Every chain has its own Lego blocks. Fluent asks what happens when they all fit on the same board.

Key Takeaways

The performance war is over, and composability across VMs is the next frontier.

Fluent’s Blended Execution puts EVM, SVM, and Wasm on one chain with no bridges.

A good chain isn’t enough, so Fluent is building Prints, its own reputation layer, to prove it.

1. The Battle After Performance

Blockchain infrastructure competition began with performance: faster, cheaper, higher throughput. That race is now effectively over. Dozens of chains exist, and performance is sufficient for all but the most extreme financial services.

Looking back, blockchain’s biggest breakthroughs came not from performance but from composability. DeFi Summer 2020 is the clearest example. Lending was layered with swaps, then yield farming stacked on top.

The key insight was that apps could snap together like Lego.

But this composability only worked within a single VM. Ethereum’s Lego blocks could not be used on Solana, and Solana’s could not be used on Ethereum. This VM fragmentation is the constraint Fluent is explicitly designed to remove.

2. The Lego Fluent Dreams Of

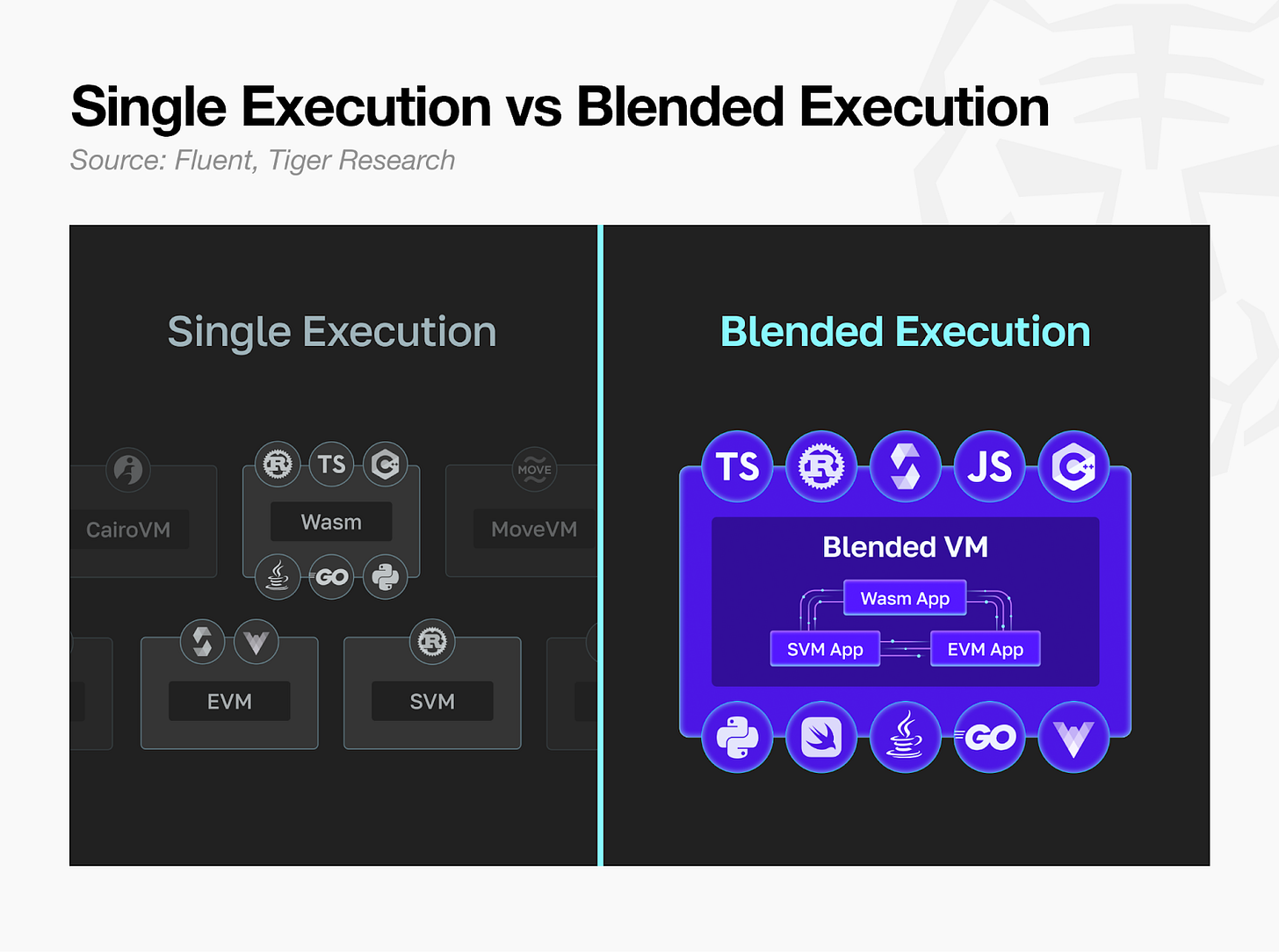

Fluent is a project designed to eliminate the boundary between VMs. Its approach is called “Blended Execution”, running apps from different VMs together within a single chain.

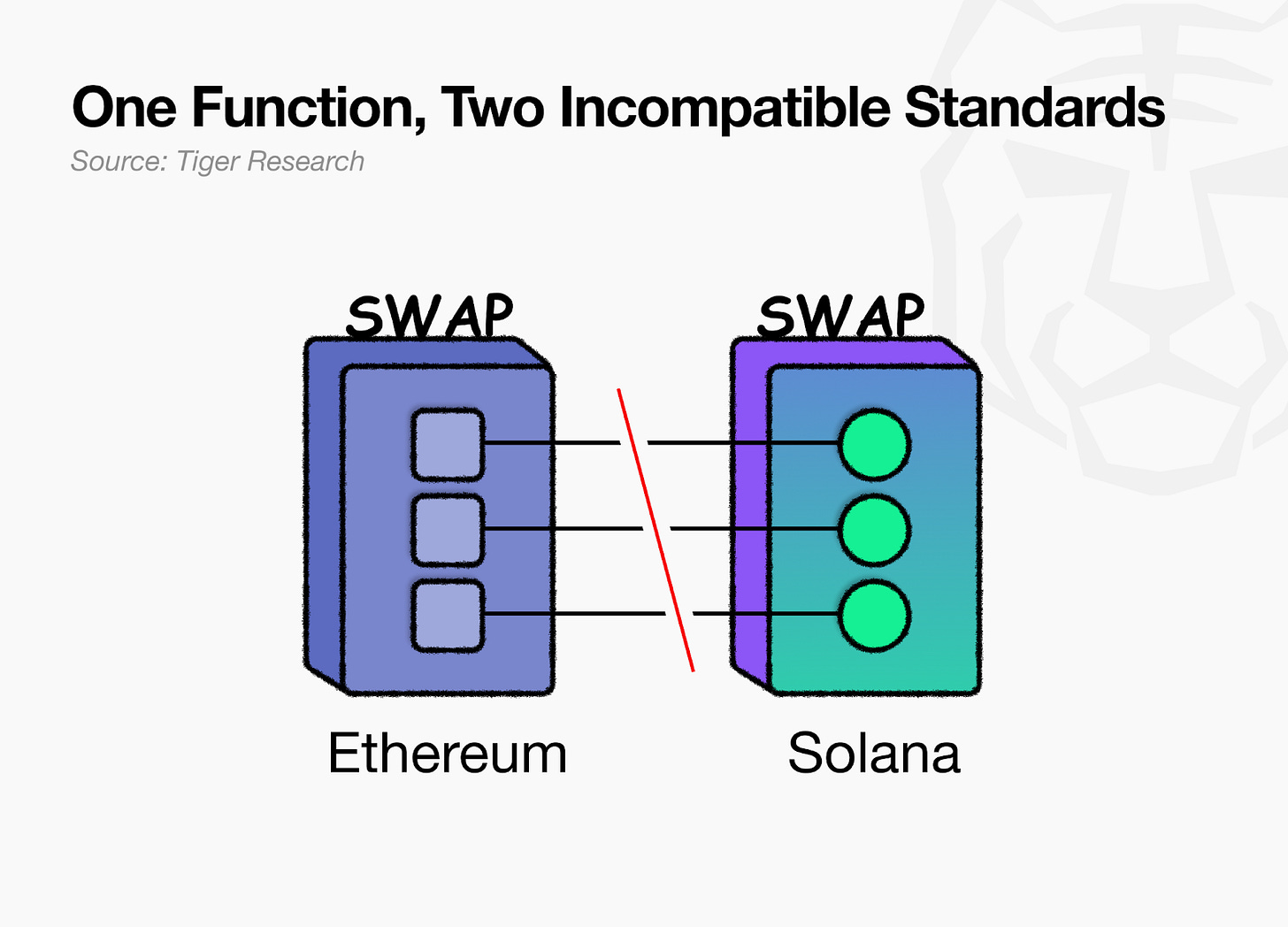

To illustrate the current situation with the Lego analog. Ethereum Lego blocks are square, and Solana Lego blocks are round. Both are good blocks, but their specs are incompatible. Even if you want to combine a lending app built on Ethereum with a trading app built on Solana, they sit in separate boxes and cannot connect.

