This report was written by Tiger Research, analyzing Edgen’s AI-powered financial intelligence platform.

TL;DR

Retail investor participation expands rapidly, yet investors lack infrastructure to interpret and utilize data effectively. Institutions manage markets systematically through professional systems like Bloomberg Terminal, while individuals still rely on fragmented information.

Edgen closes this gap through an AI-powered financial intelligence platform. The platform integrates analysis across stocks and cryptocurrencies, moving beyond data provision to deliver actionable insights.

Edgen advances further by building hyper-personalized investment analysis. The platform tailors intelligence to each investor’s style and objectives, transforming financial analysis capabilities once exclusive to Wall Street into accessible tools for everyone.

1. The Retail Investment Era Needs New Intelligence

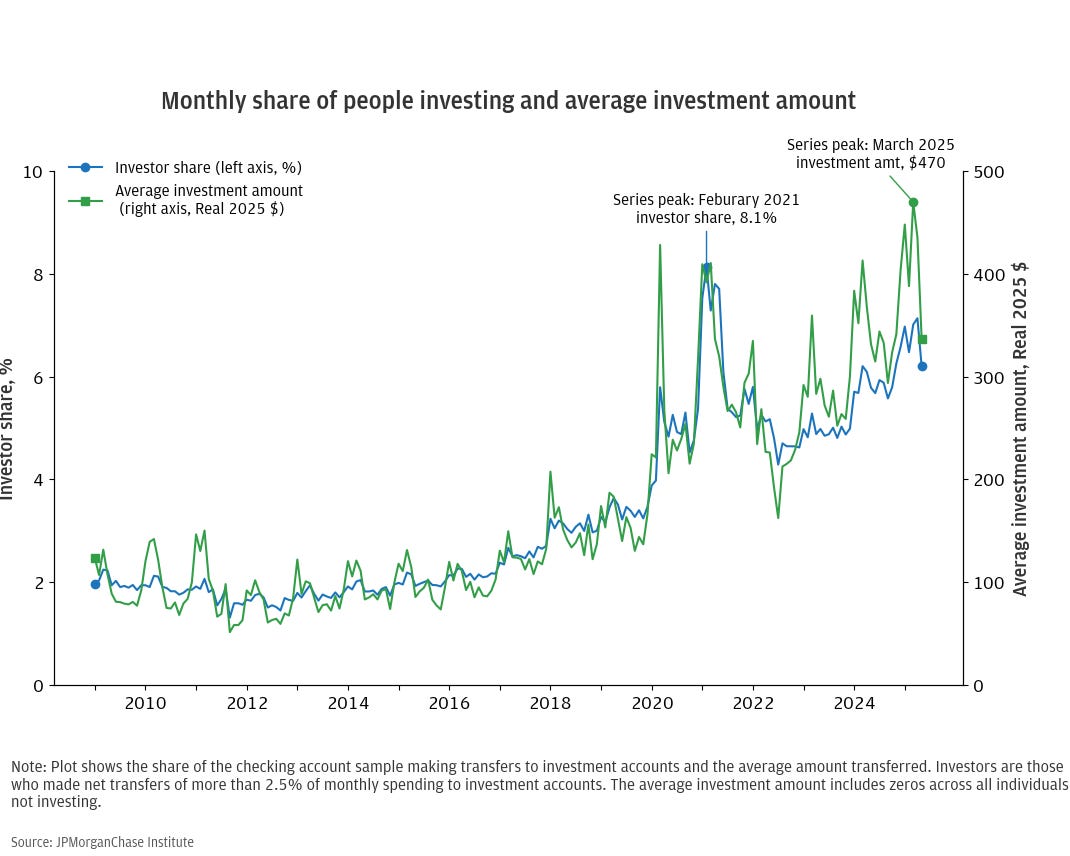

Lower financial market barriers rapidly expand retail investor participation. Anyone can now access global markets with just a smartphone from anywhere at any time. Everyone can easily access professional information including corporate disclosures, financial statements, and analyst reports. Market entry and information acquisition have never been easier.

Yet improved accessibility (market accessibility, information accessibility) fails to provide adequate infrastructure for analyzing and utilizing data effectively. Complex market environments and higher volatility increase the burden on retail investors. Investors must monitor vast data across multiple services to invest in various asset classes including national stock markets and cryptocurrencies. NASDAQ and the New York Stock Exchange plan 24-hour trading systems following the cryptocurrency market model. The investment environment will transform even more dynamically.

Retail investors lack sufficient infrastructure to manage this complexity. They lack the time and resources to analyze vast data systematically when investing is not their primary profession. Complex financial data creates a substantial cognitive burden to understand and utilize. Many retail investors access abundant information but fail to utilize it properly and timely. They rely on social media or fragmented news, apps, or self-made spreadsheets for investment decisions.

Institutional investors traditionally manage this complexity through professional systems like the Bloomberg Terminal. Ultra-high-net-worth individuals receive personalized portfolio management and customized investment strategies through private bankers. The Bloomberg Terminal costs tens of thousands of dollars annually and requires professional training. Private banking requires minimum assets of several billion won.

