tech-centered TechFin. However, the current landscape differs significantly. Previous competition focused on improving user experience within limited financial services. The competition now extends to core financial infrastructure. This includes asset issuance, movement, settlement, and custody.

The competition centers on more than simple technological superiority. It addresses who will design and operate the future financial ecosystem. Traditional financial institutions attempt gradual transformation within existing regulations and systems. Crypto-native companies build new order based on technological efficiency and scalability. This report examines the on-chain financial strategies of JP Morgan and Circle. It analyzes the direction of on-chain financial infrastructure development.

2. JP Morgan: Building Blockchain on Traditional Finance

In June 2025, Kinexys, JP Morgan's blockchain division, began pilot operations of deposit tokens (JPMD) on Base, a public blockchain. JP Morgan had previously applied blockchain technology in a limited manner through private blockchain infrastructure. This time, the company introduced a different approach. JP Morgan directly issues assets on open networks and supports transactions. This marks a significant turning point as traditional financial institutions begin operating financial services directly on public blockchain.

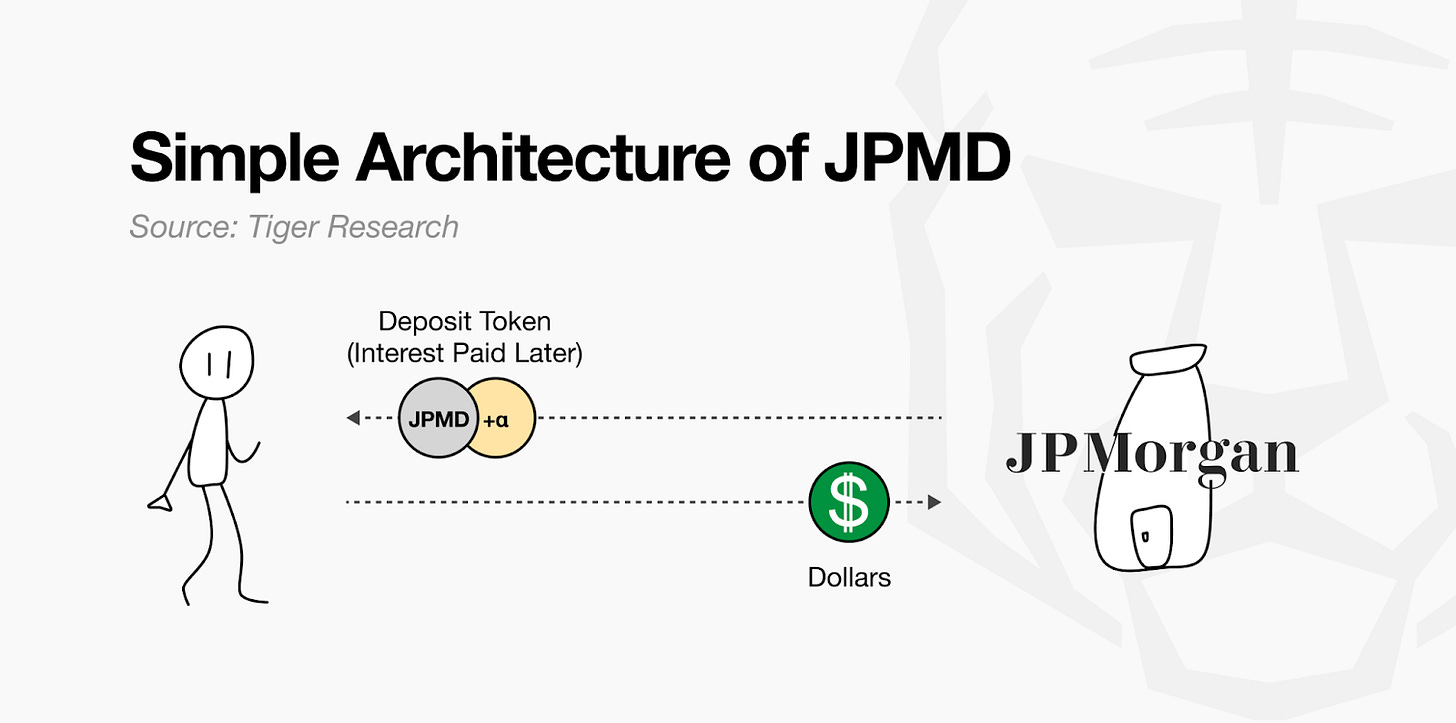

JPMD combines the characteristics of digital assets and traditional deposits. When customers deposit dollars with JP Morgan, the bank records these amounts as deposits on its balance sheet. JP Morgan then issues a corresponding amount of JPMD on the public blockchain. This token moves freely on blockchain. It also maintains legal claim rights against bank deposits. Token holders can exchange tokens for actual dollars at a 1:1 ratio. They may also qualify for deposit protection and interest income. Existing stablecoins concentrate profits with issuers. JPMD differentiates itself by granting users substantial financial rights.