Fluent is the board that unifies these specs. As an Ethereum L2, it inherits Ethereum’s security while building a new execution environment on top. Architecturally, Fluent resembles other Ethereum L2s like Arbitrum or Base, until execution begins.

The difference is one thing. Inside Fluent, contracts written for EVM, SVM, and Wasm all live on the same chain, sharing the same state. Wasm (WebAssembly) was originally created to run high-performance programs in web browsers. It converts code written in various languages (Rust, C++, TypeScript, etc.) into a single common format.

Fluent uses Wasm to compile all contracts into a shared format called rWasm (reduced Wasm). Whether a block is square or round, it gets converted to the same spec, so everything can be freely combined on one board.

This means a Solidity app can directly call a function in a Rust app. No bridge, no message relay. It all executes within a single transaction. Fluent calls this “Blended Execution.”

Currently, blended execution between EVM and Wasm is live on testnet. SVM support has completed feature development and is in the optimization phase.

3. Proving It with Prints

BUT, does building a good chain automatically attract good apps?

In reality, NO.

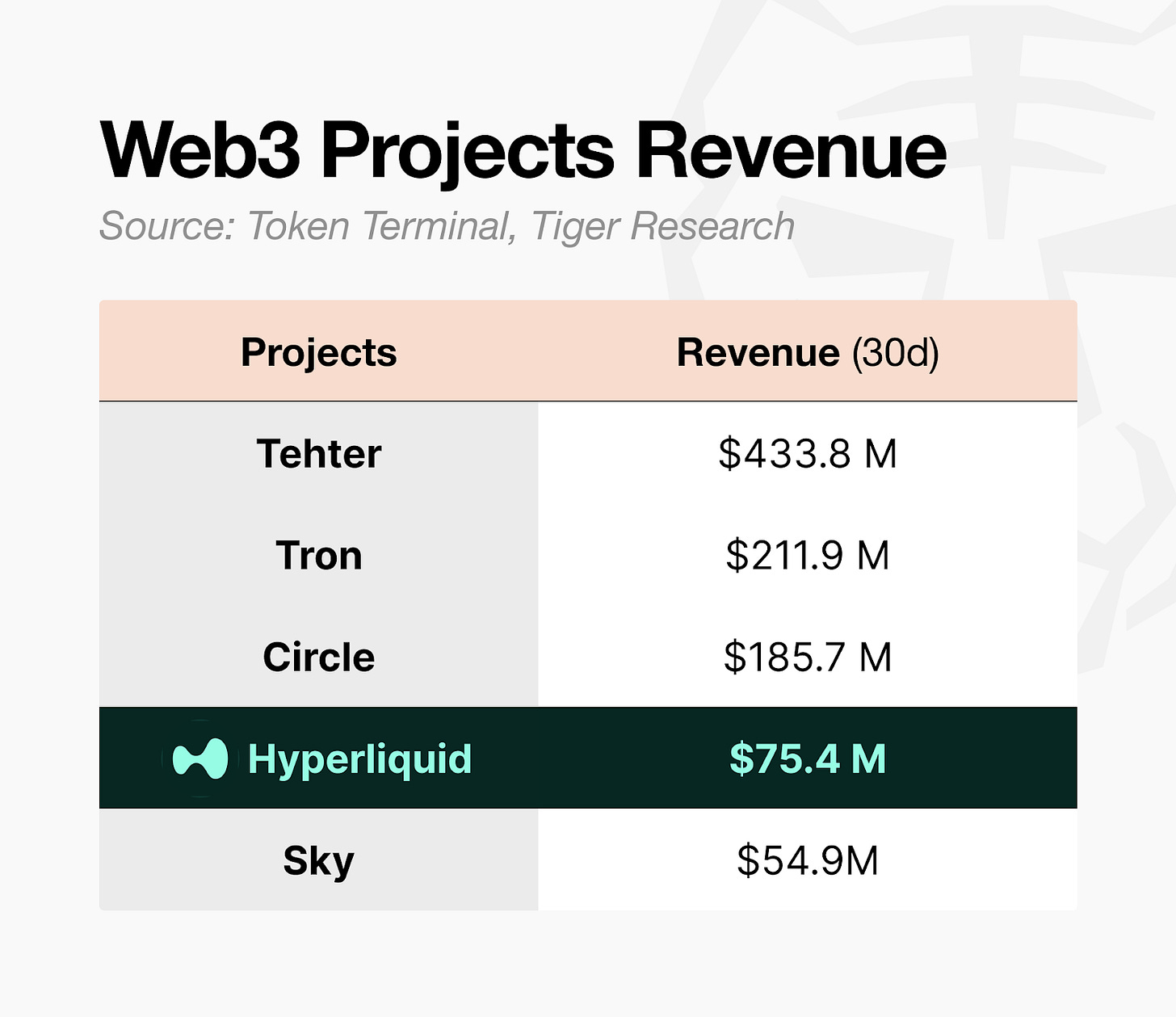

Hyperliquid is a clear example. The team’s own perpDEX became one of crypto’s standout successes. The Web3 market looks quite different before and after Hyperliquid. Before, teams relied on grant programs to attract killer apps from external builders. After, the new formula became: build it yourself and prove it.

Following this shift, Fluent is building its own service called Prints. Prints is a tool that aggregates “reputation” scattered across the internet, verifying who is real and who is trustworthy. In simple terms, it is a reputation aggregator for the info-fi era, pulling together reputation scores from multiple platforms into one view.