Most retail investors cannot access these professional tools. Yet retail investors face the same market environment as institutional investors. Expanded market participation forces retail investors to make rapid and accurate decisions in complex, fast-changing markets. AI technology advances open new possibilities to close this information gap. Services can now analyze vast data in real-time like the Bloomberg Terminal while providing personalized investment insights like private bankers for retail investors. Edgen represents a leading example of this possibility.

2. Edgen: An AI Bloomberg Terminal for All Investors

Edgen is an AI-powered financial intelligence platform built to become “the AI Bloomberg Terminal for everyone.” The platform enables retail investors to monitor and analyze both stock and cryptocurrency markets seamlessly within a single interface.

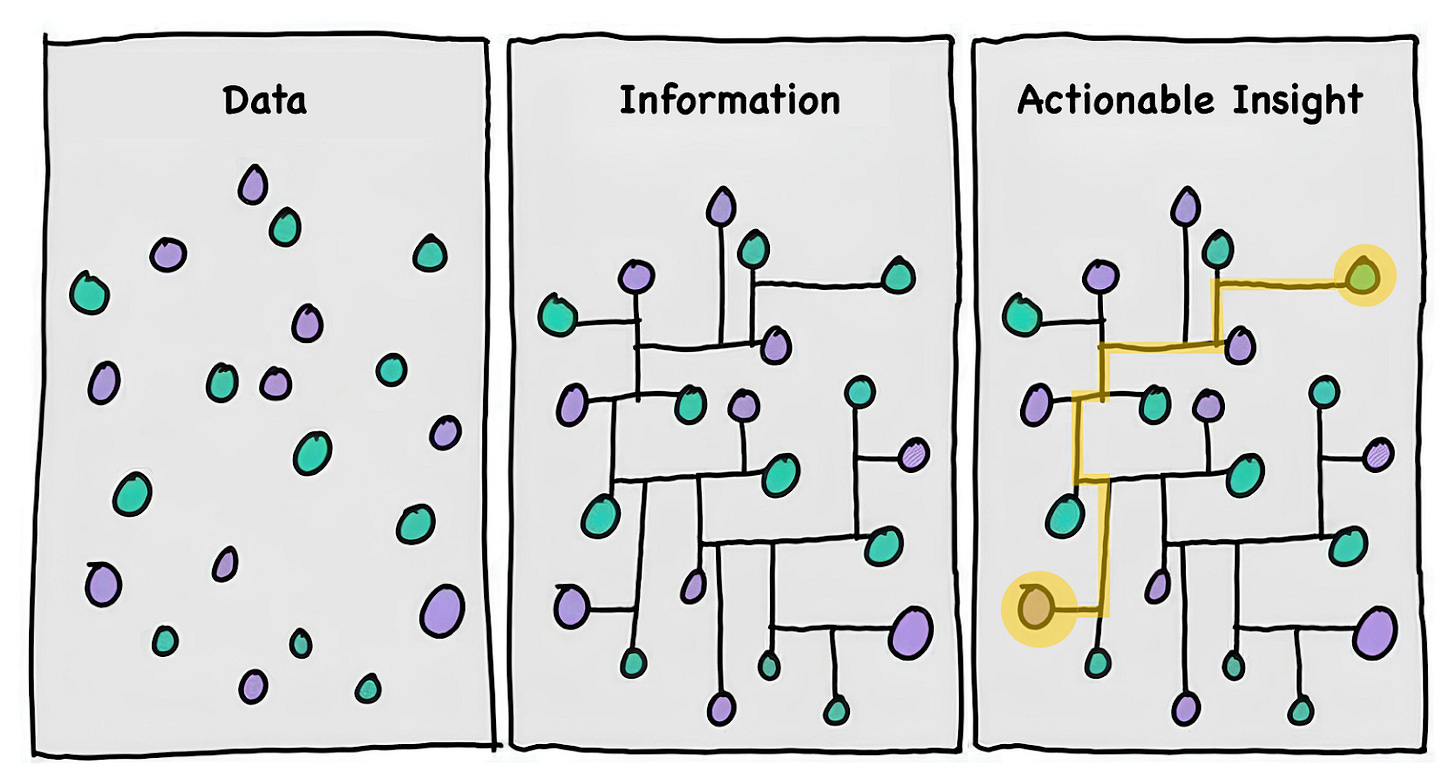

Edgen goes beyond mere data aggregation. The platform transforms fragmented data into actionable insights. Traditional financial information platforms provide raw data like news, charts, and financial statements, while Edgen analyzes this data and delivers investment insights in multiple formats: conversational answers, visualized charts, comprehensive reports, and quantitative scores personalized for every investor.

Edgen advances further by building personalized analysis tailored to each investor’s style and objectives. The platform presents individually optimized insights rather than displaying identical data to all users. This approach mirrors personalized social media feeds. Just as Facebook and Instagram show different content to each user, Edgen provides different dashboards to each investor. For example, during the same Bitcoin market conditions, long-term investors could receive “Local bottom reached, consider additional purchases,” while short-term traders would see “Short-term oversold zone, monitor rebound potential” as personalized Pivot Alerts.

