Moonbirds began as an NFT project in 2021. Its direction shifted in 2025 following the acquisition by Orange Cap Games. This raises a central question: what direction does Moonbirds now aim to define?

Key Takeaways

After acquiring Moonbirds, Orange Cap Games announced plans to issue a token and expand the broader ecosystem.

To position the Moonbirds IP around fandom rather than speculation, the team is introducing multiple engagement formats, including a card game, Blind Box 2.0 initiatives, and mobile games.

While the expansion of the Moonbirds IP is promising, a clearer and more concrete utility framework for the $BIRB token is still required.

1. Moonbirds Moving Toward a Larger Ecosystem

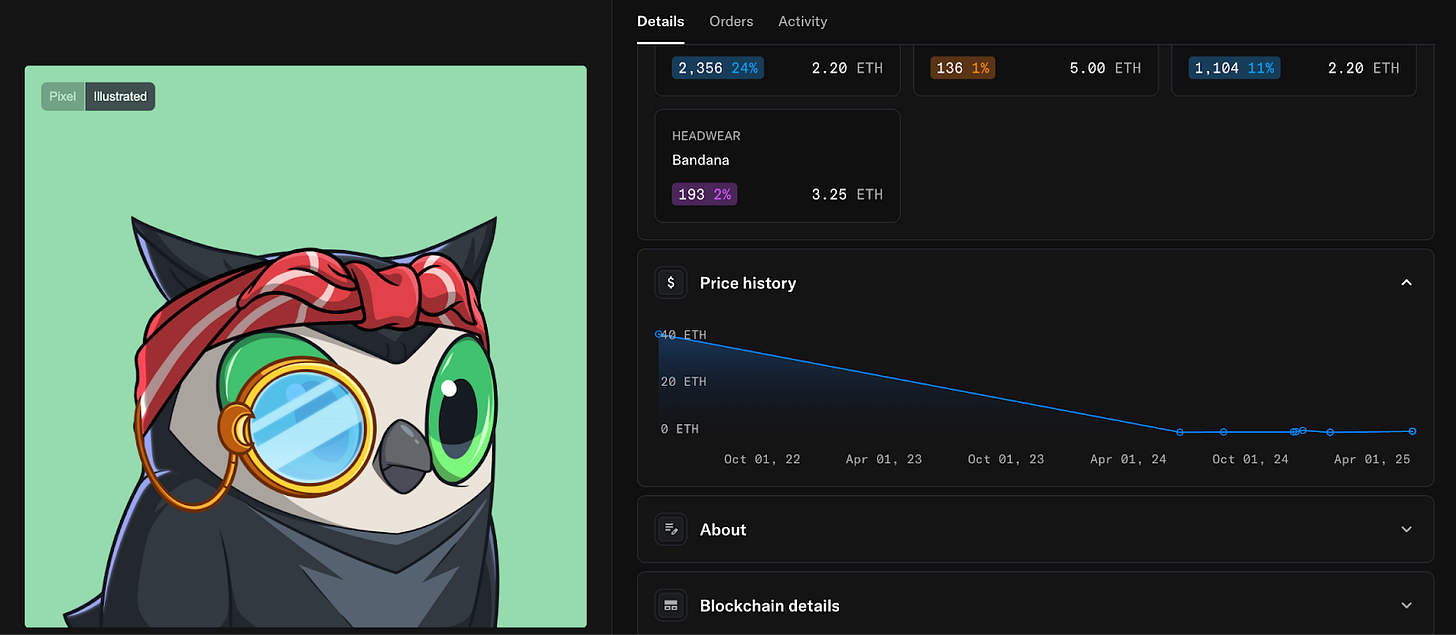

Moonbirds was a high-profile NFT project that traded up to 40 ETH in 2021. As the NFT market entered a downturn, attention faded. Recently, however, Moonbirds has returned to the spotlight following the announcement of a token launch plan. Still, viewing Moonbirds purely as an NFT reflects a perspective anchored in 2021.

