When people think of Sign, they often think first of ‘Sing Sign.’ But behind that image is the foundation built through TokenTable, which is now guiding Sign into government business.

Key Takeaways

Sign is applying its TokenTable experience in large scale distribution and identity verification to government infrastructure through the S.I.G.N. framework.

Strong backing from partners including CZ helped Sign secure contracts in Kyrgyzstan and Sierra Leone.

The next step is to turn government business expansion into a reality and keep the community aligned through token buybacks.

1. From a Sing Sign to Government

When most people think of Sign, they picture the group of people wearing orange vests and glasses singing together. As noted in the last report, Sign established a strong community known as the Orange Dynasty, which became the project’s core foundation.

But this strong foundation hides what Sign actually is. Sign is not just a community. Through TokenTable, its asset distribution platform, Sign has distributed over $3 billion in tokens to more than 55 million users. This required solving two core problems: distributing assets at massive scale and verifying each recipient’s identity and eligibility.

TokenTable operates at a scale that resembles national-level infrastructure. The platform handles millions of concurrent distributions while maintaining accurate identity verification for each transaction.

This experience directly translates to what governments need.

For example, governments must prevent duplicate claims when granting welfare benefits. They need clear identity records when issuing CBDCs. They must distribute emergency aid at scale and with speed.

These are the same problems Sign solved in Web3.

Large scale distribution(TokenTable): Web3 token distribution → Welfare payments and CBDC operations

Identity verification(sign protocol): On-chain attestations → Eligibility checks for public benefits

