In 2025, the crypto industry saw many narratives rise. Some sparked attention and quickly collapsed. But the key ones left us with lasting lessons.

Key Takeaways

The 2025 crypto market experienced rapid narrative shifts, and fatigue and skepticism accumulated across the market throughout the year.

Most narratives only consumed short-term attention, but some led to real use cases and structures that gradually advanced the market.

Beyond degen-centric trends, narratives that retail participants could access relatively easily expanded and broadened the market’s base. This was also a meaningful change.

1. Narrative, Narrative, and Narrative

The defining feature of the 2025 crypto market was the rapid pace of narrative shifts. Market attention moved to the next narrative before the current one could be properly validated.

Meme coins drove particularly dramatic transitions. New narratives emerged around Trump, Elon Musk, and Sydney Sweeney. Investors shifted their focus just as quickly.

The core problem was that most narratives proved to be one-time events. They consumed short-term attention without building structures that could evolve into real industries. Some players created fake narratives to exploit investors. As a result, market participants grew fatigued and increasingly skeptical.

That said, not all narratives ended in exhaustion. Some established themselves as real industries and advanced the crypto market. So what survived, and what disappeared? This report examines the major narratives that shaped 2025 and draws lessons from their rise and fall.

2. What Lessons Did the 2025 Narratives Reveal?

2.1. Retention Matters More Than New User Acquisition

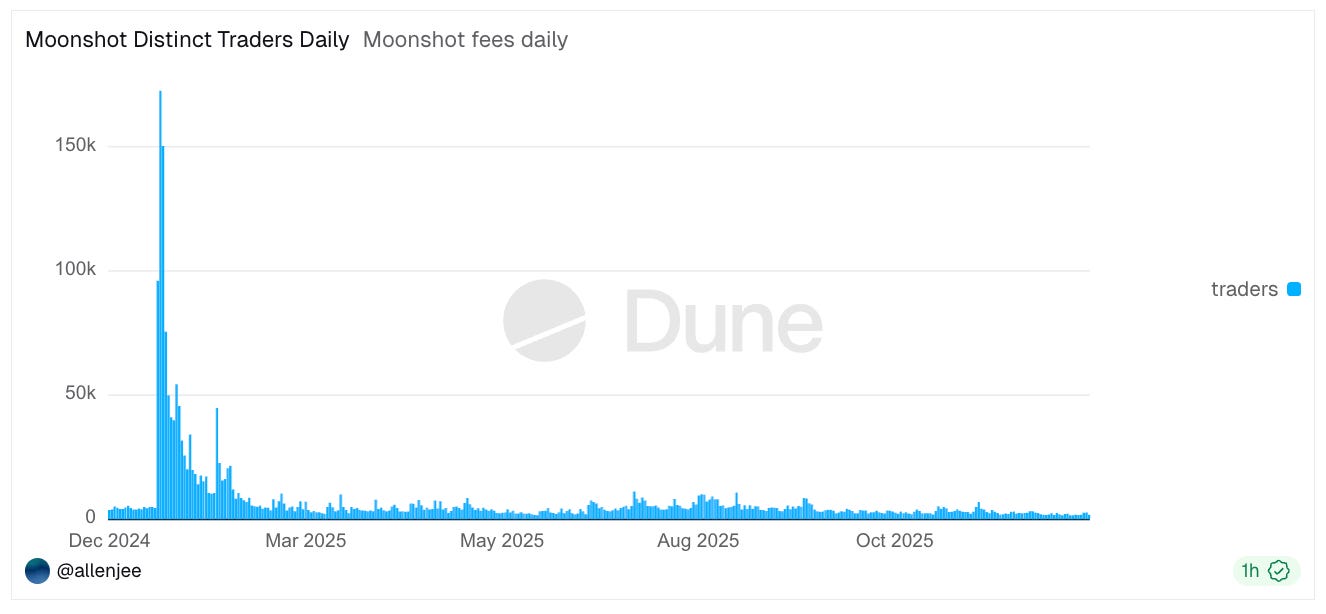

Meme coins captured the most attention this year. Their straightforward, intuitive nature attracted even those who had previously ignored crypto or found it too complex to enter. Trading apps like Moonshot lowered the barrier to entry even further, and new users surged in a short period.

However, most users did not stay long. They entered seeking quick profits and left just as fast. Their activity did not spread to other services or create any lasting trickle-down effect. The market saw an influx, but it only generated one-time engagement.

This case clearly demonstrates that massive inflows are possible when the right catalyst meets a low barrier to entry. Meme coins proved this potential. At the same time, they revealed that inflows alone are not enough. If projects fail to design reasons for users to stay, inflows will quickly turn into outflows. Retention remains a core challenge.

