The crypto industry is joining the mainstream. Institutions have become key market players. Capital moves to projects that generate real revenue. Short-term price fluctuations no longer matter. Sustainable business models have become essential. Tiger Research forecasts ten major shifts in the crypto market for 2026.

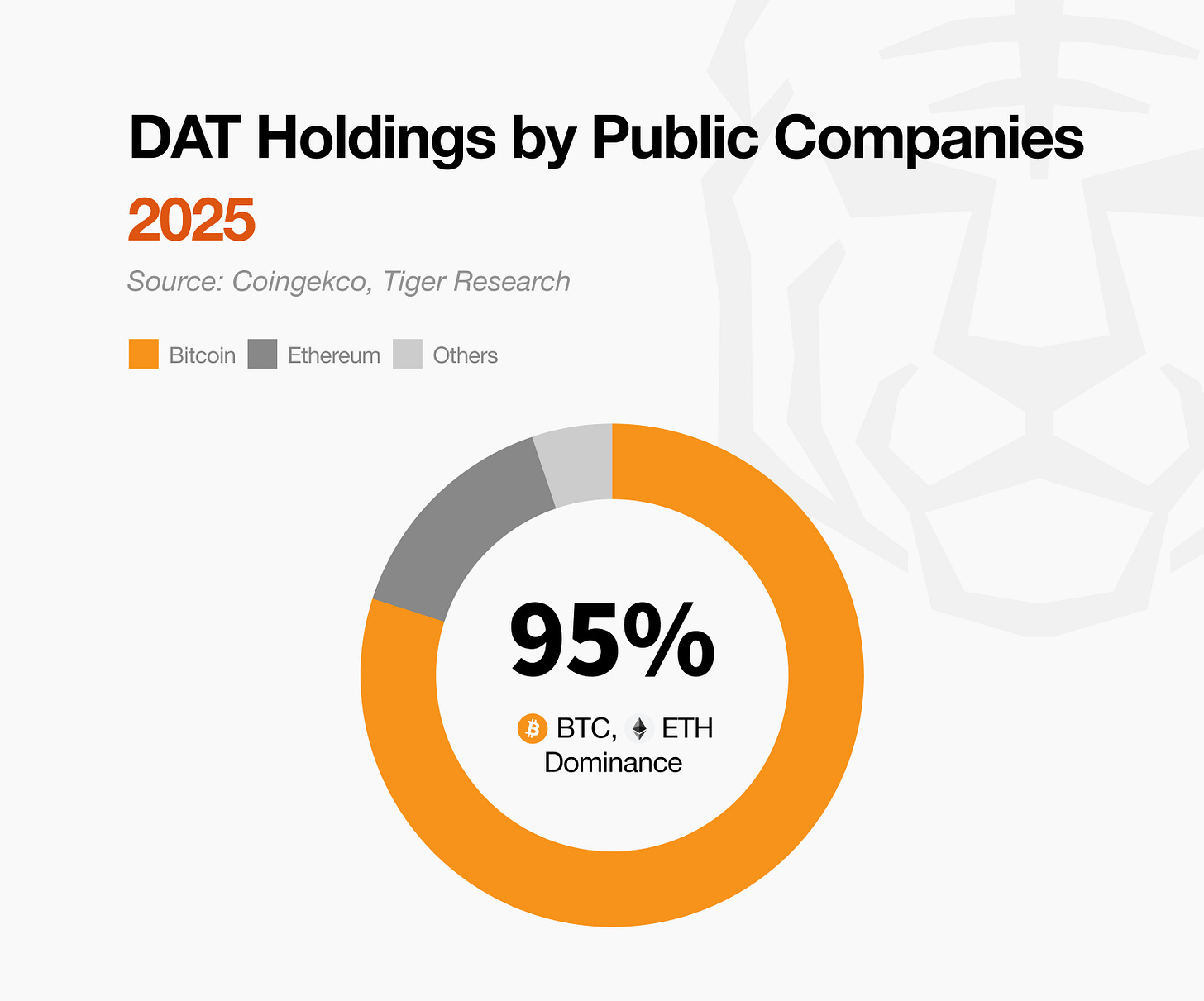

1. Institutional Capital Stays in Bitcoin

As institutions lead the market, capital flows have become cautious. These investors avoid unproven assets and limit their scope to Bitcoin and Ethereum. This trend is likely to persist. Market growth will concentrate solely on assets that meet institutional standards.

