Base token launch is nearly certain. Yet most investors overlook Definitive—a Coinbase-backed platform with 50+ institutional customers. As institutional capital enters DeFi, Definitive built the infrastructure that makes it possible.

Key Takeaways

Definitive is an institutional-grade DeFi trading platform developed by a team from Coinbase Prime.

It is already used by more than 50 institutions, offering advanced trading features that have helped hedge funds like Starkiller Capital

Having received direct investment and being listed from Coinbase, the project is expected to benefit from the expansion of the Base ecosystem.

1. The Hidden Player in the Base Ecosystem

The current market focus is on the Base ecosystem.

As discussed in previous reports, Coinbase is moving beyond its regulated exchange business through a series of strategic acquisitions, positioning itself to lead the broader Web3 landscape. With the launch of the Base app, large-scale user onboarding has begun, and efforts to strengthen the internal ecosystem are accelerating.

Adding momentum to this trend is the anticipation of a Base token launch. Although no official announcement has been made, the market largely views it as confirmed and is actively exploring related opportunities.

Projects such as Zora have already gained attention within this context. Yet one project remains relatively under the radar — Definitive Finance. Founded by the team that built Coinbase Prime, Definitive has received direct investment from Coinbase Ventures and was listed on Coinbase on the first day of its TGE.

As the Base era unfolds, the question remains: why is Definitive still not yet widely known?

2. Why Institutions Chose It First

From the outset, Definitive was designed for institutional users.