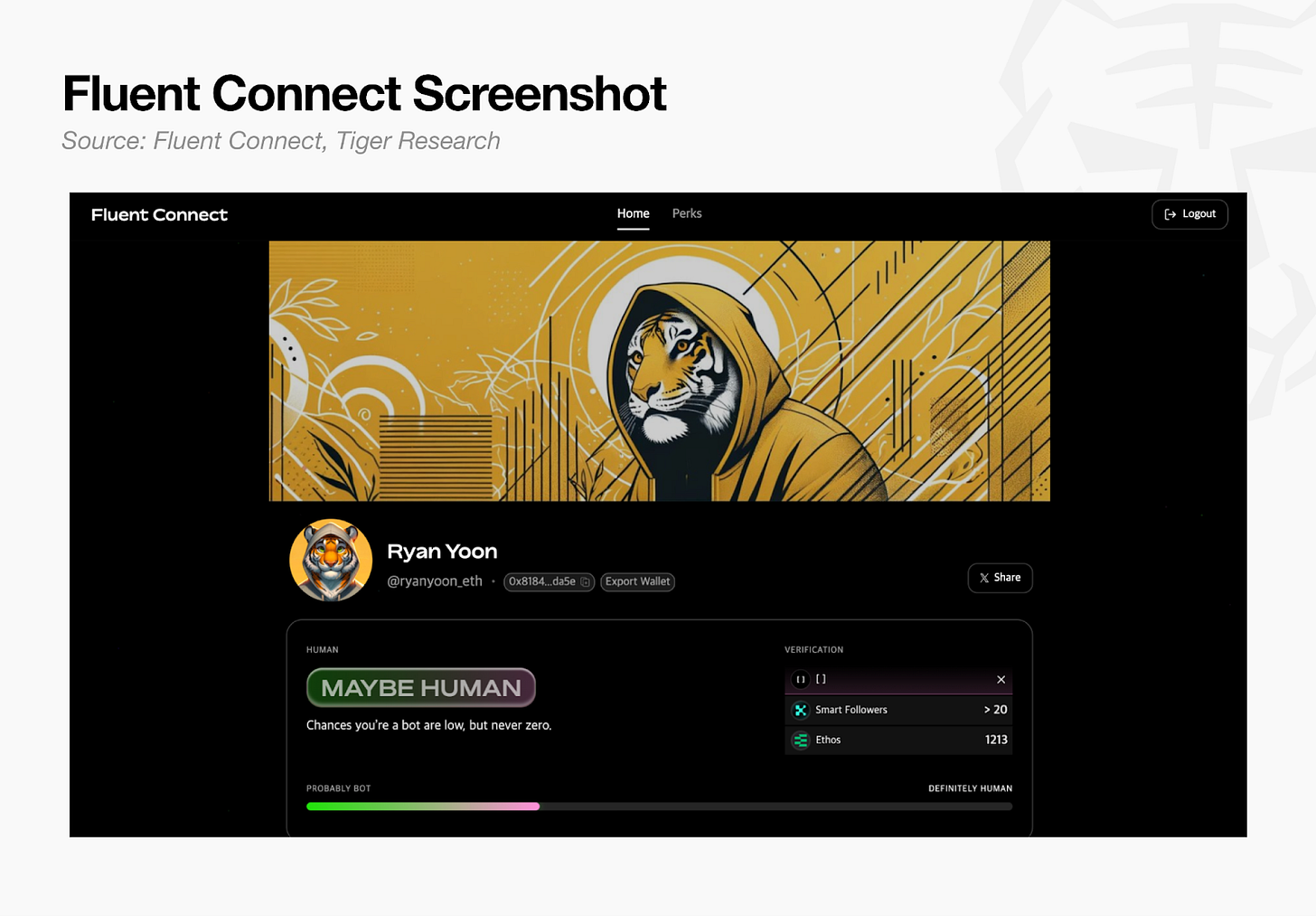

It currently integrates Ethos trust scores, Kaito smart followers, and Talent Protocol builder scores in one place. Any single metric alone is vulnerable to gaming. But while one score can be manipulated, faking several at once is far more difficult.

For users, Prints serves as a Web3 reputation resume, proving credibility across domains on a single page. For builders, it is a reputation tool that can be directly integrated into their apps.

On top of Prints sits Fluent Connect, a service where builders can use Prints’ reputation data to find users matching specific criteria and distribute early access or token benefits through a feature called Perks. In short, it is a matching tool connecting builders with genuine users.