2. S.I.G.N

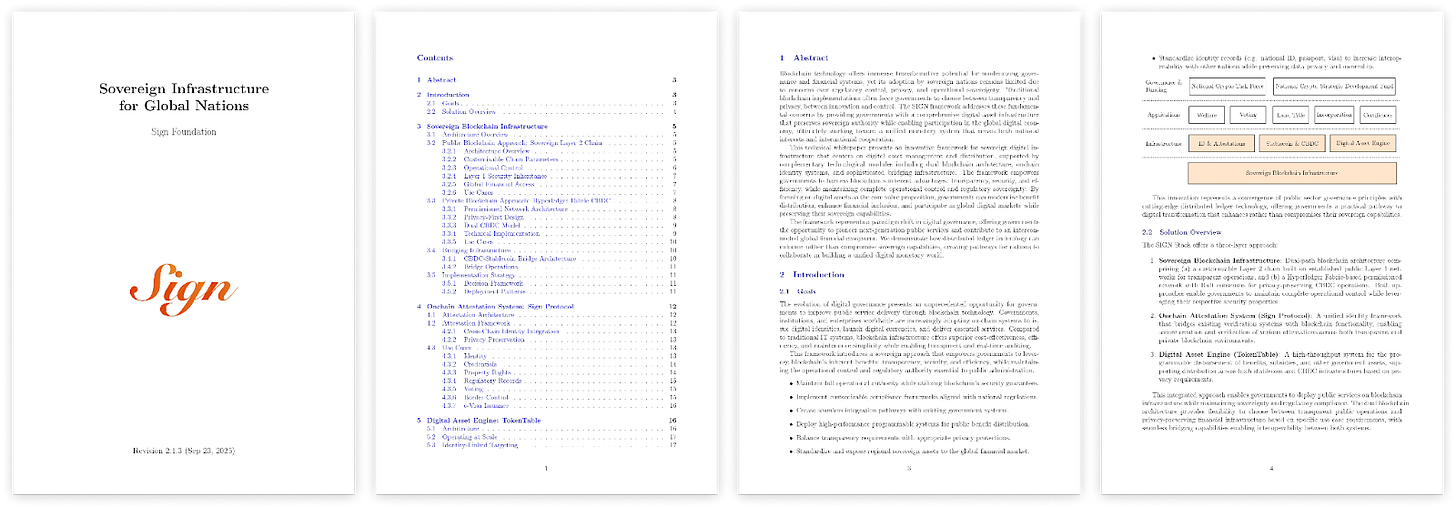

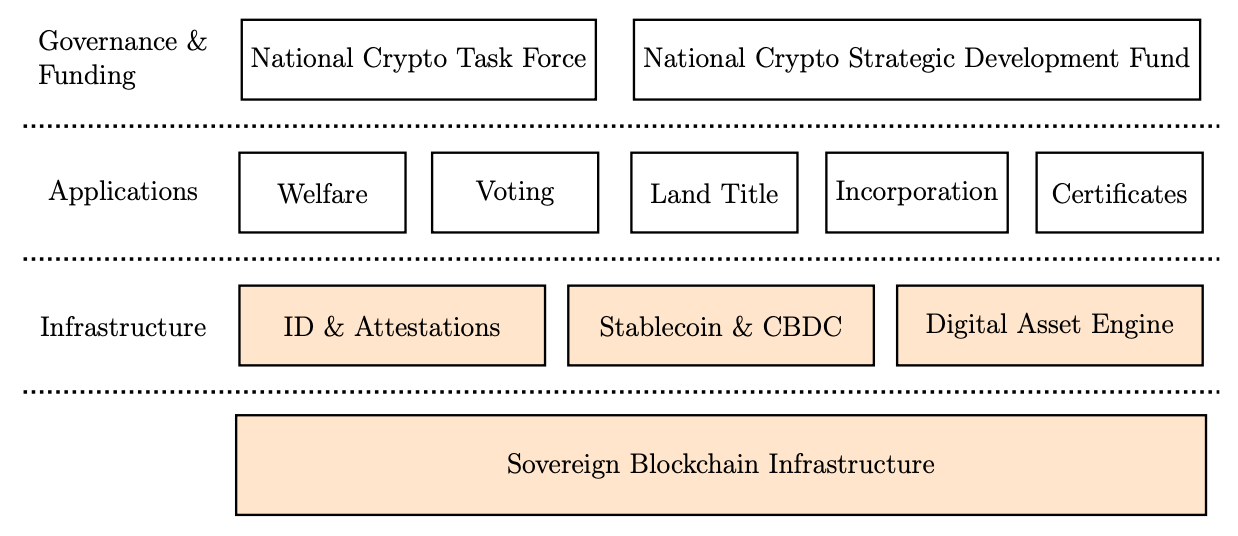

Sign is now extending this verified Web3 capability to government use cases. Sign revealed a whitepaper titled S.I.G.N. (Sovereign Infrastructure for Global Nations), presenting a comprehensive technical framework.

Governments do not seek full transparency. They require both privacy and transparency at the same time. Sign’s sovereign blockchain infrastructure addresses this by using a BNB Chain–based Layer 2 for public services that need transparency, and Hyperledger Fabric for financial systems that require privacy.

On top of this sovereign blockchain infrastructure, three infrastructure layers operate to support the government’s core businesses.

ID & Attestations: Sign Protocol provides an on-chain identity proof system. Sensitive personal information remains off-chain while eligibility requirements are cryptographically verified on-chain.

Stablecoin & CBDC: Governments issue CBDCs on Hyperledger Fabric and stablecoins on Layer 2. Each fulfills different requirements: privacy and transparency respectively.

Digital Asset Engine: TokenTable operates as the distribution engine. It delivers CBDCs and stablecoins to millions simultaneously, automatically distributing welfare payments, emergency aid, and pensions based on eligibility through conditional logic.

Beyond vision, Sign has delivered results. The team signed a CBDC development agreement with the National Bank of the Kyrgyz Republic and is building a blockchain-based digital ID system for the government of Sierra Leone.

3. The “Unsexy” Government Business

Why is Sign now entering the government business?

TokenTable continues to operate well, but its revenue model depends on a steady flow of new project launches. This flow changes with market cycles. When the market slows, fewer projects launch and TokenTable’s revenue falls.

TokenTable kept Sign alive. Government business now drives growth.

Working with governments is often considered unsexy. It moves slowly, follows strict rules, and involves long decision cycles. Yet these unsexy sectors often become strong once a team secures early ground. They may look dull at first, but they can open large markets and provide stable revenue. In the end, unsexy business is what becomes valuable.