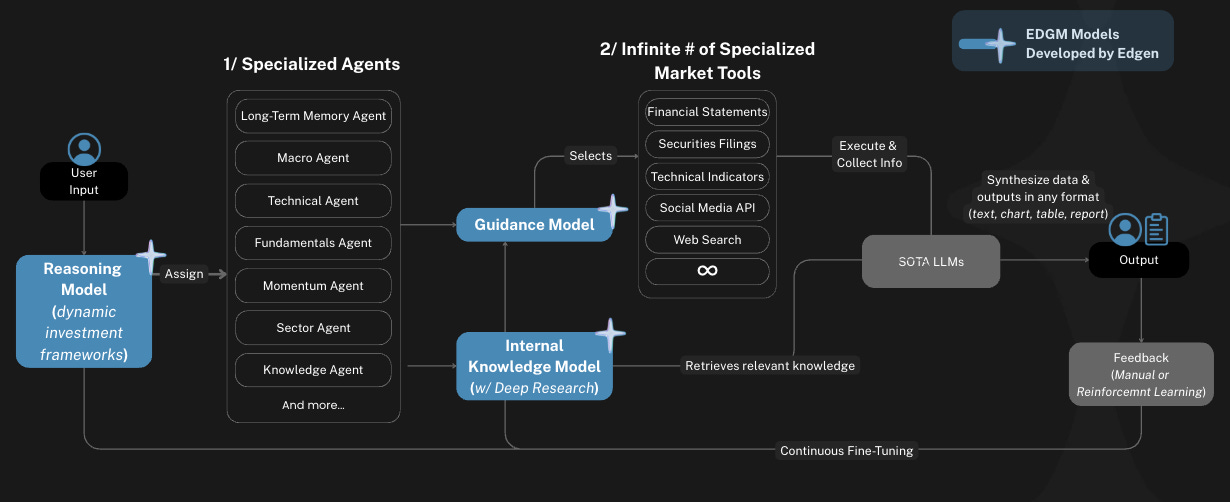

The Efficient Decision Guidance Model (EDGM) powers this capability. EDGM orchestrates specialized agents and tools through a multi-agent system rather than operating as a single monolithic model.

Unlike generic LLMs that merely process language and words, this reasoning model interprets user queries and assigns them to specialized agents based on professional investment frameworks (macroeconomic analysis, technical analysis, fundamental analysis) and real-time market data. Each agent leverages guidance models and knowledge models to collect necessary data. This process incorporates real-time market data, the individual investor’s search history, portfolio composition, and trading patterns. The system also references data from investors with similar investment profiles. Market tools and large language models (LLMs) then process and synthesize the collected data and deliver results as conversational answers, charts, or reports.

This implementation combines Bloomberg Terminal’s comprehensive market analysis with the personalized strategy formulation of private banking within a single platform. Retail investors now access financial intelligence that institutional investors and ultra-high-net-worth individuals previously monopolized.

3. How Edgen Supports the Entire Investment Journey

3.1. Market Discovery: Uncovering Investment Opportunities

Finding valuable investment opportunities in today’s complex markets challenges even experienced investors. Investors must review and analyze vast amounts of data: countless news articles, charts, financial statements, and social media signals. Edgen simplifies this process through multiple methods.

Edgen’s Search feature allows investors to explore markets conversationally rather than analyzing complex financial data directly. For example, when an investor asks “Why did Tesla’s stock price drop recently?”, Edgen analyzes the company’s news, financial situation, technical indicators, and market sentiment simultaneously and provides an integrated answer. Personalization operates here as well. Edgen learns from user search history to identify the themes, sectors, and metrics each investor values, then progressively tailors search results and investment suggestions to that specific user.