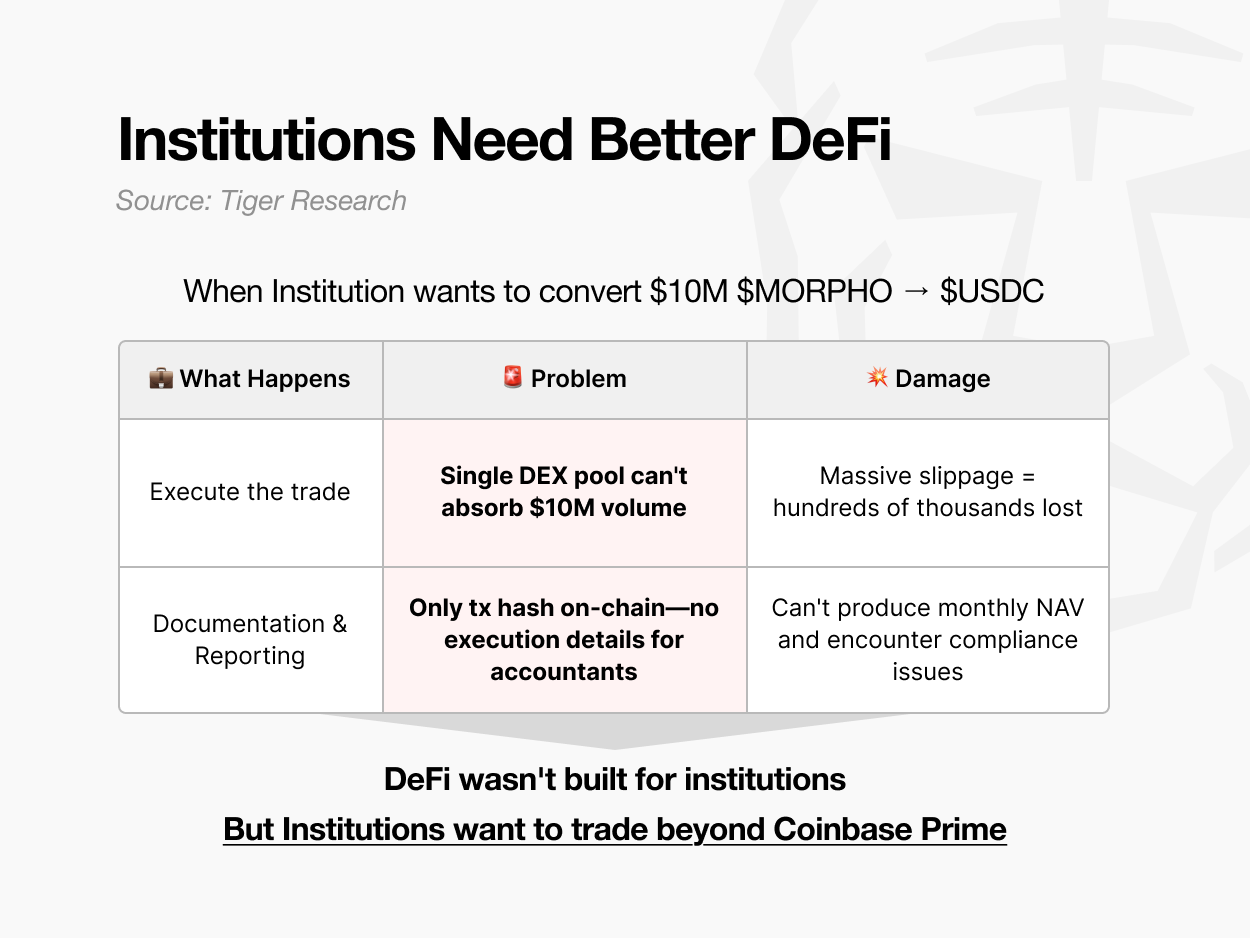

Consider a hedge fund aiming to convert $10 million worth of $MORPHO into USDC. Executing this transaction on a single DEX would cause severe price slippage, as the liquidity pool cannot absorb such volume. The result is a direct loss for the fund.

Institutional traders also face audit and compliance requirements. Each month, hedge funds must provide external accountants with detailed records showing when, at what price, and how every trade was executed. Conventional DeFi platforms leave only a transaction hash on-chain, offering no formal trade reports suitable for fund accounting use.

In short, institutions require advanced trading features tailored to their operational needs, but most DeFi services were built for retail users. Definitive targets this gap. With a team originating from Coinbase Prime, which serves institutional clients, Definitive understood precisely what institutions needed—and built accordingly.