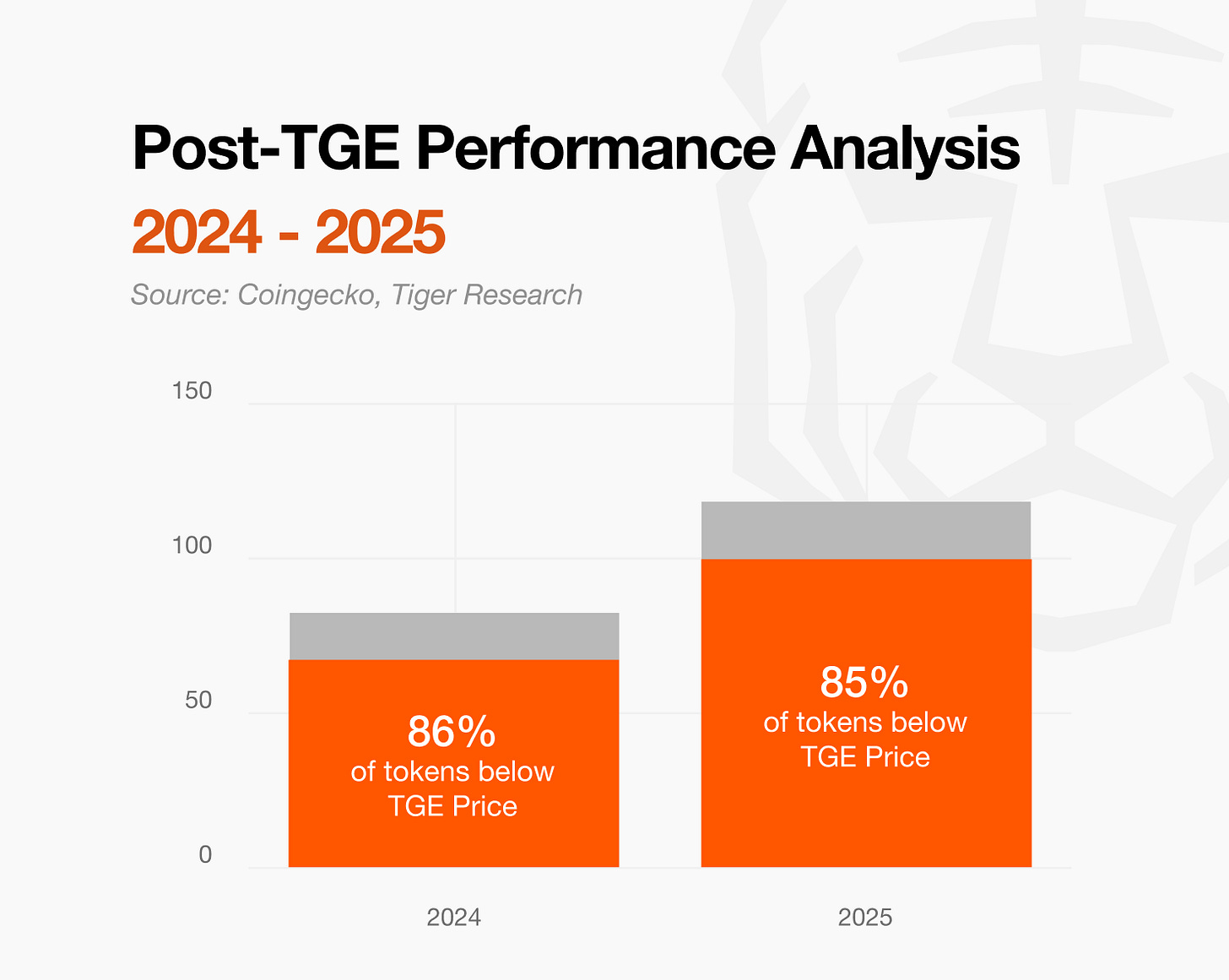

2. Profitless Projects Face Market Washout

Price drops in 85% of new tokens post-TGE expose the limits of narrative-driven growth. Hype-based projects will be replaced by new trends at an increasing rate. The market will shift toward projects that generate real revenue and demonstrate sound fundamentals.

