In 2025, the U.S. government is pursuing a pro-crypto policy. The goal is simple. It is to operate the existing crypto industry in the same way as traditional finance. If so, what changes is the United States trying to make?

Key Takeaways

The U.S. is integrating crypto into its existing financial infrastructure, not absorbing the industry itself.

Over the past year, Congress, the SEC, and the CFTC have introduced and removed rules to bring crypto into this system.

Despite inter-agency tensions, the U.S. is refining regulation while supporting industry growth.

1. The United States Absorbing the Crypto Industry

After President Trump was re-elected, the administration rolled out aggressive pro-crypto policies. This marks a sharp reversal from the past, when the crypto industry was viewed mainly as a target of control. The U.S. has entered a phase that was once hard to imagine. At a pace close to unilateral decision-making, the government is moving to absorb the crypto industry into its system.

Shifts in the stance of the SEC and CFTC, along with traditional financial institutions entering crypto-related businesses, signal broad structural change.

Notably, only one year has passed since President Trump’s re-election. What regulatory and policy changes have taken place in the U.S. so far?

2. One Year of Change in the U.S. Stance on Crypto

U.S. crypto policy reached a major turning point in 2025 with the launch of the Trump administration. The executive branch, Congress, and regulators moved at the same time. Their focus was to reduce market uncertainty and integrate crypto into the existing financial infrastructure.