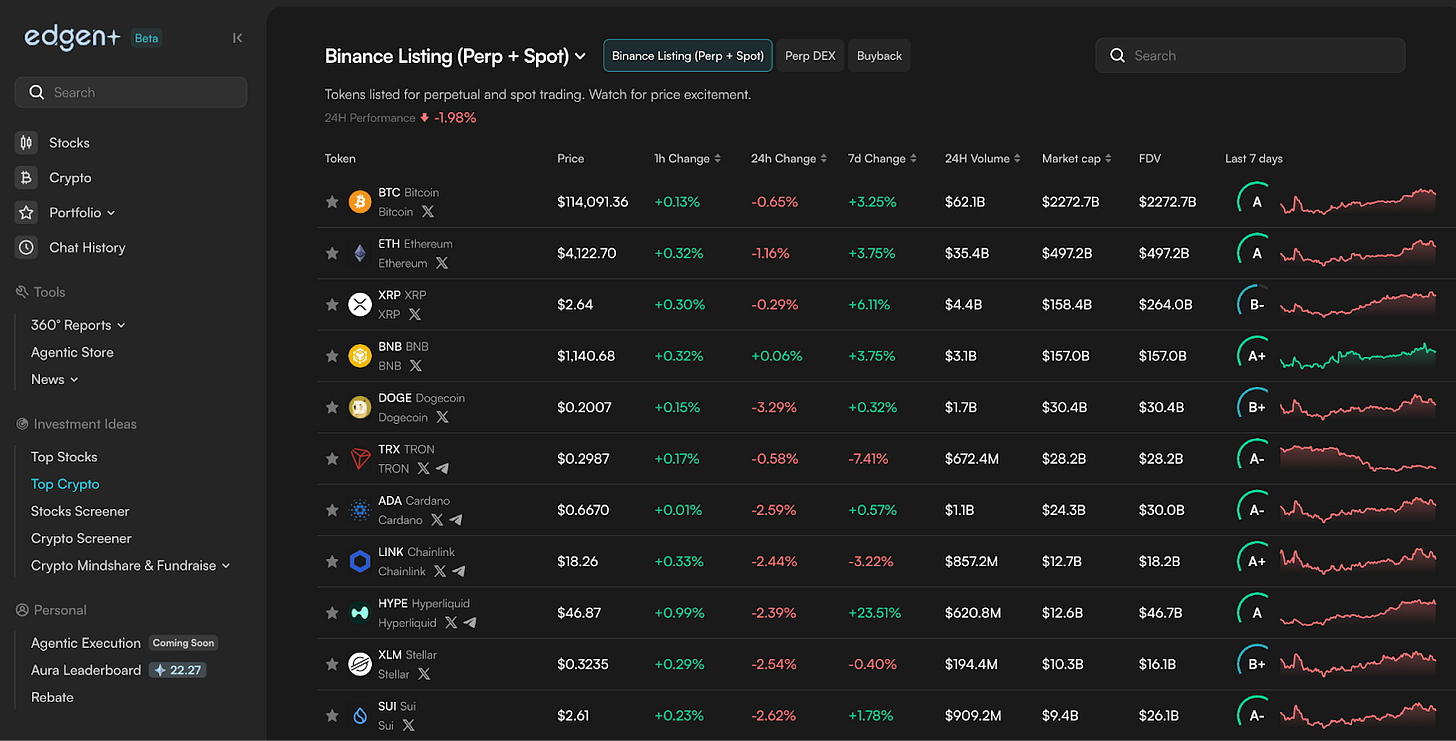

Investment Ideas systematically uncovers noteworthy market opportunities by Themes. Top Stocks and Top Crypto highlight assets with strong market momentum. Stocks Screener and Crypto Screener enable investors to create customized asset lists by setting conditions like market capitalization, trading volume, and price movement. The Crypto Mindshare & Fundraise section captures signals unique to cryptocurrency markets. Crypto Mindshare tracks tokens surging on social media in real-time through X’s (formerly Twitter) “Hype Index.” Just Fundraised provides information on recently funded projects, including funding size and participating investors. DEX Tracker analyzes on-chain transactions and reveals capital flows from professional investors.