2.1. Six Features That Enable Institutional-Grade Trading

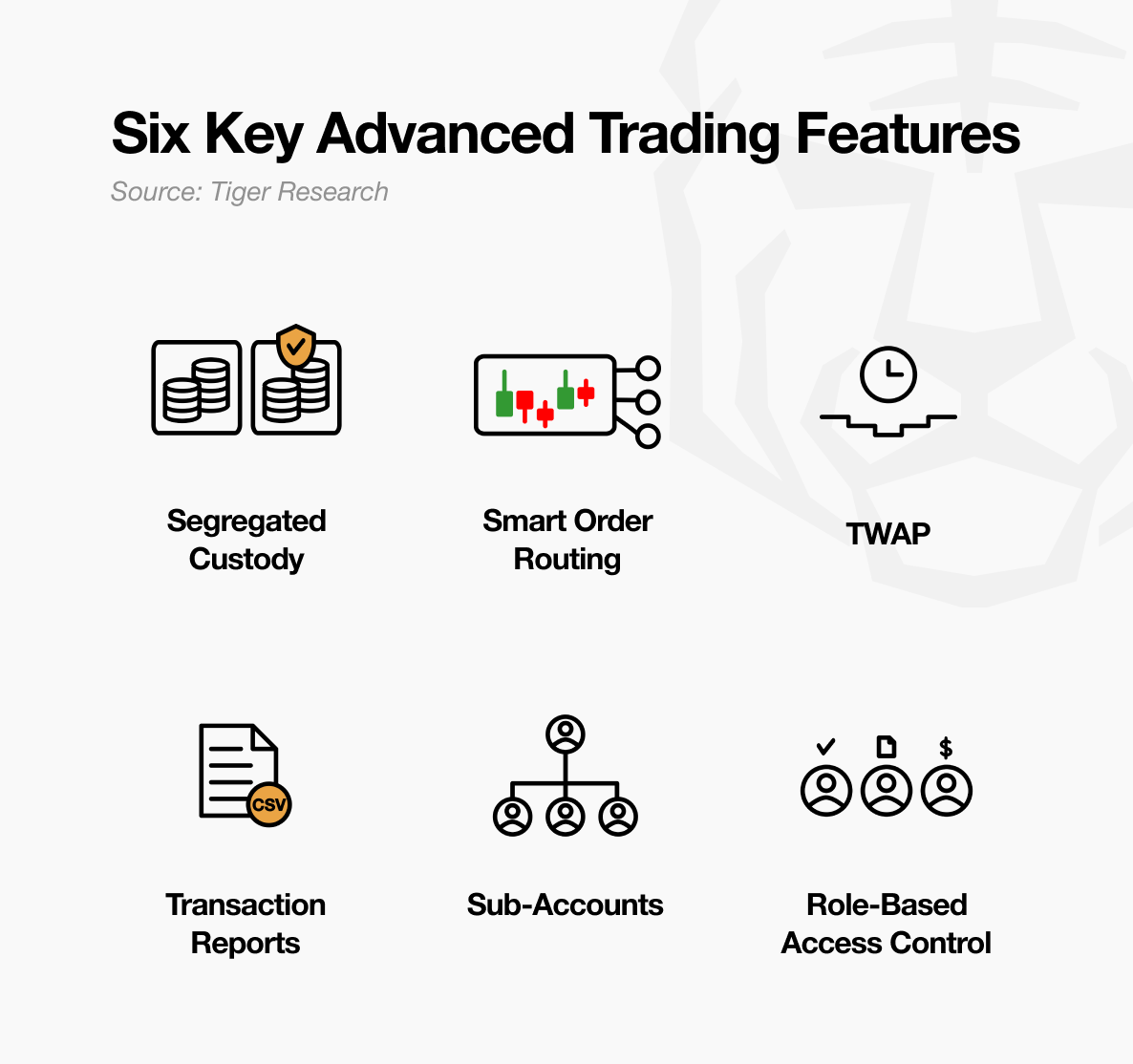

Segregated Custody: Each client holds assets in an independent trading account with full ownership rights. Even if another client is compromised, their assets remain unaffected.

Smart Order Routing: Aggregates and analyzes liquidity on over 100 DEXs across all major EVM chains and Solana in real time and automatically executes trades through the most efficient routes.

TWAP (Time-Weighted Average Price): Large transactions are split and executed over time to minimize price impact. For example, dividing a $100 million swap across 30 days prevents sudden price swings.

Transaction Reports: All trades are automatically recorded and can be exported as CSV files, ready for external audits and accountants.

Sub-Accounts: Assets are separated by trader, allowing independent portfolio and risk management within the same institution.

Role-Based Access Control: Different permissions are assigned by function—traders execute orders, portfolio managers (PMs) approve them, and risk managers monitor positions—ensuring operational security and internal control.

