The cryptocurrency market has remained in a prolonged decline. In this environment, the projects that continue to endure are those that present pragmatic and realistic visions.

Key Takeaways

Projects that address real, concrete problems tend to remain resilient even during market downturns.

Hyperliquid, Canton, and Kite target different problem areas, but they share a common trait: practical and realistic solutions rather than abstract narratives.

To assess this realism, analysis should focus on three factors: the problem the project aims to solve, the structure of its solution, and the team’s ability to execute in practice.

1. Conditions for Survival in a Down Market: Does It Work in Practice

Bitcoin has fallen below $70,000. Among the top 100 cryptocurrencies by market capitalization, only seven remain above their 200-day moving average. This stands in contrast to the Nasdaq 100, where 53 constituents are still trading above the same threshold.

Market conditions cannot be resisted. Still, some crypto assets manage to endure even in the worst environments.

Their resilience cannot be easily dismissed as the result of artificial market making or a coincidental rebound. A closer look at their trajectory suggests a different explanation.

These projects no longer rely on vague visions or technical complexity alone. Instead, they share a common trait: they address core market problems with solutions that are grounded in practical reality. Their approaches generally align with three directions.

Do they solve problems the market is facing today?

Are they prepared for real-world use in the near term?

Are they building infrastructure that the industry will depend on over the long term?

Ultimately, the ability to solve real problems in practice remains the strongest fundamental.

2. Three Directions Chosen by the Market

Projects that could answer the questions above managed to survive. They did so by, 1) clearly identifying market problems 2) presenting practical solutions that matched their specific timing.