These features provide practical convenience to both asset managers and investors beyond simple legal stability. For example, assets operated on public blockchain such as BlackRock's BUIDL fund or Franklin Templeton's tokenized money market funds can offer 24-hour redemptions when they use JPMD as redemption payment. Unlike existing stablecoins that require separate off-ramps to convert to fiat currency, JPMD enables immediate cash conversion. It also provides deposit protection and interest income opportunities. This creates significant potential for use in on-chain asset management ecosystems.

JP Morgan introduced deposit tokens to respond to new capital flows and revenue structures formed around stablecoins. Tether generates approximately $13 billion in annual revenue. Circle also creates billions in revenue by managing safe assets such as government bonds. These stablecoin models differ from traditional deposit-lending margins. However, they show similar structures to some banking functions as they generate revenue based on customer funds.

Limitations exist. JP Morgan designed JPMD within existing financial regulatory frameworks. This makes it difficult to fully implement blockchain's decentralization and openness. The service currently targets institutional clients only. Nevertheless, JPMD represents a practical strategy for traditional financial institutions to enter public blockchain-based financial services while maintaining existing stability and regulatory compliance. Industry observers view it as a representative example of expanding structural connections between traditional finance and on-chain ecosystems.

3. Circle: Building Native Finance on Blockchain

Circle has established itself as a key player in on-chain finance through its stablecoin USDC. USDC pegs to the US dollar at a 1:1 ratio. Circle maintains reserves consisting of cash and short-term US Treasuries. USDC offers technological strengths of low fees and instant settlement. Companies use the stablecoin as a practical alternative for enterprise payments and cross-border remittances. USDC enables 24-hour real-time fund transfers. It requires none of the complex procedures that existing SWIFT networks demand. This capability helps companies overcome limitations of traditional financial infrastructure.