3.2. Smart Portfolio Management: Evaluating and Managing Assets

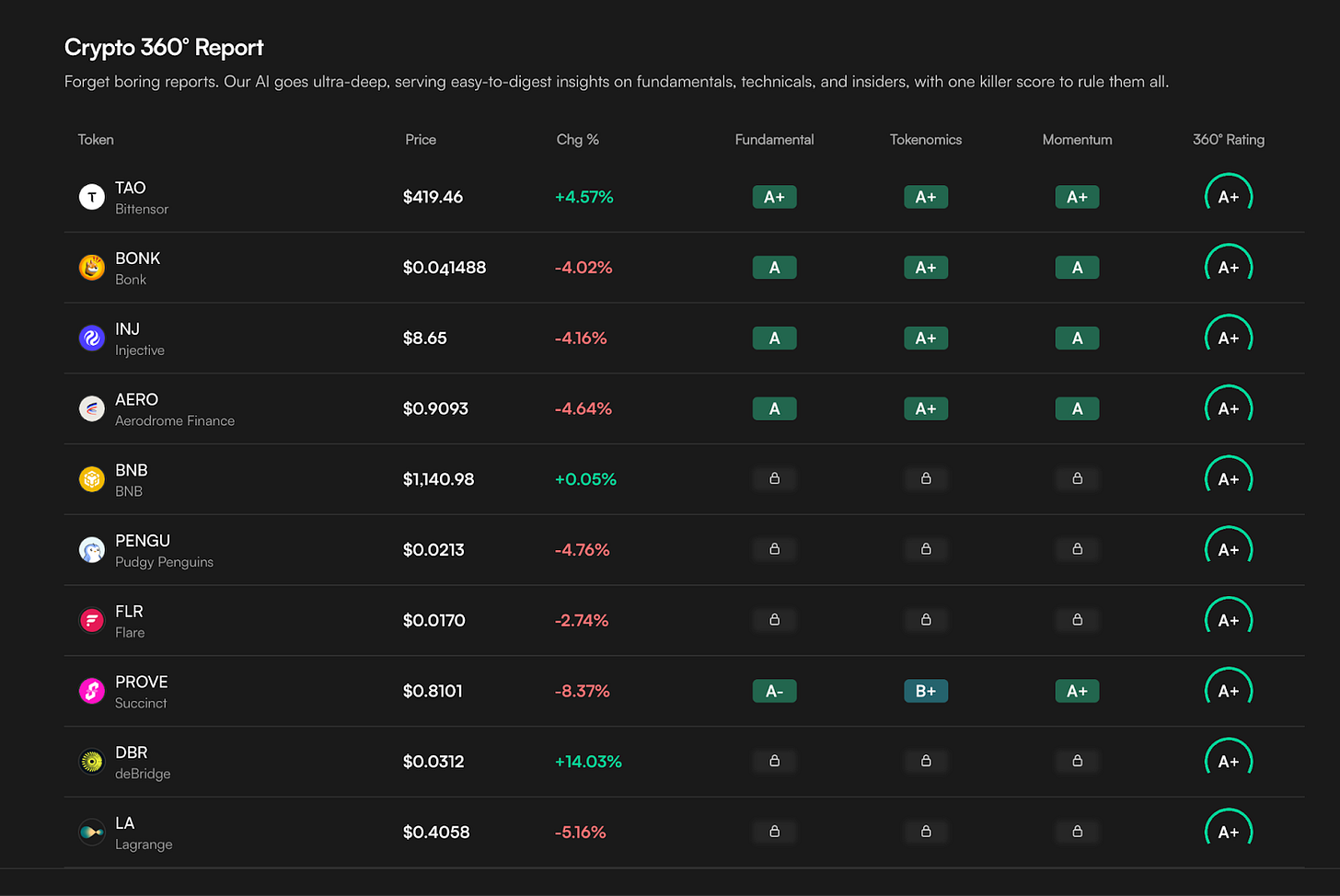

After uncovering investment opportunities, investors need tools to analyze assets deeply and monitor them continuously. 360° Reports automatically generate comprehensive analysis for individual assets. The system evaluates stocks through Valuation, Growth, Profitability, and Momentum perspectives, and assesses cryptocurrencies through Fundamental, Tokenomics, and Momentum perspectives. Edgen’s specialized agents analyze each category and assign grades from A+ to D-. The platform transparently discloses the analysis process so investors can verify how each agent reached its judgment.

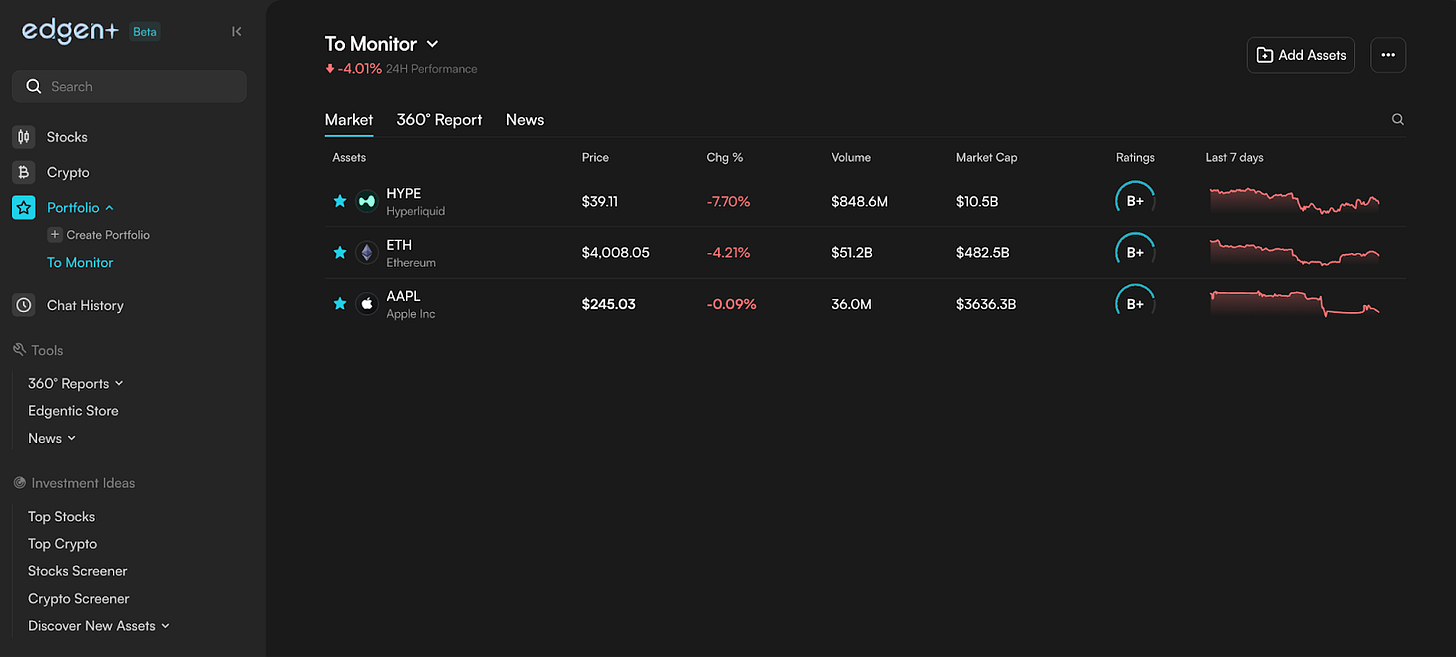

Beyond individual asset analysis, investors must manage multiple assets cohesively. Edgen provides the Smart Portfolio feature. Investors manage bookmarked stocks and cryptocurrencies on a single screen. The portfolio offers three views. Market View displays real-time prices alongside asset grades. 360° Report View aggregates in-depth analysis for each asset. News View filters and delivers portfolio-related news.

