News that Strategy could be excluded from the MSCI index raised concerns across all DAT companies. It also highlighted how much influence an index, which may appear to be just a number, can exert in the market. This raises a natural question for crypto: does the digital asset market have an index with comparable relevance?

Key Takeaways

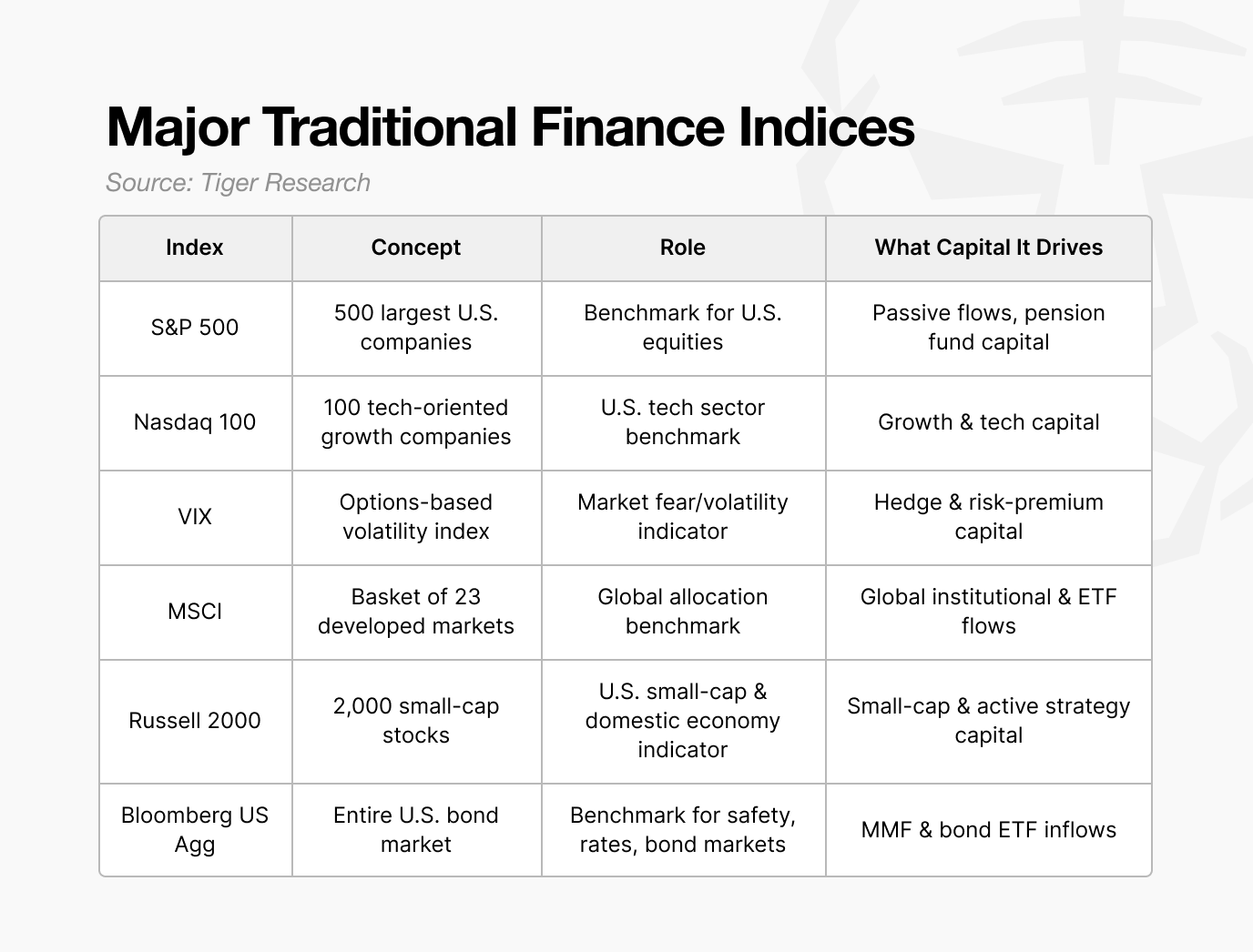

In traditional finance, indexes function as benchmarks and as the basis for derivatives, shaping major capital flows.