2.1. Hyperliquid: Solving Immediate Trading Frictions

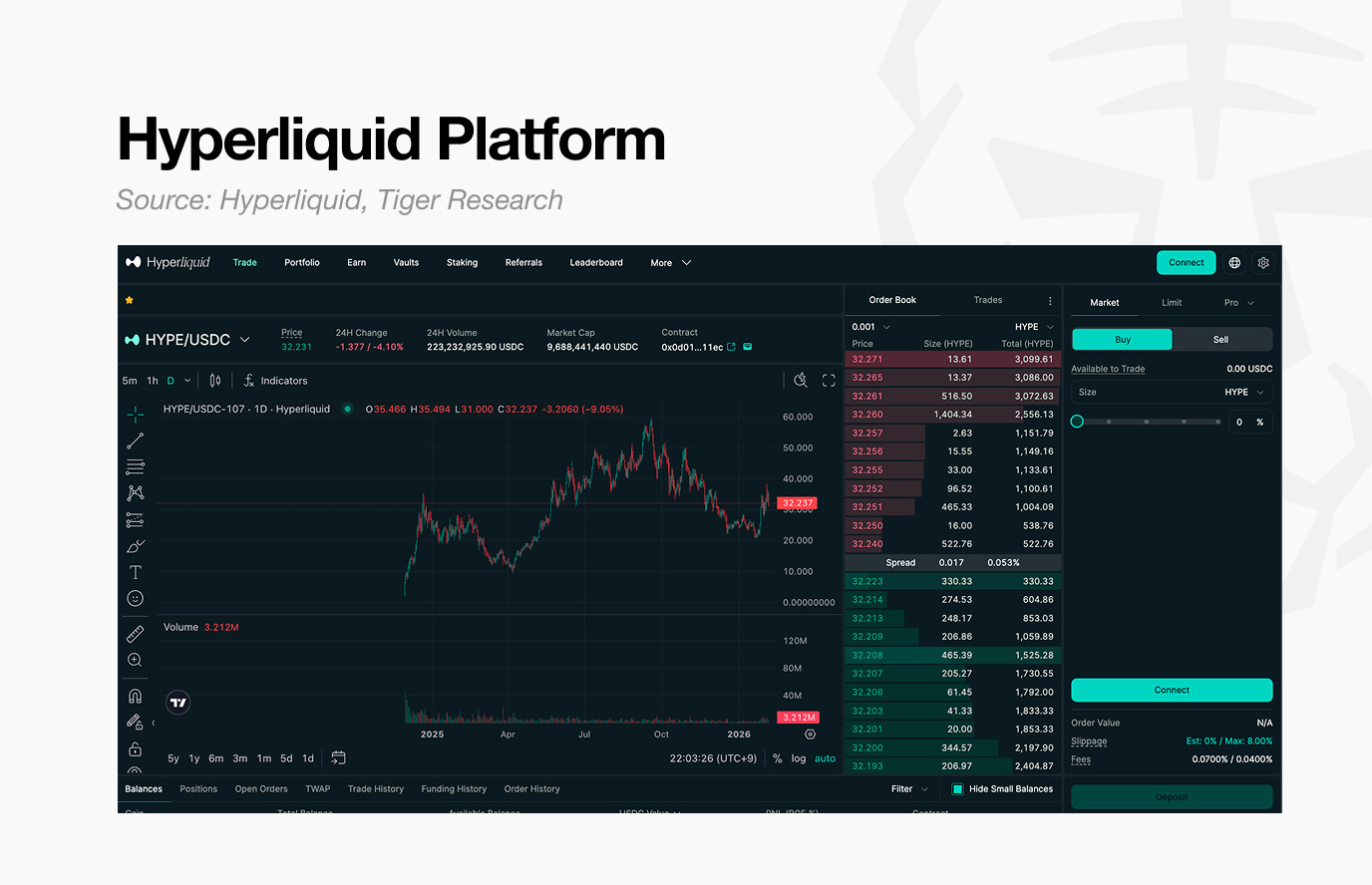

Centralized exchanges have traditionally been viewed as accountable intermediaries. In practice, however, they have often failed to align with investor interests when issues arise. Decentralized exchanges emerged as an alternative, but inferior user experience and performance led many investors to avoid them.

Against this backdrop, Hyperliquid introduced the concept of a perp DEX. It brought features investors valued in centralized exchanges such as high leverage, fast execution, and stable liquidity through its HLP mechanism into an on-chain environment.

Early usage was driven in part by demand for the $HYPE token airdrop. However, continued engagement after the airdrop reflected user satisfaction with the platform’s performance.

Ultimately, Hyperliquid’s resilience stems from addressing a persistent and current problem: dissatisfaction with centralized exchanges.