Edgen plans to further advance the Smart Portfolio feature. The platform will provide comprehensive scores for entire portfolios beyond individual asset grades, and will deliver specific action plans to achieve higher ratings.

3.3. Customized Tools: Building Your Own Investment Strategy

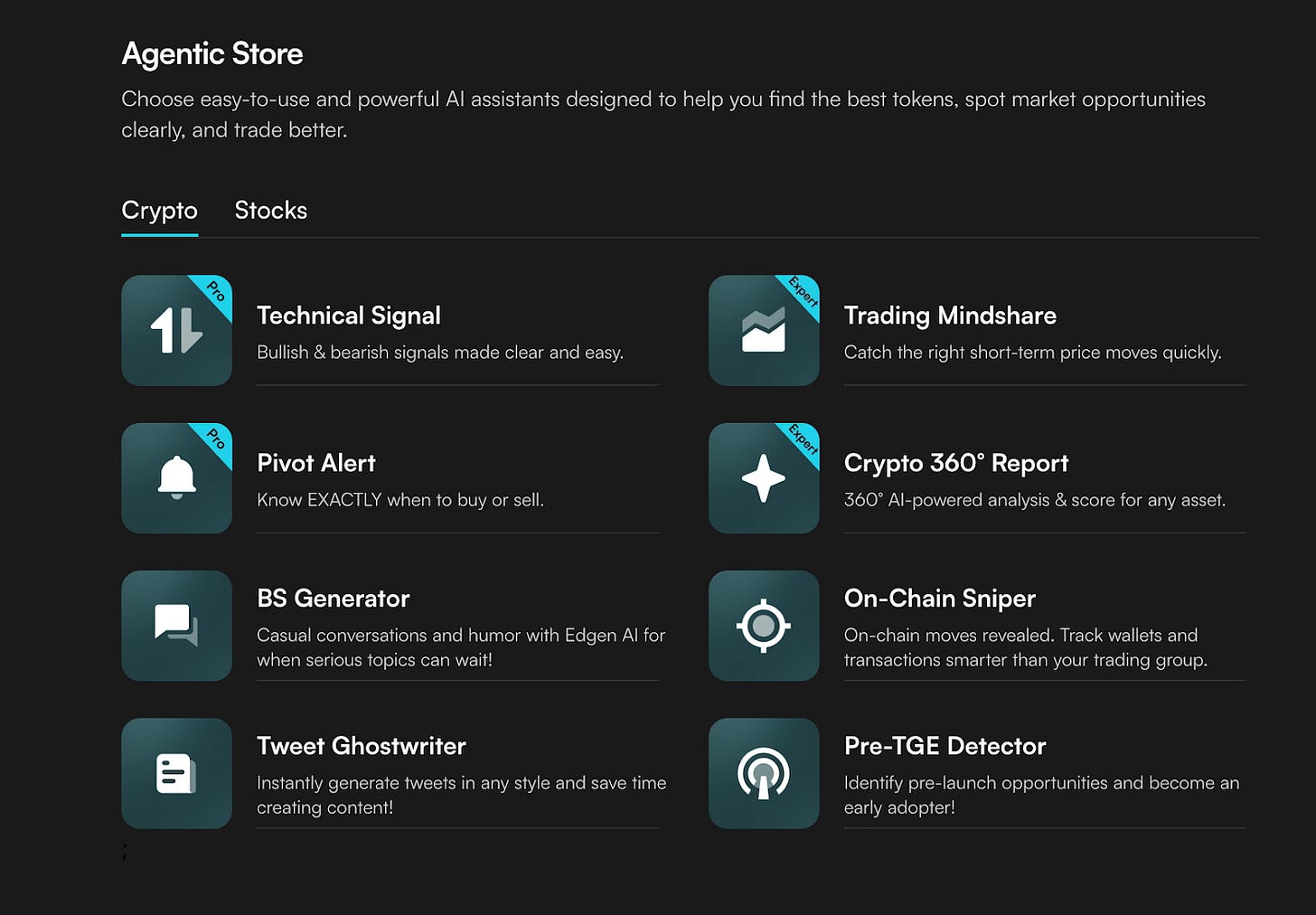

Edgen provides the Agentic Store for investors who require more specialized analysis. The store offers a collection of AI assistants specialized in specific investment perspectives. Investors directly select and deploy agents that match their investment style and objectives.

For example, the Technical Signal agent automatically calculates indicators like RSI, MACD, and moving averages, then presents “bullish” or “bearish” judgments with comprehensive 3-star ratings. The Pivot Alert agent detects when assets approach local highs or lows, helping investors fine-tune trading timing at critical inflection points. Additional agents provide various capabilities including on-chain activity analysis and pre-TGE opportunity discovery. Investors select and deploy only the agents they need for their specific objectives.

