As markets enter a downturn, skepticism toward the crypto market is growing. The question now is whether we have entered a crypto winter.

Key Takeaways

Crypto winters follow a sequence: major event → trust collapse → talent exodus

Past winters caused by internal problems; current rise and fall both driven by external factors; neither winter nor spring

Post-regulation market split into three layers: regulated zone, unregulated zone, shared infrastructure; trickle-down effect gone

ETF capital stays in Bitcoin; does not flow outside regulated zone

Next bull run requires killer use case + supportive macro environment

1. How Did Previous Crypto Winters Unfold?

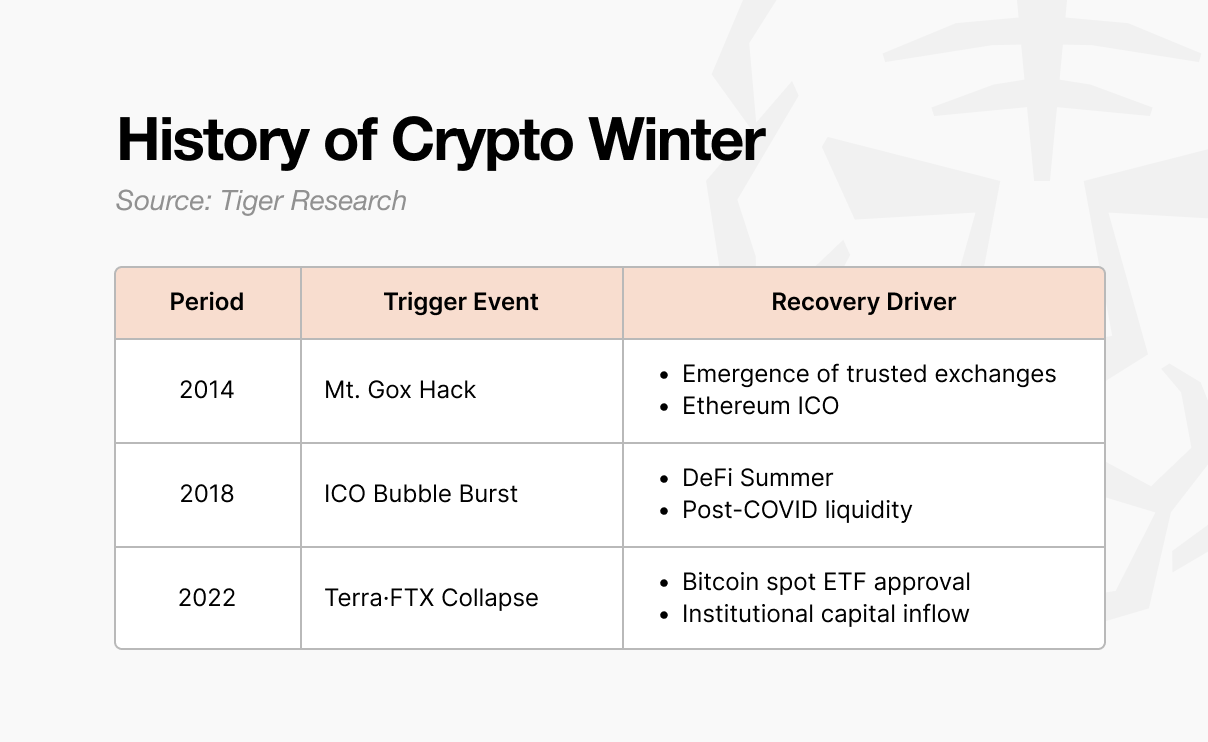

The first winter came in 2014. Mt. Gox was an exchange handling 70% of global Bitcoin trading volume at the time. Approximately 850,000 BTC vanished in a hack, and market trust collapsed. New exchanges with internal controls and audit functions emerged, and trust began to recover. Ethereum also entered the world through an ICO, opening new possibilities for vision and fundraising methods.

This ICO became the spark for the next bull market. When anyone could issue tokens and raise funds, the 2017 boom ignited. Projects raising tens of billions on a single whitepaper flooded in, but most had no substance.

In 2018, Korea, China, and the U.S. poured out regulations, the bubble burst, and the second winter arrived. This winter did not end until 2020. After COVID, liquidity flowed in, and DeFi protocols like Uniswap, Compound, and Aave gained attention, bringing capital back.

