This report was written by Tiger Research, analyzing how the combination of stablecoins, on-chain credit, and privacy technologies can unlock crypto’s structural impact beyond its current limited use.

TL;DR

Cryptocurrency has proven practical for remittances and payments. However, its influence on the broader financial system remains limited. Traditional finance offers complex and sophisticated services. Cryptocurrency still faces gaps in both application scope and trust levels.

Stablecoins have improved financial accessibility as digital money. Yet their role stays limited to basic functions like asset storage and transfers. Cryptocurrency needs on-chain credit systems and privacy protection technologies. Together, these will enable more sophisticated financial activities.

These three elements create an interconnected structure. Cryptocurrency can then move beyond simple functions and gain structural transformation potential. Integrated stablecoins, credit, and privacy deliver new experiences and operating methods that traditional finance lacks.

1. The crypto industry's potential has only just begun

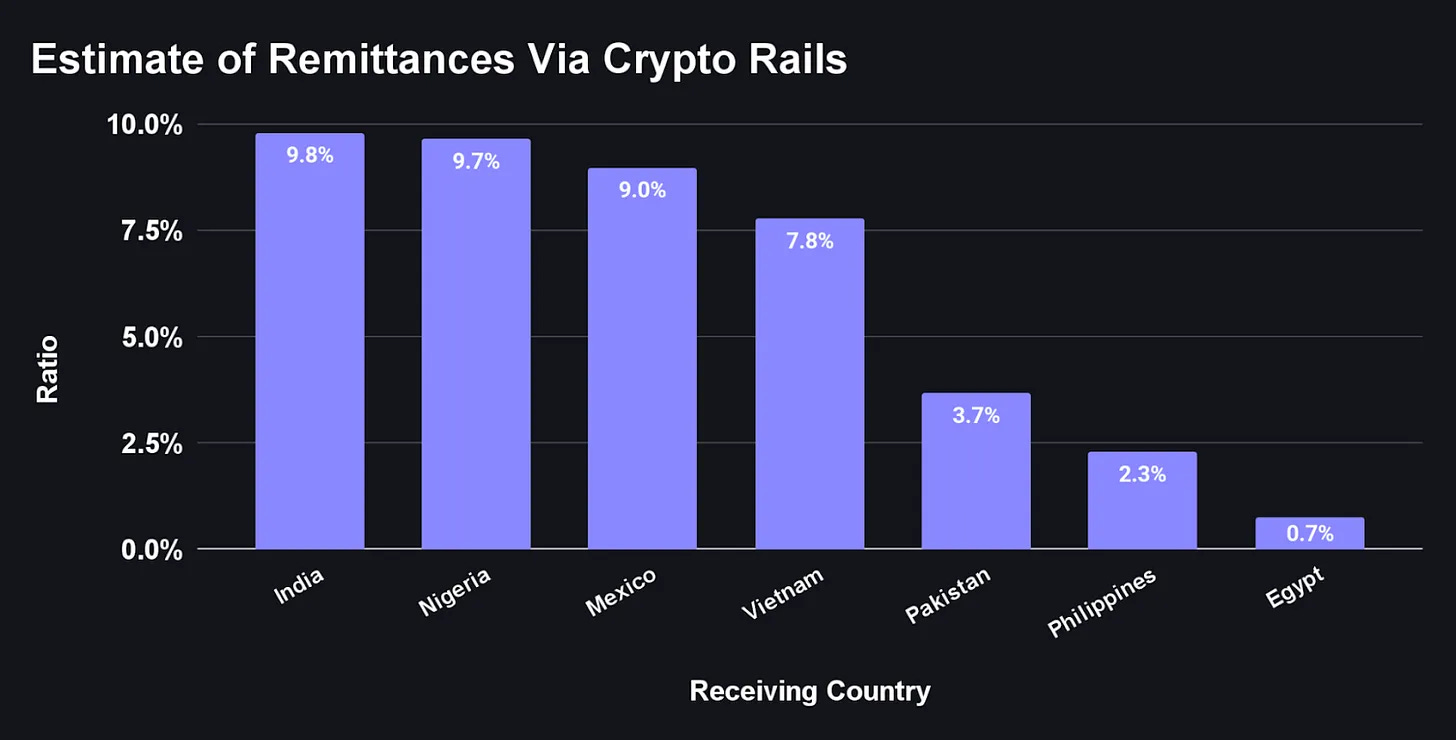

Crypto is expanding beyond speculation into practical areas like remittances and payments. Yet its market share remains limited compared to traditional finance. The numbers tell the story. Traditional financial markets reached $247 trillion in 2024, while crypto markets totaled just $4 trillion—a 60-fold difference.

Crypto has proven its practical value but hasn't achieved mainstream adoption. It remains confined to a narrow scope. A significant gap still exists between crypto and established financial systems.

So what does crypto need to advance into broader financial ecosystems? This report explores expansion strategies focused on three core elements: Stablecoins, Credit, and Privacy.

2. How can crypto expand its impact?

2.1. Stablecoins: Proven potential, yet structural limitations remain

Stablecoins represent the clearest example of crypto moving beyond speculation into practical financial infrastructure. Existing cryptocurrencies struggled as payment methods or stores of value. High volatility and complex usage created barriers. Stablecoins addressed these limitations. They provide stable value for basic financial functions like transfers, storage, and exchanges. This demonstrates clear product-market fit (PMF).

Stablecoins serve as practical alternatives in emerging markets with poor financial infrastructure or severe inflation and capital controls. Dollar-pegged stablecoins like USDT and USDC have become more trusted than local currencies in these regions. They significantly improve financial accessibility.