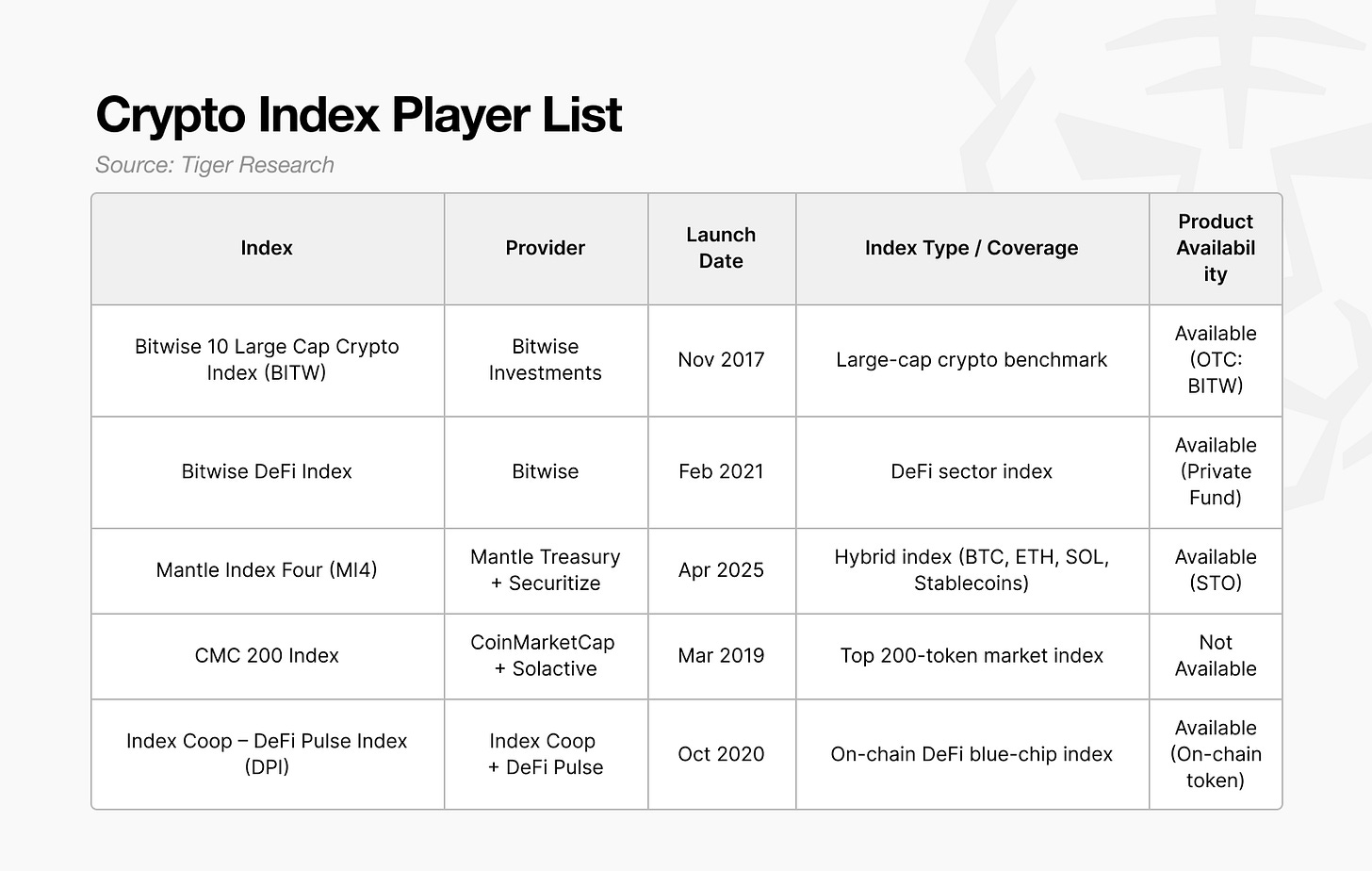

Several players in the crypto market, including Bitwise, CoinMarketCap, and Mantle, have developed their own index products.

Derivatives built on these indexes exist, but their adoption remains limited due to gaps in trust and distribution.

1. Why Crypto Indexes Matter Now

In traditional finance, indexes such as the S&P 500, MSCI, and Nasdaq 100 are not simple reference numbers. They serve as the base benchmarks for ETFs and other financial products, guiding how trillions of dollars in passive capital are allocated.

