Bitcoin’s price slump forces miners to pivot their business model. With core mining competition now fierce, how will these firms survive?

Key Takeaways

Uncertain revenue and rising bitcoin mining costs make the core mining business unstable.

As a result, mining firms pivot, using existing sites to lease data center space to Big Tech.

This move cuts strict competition and makes the sector more sound.

1. Business Risks Facing Cryptocurrency Mining Companies

In a previous report, we analyzed the financial risks facing Strategy amid falling Bitcoin prices. However, DAT companies are not the only ones under pressure. Bitcoin mining companies, which directly operate mining businesses, are also exposed to significant risk.

The vulnerability of mining companies stems from a structurally simple business model. Revenue depends almost entirely on Bitcoin prices, which are inherently unpredictable. Costs, by contrast, tend to rise over time.

Unpredictable revenue: Company revenue is determined solely by Bitcoin market prices.

Rising structural costs : Mining difficulty continues to increase, electricity prices rise, and hardware requires regular replacement.

This structure becomes especially problematic during periods of Bitcoin price declines. Revenue falls immediately, while costs continue to increase. Mining companies are caught in a double squeeze.

Regulatory risk adds another layer of uncertainty. In New York State, a proposal has been introduced to raise excise taxes on mining companies. Most major miners are currently located in relatively deregulated regions such as Texas, limiting near-term impact. Still, the risk of broader regulatory pressure cannot be dismissed.

Against this backdrop, mining companies are confronting a fundamental question: can this business model remain viable over the long term?

2. Structural Fragility of Mining Companies

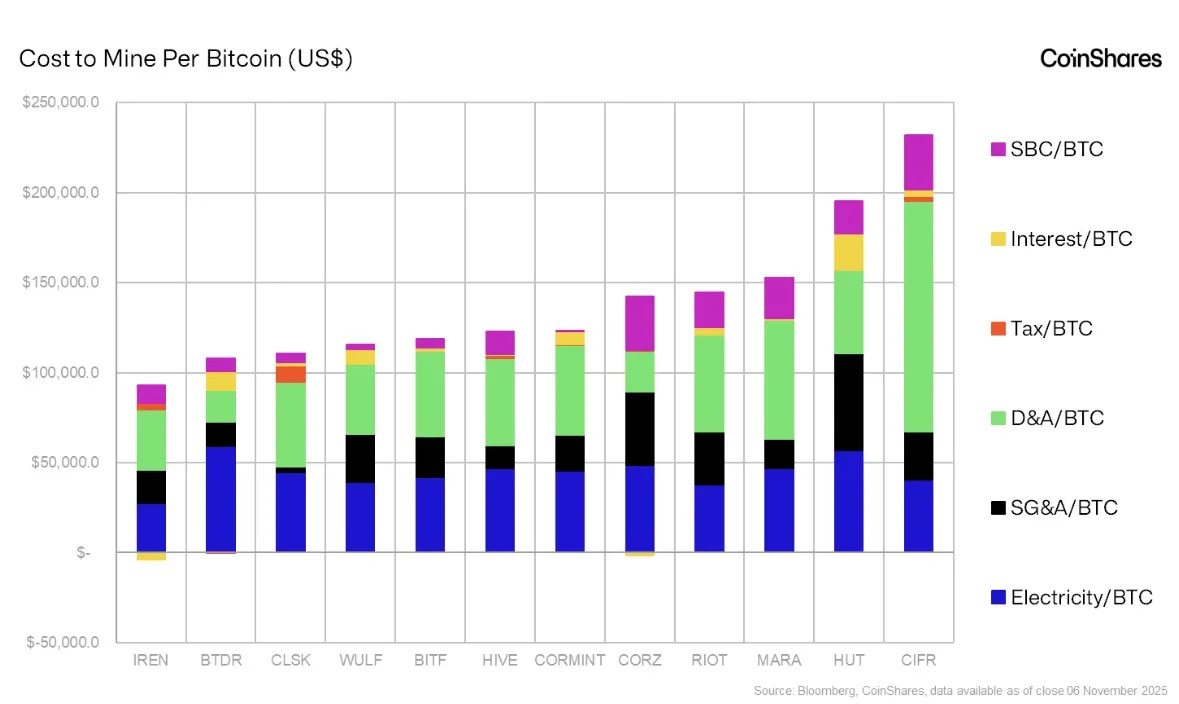

As of today, the average cost to mine one Bitcoin is approximately $74,600, up nearly 30 percent from a year ago. When depreciation and stock-based compensation are included, total production costs rise to roughly $130,000 per Bitcoin.

With Bitcoin currently trading around $91,000, mining companies are recording an accounting loss of about $46,000 for every Bitcoin mined. This gap highlights the growing disconnect between operating economics and market prices.

The situation has become more fragile over time. Compared to 2022, mining difficulty in 2025 is materially higher, while energy regulations have tightened across multiple regions. These factors have reduced cost visibility and made mining operations structurally less stable.