2.2. The Light and Shadow of InfoFi

2025 was also the year InfoFi gained serious attention. InfoFi services expanded around Kaito, and users embraced a structure where they produced information and received rewards for it. Combining incentives with information production was a meaningful experiment, and it brought many retail users into the market.

However, limitations emerged quickly. Content quality is inherently subjective and difficult to measure quantitatively. Yet reward distribution required metric-based criteria, and this gradually distorted participant behavior. Participants prioritized sensational content over accuracy. As a result, X turned from a space for accumulating information into something closer to a billboard.

InfoFi demonstrated the potential to stimulate information production. At the same time, it left an open question: how do we evaluate and reward information quality? Without solving this problem, InfoFi will likely amplify market fatigue rather than expand the information ecosystem.

2.3. Privacy Has Become Essential

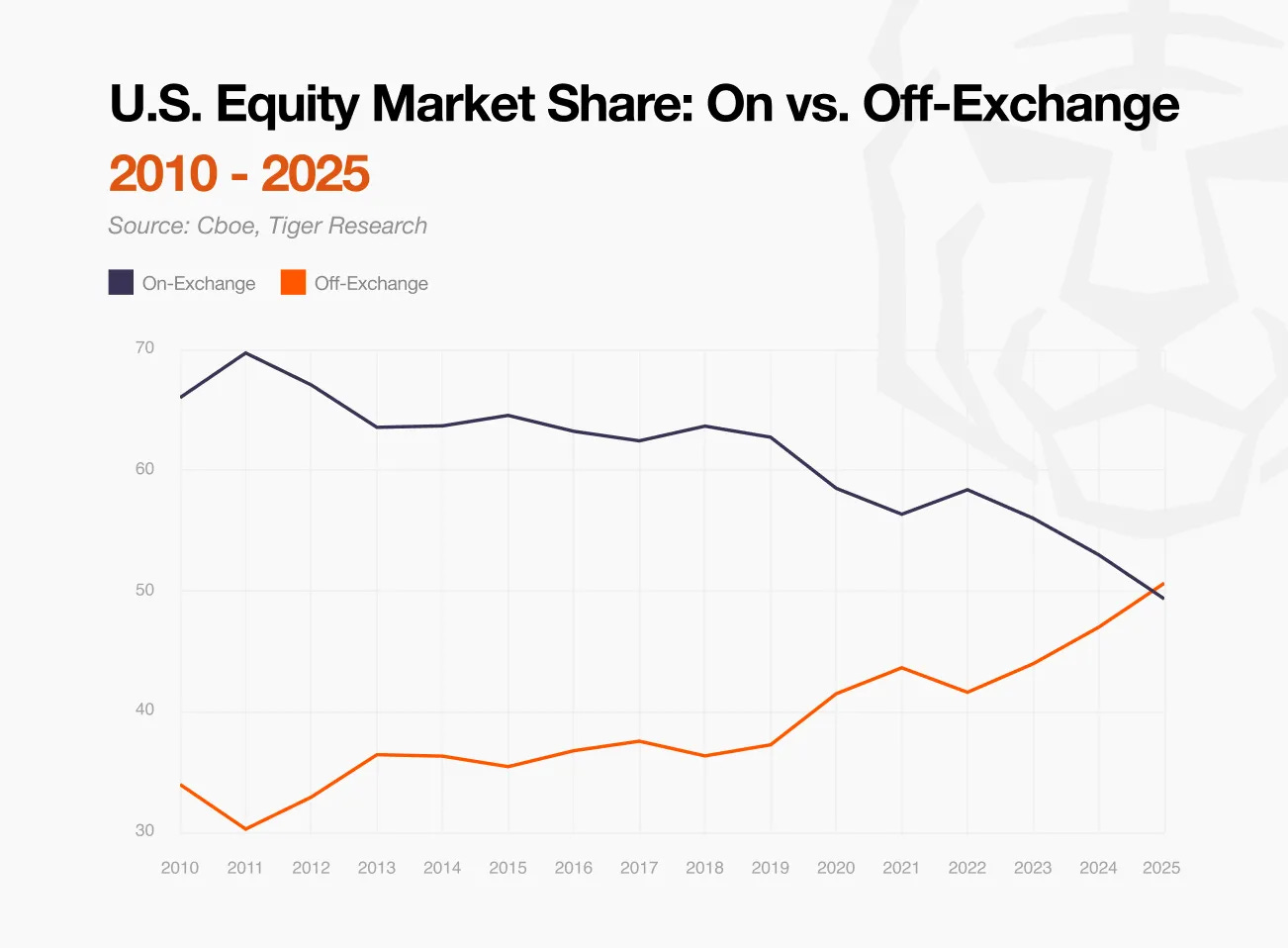

As institutional capital flows in faster, the crypto market is shifting from retail-driven to institution-driven. Alongside this shift, the privacy sector has started to gain attention. This is no coincidence.