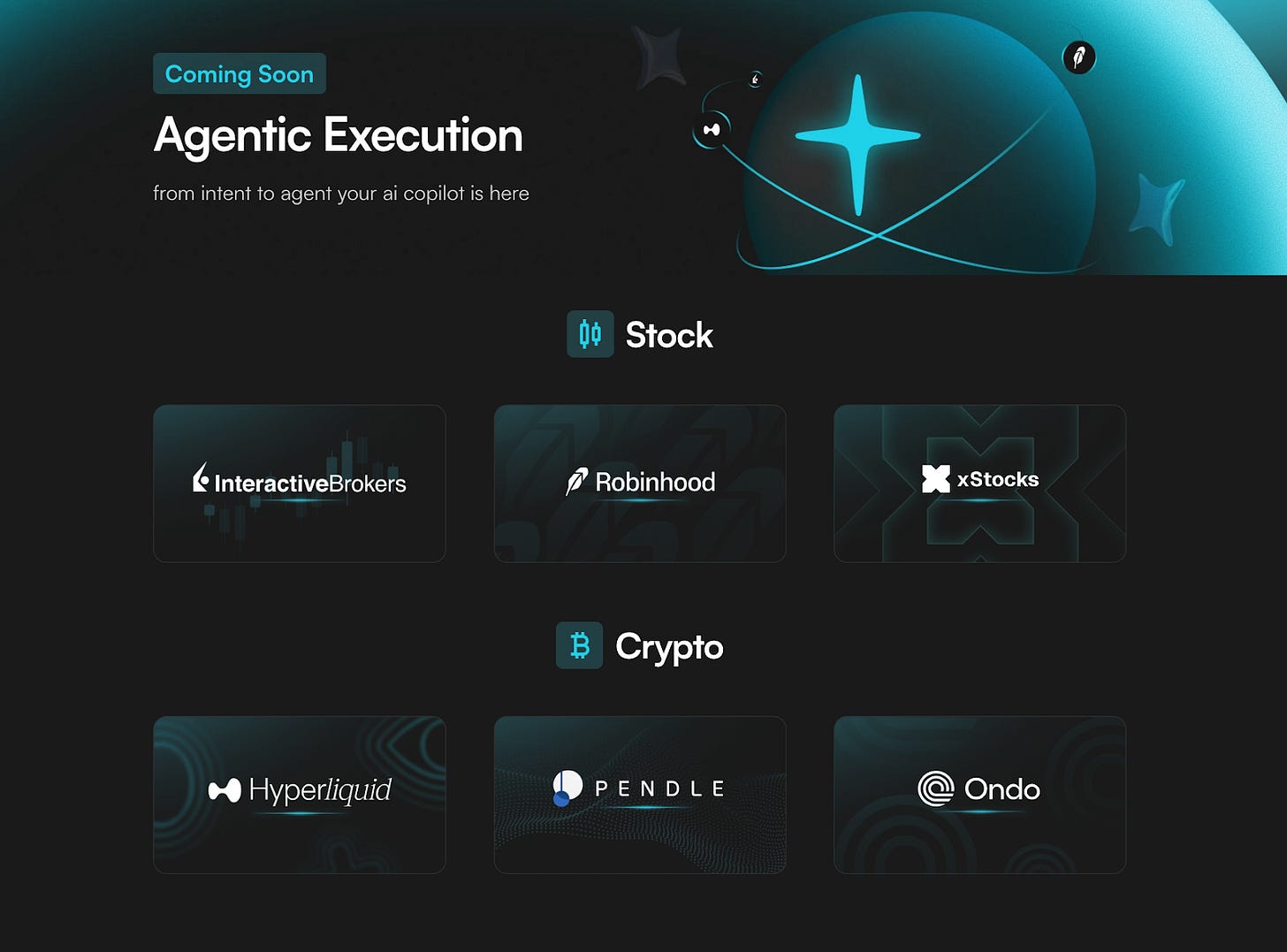

Beyond this, Edgen will soon provide Agentic Execution, which automatically executes investor requests as trades. For stocks, the platform connects with platforms like Robinhood and XStocks. For cryptocurrencies, it integrates with protocols like Hyperliquid and Pendle. The AI copilot understands investor intent and executes trades directly. Through this capability, Edgen advances beyond an intelligence platform toward a comprehensive investment operations platform.