Their influence also extends to the crypto industry. In October, MSCI proposed excluding companies whose digital asset holdings exceed 50 percent of total assets from the MSCI Global Investable Market Index. JP Morgan added weight to this view, which amplified concerns around Bitcoin and DAT companies.

If Strategy were removed from the MSCI index, the impact would be significant. Funds tracking MSCI would be required to sell the stock, triggering potential large-scale outflows.

This episode shows that an index, despite appearing to be a simple number, can exert enough influence to shape price dynamics across the crypto market.

2. Indexes and Index Products in Traditional Finance

In financial markets, an index is a statistical measure that captures the movement of the overall market or a specific sector. Traditional finance has already established standardized benchmark indexes, which are widely used by institutional investors globally.

Investors adjust their allocations based on index movements and use them to interpret broader market conditions. An index is not merely a number; it functions as a benchmark that guides how the market is understood during the investment process.

When the S&P 500 rises, it signals strength in U.S. large caps. When it declines, investors often read it as a shift toward risk aversion. Sector trends such as technology are easier to read through the Nasdaq index than through individual stocks.

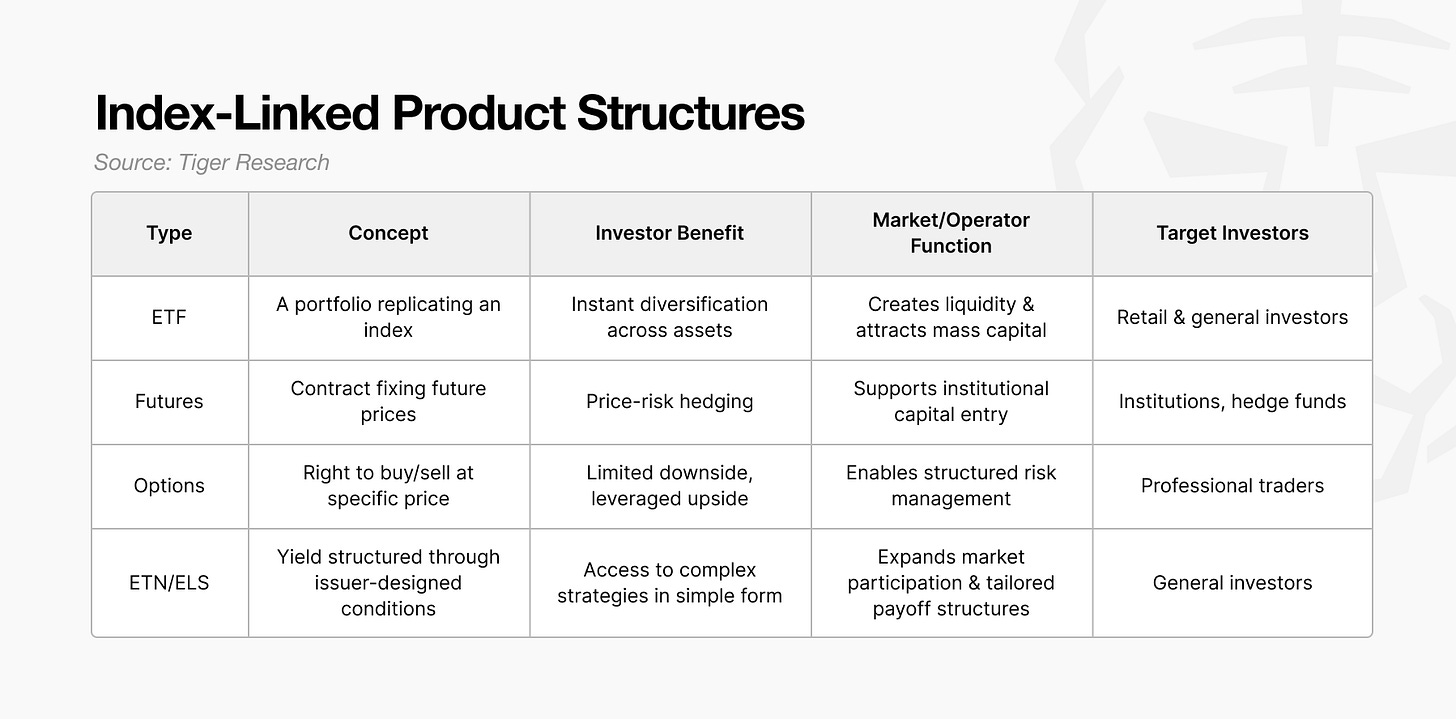

The fundamental shift came when indexes became investable products. Although indexes began as data, financial institutions built ETFs, futures, options, and other structured instruments around them. Once these products emerged, indexes turned into major benchmarks that drive substantial capital flows.

