This report was written by Tiger Research, analyzing founder dependency risks in Web3 projects and exploring sustainable governance models for long-term ecosystem resilience.

TL;DR

Web3 projects depend heavily on founder trust rather than unproven technology and products. This influence directly impacts token prices.

Founders drive initial momentum but create single points of failure. Sudden exits or offhand comments can destabilize entire projects.

Some projects like Solana are moving away from founder-centric models. They distribute power but lack complete frameworks. The industry must watch these changes.

1. The Importance of Founders

Founders are more than company establishers. They represent the project's face and drive investor trust. This phenomenon spans from startups to global tech giants. A single founder now shapes entire corporate valuations.

Elon Musk at Tesla provides the clearest example. His single tweet moves stock prices. Tesla lost $150 billion in market cap after his clash with Donald Trump. One apology from Musk quickly restored the price.

This trend hits harder in Web3. The sector talks about 'decentralization' but operates differently. Most projects rely on founder networks, vision, and leadership. Markets care more about 'who leads' than technology or systems. Projects collapse when founders exit. Communities and investors bear the consequences.

This structure cannot last. Founders drive initial design and execution but must distribute power over time. Systems need autonomous operation. This report examines founder impact on projects. We explore how to break dependency structures. We also study what sustainable models Web3 should adopt.

2. Founder Influence in Web3 Markets

Web3 project founders have far greater influence than traditional company founders. The reason is clear. These technologies and products haven't proven themselves in the market yet. Think about angel investment stages. Investors see companies with no revenue and incomplete products. What drives their investment decisions? Founder vision and track record.

Web3 projects show unique patterns here. Many projects rush through VC rounds to token launches (TGE). Tokens go public without clear technology or product validation. Retail investors pile in. By traditional standards, these projects should remain at angel stage. Yet countless people show interest and actively trade their tokens.

This structural issue maximizes founder dependency. Investors must focus on 'who builds' rather than unproven technology. Single founder statements directly drive token prices.

2.1. Founders as Project Anchors

Real examples show how much influence Web3 project founders have. Ethereum's Vitalik Buterin wrote the whitepaper and led technical design. He continues driving core technical changes like 'The Merge', 'Sharding', and 'Dencun'. He provides consistent technical vision.

Jupiter's founder Meow built trust through active community engagement. AI16Z's founder Shaw attracted public attention with strong development skills. Each used different approaches but drove early project growth.

This pattern appears across Web3. Founders handle technology, strategy, and communication. They provide momentum and stability during uncertain early stages.

2.2. Founders as Single Points of Failure

Web3 project founders often drive initial momentum. However, too much reliance on one person creates vulnerabilities. Heavy dependence on individuals increases single point of failure risks.

SushiSwap demonstrates these structural limits. Founder Chef Nomi suddenly left the project and withdrew treasury funds. The community panicked immediately. The project looked decentralized but operational control stayed with the founder. Quick responses became impossible.

Leadership gaps and internal fights delayed product development. The community split apart. Restoring stability and trust took over two years. Most early projects cannot survive such periods.

Jupiter shows similar issues. Founder Meow served as the project's face and main spokesperson. One bad tweet about memecoins sparked community backlash. This triggered a trust crisis and token price drop.

Meow apologized publicly to fix the situation. This incident showed how founder actions affect entire projects. It exposed structural risks when founders control technology, communication, and decisions.

Recent Web3 projects see more founder exits. Key figures like Aptos's Mo Shaikh and Polygon co-founders left their projects. Token values fell and communities grew anxious. People don't see these as simple staff changes. Many projects still lack clear market fit. Founder departures feel like losing key growth drivers.

This leaves investors with only one pillar from their three key factors — product, founder, and vision. Only vision remains. This hurts project credibility.

3. What Structure Should Web3 Projects Build?

What structure should Web3 projects target? As we've seen, founders provide strong momentum early but can become single points of failure. One statement moves markets. Unexpected departures trigger immediate crises. Heavy dependence on individuals cannot sustain long-term growth.

The key lies in gradually moving away from founder-centric structures as projects grow. Authority and responsibility must spread across the ecosystem. Concentrated leadership boosts execution early. However, communities should become operational centers over time. Balancing short-term efficiency with long-term autonomy represents a core challenge for Web3 projects.