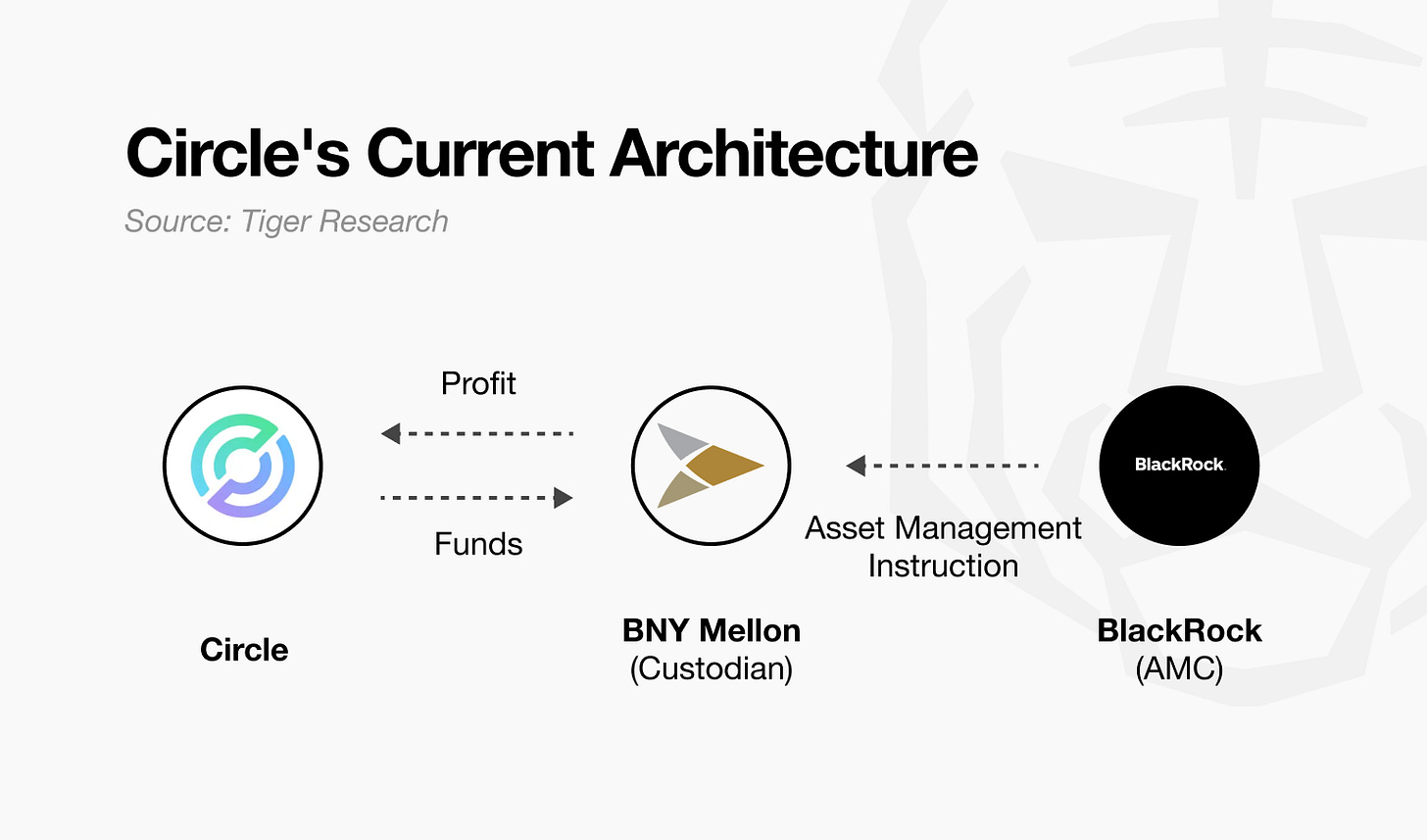

However, Circle's current business structure faces several constraints. BNY Mellon holds USDC reserves in custody. BlackRock manages asset operations. This structure delegates core functions to external institutions. Circle secures interest income but maintains limited actual control over assets. The current revenue model also depends significantly on high interest rate environments. Circle requires more independent infrastructure and operational authority. This need exists for long-term sustainability and revenue diversification.