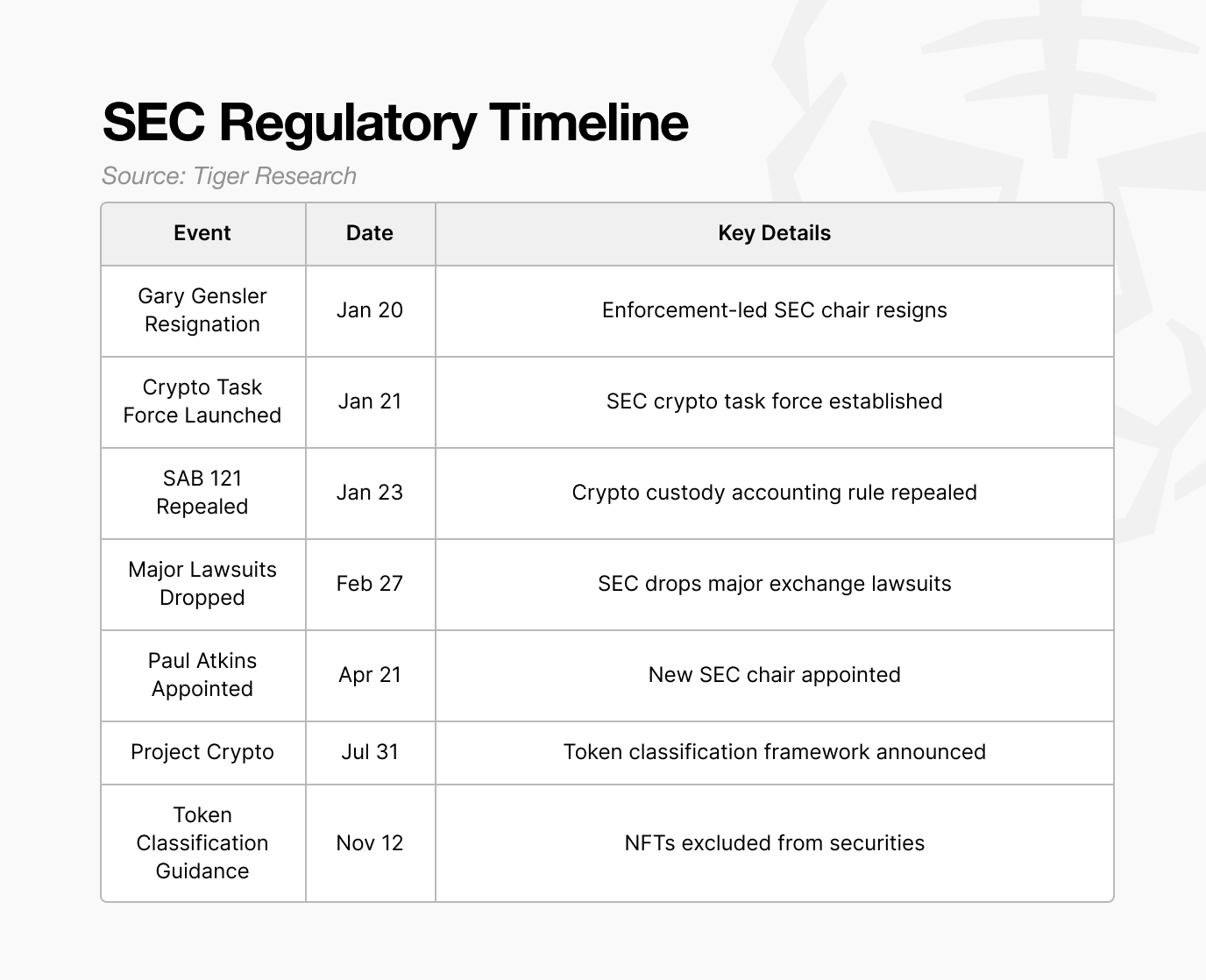

2.1. SEC

In the past, the SEC responded to crypto-related activity primarily through enforcement. In major cases involving Ripple, Coinbase, Binance, and Kraken’s staking services, the SEC moved forward with lawsuits without providing clear standards on the legal status of tokens or what activities were permitted. Enforcement was based on post hoc interpretation. As a result, crypto firms focused more on managing regulatory risk than on business growth.

This stance began to change after the resignation of Gary Gensler, who had taken a conservative view of the crypto industry. Under the leadership of Paul Atkins, the SEC shifted toward a more open approach. Rather than regulating through lawsuits, it began building baseline rules to incorporate the crypto industry into the regulatory framework.

A key example is the announcement of Project Crypto, through which the SEC stated its intention to define clear criteria for determining which tokens qualify as securities and which do not. A regulator that once lacked direction has begun to reposition itself as a more inclusive institution.