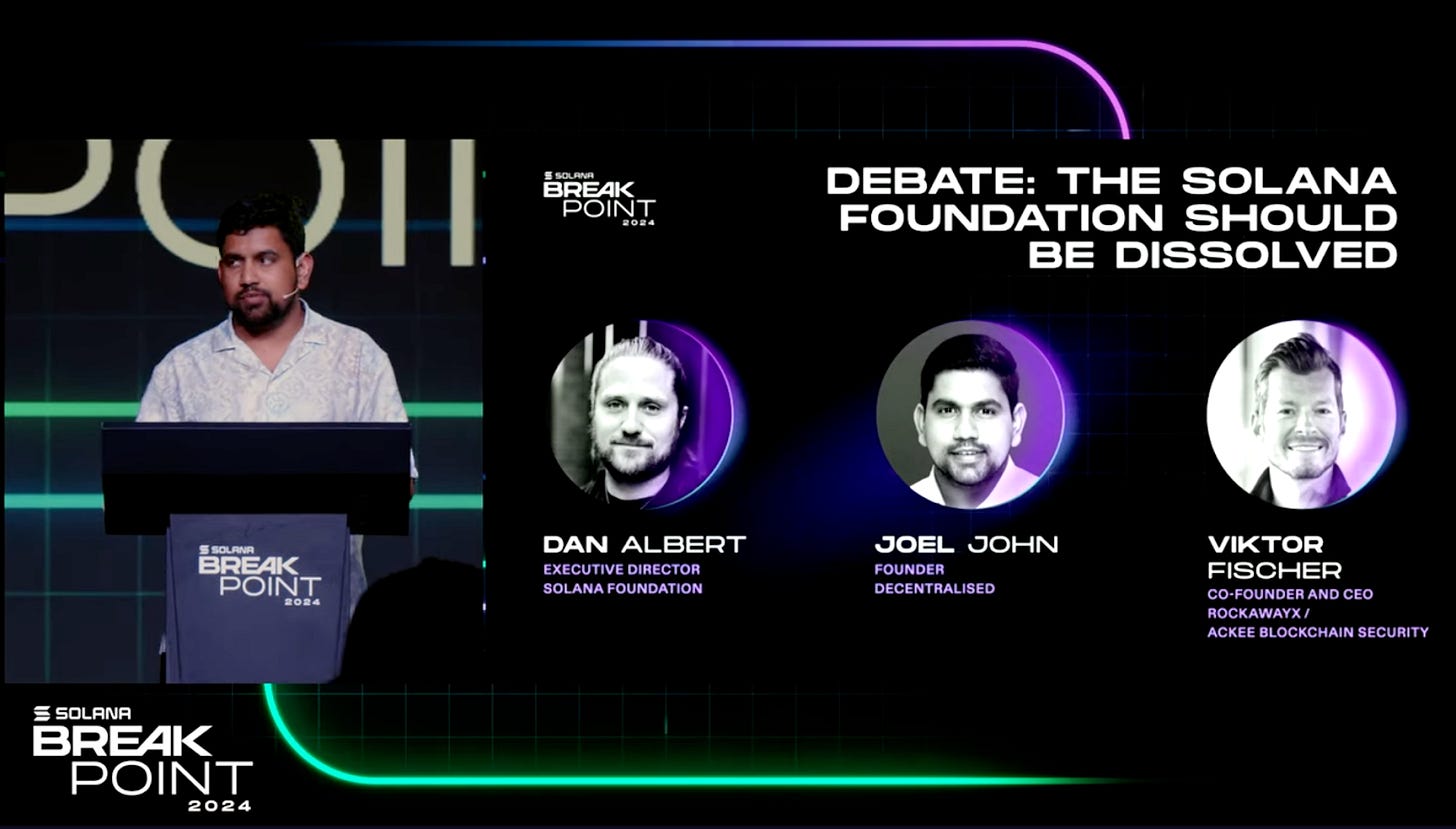

Solana experiments with this direction. The Solana ecosystem now consists of multiple independent organizations including Solana Foundation, Solana Labs, and Superteam. Each entity shares responsibilities for network expansion and operations. At Solana Breakpoint 2024 in Singapore, the foundation publicly discussed potential dissolution. The foundation stated their role should shrink over time. They showed clear intent to shift from single organization control to ecosystem-centered operating models.

These attempts face short-term challenges and lack complete models yet. However, they pursue gradual authority distribution through practical methods. The focus moves away from founder-controlled decisions. Various stakeholders now share responsibility for network maintenance and expansion.

Web3 needs fundamental redesign starting now. This evolution goes beyond technical decentralization. The industry must build ecosystems with autonomy and resilience in operations and governance.

4. Closing Thoughts

Web3 projects don't need complete decentralization like Bitcoin. Early stages require clear vision and fast execution. Founder leadership becomes a strong advantage here. However, this structure gradually turns risky over time. It can threaten long-term sustainability.

The realistic goal balances concentrated authority and autonomy, not full decentralization. Projects need structures that gradually reduce founder influence while keeping direction and execution. Communities must join this process and build autonomous operational skills. This represents the model Web3 should pursue.

Projects like Solana and Dogecoin experiment with these transitions differently. Founders step back from the spotlight. Foundations shrink their roles. Operations gradually shift toward community-centered models. These changes are ongoing processes, not final answers. No complete model exists yet.

Web3 must evolve beyond technology into operations and governance. We shouldn't imagine structures without founders. We should design systems that work without them. These structures determine ecosystem resilience. The structures we design now decide whether Web3 stays a temporary trend or becomes true paradigm shift.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.