Miners Quit Mining to Pivot to AI [link]

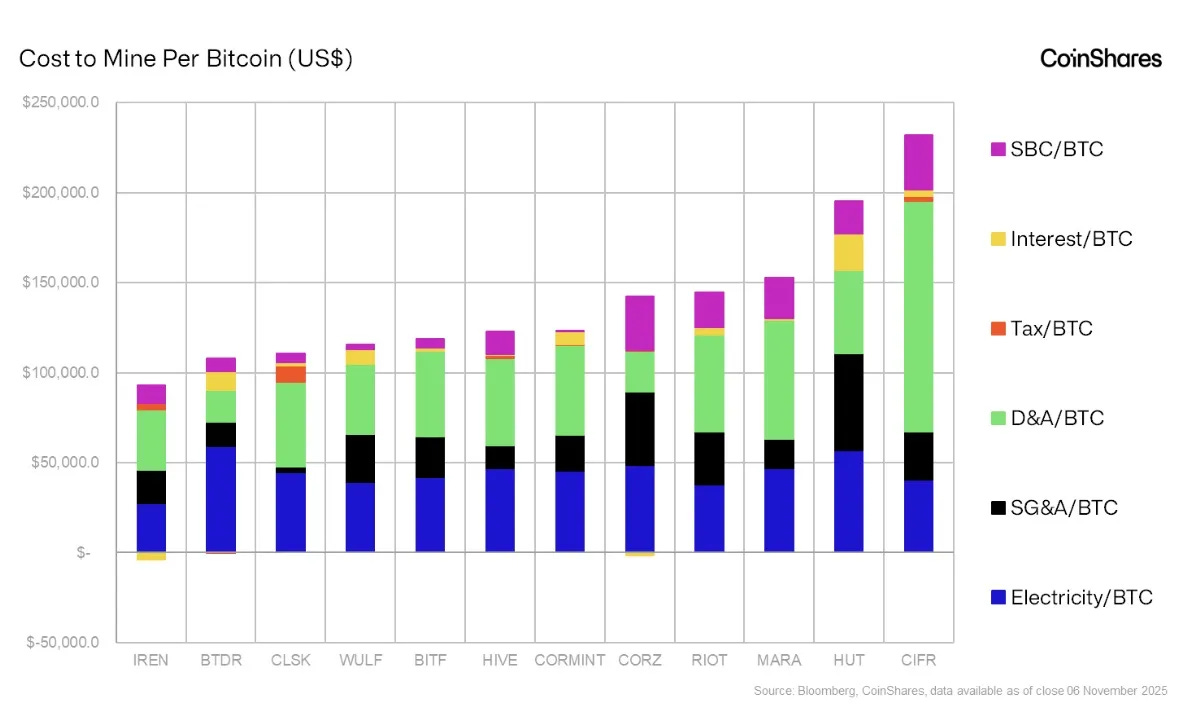

Why it matters: Bitcoin price volatility is a surface risk, but the real threat is structural cost. Revenue moves with the market while difficulty and energy costs only go up. This mismatch breaks the old pure-play model and forces a hard pivot for survival.

The Takeaway: Miners leverage existing GPUs and cooling systems to solve the AI capacity bottleneck. With production costs now near $130k per coin, firms must lease their “shells” to big tech. The goal is to generate cash flow that funds the ability to hold, rather than sell, Bitcoin.

Tokenized Stock Market Map [link]