2.2. Canton Network: Preparing for the Institutional Finance Era

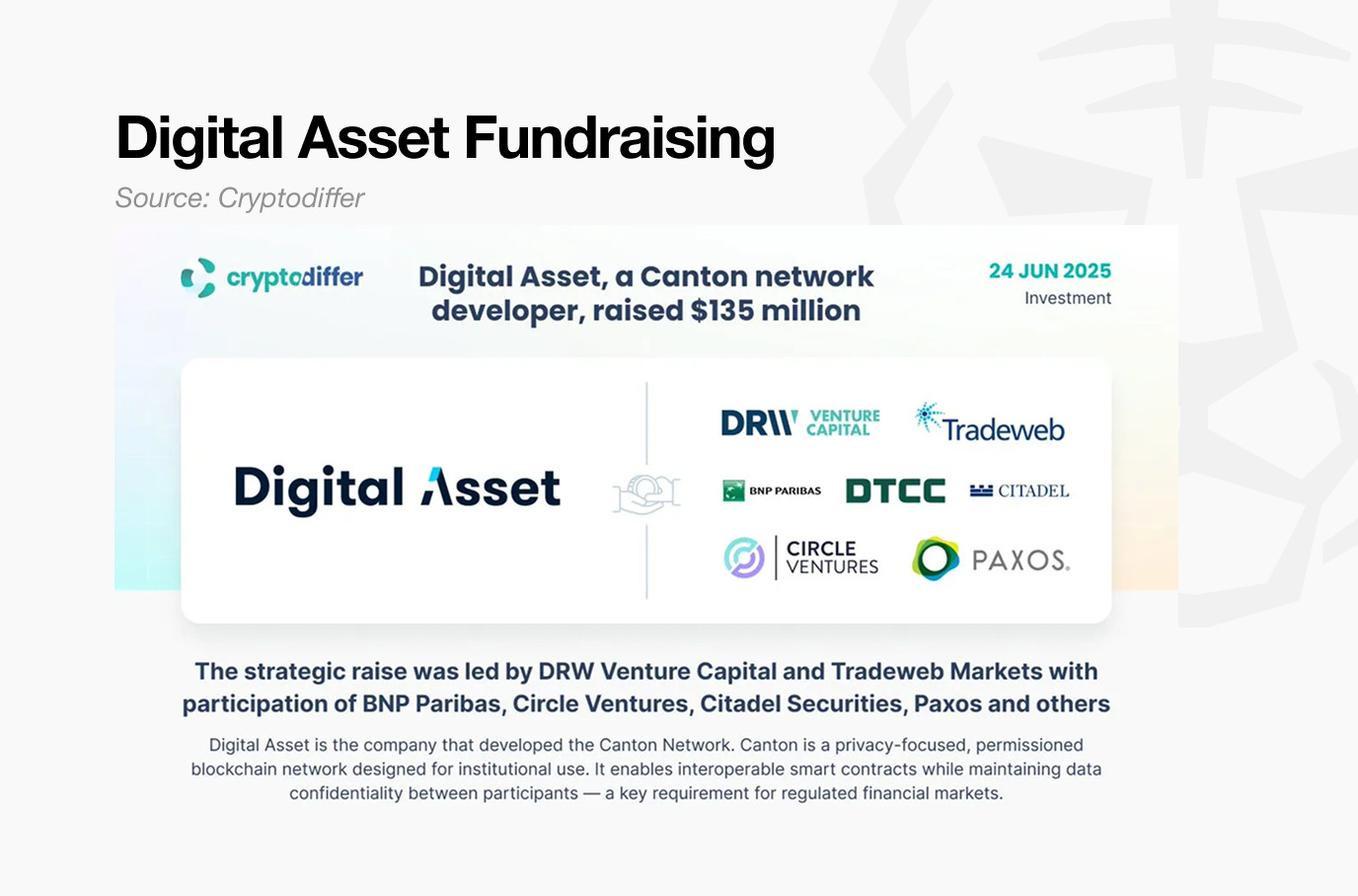

Canton presents a solution aimed at the near future. As interest in real-world assets continues to rise, institutions have begun to view blockchain not as a public network, but as financial infrastructure. In this context, what institutions require is not full data transparency, but a selective privacy model that supports both regulatory compliance and confidentiality.

The Canton Network emerged in response to these demands. Through DAML, Canton enables configurable data disclosure tailored to each participating party.

This allows institutions to preserve transaction confidentiality while sharing information only within necessary boundaries. Rather than imposing a provider-driven design, Canton builds infrastructure aligned with institutional demand.

Another critical factor is that Canton has expanded its ecosystem with real-world deployment in mind from the outset, supported by early collaboration with financial institutions.

Most notably, its partnership with DTCC establishes a pathway for assets managed within traditional financial systems to extend into a Canton-based environment. DTCC processes approximately $3.7 quadrillion in transactions annually, underscoring the practical feasibility of the Canton Network’s approach.

Ultimately, the Canton Network offers a structural solution that aims to satisfy three institutional requirements simultaneously: privacy protection, regulatory compliance, and integration with existing financial systems.