Index inclusion also has direct price effects, as it can trigger mandatory buying. Index inclusion also has direct price effects, as it can trigger mandatory buying. Tesla’s share price surged after its addition to the S&P 500. Global S&P 500 ETFs and passive funds were required to add Tesla to their portfolios, creating concentrated structural demand within a short period.

This price reaction had little to do with changes in Tesla’s fundamentals; it was the result of a single index decision that forced a significant inflow of capital.

3. Crypto Indexes as Emerging Market Benchmarks

Players in the crypto market are also working to develop index products with similar influence to traditional benchmarks. Although the market still focuses heavily on individual assets, broader index adoption could position these products as future market leaders, much like the roles MSCI and the S&P 500 play in traditional finance.

3.1. Bitwise 10 Large Cap Crypto Index (BITW)

BITW is a large-cap index composed of the ten largest crypto assets by market capitalization. Recent weights show Bitcoin at roughly 74 percent and Ethereum at about 15 percent, meaning the two assets account for nearly 90 percent of the index. Assets such as XRP, SOL, and ADA fill the remaining allocation according to their market-cap rankings.

The index is rebalanced monthly, adding assets that rise in market cap and removing those that decline. It primarily reflects the overall direction of large-cap crypto assets. BITW is the closest equivalent to a large-cap S&P 500 benchmark within the crypto market.

3.2. Bitwise DeFi Index

The Bitwise DeFi Index is an institutional benchmark that captures the broader DeFi market. Rather than mechanically holding the largest assets by market capitalization, the index breaks DeFi into core sectors and selects the representative assets within each category.

A notable feature is its focus on risk management. The index does not rely solely on quantitative metrics such as TVL. It screens out projects with security incidents or anonymous development teams, addressing potential risks before inclusion. Even verified projects undergo regular rebalancing, allowing the index to adapt to the fast-changing DeFi landscape.

This structure positions the index as one of the more accurate measures for tracking overall DeFi market trends.