However, stablecoins represent just a starting point. Their current role focuses on basic functions like asset storage and transfers. Their impact remains limited to specific regions or use cases. Traditional finance offers complex services like credit, investment, and asset management. Stablecoins alone cannot replace or expand these due to structural limitations.

These limitations stem from crypto's structural characteristics, not simple technical issues. Blockchain's transparency makes all transactions public. This compromises financial privacy for individuals and businesses. Current collateral-based lending systems cannot implement flexible, credit-based asset management. These constraints represent common challenges for all crypto finance, including stablecoins.

Stablecoins need additional components to expand beyond current possibilities into broader financial ecosystems. The crypto industry must develop functioning on-chain credit systems and privacy protection technologies. Stablecoins can then evolve from simple digital money into infrastructure supporting complex financial activities. This creates the foundation for substantially expanding crypto's financial impact.

2.2. On-chain credit: Scaling up crypto finance structures

Stablecoins proved crypto works in practice. They provided a foundation. However, stablecoins alone cannot deepen financial structures sufficiently. The next step is on-chain credit. This serves as the key driver for scaling up crypto finance's structural reach.

Current crypto finance relies on over-collateralized lending. Borrowers must deposit assets before accessing loans. Loan-to-value ratios typically cap at 50%. Users can only borrow half the value when pledging one Bitcoin as collateral.

This stems from blockchain's lack of identity verification and legal recourse. Risk management depends entirely on liquidatable collateral. This structure restricts financial access to asset holders only. It also limits capital efficiency. DeFi claims to be "open to all." Yet credit remains exclusive to those with assets.

On-chain credit scoring projects tackle these constraints. Cred Protocol exemplifies this approach. It applies machine learning to analyze on-chain behavior from DeFi protocols like Aave. This covers liquidation history, position sizing, and transaction patterns.

The system forecasts liquidation risk within 90 days. It generates real-time credit scores from this analysis. These scores enable risk-based lending at the wallet level. This can lower collateral requirements. It may even support unsecured lending.