In May 2025, Moonbirds entered a new phase after being acquired by Orange Cap Games. The acquirer’s objective is not to operate Moonbirds as a standalone NFT collection, but to develop it as a broader IP-driven business. This shift requires moving beyond the valuation of a single NFT and instead assessing Moonbirds within a larger strategic framework.

2. Moonbirds and the Ambition to Become the Next Pop Mart

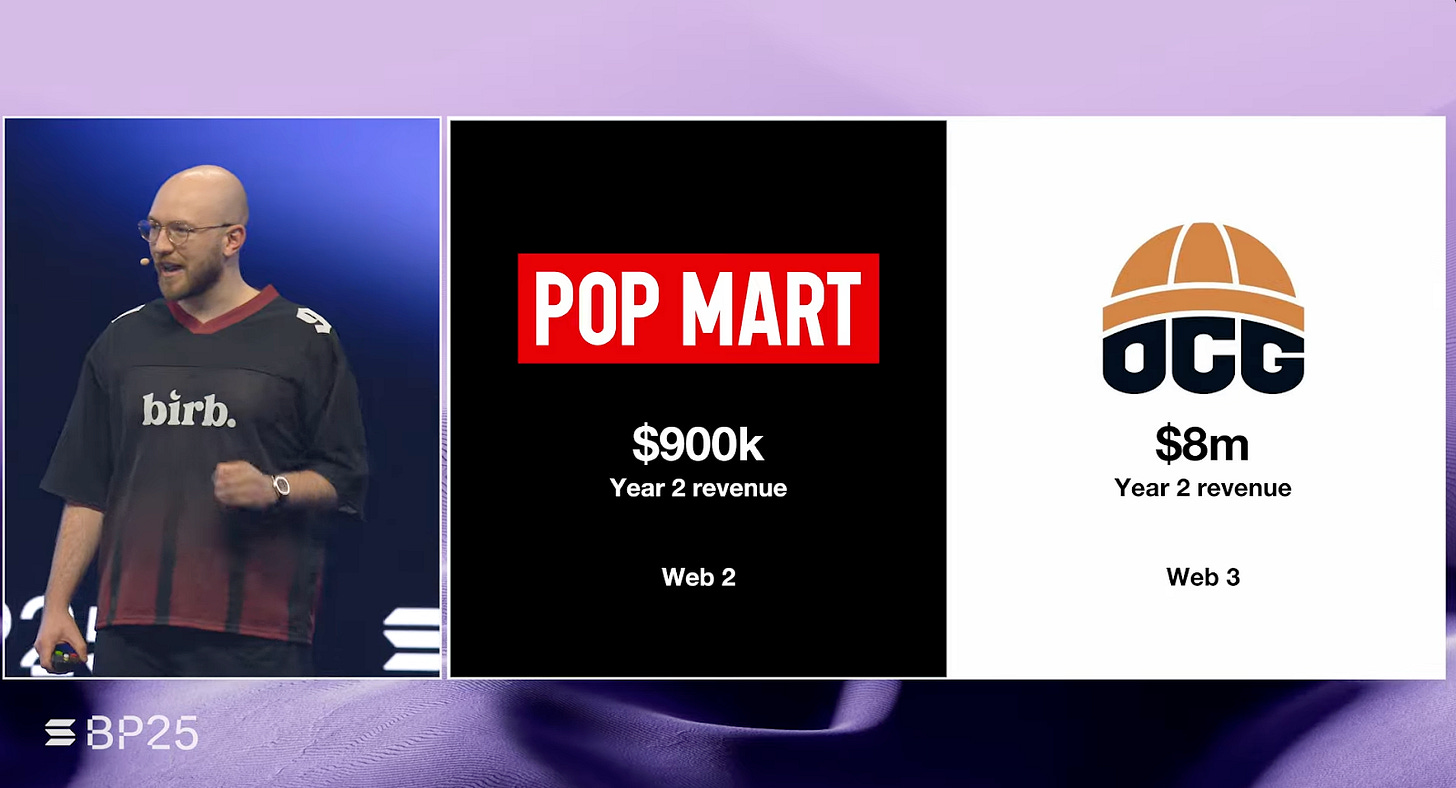

The future Orange Cap Games envisions through Moonbirds is becoming the “next Pop Mart.”