The third winter was the harshest. When Terra-Luna collapsed in 2022, Celsius, Three Arrows Capital, and FTX failed in succession. It was not a simple price drop; the industry’s structure itself was shaken. In January 2024, the U.S. SEC approved spot Bitcoin ETFs, followed by the Bitcoin halving and Trump’s pro-crypto policies, and capital began flowing in once again.

2. Crypto Winter Pattern: Major Event → Trust Collapse → Talent Exodus

All three winters followed the same sequence. A major event occurred, trust collapsed, and talent left.

It always started with a major event. The Mt. Gox hack, ICO regulations, and the Terra-Luna collapse followed by the FTX bankruptcy. The scale and form of each event differed, but the result was the same. The entire market fell into shock.

The shock soon spread into trust collapse. People who had been discussing what to build next began asking whether crypto was truly meaningful technology. The collaborative atmosphere among builders disappeared, and they began tearing into each other over who was to blame.

Doubt led to talent exodus. Builders who had been creating new momentum in blockchain fell into skepticism. In 2014, they left for fintech and big tech. In 2018, they left for institutions and AI. They departed for places that seemed more certain.

3. Is This a Crypto Winter?

The patterns from past crypto winters are visible today.

Major events:

Trump memecoin launch: market cap hit $27 billion in one day, then crashed 90%

10.10 liquidation event: U.S. announced 100% tariffs on China, triggering Binance’s largest-ever liquidation ($19 billion)

Trust collapse: Skepticism spreading in industry. Focus shifted from next build to blame games.

Talent exodus pressure: AI industry growing fast. Promises faster exits, greater wealth than crypto.

However, it is difficult to call this a crypto winter. Past winters erupted from within the industry. Mt. Gox was hacked, most ICO projects were revealed as scams, and FTX collapsed. The industry lost trust on its own.

Now is different.

ETF approval opened the bull market, and tariff policy and interest rates drove the decline. External factors lifted the market, and external factors brought it down.

Builders have not left either.

RWA, perpDEX, prediction markets, InfoFi, privacy. New narratives kept emerging, and they are still being created. They have not pulled up the entire market like DeFi once did, but they have not disappeared. The industry did not collapse; the external environment changed.

We did not create the spring, so there is no winter either.