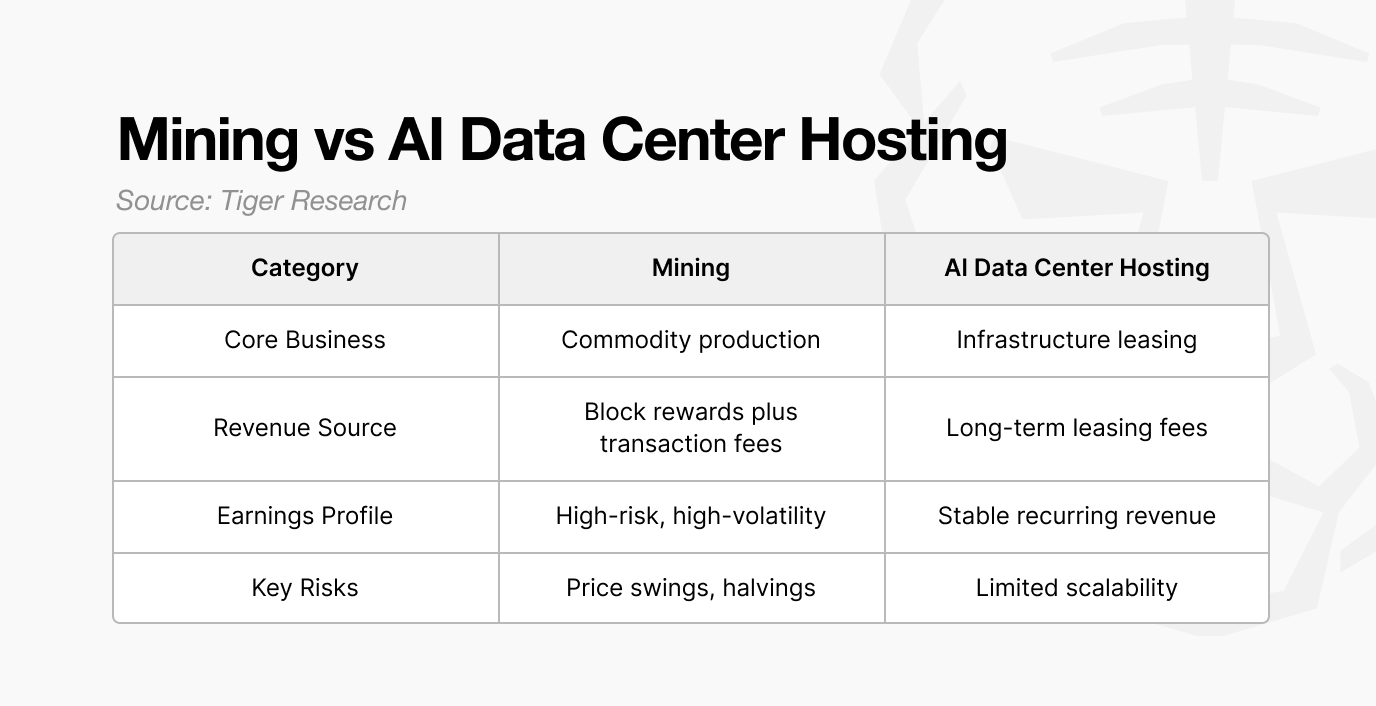

3. Pivoting to AI Data Center Leasing

As competition in AI accelerates, demand for data centers from large technology companies is rising sharply. Building new data centers, however, takes several years. In an AI race measured in months and quarters, waiting is not an option.

Mining companies have identified an opportunity in this gap. They already operate facilities with high-performance compute hardware, large-scale power access, and advanced cooling systems. While these sites cannot be converted one hundred percent overnight, their specifications align closely with what large technology companies require. This allows for relatively fast conversion into AI-ready data centers.

High-performance GPUs: Mining companies operate large fleets of GPUs that can be repurposed for AI computation. NVIDIA GPUs are a common example. With facility-level adjustments, these assets can support new revenue streams beyond mining.

Power infrastructure: Miners have secured grid access at the scale of hundreds of megawatts. In heavily regulated power markets, such access is scarce and difficult to replicate, even with capital.

Cooling systems: Experience gained from operating ASIC mining rigs translates well to managing high-heat AI servers such as H100 and H200 units. In practice, many mining sites can be converted into AI data centers within six to twelve months.