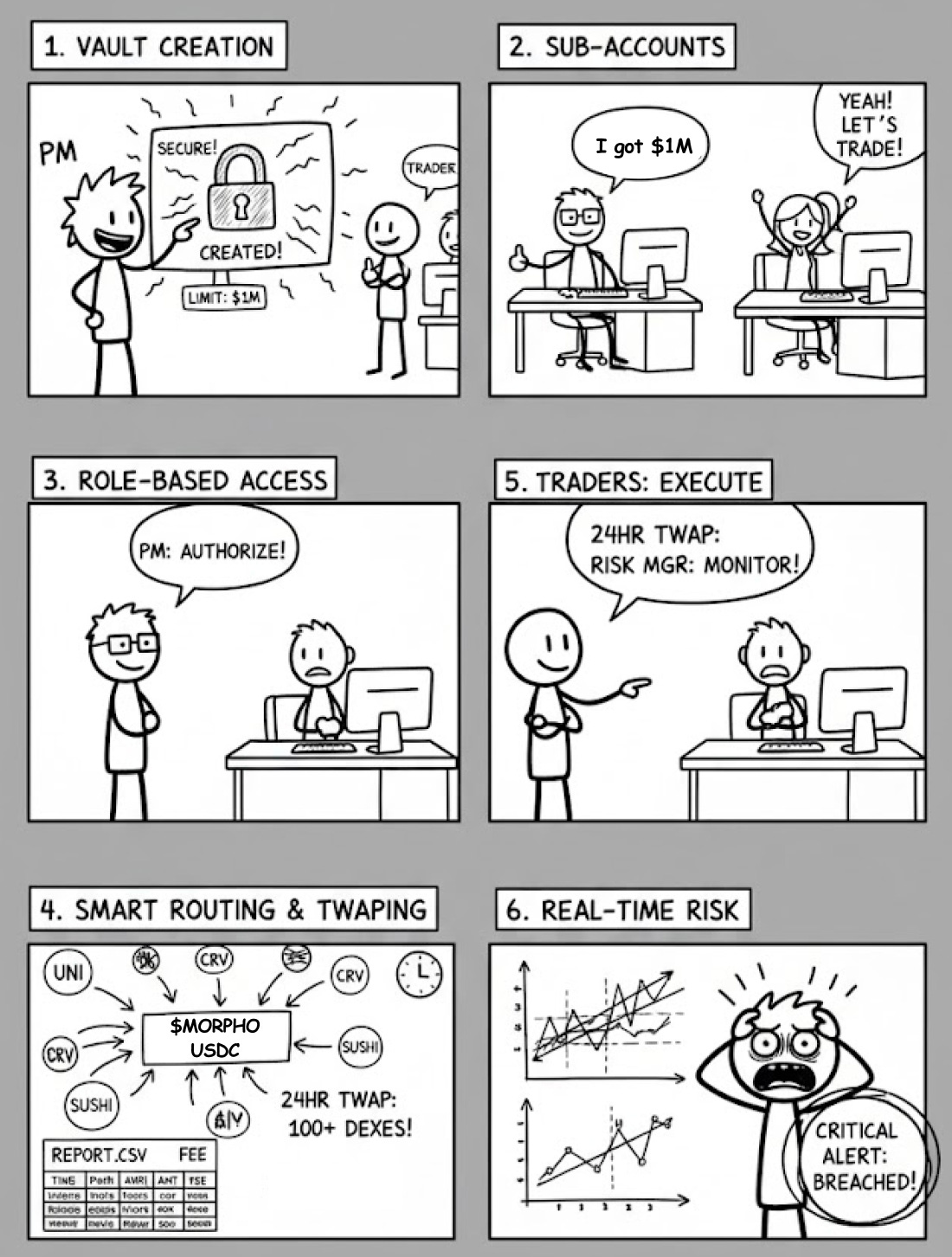

To illustrate how these features work in practice, consider Tiger Crypto Fund, which plans to convert $2 million in $MORPHO to USDC. The fund has two traders, one risk manager, and one Portfolio Manager.

Vault creation and segregation: A dedicated trading vault is created, controlled only by the fund’s wallet.

Sub-account setup: Each trader receives a separate sub-account with predefined trading limits.

Role-based access: The Portfolio Manager authorizes trade ideas, traders execute orders, and the risk manager monitors exposures.

TWAP execution: Traders can automate trading over hundreds of smaller trades using TWAP orders to swap $2 million worth of $MORPHO into USDC over 24 hours to minimize price slippage.

Smart routing: The system dynamically compares more than 100 DEXs for each trade fill in real time (e.g., Uniswap, Curve) and executes through the most efficient path.

Automated reporting: After 24 hours, all trades are completed and logged with execution price, size, and fees. The report is exported as a CSV file for monthly accounting or annual audits.

Real-time risk monitoring: The risk manager tracks both traders’ positions and can alert the team when exposure approaches internal limits.

2.2. Starkiller Capital’s 21% Gain in AERO Token Execution

To see how these features work in practice, consider the case of Starkiller Capital, a crypto hedge fund.