4. Post-Regulation Market Structure Changes

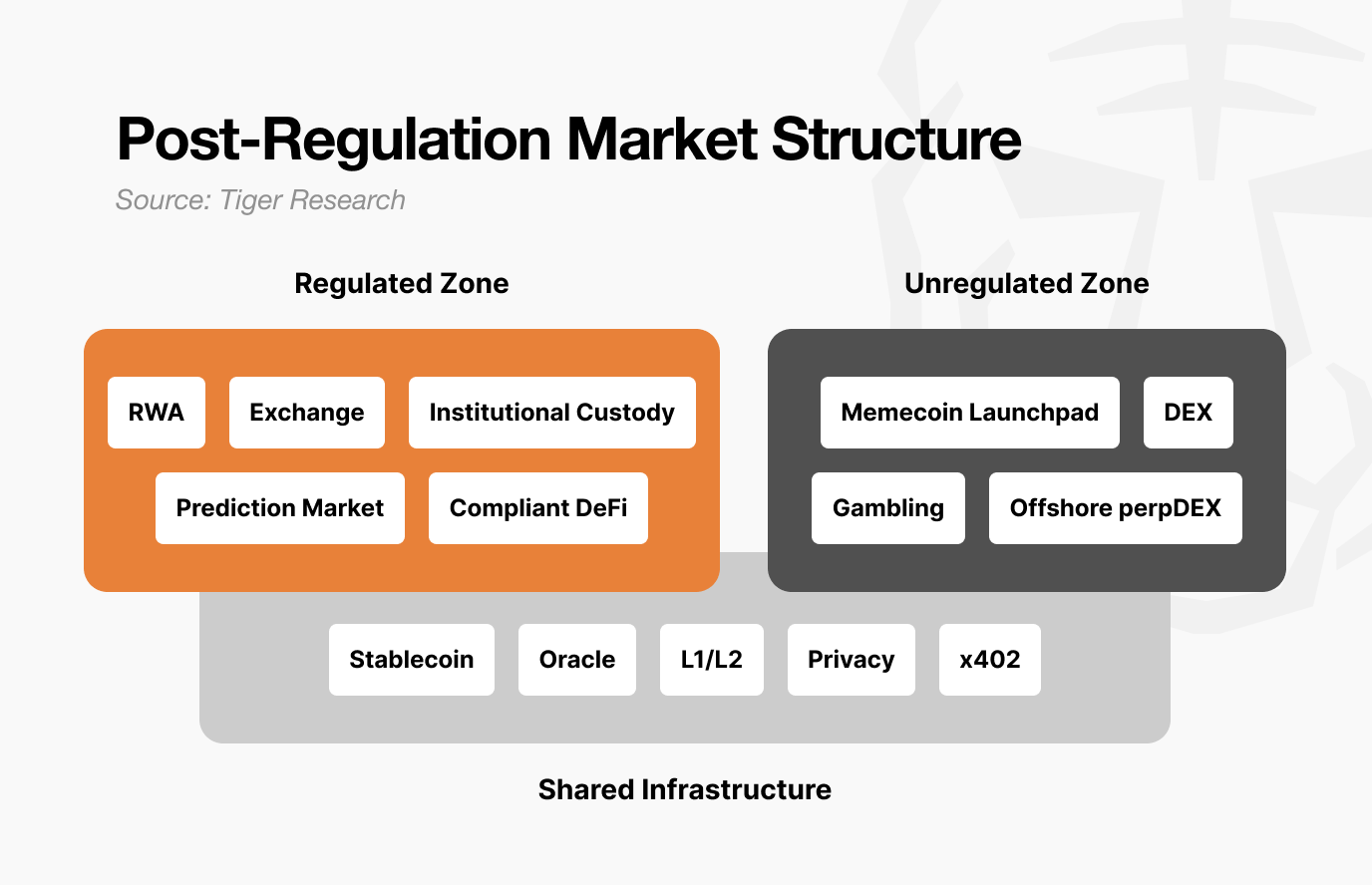

Behind this lies a significant shift in market structure following regulation. The market has already split into three layers: 1) regulated zone, 2) unregulated zone, and 3) shared infrastructure.

The regulated zone includes RWA tokenization, exchanges, institutional custody, prediction markets, and compliance-based DeFi. They undergo audits, make disclosures, and receive legal protection. Growth is slow, but capital scale is large and stable.

However, once inside the regulated zone, explosive gains like the past become difficult to expect. Volatility decreases and upside is capped. But downside is also capped.

The unregulated zone, on the other hand, will become more speculative going forward. Entry barriers are low and speed is fast. 100x in a day, -90% the next day happens more often.

However, this space is not meaningless. Industries born in the unregulated zone are creative, and once validated, they move into the regulated zone. DeFi did this, and prediction markets are doing so now. It serves as an experimental ground. But the unregulated zone itself will become increasingly separated from regulated zone businesses.

Shared infrastructure includes stablecoins and oracles. They are used in both the regulated and unregulated zones. The same USDC is used for institutional RWA payments and for Pump.fun trades. Oracles supply data for tokenized treasury verification and for anonymous DEX liquidations alike.

In other words, as the market split, capital flows also changed.

In the past, when Bitcoin rose, altcoins rose too through a trickle-down effect. Now it is different. Institutional capital that entered through ETFs stayed in Bitcoin, and it ended there. Regulated zone capital does not flow into the unregulated zone. Liquidity stayed only where value was proven. And even Bitcoin has not yet proven its value as a safe asset compared to risk assets.

5. Conditions for the Next Bull Run

Regulation is already being sorted out. Builders are still building. Then two things remain.

First, a new killer use case must emerge from the unregulated zone. Something that creates value that did not exist before, like DeFi Summer in 2020. AI agents, InfoFi, and on-chain social are candidates, but they are not yet at a scale to move the entire market. The flow where experiments in the unregulated zone get validated and move into the regulated zone must be created again. DeFi did this, and prediction markets are doing so now.

Second, the macroeconomic environment. Even if regulation is sorted out, builders are building, and infrastructure is accumulating, the upside is limited if the macroeconomic environment does not support it. DeFi Summer in 2020 exploded as liquidity was released after COVID. The rise after ETF approval in 2024 also coincided with rate cut expectations. No matter how well the crypto industry performs, it cannot control interest rates and liquidity. For what the industry has built to gain persuasiveness, the macroeconomic environment must turn around.

A “crypto season” where everything rises together like the past is unlikely to come again. Because the market has split. The regulated zone grows steadily, and the unregulated zone rises big and falls big.

The next bull run will come. But it will not come for everyone.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.