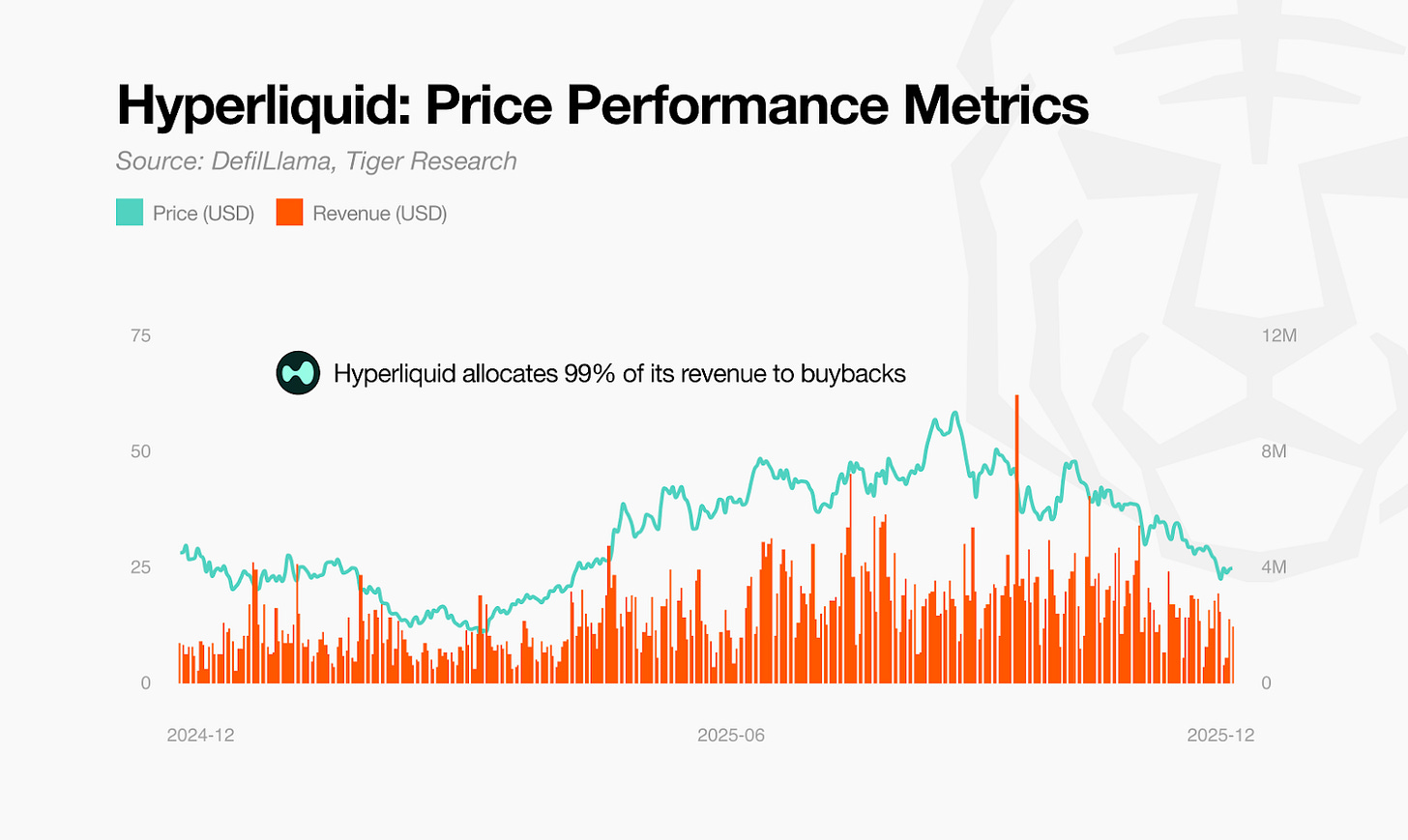

3. Utility Failed. Buybacks Are the Only Answer.

Utility-focused tokenomics failed. Governance voting rights didn’t attract investors. Complex structures weren’t sustainable. The market now demands clear value returns. Direct returns through buybacks and burns will survive. Structures where protocol growth immediately impacts token price will also survive. New innovative models will emerge from this shift.