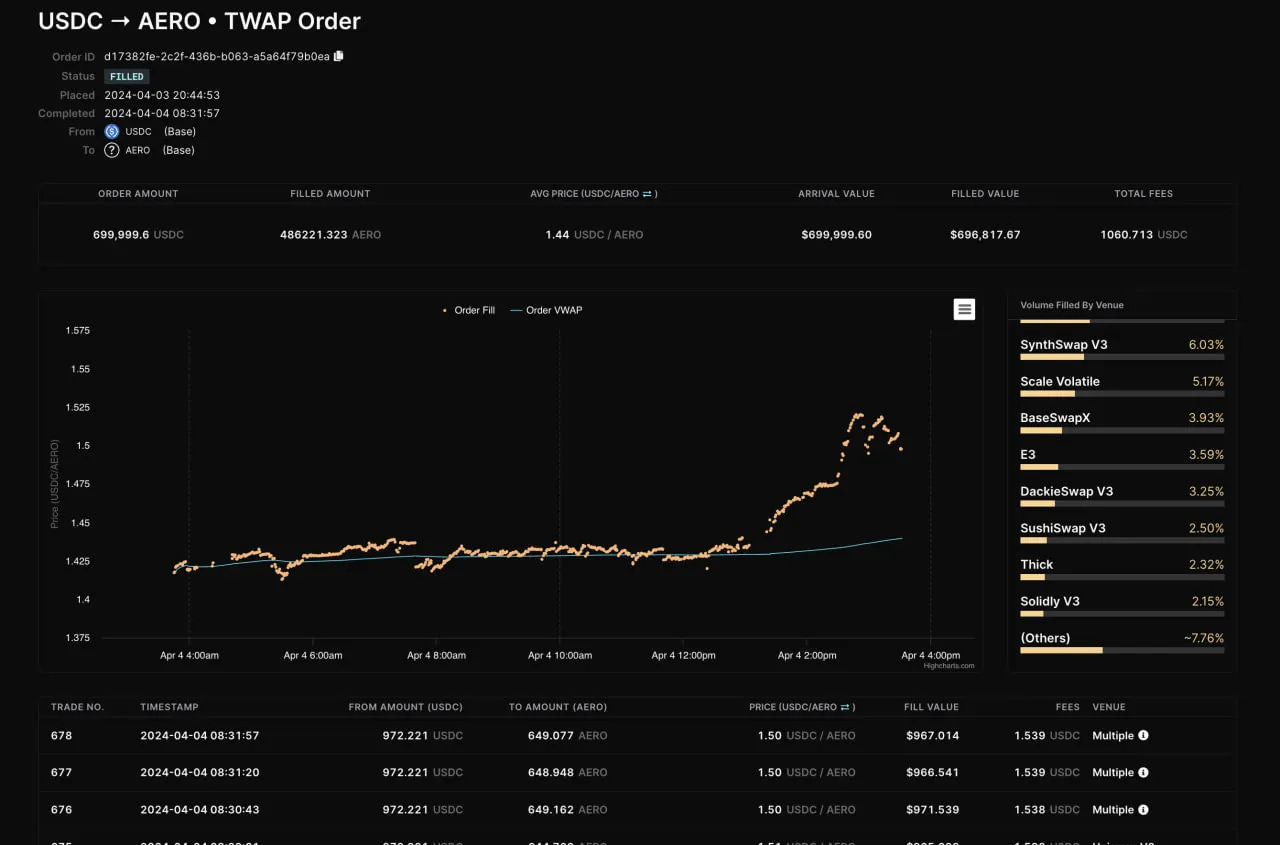

Starkiller planned to purchase $700,000 worth of AERO tokens. Although AERO was already listed on Coinbase and KuCoin, executing such a large order at once would have driven the price sharply higher, resulting in significant slippage losses. When Starkiller approached major OTC market makers, the quoted bid–ask spread was 26.19%—effectively paying $126 for every $100 of AERO purchased.

Instead, the fund used Definitive’s TWAP order function, splitting the $700,000 order into 678 smaller trades executed over time. Smart order routing compared prices across multiple DEXs—Uniswap V3, PancakeSwap V3, Aerodrome, and others—and automatically selected the most efficient route for each execution.

As a result, Starkiller secured 21.33% more AERO tokens than it would have through OTC execution, while paying just $10.71 in network fees. This effectively prevented what could have been a 20% loss in execution efficiency.

Leigh Drogan, CIO of Starkiller Capital, summarized:

2.3. Definitive in the Era of Institutional Capital Inflows

The current market expects institutional inflows to drive the next growth phase more than retail participation. In this environment, institutional-grade infrastructure like Definitive is essential.

Consider a bullish scenario where traditional financial institutions enter DeFi as regulatory clarity improves. These entities manage multi-billion-dollar portfolios, yet existing DeFi services cannot handle such transaction sizes securely or efficiently.

Definitive bridges this gap. It enables institutions to move large amounts of capital on-chain while maintaining security through segregated custody, minimizing market impact via TWAP execution, and meeting compliance standards with automated reporting tools.

As a result, more institutional funds can enter the DeFi market confidently. Positioned at the center of this capital flow, Definitive stands to benefit from exponential growth in trading volume and fee revenue, reinforcing its strategic value within the Base ecosystem.