3Jane goes a step further with this approach. It analyzes predictable income streams from both on-chain and off-chain sources. This includes recurring bank deposits, DeFi activities, and exchange earnings. This model evaluates credit based on cash flow rather than asset ownership. It opens new possibilities for "thin filers" - users with limited traditional credit histories.

Future developments could potentially incorporate additional income sources. These might include airdrops, DeFi participation, and node operations. These efforts are still in early stages. However, they align with a broader trend where on-chain behavioral data transforms into actionable financial intelligence. This represents a significant development direction.

On-chain credit can expand beyond individuals to projects. Some projects maintain consistent treasury management. Others show steady protocol revenue streams. These projects can access loans without external investment. They leverage their track record for on-chain financing. This shows crypto's potential to evolve beyond personal finance into corporate finance.

On-chain credit ultimately lowers the collateral barrier. It enables users to build credit history through their on-chain activities. This shifts crypto finance away from structures serving only asset holders. It creates a more inclusive financial system with broader participation. This strengthens crypto's role as genuine financial infrastructure.

2.3. Privacy: The scaling-out axis for expanding crypto's reach

Blockchain transparency provides the foundation for system trust. However, all transactions being public creates constraints in real-world applications. Sensitive financial information from individuals and businesses gets recorded and publicly exposed on-chain. This creates structural limitations that hinder crypto adoption.

Individuals face exposure of salary receipts and spending records. Traditional finance protects basic financial privacy, but blockchain environments fundamentally abandon this protection. This limits real-world scalability.

Businesses face more severe problems. When internal transactions get exposed externally, cost structures and strategies can leak to competitors. Asset management firms and investment companies are especially vulnerable. Public disclosure of investment timing and amounts creates opportunities for front-running and copy trading.

Technical approaches address these limitations through confidentiality protection rather than full anonymity. Inco and Circle Research jointly developed cERC20 (Confidential ERC-20). It uses Fully Homomorphic Encryption (FHE) to keep transaction amounts and balances encrypted while maintaining on-chain transaction validity verification.

cERC20's core strength lies in selective disclosure rather than complete anonymity that hides all information. Information can be revealed to authorized parties only when necessary. This enables regulatory and audit compliance. It represents a technical solution harmonizing the conflicting demands of transparency and confidentiality.

Such confidentiality technologies serve as prerequisites for crypto expansion beyond simple peer-to-peer transfers. They enable real-world adoption by businesses and institutions. cERC-20 provides privacy infrastructure meeting these conditions. It plays a crucial role in establishing crypto as a trust-based expansion structure where diverse economic actors can participate.

3. From limited impact to structural transformation

Crypto's influence remains limited compared to traditional finance. It has proven product-market fit in some areas. However, gaps still exist in both scope and trust levels when compared to the multi-layered, complex systems that traditional finance has built over decades.

Stablecoins were the first step in narrowing this gap. They improved financial access and efficiency, especially in regions with poor financial infrastructure. Yet they remain focused on basic functions like value storage and transfers. Expanding into broader financial ecosystems requires combining on-chain credit with privacy protection technologies.

When these three elements combine, crypto can expand beyond simple functionality. It can become a structure enabling continuous and comprehensive financial activities. For example, freelancer A in Korea could receive salary payments in stablecoins from overseas. Based on that transaction history, they could access on-chain loans for active investment activities. Throughout this process, financial information stays protected. Yet it can be selectively disclosed when needed for tax reporting.

The key structural change lies in automation. Complex fund flows and regulatory compliance processes from traditional finance can be automated within a single environment. This structure also enables borderless financial participation. Users and businesses from various countries can access this ecosystem without existing infrastructure constraints.

Many financial areas remain unimplemented in on-chain environments. However, as on-chain credit and privacy technologies build upon stablecoins' foundation, crypto shows potential for creating structural impact comparable to traditional finance. How quickly and effectively these three axes integrate will determine whether the crypto industry can bring real change to traditional finance - a sector 60 times larger.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.