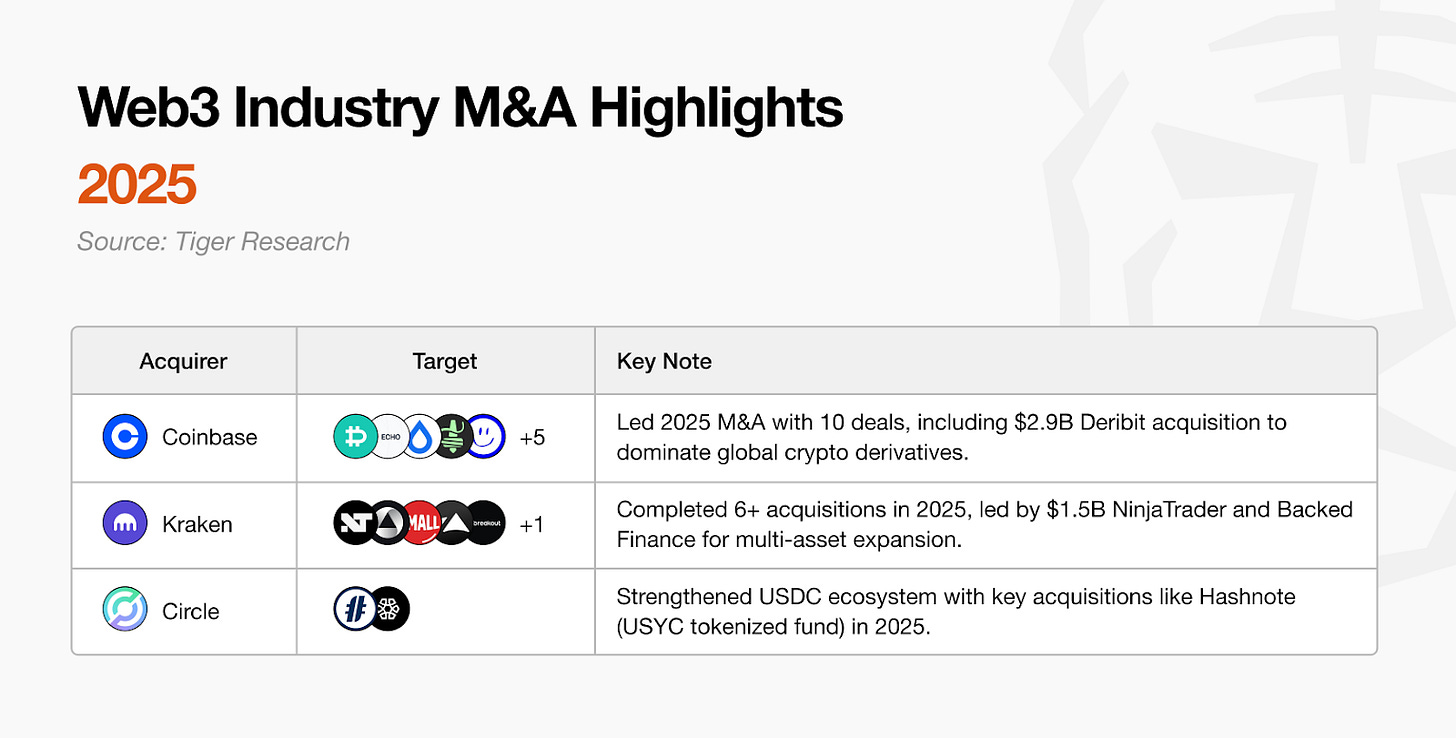

4. M&A Opportunities Between Projects to Rise

Web3 is maturing. Competition for market dominance intensifies. M&A is the fastest way for companies to scale and strengthen competitiveness now. Winners will drive aggressive M&A activity. The market will be reshaped by businessmen who generate real profits.