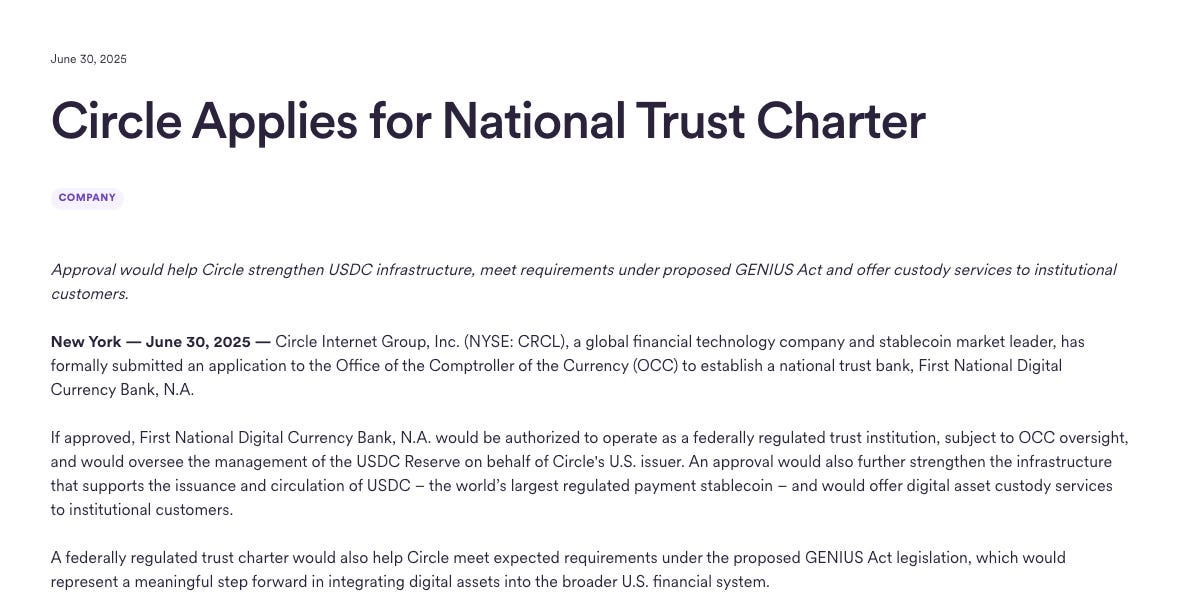

Circle applied to the Office of the Comptroller of the Currency (OCC) for national trust bank establishment in June 2025. The company seeks to address these constraints. This represents a strategic decision that goes beyond simple regulatory compliance. Industry observers interpret this as Circle's transition from stablecoin issuer to institutional financial entity. Trust bank status would enable Circle to directly manage reserve custody and operations. This move allows stablecoin issuers to strengthen internal control over existing financial infrastructure. It also helps them expand business operations. The company expects to establish foundations for expanding into digital asset custody services for institutional investors.

Circle started as a crypto-native company. The company has adjusted its strategy to establish sustainable operations within the institutional framework. Circle accepts existing financial system rules and roles. This transition involves trade-offs such as reduced flexibility and increased regulatory burden. Future authorities granted will depend on policy changes and supervisory interpretations. Nevertheless, this attempt serves as an important milestone. It measures how on-chain financial structures can establish themselves within existing institutional frameworks.

4. Who Will Lead On-Chain Finance?

Various players with different starting points are actively entering the on-chain financial ecosystem. These range from traditional financial institutions like JP Morgan to crypto-native companies like Circle. This recalls the competitive landscape that unfolded in the past fintech industry. Technology companies entered finance by implementing core financial functions like payments and remittances internally. Financial institutions pursued digital transformation to expand user touchpoints and improve operational efficiency.

The important point is that this competition did not simply unfold in parallel. It broke down boundaries between the two camps. A similar phenomenon appears in current on-chain finance. Circle pursues trust bank establishment to directly perform core financial functions. These include reserve management and custody. JP Morgan issues deposit tokens on public blockchain and expands business into on-chain asset management areas. Each started from different directions. They gradually absorb parts of each other's strategies and territories. Both sides seek new balance points.

This trend opens new possibilities but also contains risks. Traditional financial institutions may clash with existing risk control systems. This happens when they forcefully imitate the agility and speed of technology companies. Deutsche Bank promoted a 'digital first' strategy and proceeded with large-scale IT investments. However, collisions with legacy infrastructure caused repeated system errors. This resulted in billions of dollars in losses.

Conversely, crypto-native companies face different risks. They may lose the flexibility and execution capabilities that have supported their competitiveness. This occurs when they excessively expand institutional acceptance.

Success in on-chain finance competition ultimately depends on understanding one's foundation and strengths. Companies must base this understanding on their unfair advantages. They must harmoniously integrate technology and institutions on that foundation. The ability to balance these elements will determine the winners.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.