Scale: Global software spending reached 675 billion dollars in 2024. If blockchain captures even 5 percent of this market, it becomes a 30 billion dollar segment. If Sign takes just 1 percent of that, annual revenue could reach 300 million dollars, far above TokenTable’s current 15 million dollars.

Stable revenue: Government budgets do not depend on crypto market cycles. Spending continues even in downturns, and once a system is adopted, high switching costs often lead to long-term contracts.

Low competition: Most Web3 projects have no experience building government systems. Sign already has track records in Kyrgyzstan and Sierra Leone, giving it a meaningful head start.

So do governments actually want blockchain? More than expected. Several governments are already preparing for on-chain systems.

Dubai: Plans to move all government transactions on chain by 2030, with expected savings of 5.5 billion dirhams per year.

Singapore: Runs a 12 million SGD blockchain innovation program and continues trials including a CBDC project.

United States: The Department of Commerce launched a pilot to publish economic data such as GDP on blockchain, and Wyoming issued a state-backed stablecoin.

These cases may look like pilots or tests, and it is fair to ask when real adoption will come. Turning points, however, do not arrive with notice.

It has been one year since Trump’s election in November 2024. In that year, stalled rules became clearer through the Clarity Act and the Genius Act. Circle listed publicly, and Nasdaq filed to list tokenized stocks. Few expected this pace at the end of 2024.

Government blockchain adoption may follow the same pattern. Most projects remain pilots today, but once one or two countries show success, others can move quickly.

4. Sign Prepares for a Shift

Sign has already signed contracts and MOUs with two national governments and is building systems for them. In Kyrgyzstan, it is tasked with the payment system. In Sierra Leone, it handles the identity system. Both are core parts of national operations.

Of course, this is still early stage. Kyrgyzstan’s CBDC, called the Digital Som, is in development. Sierra Leone is at the MOU stage. It will take time before the systems run at scale and reach millions of users.

The important point is that the work is underway. Governments do not sign agreements easily. Without proven technology and trust, they do not hand over national infrastructure. Sign has earned that trust in both countries.

4.1. Kyrgyzstan: Building the CBDC System

On October 24, 2025, Sign CEO Xin Yan signed a technical service agreement with Mels Atokurov, the Deputy Governor of the National Bank of Kyrgyzstan.

The signing took place during the second meeting of the National Committee for Virtual Assets and Blockchain Technology. President Sadyr Japarov and Binance founder Changpeng Zhao (CZ) attended the event, showing the government’s commitment to digital financial transformation.

The Digital Som, which is the focus of this agreement, is Kyrgyzstan’s central bank digital currency. The government has already signed an amendment that gives the Digital Som legal status. A pilot program will begin in 2025. Based on the results, the central bank will decide at the end of 2026 whether to proceed with full issuance. If confirmed, the Digital Som will become an official means of payment on January 1, 2027.

Through this agreement, Sign will build the pilot platform and the full CBDC infrastructure. If the central bank moves forward with issuance, it will need strong security and fraud protection measures. Sign is expected to play a key role in these areas.

At this point, Sign’s Hyperledger Fabric-based CBDC infrastructure could serve as the technical foundation for Digital Som. TokenTable may function as the digital currency distribution engine, while Sign Protocol could provide participant identity verification. The specific technical configuration will be determined based on results.

4.2. Sierra Leone: Digital Identity and Payment Infrastructure

On November 6, 2025, Sign CEO Xin Yan signed an MOU with Salima Monorma Bah, the representative of Sierra Leone’s Ministry of Communication, Technology and Innovation. The goal of the partnership is to build a blockchain based digital ID system and a stablecoin payment infrastructure that can serve as the base of Sierra Leone’s digital economy.

The project focuses on two core systems.

The first is the digital identity platform. With a blockchain based digital ID, citizens gain a verified and reusable identity. This single ID allows access to government services, opening of bank accounts, and use of private sector services. Repeated submission and verification of documents is no longer required.