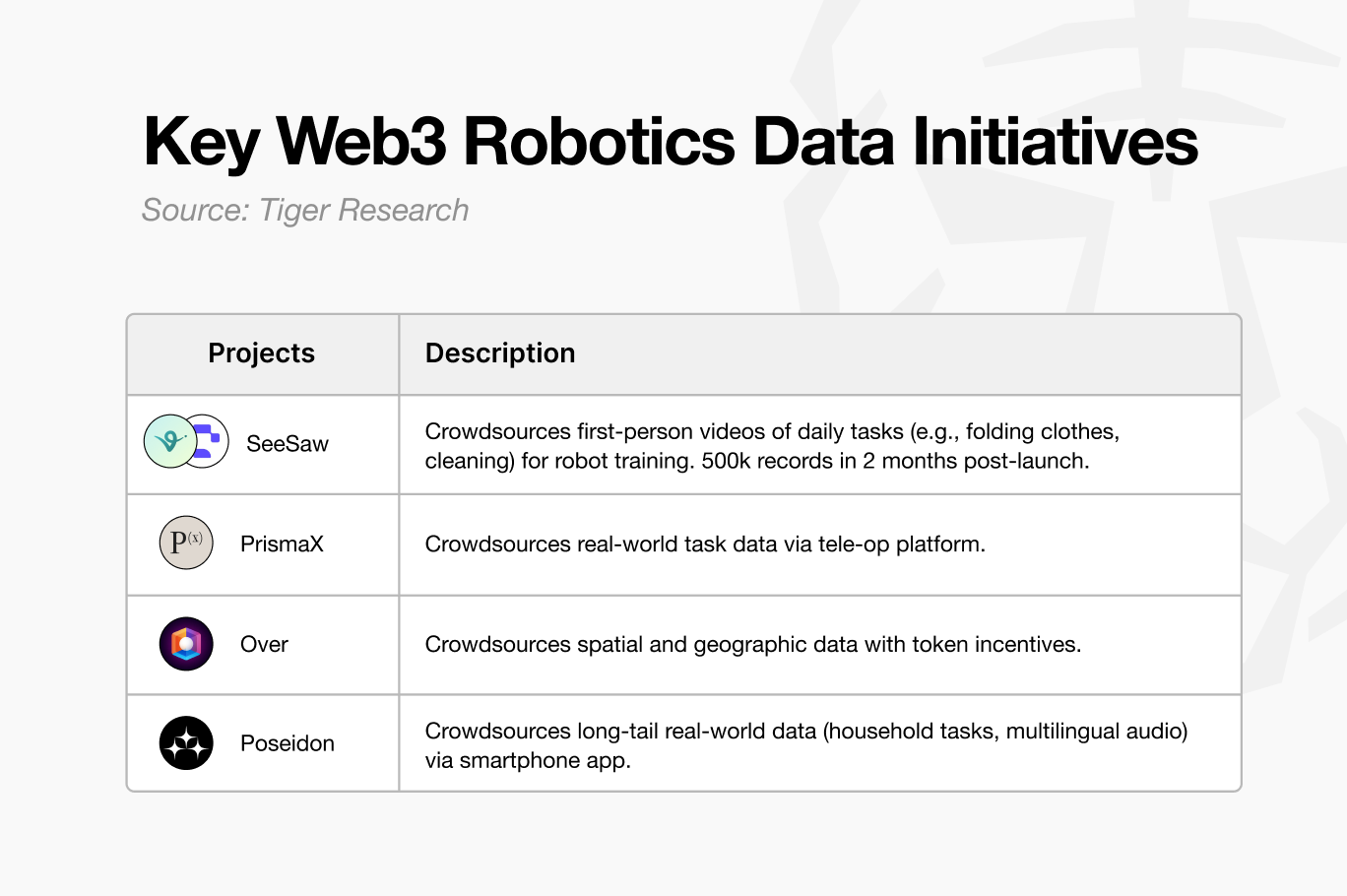

5. Robotics and Crypto Will Open a New Gig Economy Era.

The robotics industry is growing. Real-world data for robot training has become critical. Traditional centralized methods can’t collect vast data efficiently. Blockchain-based decentralized crowdsourcing solves this problem. It collects massive data from individuals worldwide and provides transparent, instant rewards. A new gig economy centered on robotics will emerge.