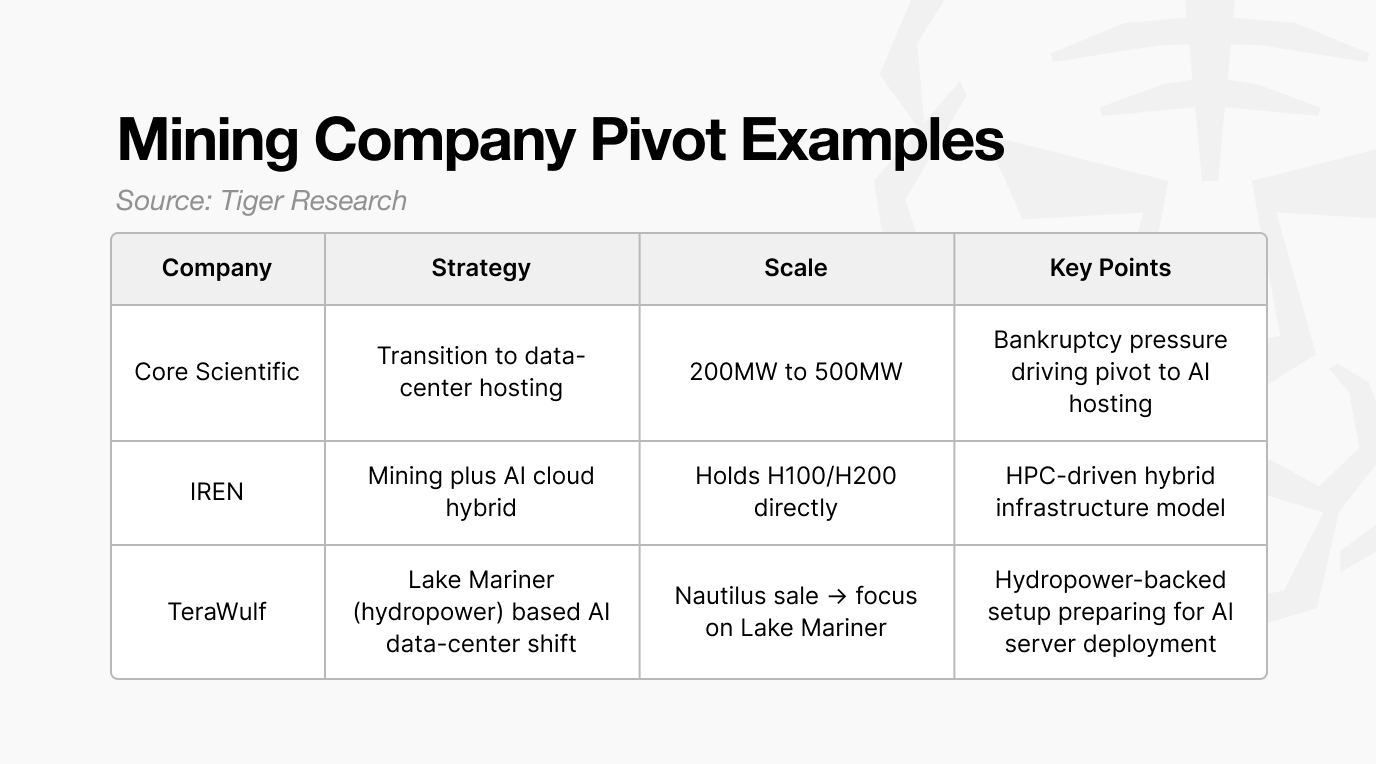

A representative example is Core Scientific. The company faced bankruptcy risk in 2022 but pivoted toward AI data center operations. It currently operates approximately 200 MW of capacity and plans to expand to 500 MW over time. This shift from a distressed miner to a data center leasing business illustrates how alternative infrastructure use can stabilize the business.

Other mining companies are following similar paths. IREN and TeraWulf are also expanding beyond pure mining operations. While they have not fully transitioned into data center leasing businesses, they are developing supplementary models outside of Bitcoin mining.

These moves reflect a broader trend. As mining profitability weakens, mining companies are seeking business models better aligned with the AI era. The shift is less about growth ambition and more about necessity.

4. Diversifying Strategies Among Mining Companies

The shift by mining companies away from unprofitable mining operations toward AI data center businesses is not a temporary trend. It reflects a rational survival strategy aimed at reallocating capital to higher-efficiency uses.

This transition should not be viewed as a negative development. On the contrary, it allows mining companies to build more stable cash flow. With steadier income, firms can continue to hold Bitcoin without being forced into distressed sales.

The alternative is far less constructive. Companies that remain cash-flow negative risk bankruptcy and are often forced to liquidate Bitcoin holdings at unfavorable prices. By contrast, data center revenue gives mining firms the flexibility to hold or sell Bitcoin strategically. This outcome is healthier for both the companies and the broader market.

Not all firms are converging on pure data center leasing. Some, including Bitmine and Cathedra Bitcoin, are expanding beyond mining into DAT-style business models.

Taken together, these changes suggest a maturation of the cryptocurrency mining industry. Less competitive players exit or pivot, reducing excess mining pressure. At the same time, leading firms are evolving beyond simple mining into diversified DAT businesses.

In effect, weaker links are being removed, and the overall market structure is becoming more resilient.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.