The second is the digital payment system. A national digital wallet will allow individuals, businesses and the government to transact on the same platform. Since the system is built on stablecoins, transactions are faster and cheaper than traditional rails. It also expands financial access because people without bank accounts can still use the digital wallet for payments and financial services.

The MOU also includes broader cooperation plans such as real world asset tokenization, development of an innovation ecosystem through Felei Tech City, and a jointly managed innovation fund. These items outline future directions. The confirmed scope of the current MOU is the digital ID system and the payment infrastructure.

Sign Protocol appears positioned to serve as the on-chain attestation system for digital identity. Layer 2-based stablecoin infrastructure could provide the blockchain foundation for the payment system. TokenTable may be utilized for distributing government payments or subsidies. The actual implementation scope will be clarified as the project progresses.

5. How BNB and Key Partners Accelerate Sign’s Government Business

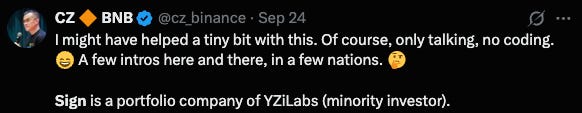

Sign’s move into government infrastructure is supported by a strong group of strategic investors, including Sequoia Capital, Circle, Altos Ventures, and IDG Capital. Among them, the partnership with CZ and YZi Labs plays a central role in opening access to national governments.

The Kyrgyzstan deal illustrates this clearly. CZ was present when Sign signed the Digital Som agreement with the central bank. At the same time, the government announced that KGST, a stablecoin pegged to the Som, will be issued on BNB Chain.

In short, the country’s stablecoin will run on BNB Chain, and its CBDC system will be built by Sign. This highlights the close partnership between Sign and BNB Chain.

This link is also reflected in Sign’s position as a portfolio company of YZi Labs. YZi Labs invested 16 million dollars as the lead in Sign’s Series A round in January 2025 and added another 25.5 million dollars with IDG Capital in October.

Building on this base, CZ has stated that he provides direct support to Sign in its work with governments. In his posts, he wrote that he has spoken with the team and helped connect Sign with several national governments.

Sign is building its technology with BNB at the center. The new Sign Sovereign Layer 2 Stack is a government-focused framework based on opBNB. It allows a state to deploy a full Layer 2 stack without building a chain from the ground up. With this stack, a government can launch its system within weeks. And because it runs on BNB Chain, any state that adopts it becomes part of the broader BNB ecosystem.

Sign can advance on its own, but government adoption does not scale on product strength alone.

Public institutions look for trusted third parties, and external validation often speeds up adoption. Support from YZi Labs, CZ, BNB Chain, and investors such as Altos Ventures strengthens this trust. With this network in place, Sign is in a strong position to expand beyond Kyrgyzstan and Sierra Leone and enter more countries at a faster pace.

6. Sign Moves Into Long Term Growth

By entering government business, Sign is shifting from short term survival to long term growth. The agreements in Kyrgyzstan and Sierra Leone are only the beginning, and additional deals, especially in the Middle East, are likely to follow.

For this expansion to benefit token holders, a clear structure is needed. Sign completed a token buyback in August 2025. It may not adopt an automated DeFi model, but it will need a framework that allocates part of the revenue from government projects to future buybacks. This is how the business and the community stay aligned.

For any buyback plan to be sustainable, the pilot phase must progress. The Digital Som in Kyrgyzstan is in pilot testing in 2025, and Sierra Leone remains at the MOU stage. These systems must go live, reach millions of users, and generate stable revenue before buybacks can continue in a consistent way.

Sign survived through TokenTable and began its growth through government business. To capture this growth fully, it must turn pilots into full scale systems and build a clear link to its community.

That is when this unsexy work becomes the part that creates real value.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report was partially funded by Sign. It was independently produced by our researchers using credible sources. The findings, recommendations, and opinions are based on information available at publication time and may change without notice. We disclaim liability for any losses from using this report or its contents and do not warrant its accuracy or completeness. The information may differ from others’ views. This report is for informational purposes only and is not legal, business, investment, or tax advice. References to securities or digital assets are for illustration only, not investment advice or offers. This material is not intended for investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo following brand guideline. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.