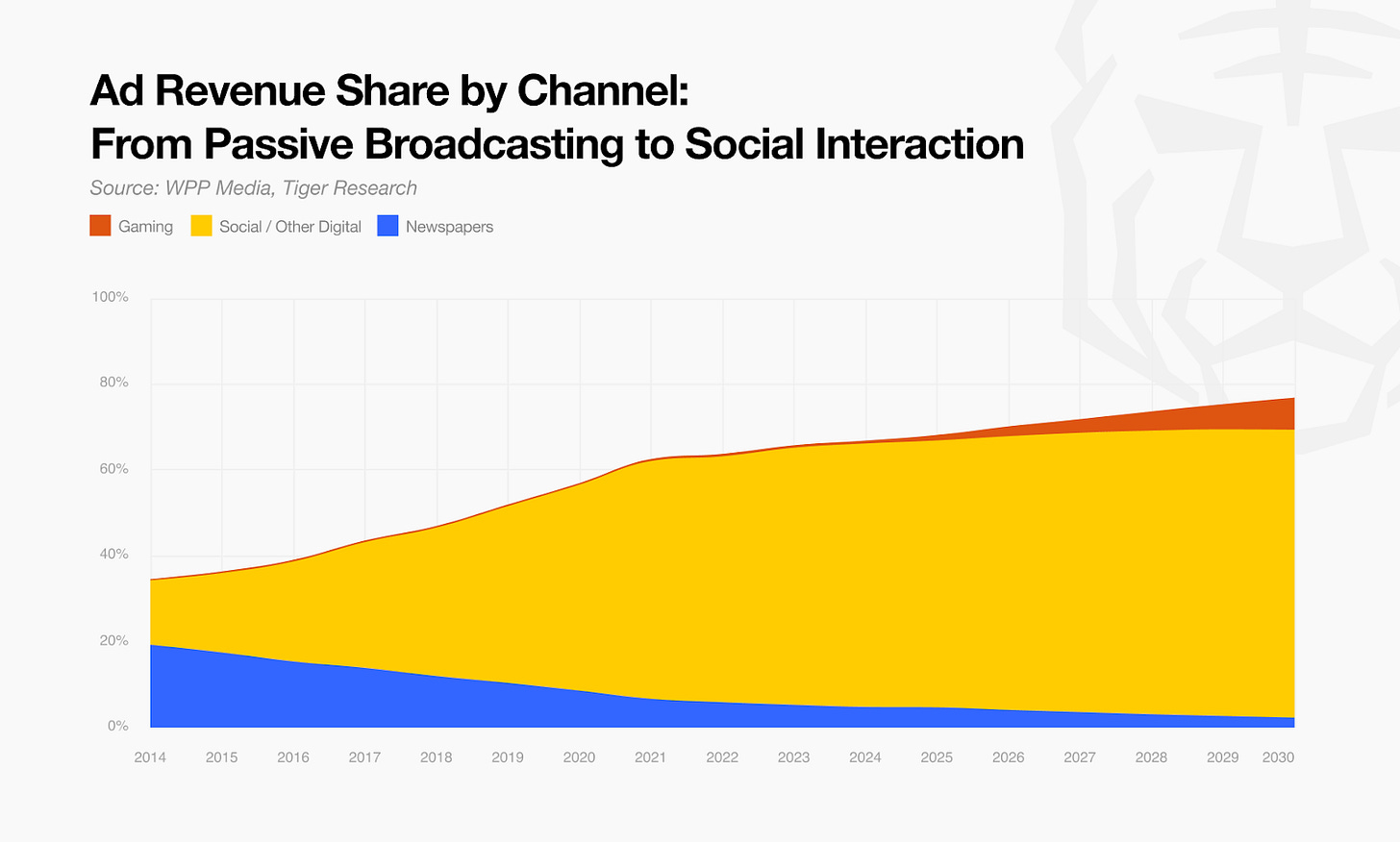

6. Media Firms Adopt Prediction Markets

As traditional revenue models reach their limits, media firms will adopt prediction markets as a survival strategy. Readers will transition from passive consumption to active participation by staking capital on news outcomes. This shift will optimize revenue structures while driving deeper audience engagement.