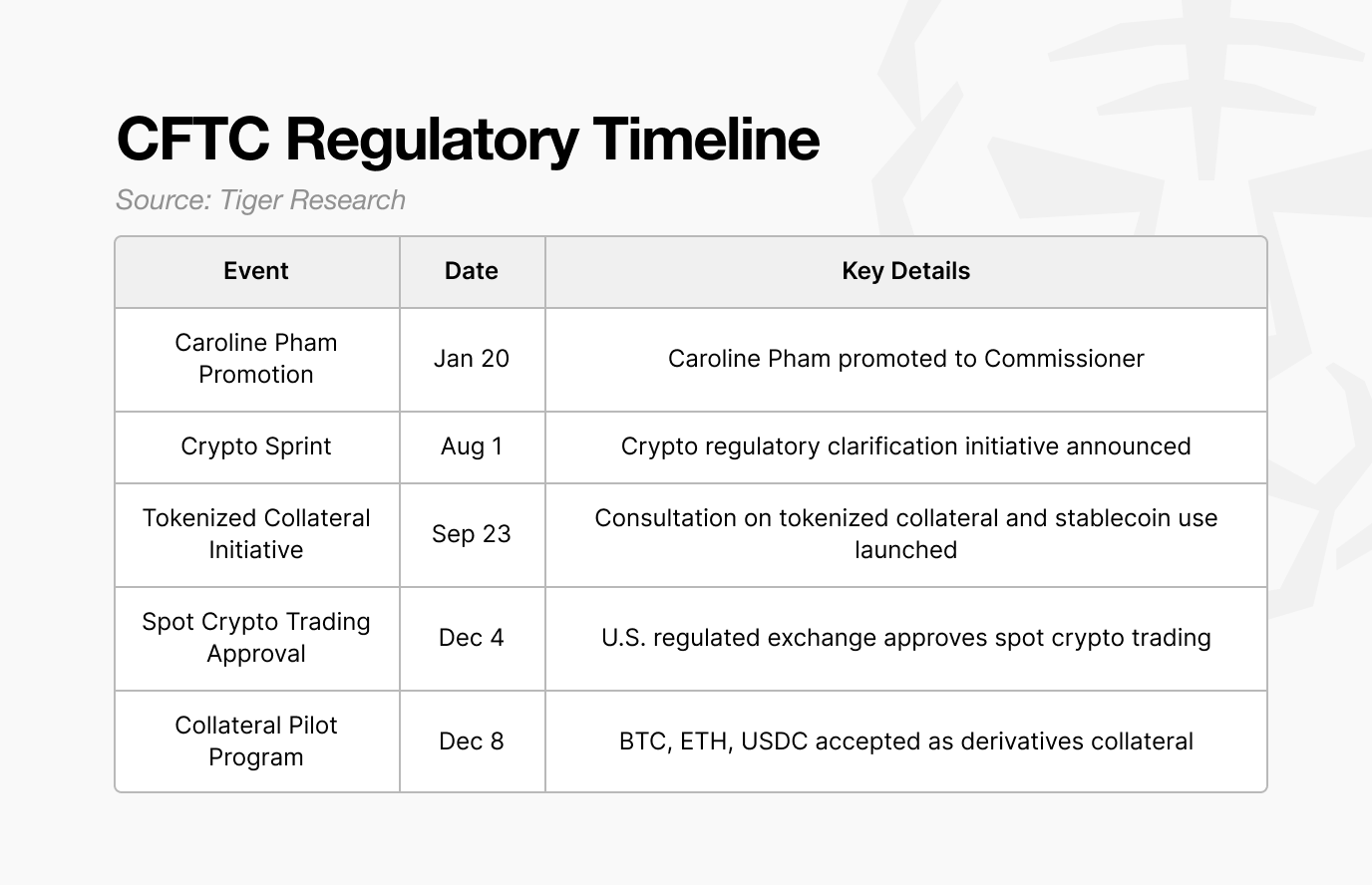

2.2. CFTC

In the past, the CFTC’s involvement with crypto was largely limited to overseeing derivatives markets. This year, however, it has taken a more proactive stance. The CFTC formally recognized Bitcoin and Ethereum as commodities and supported their use by traditional institutions.

A key example is the Digital Asset Collateral Pilot Program. Through this initiative, Bitcoin, Ethereum, and USDC were approved as collateral for derivatives trading. The CFTC applied haircuts and risk management standards, managing these assets in the same way as traditional collateral.

This shift shows that the CFTC no longer views crypto assets purely as speculative instruments. Instead, it now recognizes them as stable assets that can be used as collateral alongside traditional financial assets.