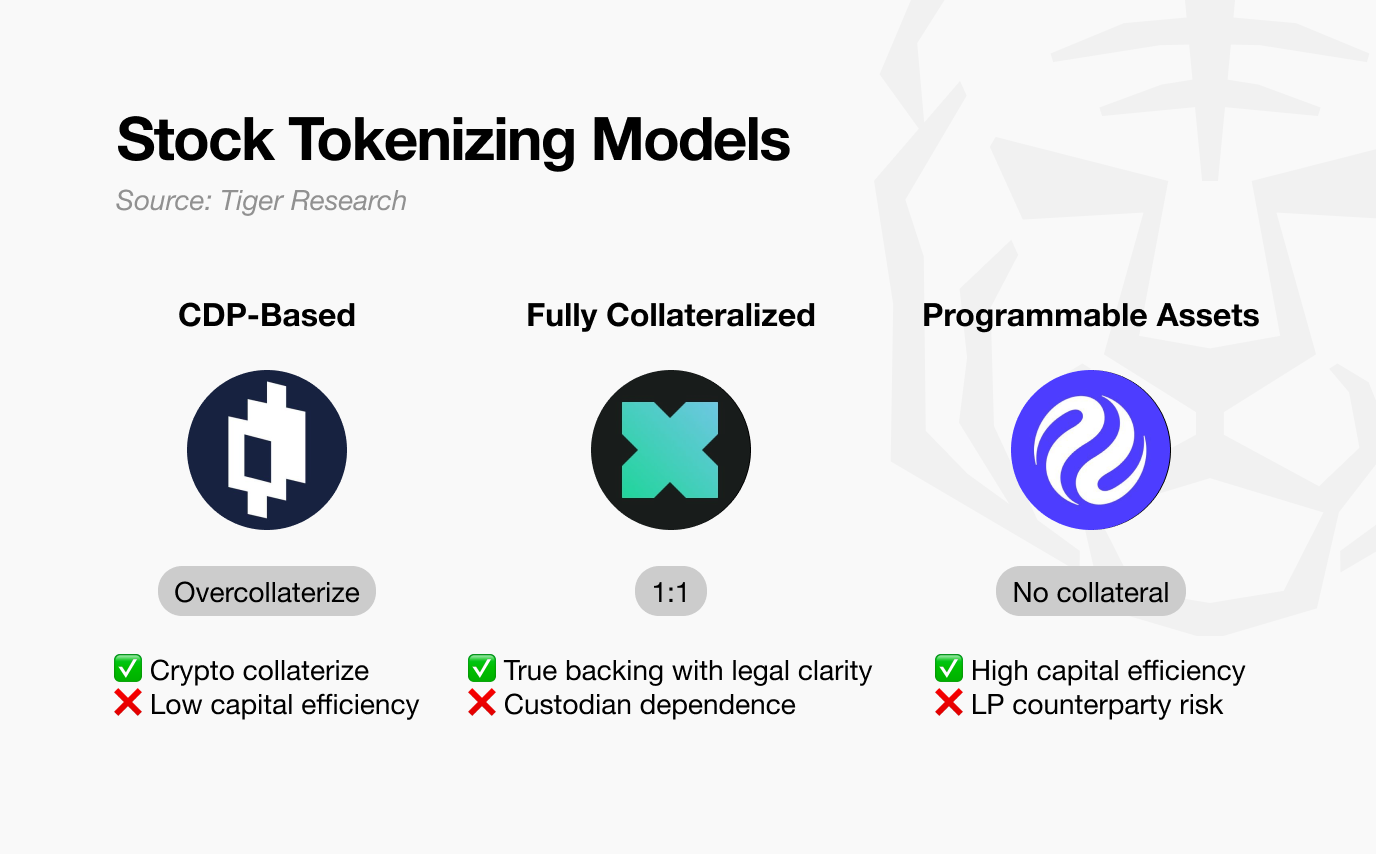

Why it matters: Nasdaq’s application for tokenized asset listings and the DTCC’s digital settlement roadmap signal a permanent structural shift. This is not about hype. It is about the heavyweights slashing costs and unlocking liquidity for tokenized assets.

The Takeaway: Tokenized stocks unlock a 2,680x growth opportunity by turning idle shares into active DeFi collateral. The market sits at a tiny $500 million today against a $134 trillion total addressable market. The critical edge is structural: this sector serves proven demand, while other RWA sectors must manufacture it.

When Stablecoins Meet On-Chain Credit and Privacy [link]

Why it matters: Crypto handles remittances and payments well, but traditional finance is still 60x larger ($247T vs $4T). The gap is structural: blockchain exposes all transactions publicly, and DeFi only lends against collateral. These constraints block real adoption by businesses and institutions.

The Takeaway: Crypto needs three elements to scale: Stablecoins, Credit, Privacy. Combined, they let users receive salaries, borrow against transaction history, invest, and file taxes—all on-chain, automated, and borderless.