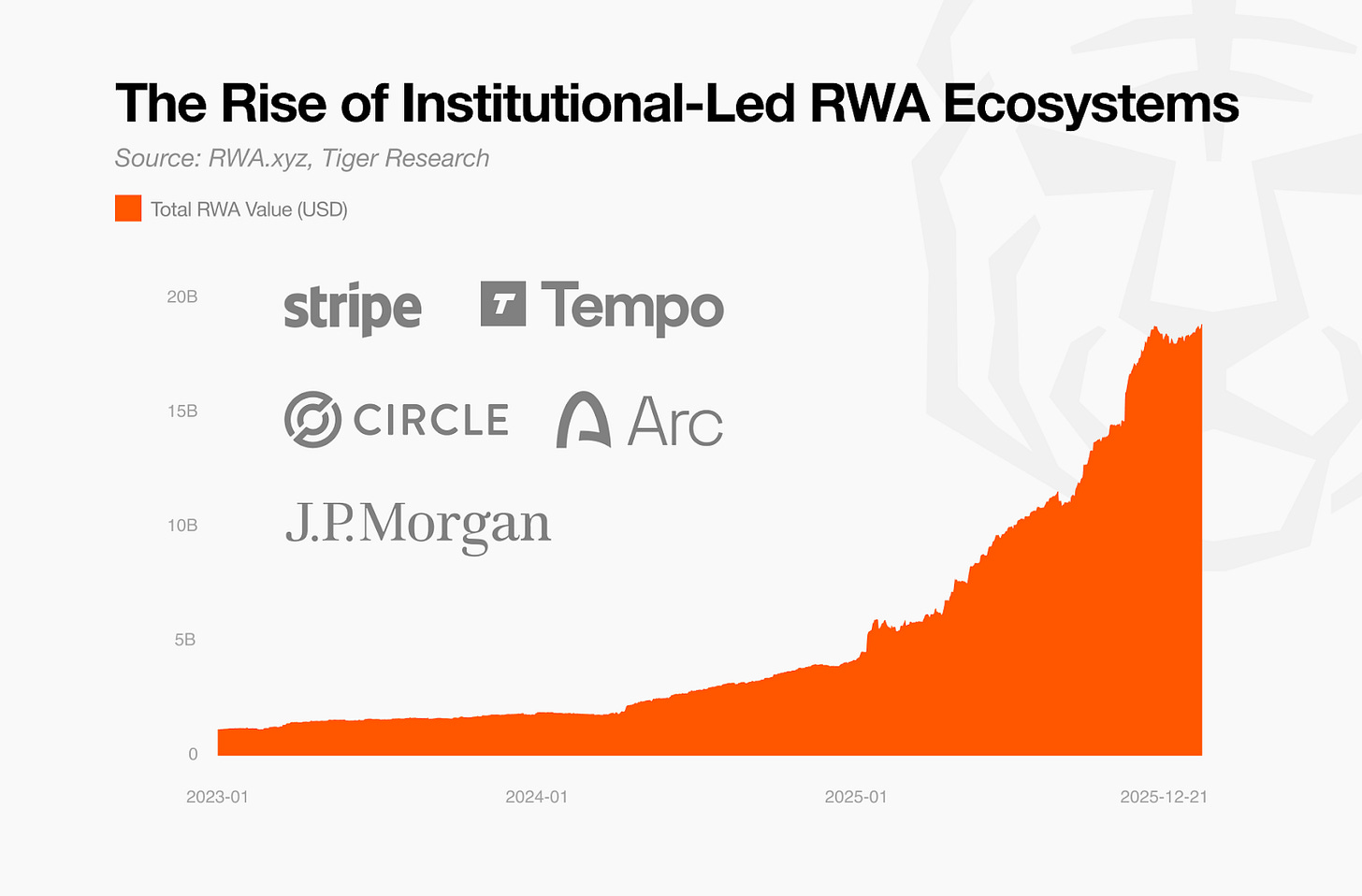

7. TradFi Leads RWA via Own Chains

Traditional financial institutions are the primary suppliers for the RWA market. Given the need for asset control and security, the benefit of using third-party platforms is low. These firms will likely build their own chains to maintain market leadership. RWA projects that lack independent asset supply will lose their competitive edge and face exclusion.

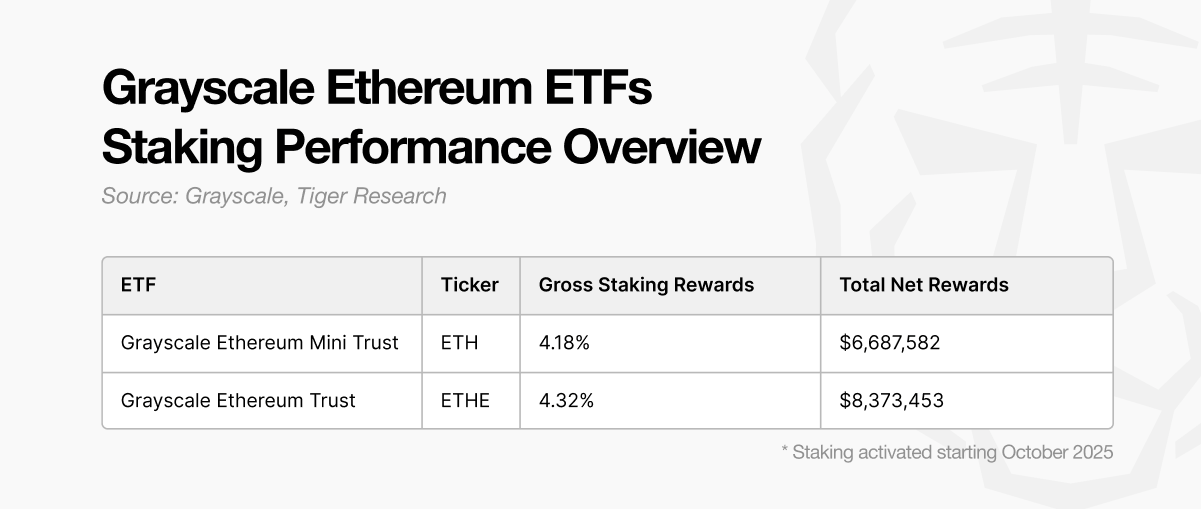

8. ETH Stake ETFs to Boost BTCFi Growth

The launch of ETH stake ETFs will push BTC ETF holders to seek yield. BTCFi fills this gap. As large funds enter BTC, the need for asset utility will rise. This push for yield will drive the next wave of BTCFi growth.