3. Why Retail Users Are Also Satisfied

If institutions find the platform effective, retail investors benefit even more. Definitive has made most of its institutional-grade features available to individual users, offering a pro-trading experience that is both fast and cost-efficient.

Degen Mode: Allows dynamic slippage up to 20% during network congestion to prevent failed transactions and improve execution success for hyped tokens.

Quick Trade: Enables one-click buy/sell orders from a side panel using preset amounts—ideal for fast-moving markets.

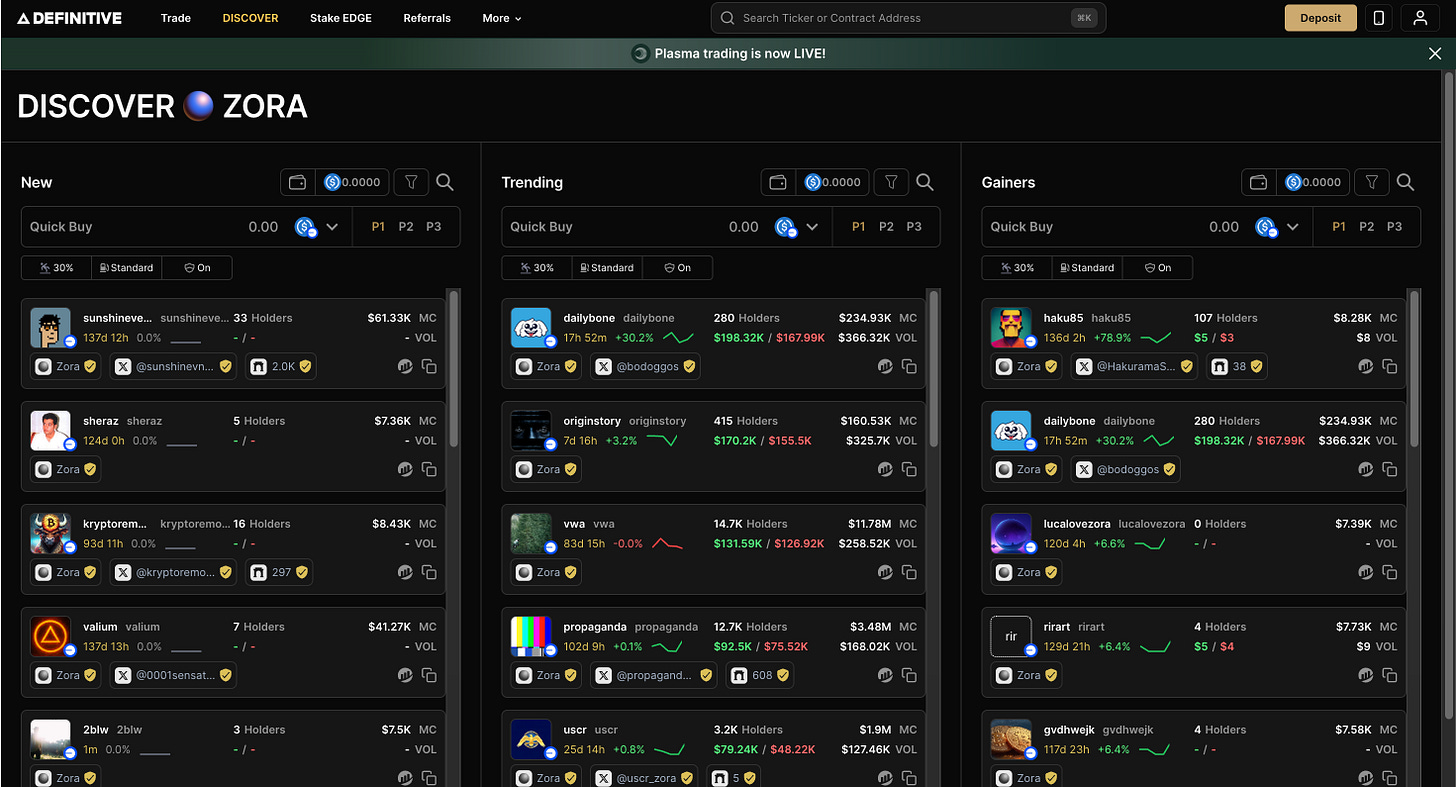

Discovery: Displays newly launched tokens on platforms like Zora in real time, filterable by trend or performance for immediate trading.