2.3. Kite AI: Building an AI Economy That Has Not Yet Arrived

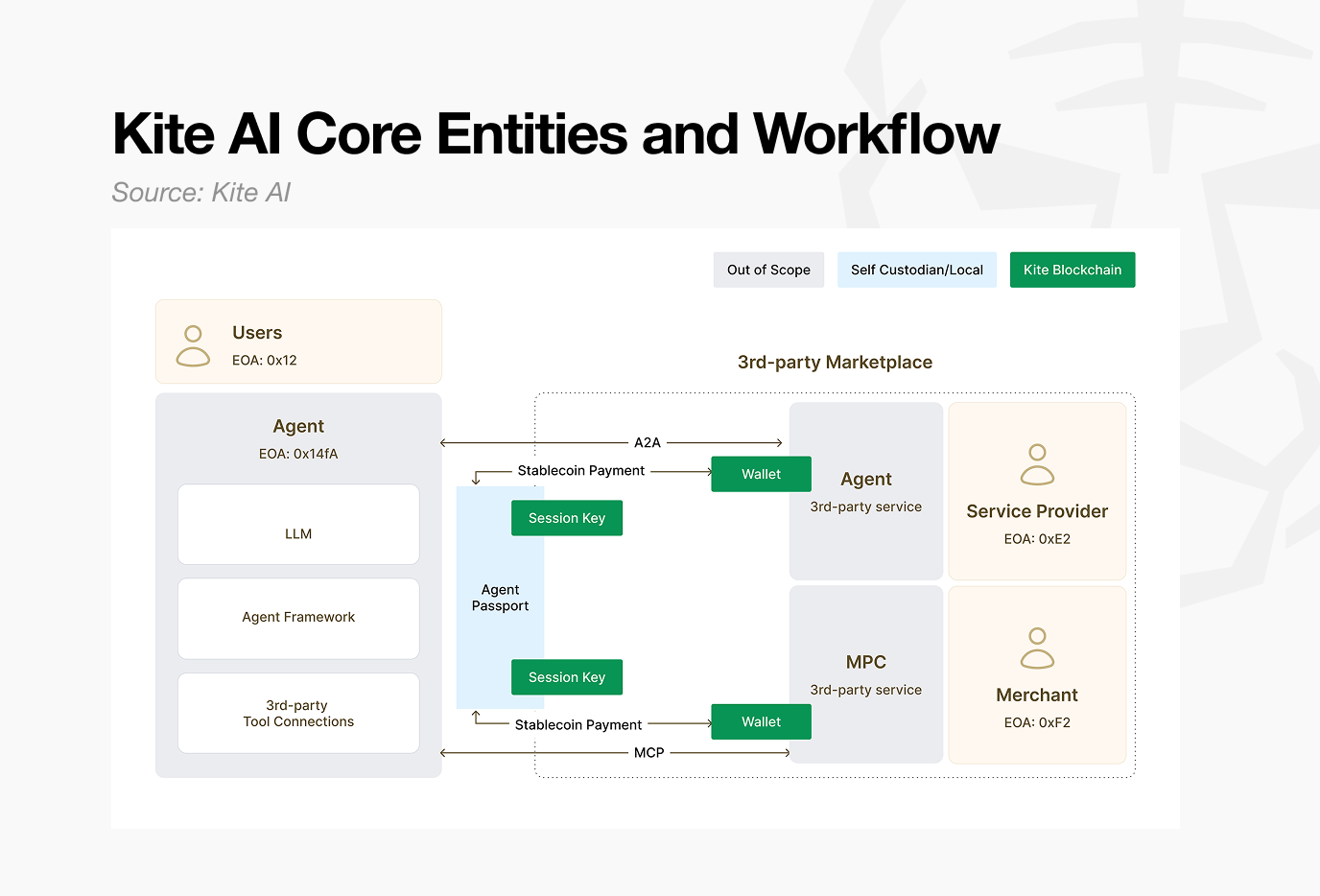

Unlike the previous examples, Kite AI currently has limited real world adoption. However, when viewed through the lens of a future in which AI agents operate as economic actors, its structural logic remains compelling.

Across both Web2 and Web3, there is broad consensus on an agent-driven future. Few dispute a scenario in which AI agents handle tasks such as booking hotels or ordering groceries on behalf of users.

That future, however, requires infrastructure that allows AI agents to initiate and execute payments independently. Existing transaction systems were designed around human-to-human transfers and efficiency between human participants.

As a result, for AI agents to function as autonomous economic entities, new mechanisms are required, including identity verification and automated payment frameworks.

Kite AI is building payment infrastructure designed for this environment. Its core components include an “agent passport” for identity verification and x402 protocol functionality to enable automated payments.

The vision Kite AI presents cannot be deployed at scale today, simply because the future it targets has not yet materialized.

Still, the project derives realism from a broader premise: when this widely anticipated future arrives, the underlying technology it is developing will be necessary. This alignment with a broadly accepted trajectory lends the project structural credibility despite limited current usage.