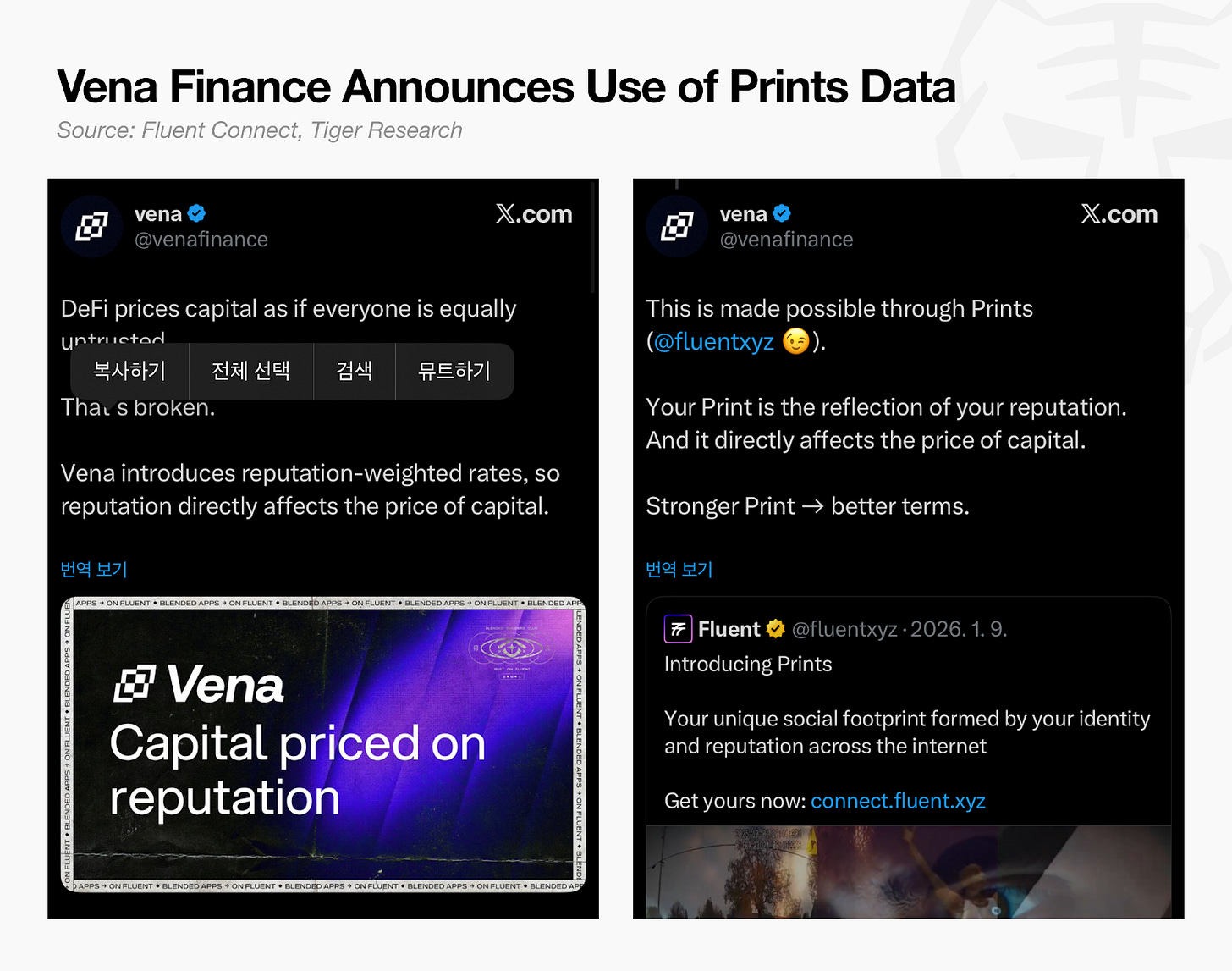

Third-party adoption is already emerging.

Vena Finance announced it will use Prints data to introduce reputation-based interest rates, offering better lending terms to higher-reputation users. The service has launched with approximately 40,000 sign-ups, and a builder API is under development.

However, since Prints aggregates external services, it lacks proprietary reputation signals of its own. To address this, Fluent has created an internal feedback score and plans to integrate additional signals such as prediction market performance, yield curator track records, and AI agent reputation over time.