CEO Spencer Gordon Sand has stated his ambition to build a multi-billion-dollar company by positioning Orange Cap Games as the Pop Mart of Web3.

This ambition is closely tied to Sand’s career background. He has been an early investor in NFT projects such as Bored Ape Yacht Club, RTFKT, and Cool Cats, giving him firsthand exposure to how NFT projects evolve into IP, and how they fail.

In particular, as one of the largest holders of Pudgy Penguins, he has seen the brand extend into mainstream media, including television, where non-crypto audiences actively engage with the characters.

This experience likely shaped his conviction around building a “next Pop Mart.”

Consistent with this background, Orange Cap Games’ vision for Moonbirds diverges sharply from a typical NFT sales model. Rather than focusing on NFT distribution within Web3, the company aims to use Moonbirds as a starting point to acquire and scale multiple high-potential IPs, ultimately positioning itself as a diversified, IP-centric consumer business similar in structure to Pop Mart.

A representative success case of Pop Mart is the character Labubu. Labubu was not originally created by Pop Mart. In 2019, the company signed an exclusive agreement with a Hong Kong–based artist and successfully introduced the character to a mass market.

Pop Mart is not a simple reseller of third-party IP. Its core strength lies in vertical integration.

Similar to a talent agency, the company manages the full lifecycle of IP development, from artist discovery and IP licensing to product design, manufacturing, and direct-to-consumer distribution through its own channels. This integrated structure allows Pop Mart to repeatedly scale new characters using a consistent expansion model.

Orange Cap Games appears to be pursuing a comparable approach. Rather than focusing solely on product creation, the company aims to build a distribution layer capable of delivering multiple IPs.

This system spans physical distribution, such as figurines and trading cards, cultural distribution through offline tournaments and events, and digital distribution via games and NFTs. The objective is to create a repeatable framework that can support and scale any IP introduced into the ecosystem.

3. To Become Pop Mart, Products Must Be Well Made and Well Distributed

For Orange Cap Games, producing physical toys inspired by Moonbirds NFTs matters. However, trading cards play a more central role in establishing a scalable ecosystem.