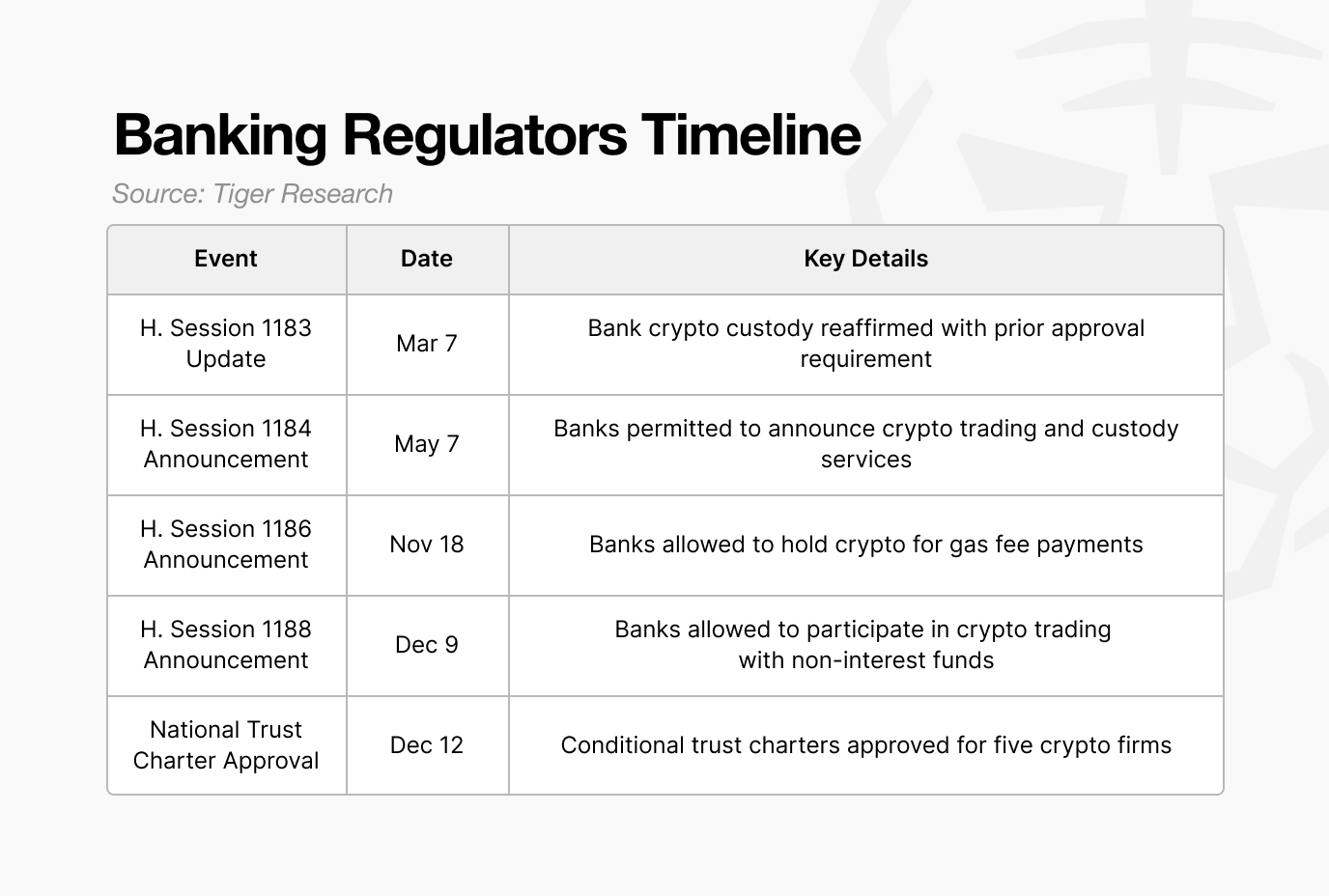

2.3. OCC

In the past, the OCC kept its distance from the crypto industry. Crypto firms had to obtain licenses on a state-by-state basis and faced difficulty entering the federal banking supervision framework. Business expansion was limited, and connections to the traditional financial system were structurally blocked. As a result, crypto firms were largely confined to operating outside the regulated system.

That approach has now shifted. Rather than keeping crypto firms outside the financial system, the OCC has chosen to bring them into the existing banking regulatory framework. It has issued a series of interpretive letters, which are formal documents clarifying whether specific financial activities are permitted.

Through these letters, the OCC gradually expanded the scope of allowed activities, including crypto custody, trading, and even the payment of gas fees by banks. This shift culminated in December, when the OCC conditionally approved national trust bank charters for major firms such as Circle and Ripple.

This approval is significant because it places crypto firms on equal footing with traditional financial institutions. With a single federal regulator, they can now operate nationwide. Transfers that previously required intermediary banks can now be processed directly, like those of conventional banks.