4. Fluent’s Ecosystem

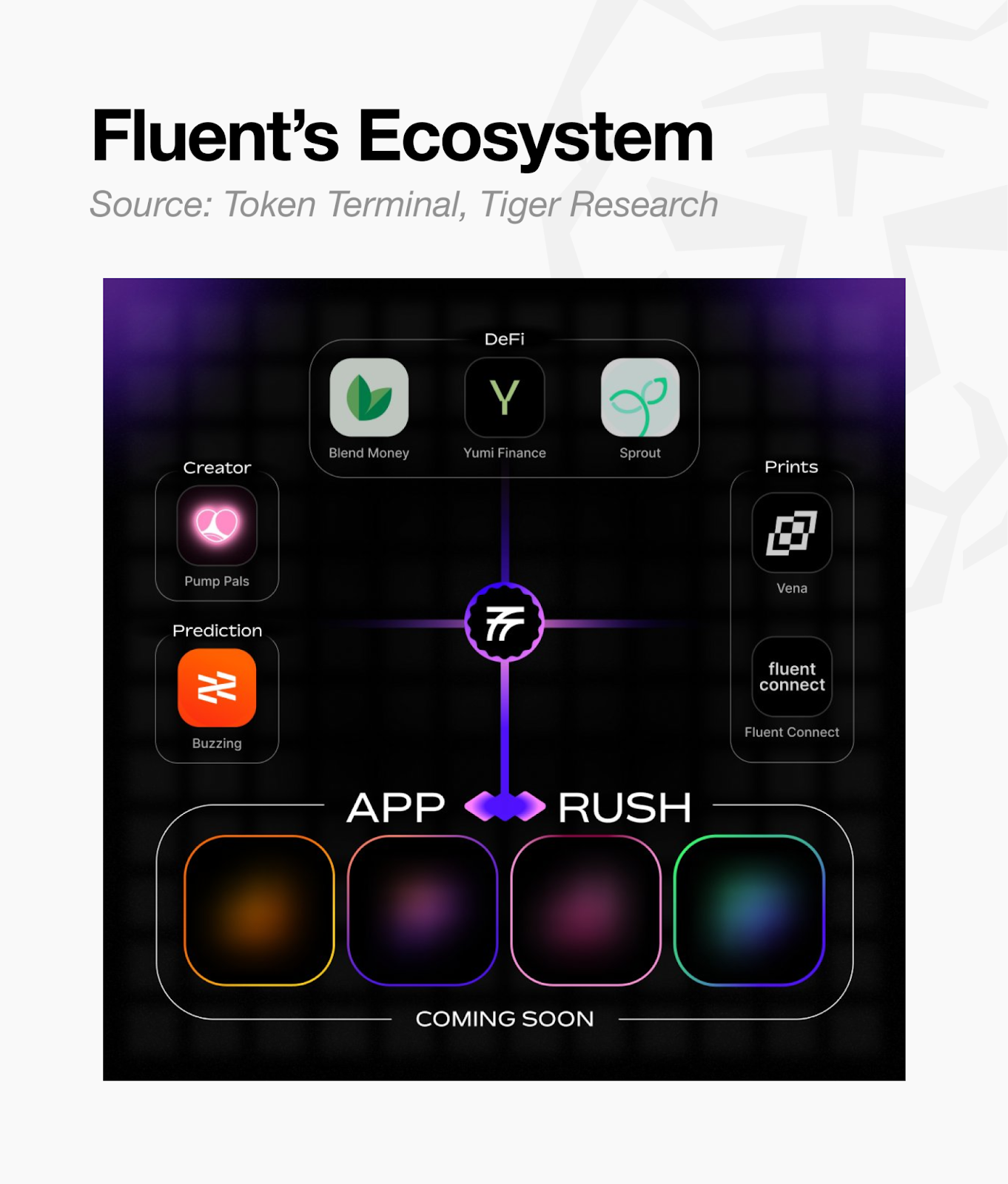

Prints is still in its expansion phase and needs time to become a complete reputation system. Fluent is not simply waiting. It is building its ecosystem by nurturing external builders in parallel. The vehicle for this is the Blended Builders Club (BBC), Fluent’s own accelerator.

Five teams were selected for the first cohort:

Pump Pals: A social trading platform enabling community-driven trading experiences

Sprout: An automated yield optimization platform that matches strategies to user risk profiles

Buzzing: A prediction market platform where users create their own markets and bet on outcomes

Yumi Finance: On-chain credit infrastructure that attaches credit scoring to crypto cards, enabling buy-now-pay-later

Blend Money: An on-chain savings platform that automatically applies yield strategies and currency hedging when users deposit in local currency

Among these, PumpPals, Sprout, and Buzzing have already completed user testing on testnet. The testnet approach itself is worth noting. On most chains, testnets function as airdrop farming tools. Users repeat meaningless transactions expecting rewards, and teams mistake inflated metrics for real demand.

Fluent reframed the testnet’s purpose around feedback collection. User feedback is delivered directly to builder teams, who use it to improve their products. Users who provide quality feedback earn reputation scores in Prints, gaining priority for future benefits. Apps are not launched all at once but featured one at a time over several weeks, ensuring each team receives focused feedback.