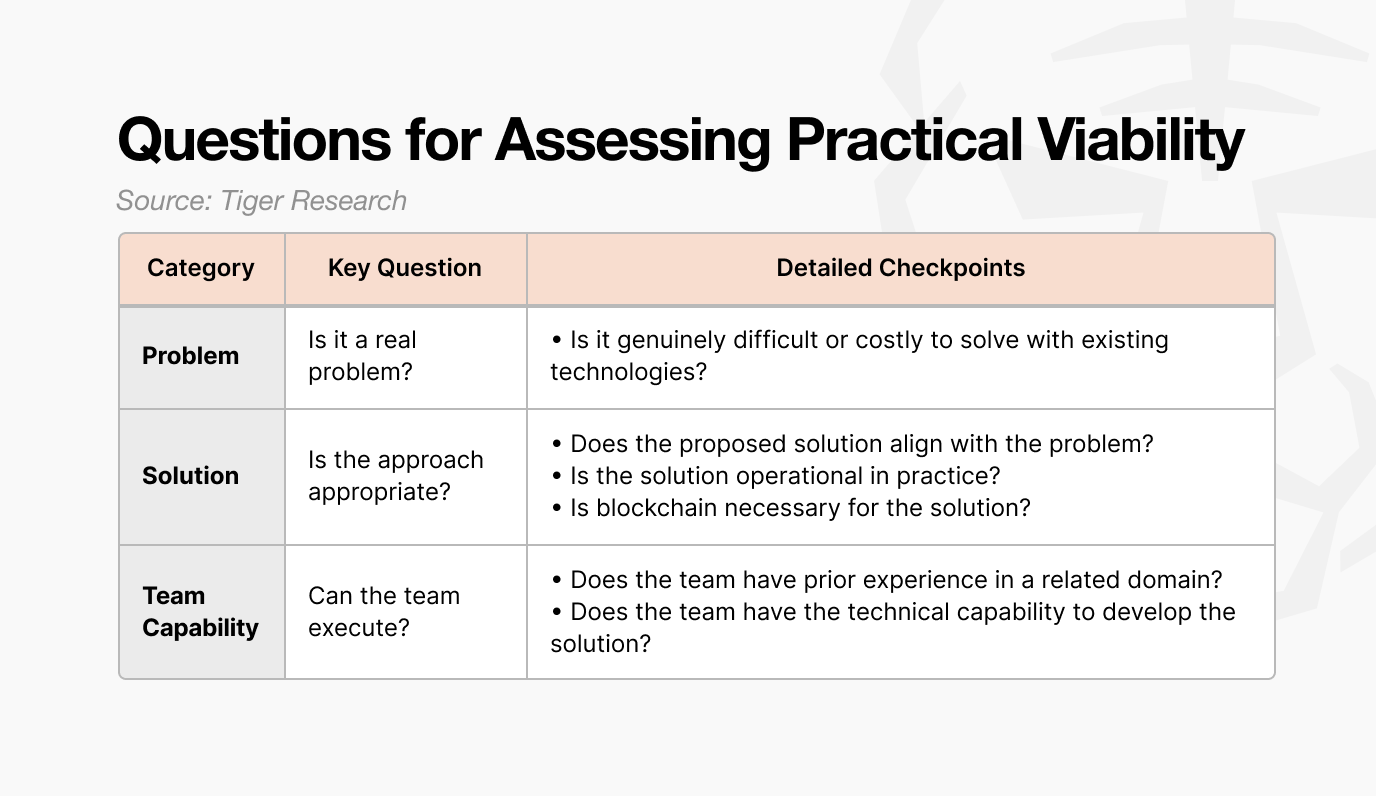

3. Three Key Questions for Assessing Practical Viability

Although the three projects operate on different timelines, they share a common characteristic: real-world viability.

Assessments of the same project often diverge. Some view it as solving real problems, while others dismiss it as overhyped. To reduce this gap in interpretation, at least three core questions must be asked.

Because most projects promote optimistic future narratives, answering these questions properly requires time and effort. Filtering out misleading or incomplete information is not straightforward. Projects that cannot answer these three questions with confidence may experience short-term price appreciation, but they are likely to fade when the next downturn arrives.

The current state of the crypto market is clearly unfavorable. That does not mean it is over. New experiments will continue, and the task is to evaluate what those efforts truly represent.

What matters now is realism.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.