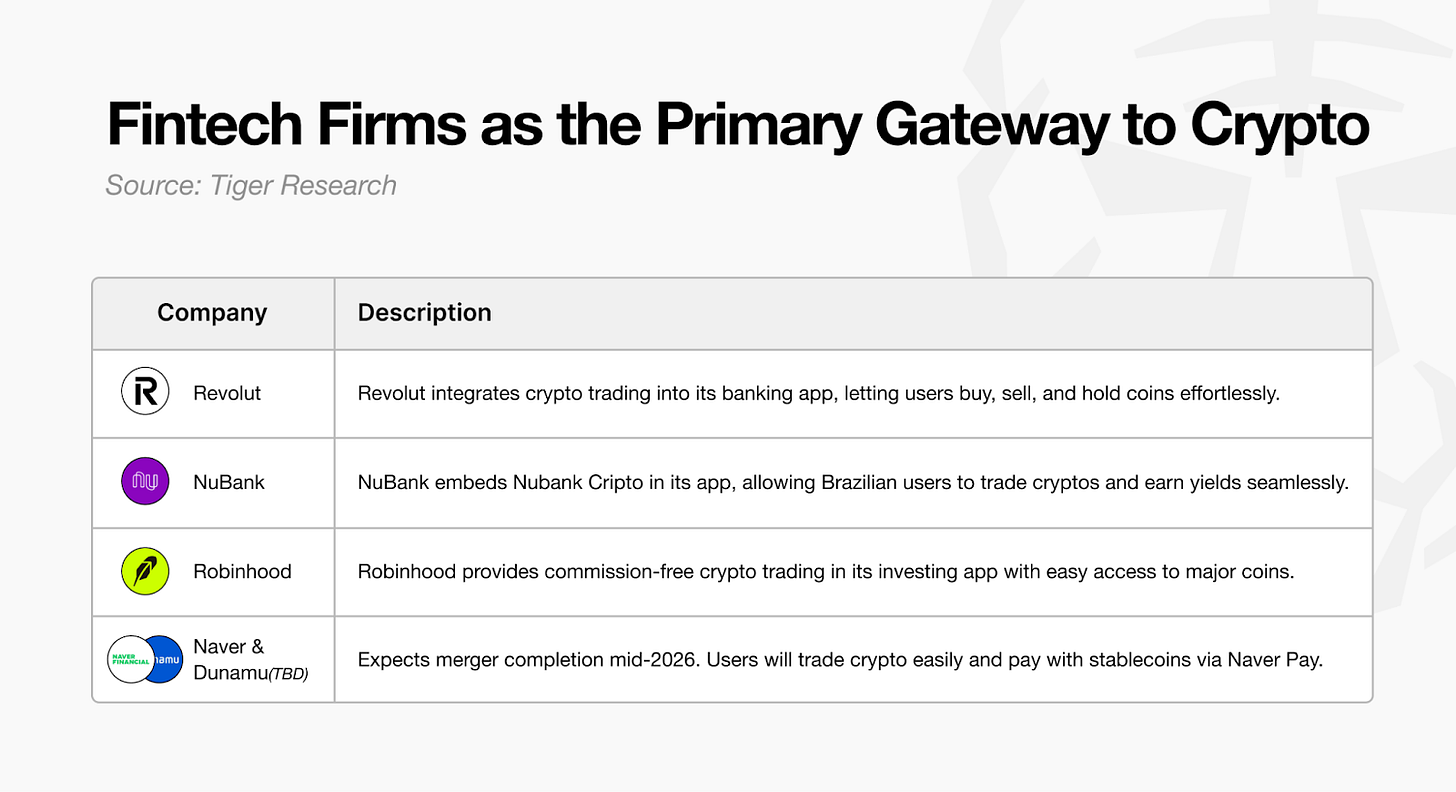

9. Fintech to Overtake Exchanges as Main On-Ramp

As rules clear up, fintech apps have become the top choice for crypto trade. New users no longer need to use crypto exchanges. They can buy and sell in the apps they use each day. The next wave of growth will be led by these fintech tools.

10. Privacy Tech as Core Institutional Infrastructure

Chain transparency reveals trade plans. This is a weakness for large firms. High-net-worth players must hide their moves to stay safe. Privacy tech is a vital tool for these firms to join the market. Big capital will only flow in if trade data is secure.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.