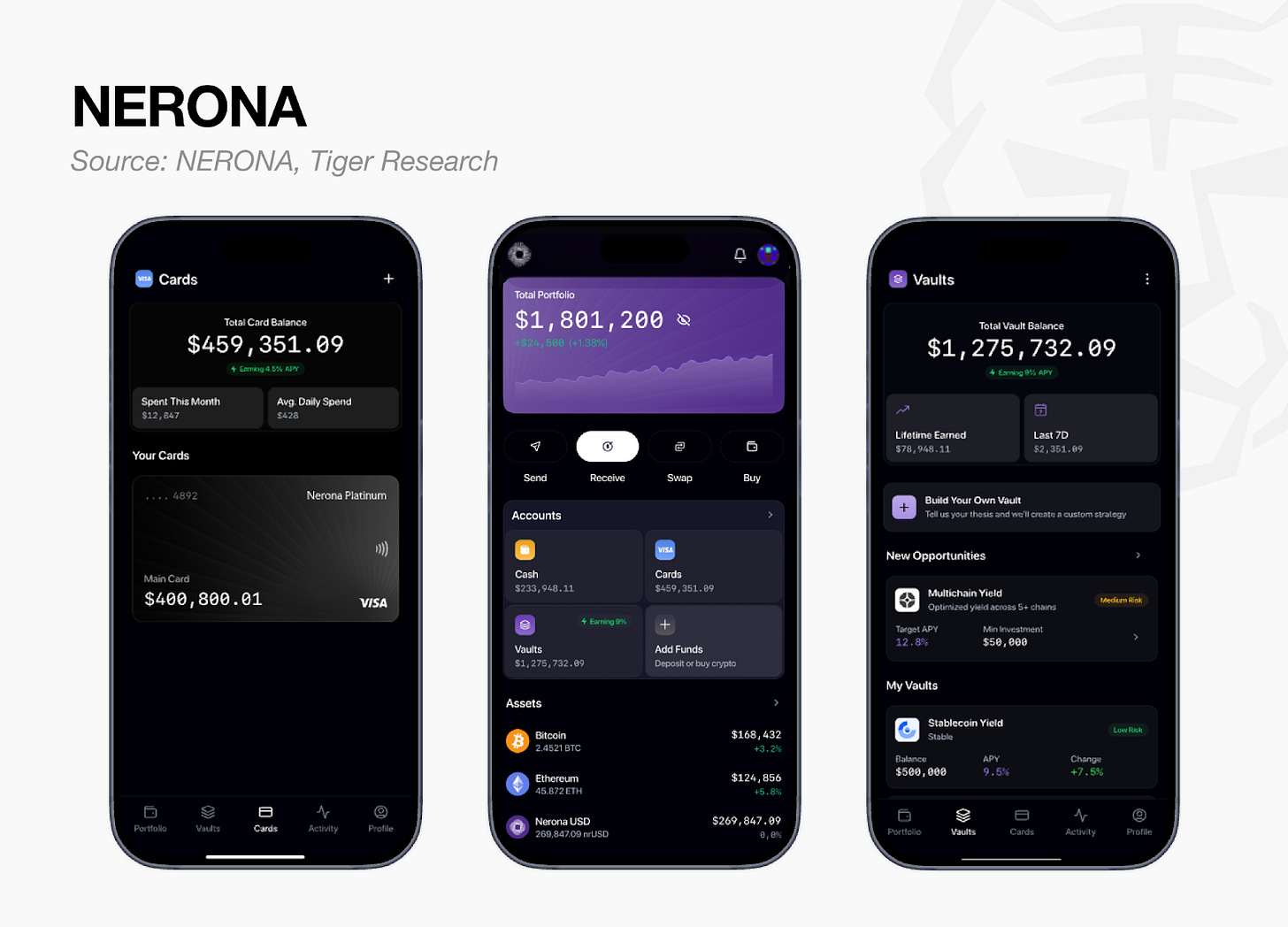

Beyond BBC, additional ecosystem growth is emerging. Nerona is an on-chain asset management platform that bundles a mobile app, crypto card, stablecoin yield, and lending into one place. Previously, these functions were scattered across separate services, leaving capital idle. Nerona consolidates them so capital is always working.

When combined with Prints’ reputation data, it becomes possible to offer differentiated interest rates or service terms based on user trustworthiness. This aligns with the same direction as Vena Finance’s reputation-based interest rates introduced earlier.

5. The Picture Fluent Is Drawing

Fluent is building three things simultaneously.

First, the chain. Blended Execution enables EVM, SVM, and Wasm apps to be composed on a single chain. The technical direction is clear, and EVM-Wasm blended execution is already working on testnet. However, SVM integration is still in the optimization phase, and whether all three VMs run stably in a mainnet environment remains to be verified.

Second, Prints. The design of aggregating multiple reputation signals for cross-verification is compelling. One metric can be gamed, but faking several at once is far harder. That said, the number of integrated signals is still small, and most depend on external services. Whether Prints can reach the stage of generating and verifying reputation on its own is something to watch.

Third, the ecosystem. BBC is cultivating builders, and services like Vena Finance and Nerona are attempting to link reputation to financial terms. Most are still at an early stage or closer to concept, so how each service achieves real user acquisition will need to be observed.

Fluent is still early, but by designing chain, service, and ecosystem as a single integrated structure from the start, it sets expectations for what the completed picture could look like. Early execution has been demonstrated: blended execution works on testnet, and Prints-based services are beginning to attach.

In the last cycle, dozens of L2s launched, but most led with performance metrics alone and ended up as empty chains without users. Whether Fluent can break this pattern will be answered by real user numbers and on-chain activity after mainnet.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report was partially funded by Fluent. It was independently produced by our researchers using credible sources. The findings, recommendations, and opinions are based on information available at publication time and may change without notice. We disclaim liability for any losses from using this report or its contents and do not warrant its accuracy or completeness. The information may differ from others’ views. This report is for informational purposes only and is not legal, business, investment, or tax advice. References to securities or digital assets are for illustration only, not investment advice or offers. This material is not intended for investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo following brand guideline. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.