4. Open Intelligence: Evolution Through Participation

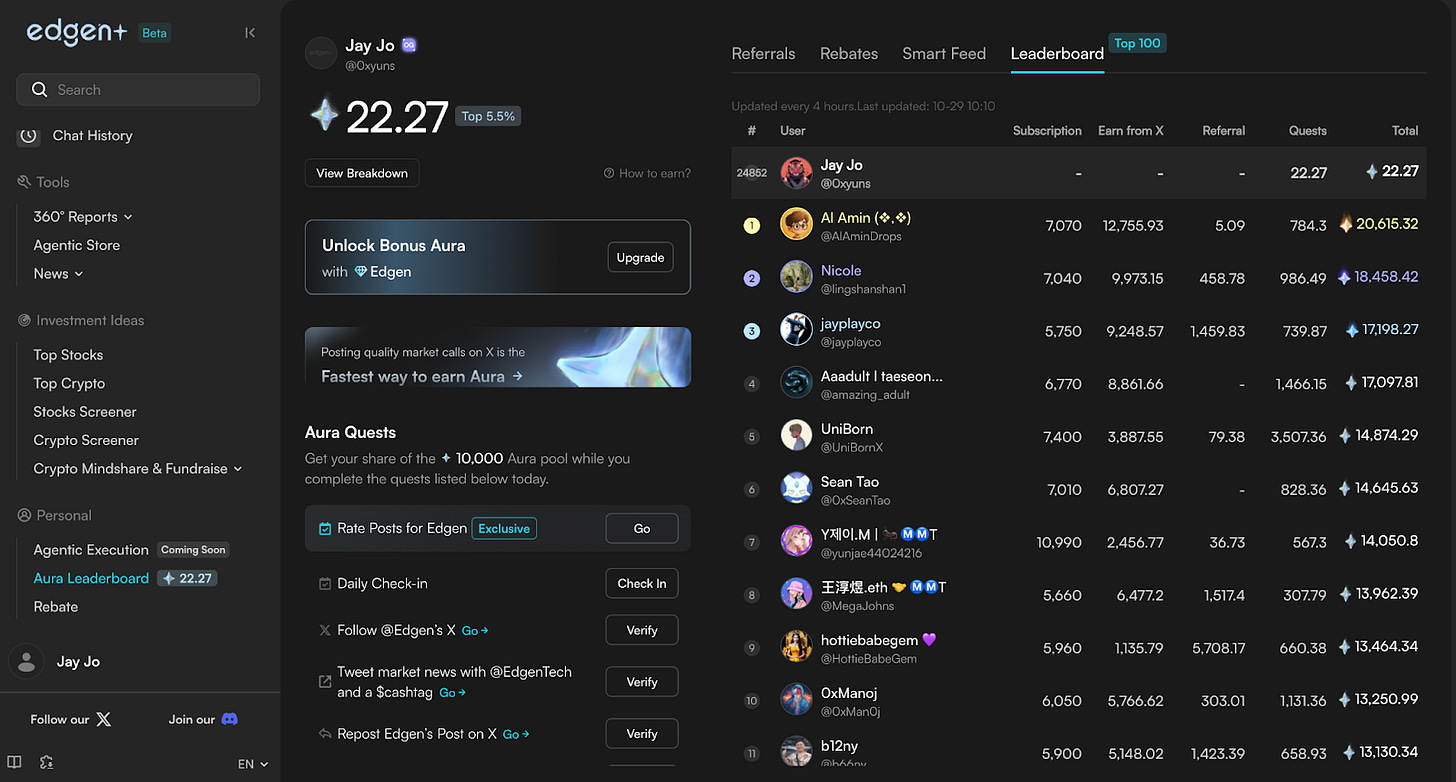

Edgen moves beyond providing information to build an open intelligence ecosystem where users directly participate and contribute. The Aura system anchors this ecosystem. Aura serves as a non-transferable reputation metric that synthesizes user insight contributions, prediction accuracy, and social media influence into a comprehensive score.

Users earn Aura by posting market analysis or insights on the platform, or by sharing them on social media. The reward pool allocates 30% to distribution activities and 70% to AI training contributions. The platform evaluates all contributions through AI scoring, community assessment, and expert verification. Users check Aura scores through the in-platform leaderboard and on X (formerly Twitter) via a browser extension. The system categorizes scores into three tiers: Aura, Super Aura, and Ultra Aura. The platform transparently records who provided which analysis and when.

User-provided insights train the AI. User contributions improve the AI, and the improved AI delivers better analysis back to users, creating a virtuous cycle. Through this participatory structure, Edgen develops as a platform that learns and advances alongside its community.

5. From Wall Street to All Street

Bloomberg Terminal and private banking services have long served only institutional investors and ultra-high-net-worth individuals. These entities maintain overwhelming competitive advantages in markets through exclusive information access and analytical tools. Retail investors, meanwhile, must make investment decisions with incomplete information amid fragmented data and limited tools.

Markets grow increasingly complex and widen this gap further. Variables investors must consider multiply exponentially: on-chain data analysis, social media signal tracking, global market trend identification. Individual investors find uncovering meaningful insights and making timely investment decisions within this vast information flood nearly impossible.

Edgen solves this information gap. The platform automates complex analytical tasks through multi-agent systems and integrates stocks and cryptocurrencies within a single interface. Investors now access institutional-grade analytical tools effortlessly, without collecting and cross-referencing information across multiple platforms.

Edgen advances further toward personalized financial intelligence. The platform provides optimized analysis and strategies tailored to each investor’s style, risk appetite, and objectives. This approach goes beyond simply delivering institutional tools to retail investors. Edgen essentially provides each individual with a customized private banker.

Retail investment democratizes rapidly. Edgen transforms “Wall Street privilege” into “opportunity for all” through AI technology. Financial intelligence once reserved for the few now reaches all investors. The investment landscape will shift fundamentally.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report was partially funded by Edgen. It was independently produced by our researchers using credible sources. The findings, recommendations, and opinions are based on information available at publication time and may change without notice. We disclaim liability for any losses from using this report or its contents and do not warrant its accuracy or completeness. The information may differ from others’ views. This report is for informational purposes only and is not legal, business, investment, or tax advice. References to securities or digital assets are for illustration only, not investment advice or offers. This material is not intended for investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo following brand guideline. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.