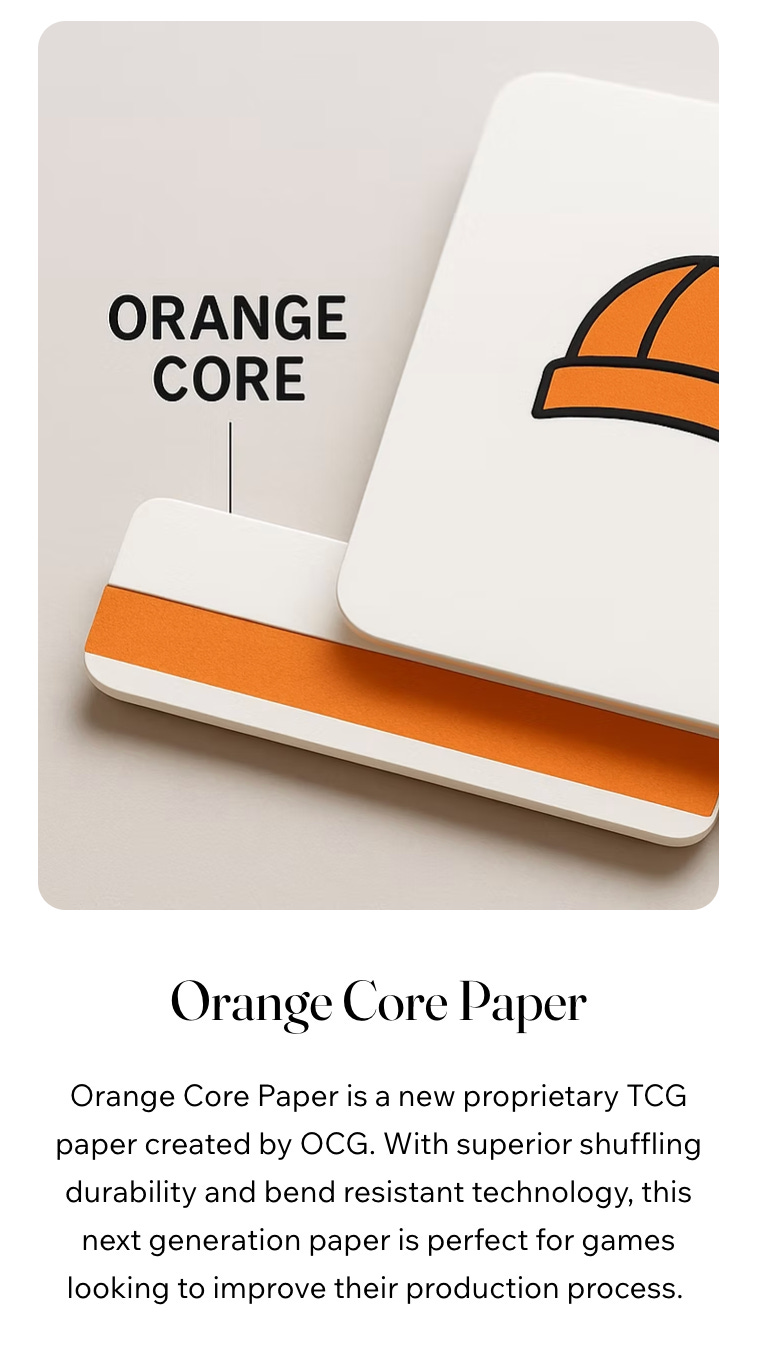

To differentiate its trading card game, the company avoided the industry-standard Blue Core card stock and instead developed its own Orange Core material. This proprietary stock reduces common issues such as edge wear and card bending. Orange Cap Games controls both material selection and the manufacturing process, extending product ownership down to production details.

These efforts were validated when the cards received PSA 10 grades from PSA, the highest rating available. This was followed by a direct collaboration with PSA, resulting in co-branded promotional cards.

Product quality alone is not sufficient. Distribution infrastructure determines whether physical products reach the right audience. Placement in high-traffic locations frequented by target consumers is critical.

To this end, Orange Cap Games partnered with major global distributors:

GTS Distribution, the largest collectibles distributor in North America

Star City Games, a core distributor for Magic: The Gathering

Asmodee, the world’s third-largest board game and toy distributor

As a result, Moonbirds products are no longer limited to crypto-native channels such as exchanges. They are now available in local hobby shops and toy stores, meeting a baseline requirement for global expansion.

At this stage, Orange Cap Games has secured both product quality and distribution access. The next challenge is retention: whether customers who purchase these products remain engaged within the broader Moonbirds ecosystem.

4. Convincing Consumers to Choose Moonbirds

Producing high-quality products and securing distribution are necessary, but not sufficient. The real challenge is persuasion. Among countless character products on retail shelves, what makes consumers choose Moonbirds?

The success of Labubu at Pop Mart was not driven by visual appeal alone. Orange Cap Games applies a similar logic, using structured strategies designed to influence consumer behavior rather than relying on design alone.

4.1. Trading Card Games as a Cultural Entry Point

Cards function not only as collectibles but as components of a game. For cards to become meaningful collectibles, a playable game must exist first. Without active gameplay, even well-designed and well-manufactured cards remain decorative objects.

The central question is how to attract players to a new card game.

Orange Cap Games targets participants in large-scale trading card tournaments. These events often run for five days, with roughly half of participants eliminated on the first day. The company schedules its own tournaments on the second day, positioning them as an alternative for eliminated players.

From a participant’s perspective, an additional competitive opportunity is compelling. Preparation leads to familiarity with the game, core players begin to cluster, and the product starts to function as a real game rather than a niche experiment.

When a Moonbirds tournament is held alongside a major established competition, players also begin to associate it with the same competitive standard. This shift in perception is critical. The strategy is less about immediate conversion and more about reframing Moonbirds TCG as a legitimate part of the broader card game ecosystem.

At its core, this approach is not only about participation, but about changing how the product is perceived.

In practice, Orange Cap Games applied this strategy in 2025 with its Vibes TCG at SCG Con, where side tournaments were run alongside major competitions. Over time, this approach has steadily expanded the scale and visibility of the Vibes TCG events.