Bridging: Compares cross-chain routes via multiple bridge providers, including debridge, Bungee, Socket, LiFi, and Relay, and automatically selects the most efficient bridge, reducing time and cost.

Cross-Chain Swap: Swaps any token to any token across different blockchains without separate bridging steps, completing the transaction in one action.

Why are these features important?

Consider a practical scenario. A new creator token launches on Zora, quickly gaining traction on X as prices start to surge.

What happens if a user trades through a typical DEX?

They first need to bridge assets to Zora, a process that can take several minutes—long enough for the price to rise significantly. When they finally attempt the trade, network congestion and tight slippage settings may cause the transaction to fail. Each retry takes additional time, leading to missed opportunities and potential losses.

What if the user trades through Definitive instead?

The token appears immediately in Discovery, allowing the user to locate it without delay. If their assets are on another chain, they can execute a cross-chain swap directly—no separate bridging required. Degen Mode ensures successful execution even under network congestion, while Quick Trade completes the purchase with a single click. Using any of these options, the entire process finishes within seconds, not minutes.

A more important factor is low trading fees. While fees matter to institutions trading at scale, they are also important for retail investors managing smaller amounts.

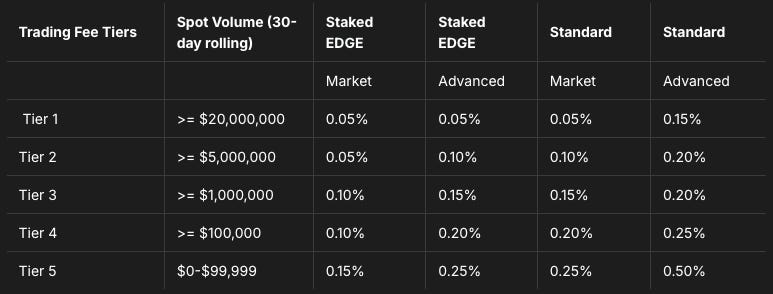

Definitive charges 0.05–0.25% market order fees based on volume and token type. In contrast, standard DEX platforms charge 0.25–0.30%, making Definitive already competitive.

Users lower fees by staking $EDGE tokens. Staking 2,000 $EDGE with $100,000 monthly volume drops the fee to 0.15%—a 40% reduction from the base rate.

The team has already implied that stablecoin pairs like USDC/USDT will trade for free, and plans to offer major assets such as BTC, ETH, and SOL at just 0.05%. This tiered approach strategically targets the highest-volume pairs where fee sensitivity matters most.

Lower costs compound over time. For active traders, the fee savings translate directly into higher net returns.

4. Core Infrastructure for the Base Era

Definitive first proved itself in the institutional market.

Since its beta launch in March 2024, more than 50 institutions have joined the platform, including hedge funds such as Starkiller Capital and Skycatcher, major OTC desks like Blockfills, and top-tier VCs such as the Base Ecosystem Fund. Cumulative trading volume has already reached several billion dollars.

Having gained credibility among institutions, Definitive is now expanding to retail users. It has introduced retail-oriented features such as Quick Trade, Discovery, and Cross-Chain Swap, and launched mobile apps for iOS and Android. A new trading product, Turbo, is also set to be released soon.

The Base ecosystem is entering a pivotal stage. Coinbase has begun large-scale user onboarding through the Base app, and market anticipation for a Base token launch continues to rise.

Definitive sits at the center of this momentum. Founded by the developers behind Coinbase Prime, backed by direct investment from Coinbase Ventures, and listed on Coinbase on the first day of its TGE, Definitive is establishing itself as core infrastructure for the Base ecosystem and beyond.

As institutional capital flows into DeFi, Definitive stands out as one of the most strategically positioned projects. When the Base token launches and the ecosystem expands, Definitive is likely to remain at the center of that growth.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report was partially funded by Definitive Finance. It was independently produced by our researchers using credible sources. The findings, recommendations, and opinions are based on information available at publication time and may change without notice. We disclaim liability for any losses from using this report or its contents and do not warrant its accuracy or completeness. The information may differ from others’ views. This report is for informational purposes only and is not legal, business, investment, or tax advice. References to securities or digital assets are for illustration only, not investment advice or offers. This material is not intended for investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo following brand guideline. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.