3.3. Mantle Index Four (MI4)

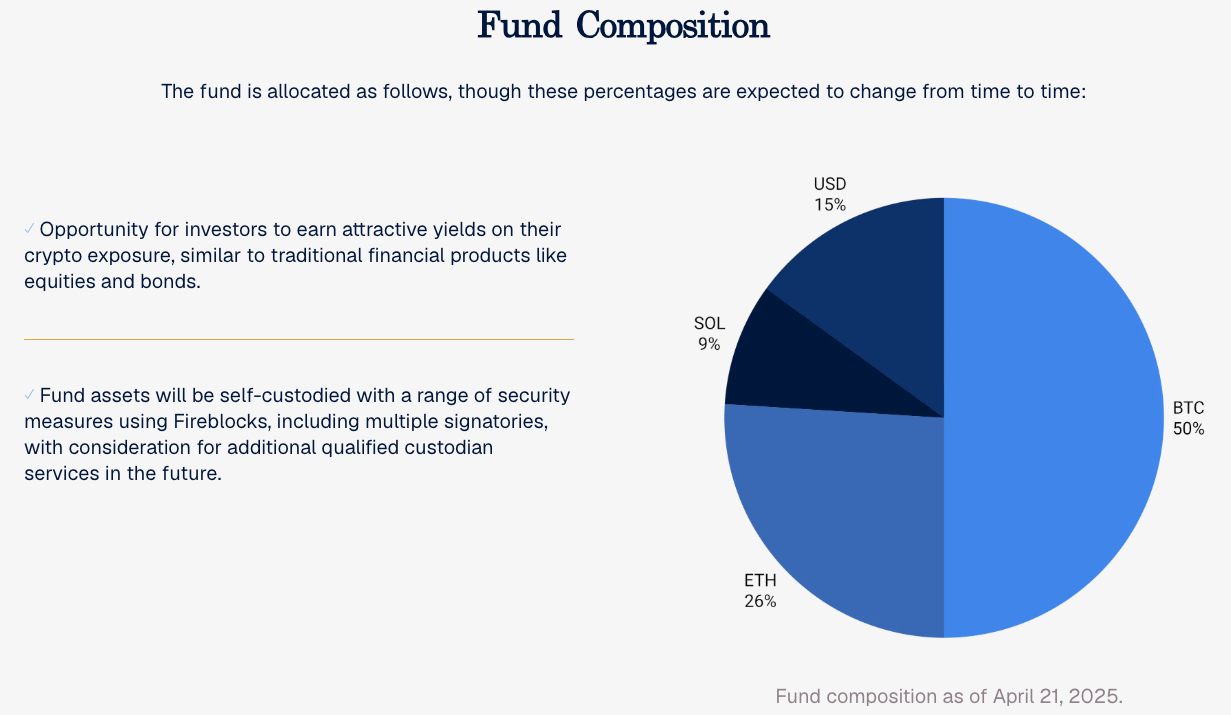

MI4 is an index built around the Mantle ecosystem and is composed of BTC, ETH, SOL, and a stable pool. BTC and ETH serve as core base assets, SOL provides growth exposure, and the stable pool reduces overall volatility.

A key feature of MI4 is that its weights are determined not by simple market capitalization but by a combination of on-chain yield, liquidity, and volatility metrics. MI4 is also issued as a security token through Securitize, allowing institutional investors to access the product within a regulated structure.

MI4 differs from existing products in its form. Bitwise operates as a traditional fund and DPI exists as a native on-chain token, while MI4 combines these models by issuing an STO and distributing it through an RWA platform.

This positions MI4 as a hybrid index, merging the stability of traditional index construction with real-time on-chain yield dynamics. It is also one of the few indexes that incorporates activity across the L2 ecosystem and on-chain financial flows.

3.4. CMC 200 Index

CMC200 is a broad index that includes the top 200 crypto assets by market capitalization.

Its top ten constituents are similar to BITW, while the lower segments are more diverse, creating a basket that resembles a mix of large, mid, and small caps. For this reason, it is often used not only as a market benchmark but also as an indicator of overall market sentiment, particularly shifts between risk-on and risk-off conditions.

To prevent excessive concentration in Bitcoin and Ethereum, weighting caps are applied. The index is reviewed monthly by Solactive, a German index provider, which adds rapidly growing projects and removes those that have become inactive. CMC200 functions similarly to MSCI ACWI in traditional equity markets.

3.5. Index Coop – DeFi Pulse Index (DPI)

DPI is a crypto-native index that selects only core DeFi protocols, unlike Bitwise, which covers the broader market. Its scope is narrower and focuses on 10 to 15 foundational DeFi protocols rather than the entire sector.

The selection process follows the on-chain evaluation framework of DeFi Pulse. This framework scores protocols not only by market capitalization but also by TVL, trading volume, and activity metrics such as transactions and user counts. Protocols with the highest composite scores become candidates for DPI.

Index Coop and external contributors then validate on-chain data and assess additional factors including token distribution, governance risks, and security history before finalizing component changes. This community-driven approach differs from Bitwise’s traditional committee-based review.

DPI is also a tokenized index that can be purchased directly on-chain. While Bitwise products are typically accessed through ETFs or funds in traditional markets, DPI can be acquired through wallet swaps or integrated into liquidity pools for on-chain strategies. These characteristics make DPI more suitable for active DeFi users than for institutions.

4. Current Limits of the Crypto Index Market

The crypto index market remains at a very early stage, and only a small number of investors use these indexes as actual benchmarks. Financial products built on top of these indexes are also difficult for most investors to access.

The primary constraint is the lack of assets that the market broadly recognizes as “verified.”

In equity markets, few question whether companies included in MSCI indexes are high-quality firms. Crypto is different. Even assets ranked within the top 50 or top 100 by market capitalization often face conflicting assessments from experts regarding their fundamental value.

Because of this uncertainty, investors still rely almost entirely on the movements of Bitcoin and Ethereum as their core reference points. Trust in index-based benchmarks remains limited.

The investment appeal of index products is also relatively low. Access is not straightforward, and in a market driven by expectations of outsized returns, the more stable performance profile of index-based products may appear less attractive.

These constraints ultimately stem from the broader immaturity of the crypto market itself, and they are unlikely to be resolved until the market develops a deeper base of assets and a more stable investor framework.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.