4.2. Blind Box 2.0: From a Single Experience to Three

Pop Mart’s traditional blind boxes, such as those featuring Labubu, typically contain a single figurine. Once the box is opened and the item revealed, the experience ends. The model is designed around one-time consumption.

Moonbirds takes a different approach with Blind Box 2.0. Each box contains three distinct collectibles:

A plush or figurine

Trading Card

NFT

By purchasing a single box, consumers engage with three separate experiences rather than one.

Orange Cap Games refers to this model as the “Hybrid” category. This is not simply a bundle of three products. The core idea is cross-channel onboarding, where each item serves as an entry point into a different part of the ecosystem.

Toy-focused buyers discover TCG cards and are introduced to gameplay.

TCG-focused buyers receive NFTs and gain exposure to onchain assets.

NFT-focused buyers receive physical toys and are guided into offline communities

A single blind box becomes a gateway into all three of Orange Cap Games’ business lines: toys, TCG, and NFTs. Consumers may engage only with their original purchase intent. However, once curiosity extends beyond that initial purpose, they are naturally guided into adjacent parts of the ecosystem.

4.3. Mobile Games as an Expansion Channel for Daily Engagement

Purchasing trading cards requires spending, and collecting figurines requires prior interest. Free-to-play mobile games, by contrast, require little more than a download. Some users may later invest time or money to improve their decks or progress, but the initial barrier to entry remains low.

Angry Birds provides a useful reference. The gameplay was simple, but the characters became globally recognizable. From there, the IP expanded into films, merchandise, and theme parks. The game served as the starting point for broad IP distribution.

Moonbirds’ mobile game is designed to play a similar role. Through gameplay, users become familiar with the characters and gradually absorb the broader worldbuilding. Even users with no immediate intention to purchase cards or figurines are exposed to Moonbirds through the game.

Over time, this familiarity creates recognition. When consumers later encounter Moonbirds products in retail settings, the characters are no longer unfamiliar. The mobile game establishes the mental bridge that turns passive awareness into potential purchase intent.

5. From Moonbirds to Orange Cap Games: The Role of $BIRB

Orange Cap Games has built the infrastructure and strategy to expand Moonbirds. For investors, however, the key question remains: what does the $BIRB token actually do?

The team describes $BIRB as a “coordination layer.” In this framing, the token is intended to accelerate cultural distribution and enable memes to spread more efficiently. The strategy is to anchor the business in physical consumer products while using crypto-native dynamics to amplify brand reach.

The challenge lies in specificity. It remains unclear what concrete benefits accrue to token holders. Revenue sharing from product sales, NFT-linked memberships, or other incentive mechanisms have not been clearly defined.

Orange Cap Games emphasizes long-term ecosystem growth. Rather than distributing profits to token holders, revenue is expected to be reinvested into the business. The goal is to create a positive feedback loop where attention generated in non-crypto markets feeds back into the crypto community.

A notable strength is that this is not a business assembled solely to justify a token launch. The company generated real revenue through Vibes TCG before introducing the token layer. This approach differs materially from meme coins that lack underlying operations.

However, open questions remain. Whether the token’s proposed “cultural coordination” function can operate in practice, and whether that function translates into sustained token value, has yet to be demonstrated. A reinvestment-first strategy may also be less appealing to short-term investors.

It remains uncertain whether Moonbirds can achieve Pop Mart level success. Still, the project serves as a live experiment in how NFT-originated IP can be monetized in the real world. The concrete design of $BIRB and its early performance will determine the outcome of that experiment.

🐯 More from Tiger Research

Read more reports related to this research.

Disclaimer

This report was partially funded by Moonbirds. It was independently produced by our researchers using credible sources. The findings, recommendations, and opinions are based on information available at publication time and may change without notice. We disclaim liability for any losses from using this report or its contents and do not warrant its accuracy or completeness. The information may differ from others’ views. This report is for informational purposes only and is not legal, business, investment, or tax advice. References to securities or digital assets are for illustration only, not investment advice or offers. This material is not intended for investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo following brand guideline. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.