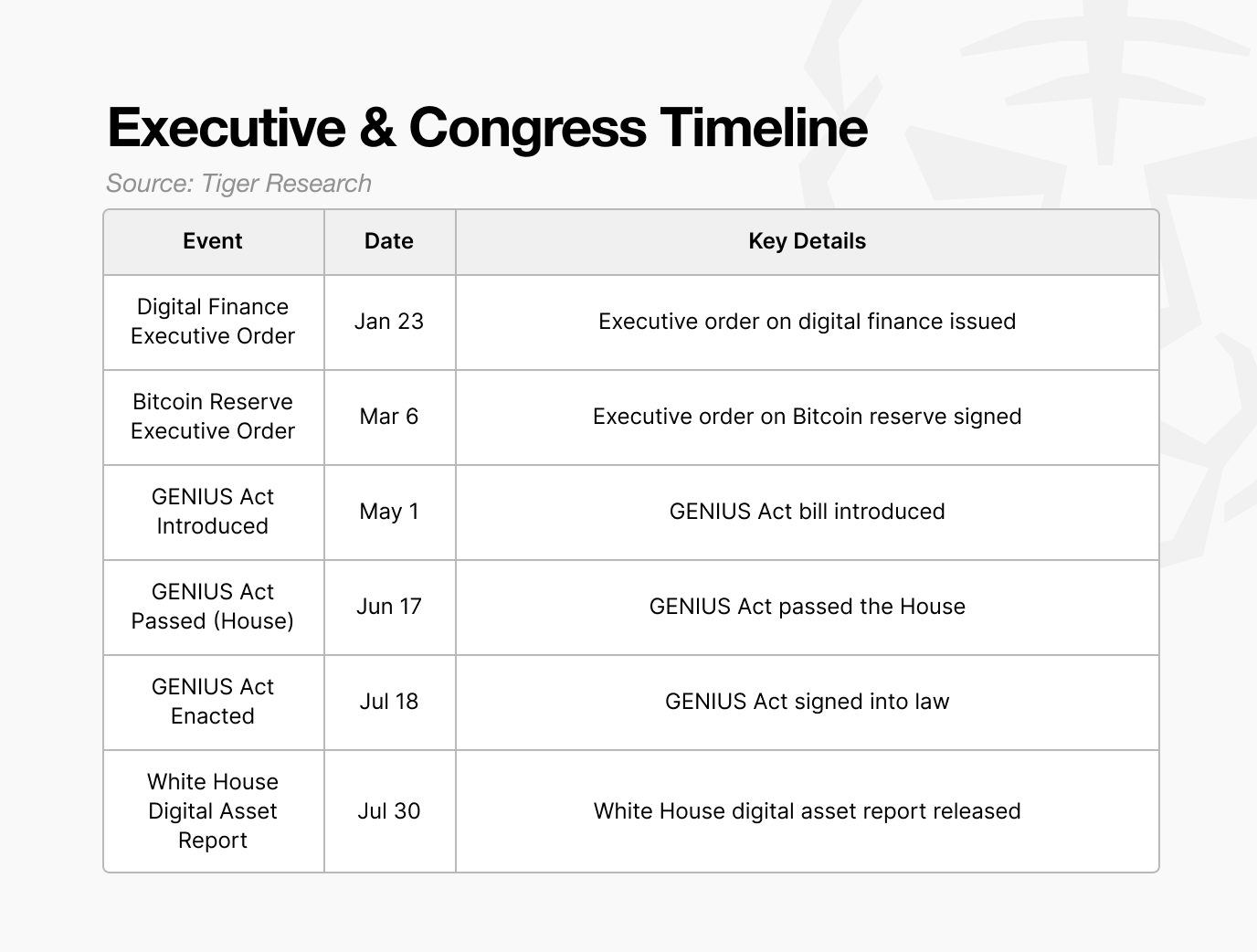

2.4. Legislation and Executive Orders

In the past, the U.S. began preparing stablecoin legislation in 2022. However, repeated delays created a regulatory gap in the market. There were no clear standards on reserve composition, supervisory authority, or issuance requirements. Investors had no reliable way to verify whether issuers actually held sufficient reserves, which led to concerns over reserve transparency at some issuers.

The GENIUS Act addressed these issues by clearly defining stablecoin issuance requirements and reserve standards. Issuers are required to hold reserves equal to 100 percent of the issued amount, and rehypothecation of reserve assets is prohibited. Supervisory authority was also unified under federal financial regulators.

As a result, stablecoins have become legally recognized digital dollars with guaranteed payment capacity.

3. One Direction, While Preserving Competition and Checks

Over the past year, the direction of U.S. crypto policy has been clear. The goal is to bring the crypto industry into the formal financial system. That said, the process has not been uniform or frictionless.

Differences in views still exist within the U.S. A representative example is the debate surrounding Tornado Cash, a privacy mixing service. The administration has enforced the law aggressively, citing the need to block illicit financial flows. In contrast, the SEC chair has publicly warned against approaches that excessively suppress privacy. This shows that perspectives on crypto are not fully aligned within the U.S. government.

These differences, however, do not signal policy instability. They are closer to a defining feature of the U.S. decision-making system. Institutions with different mandates interpret issues from their own perspectives, sometimes voicing disagreement in public while checking and persuading one another. The tension between strict enforcement and the protection of innovation may appear as short-term friction, but over time it has helped make regulatory standards more concrete and precise.

The key point is that this tension does not halt progress. Even amid debate, the U.S. pushes forward on multiple fronts at once: rulemaking by the SEC, infrastructure integration by the CFTC, institutional absorption by the OCC, and the codification of standards through congressional legislation. It does not wait for full consensus. Competition and coordination move in parallel, keeping the system advancing.

Ultimately, the U.S. has neither fully deregulated crypto nor sought to suppress it. Instead, it has redesigned regulation, leadership, and market infrastructure at the same time. By turning internal debate and tension into momentum, the U.S. has chosen a strategy to pull the center of the global crypto industry toward itself.

The past year is significant because this direction moved beyond declarations and was translated into concrete policies and execution.

🐯 More from Tiger Research

Read more reports related to this research.The Battle for On-Chain Finance: Who Will Design the New Order?

US SEC’s Policy Shift: From Strict Regulation to Collaborative Approach

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.