On-chain transparency has long been considered a strength of crypto. However, an environment that exposes transaction size, timing, and positions means strategy exposure for institutional investors. The growing share of off-exchange trading in traditional finance also reflects rising discomfort with fully transparent structures.

Transparency did not serve all participants equally. As discussions around institutional participation and market expansion continue, privacy can no longer remain a secondary concern.

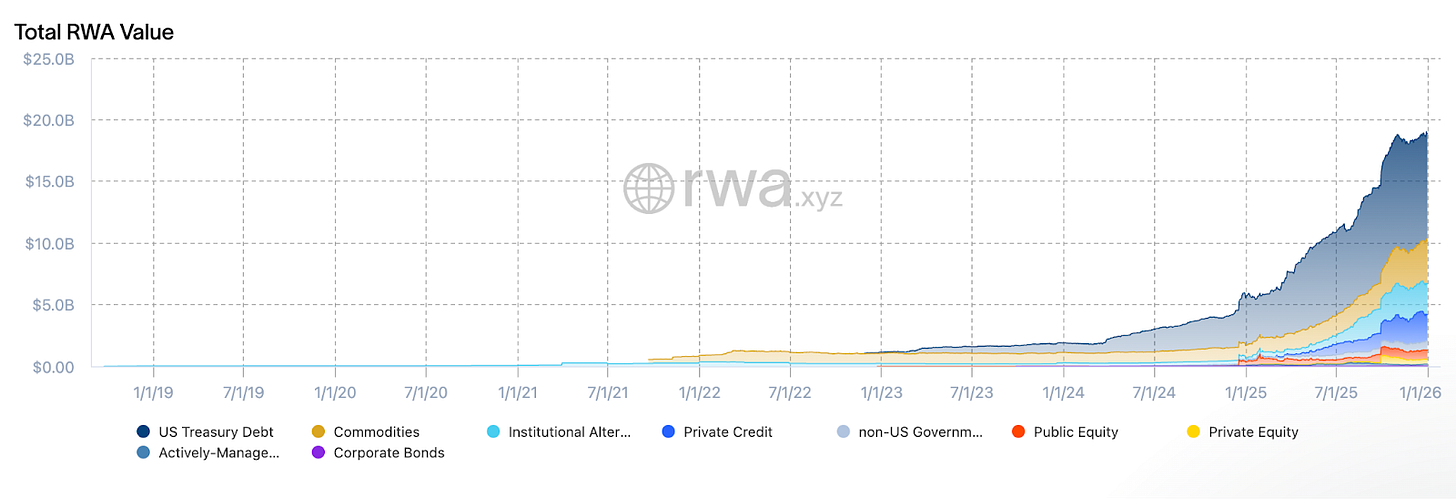

2.4. The Year Crypto Revealed Its Product-Market Fit

2025 was the year crypto moved beyond abstract potential and started to demonstrate real, working use cases. Stablecoins, x402, and prediction markets each took different forms. Yet they shared a common strength: they connected crypto’s borderless currency nature and ability to provide transaction trust to real-world problem-solving.

The key to these cases was that crypto could facilitate transactions and provide trust in outcomes without a central authority. In an environment where participants from around the world engage simultaneously, crypto enables transactions and verifies results without intermediaries. Traditional systems struggle to offer this advantage. These cases suggest that crypto can show relative strength in areas where these conditions align.

These examples do not prove that crypto is the answer for every domain. However, they show that when crypto’s unique characteristics match the structure of a problem, projects can achieve clear product-market fit. 2025 first revealed these conditions with relative clarity.

3. Rapid Narrative Cycles and What Remained

The 2025 crypto market saw an unusually high number of narratives. Attention shifted to the next story before anyone could properly validate the current one, and many narratives faded quickly after brief consumption. Given the speed of these transitions, the year could easily appear wasteful on the surface.

However, this impression alone does not justify dismissing 2025 as meaningless. Narratives had short lifespans, but various experiments ran simultaneously behind the scenes, and institutions began integrating in earnest. The trends during this period extended beyond purely speculative narratives. Rather than insular stories centered on degens, many narratives emerged that retail participants could access relatively easily. This began to broaden the market’s base.

Rapidly consumed narratives did not leave immediate results. Yet the process helped distinguish which structures worked and which did not. Now is the time to use these lessons as fuel and move to the next stage.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.