In effect, safety measures exist, but the vehicle for growth does not

Korea’s virtual asset regulation is based on a pre-emptive approach shaped by past financial crises and now being applied to the Web3 industry. Over the past decade, regulatory efforts have largely prioritized investor protection, notably through the 2021 Specified Financial Transactions Act and the 2024 Virtual Asset User Protection Act.

There is limited progress toward institutional integration. The recent passage of amendments related to Security Token Offerings marks an initial step, alongside ongoing debate over four key issues:

Spot ETFs: The current administration continues to consider their introduction under election pledges and economic growth strategies.

KRW stablecoins: The Financial Services Commission supports fintech participation, while the Bank of Korea favors a bank-led consortium to preserve monetary stability.

Virtual asset taxation: Long postponed, taxation on individual transactions is now scheduled for implementation in 2027.

Exchange ownership restrictions: Proposed by the Financial Services Commission and opposed by the Digital Asset Exchange Alliance.

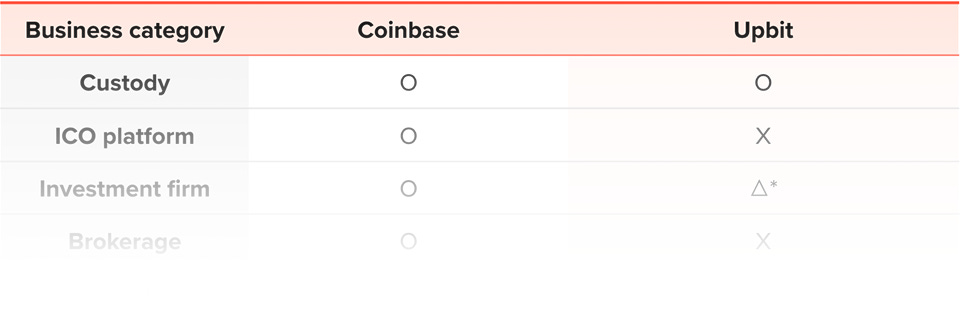

A key structural limitation is that exchanges have been confined to transaction intermediation, preventing expansion into custody, brokerage, or ICO platforms. Unlike Coinbase’s evolution into a comprehensive crypto financial platform, Upbit remains limited to exchange functions, generating little spillover for the domestic ecosystem.

In short, Korea’s regulatory framework has succeeded in risk prevention but fallen short in fostering industry growth. Despite active participation in the global Web3 market, Korea has yet to build a corresponding domestic ecosystem.

Closer dialogue with the industry is now needed to develop a regulatory model where investor protection and innovation can coexist.

Essential 2026 Crypto Regulations in South Korea. From the debate on Spot ETF approval to the conflict between the FSC and BOK over KRW-stablecoins, stay ahead with the must-know issues shaping the Korean market in 2026.

Core regulatory principle = “Pre-emptive regulation”

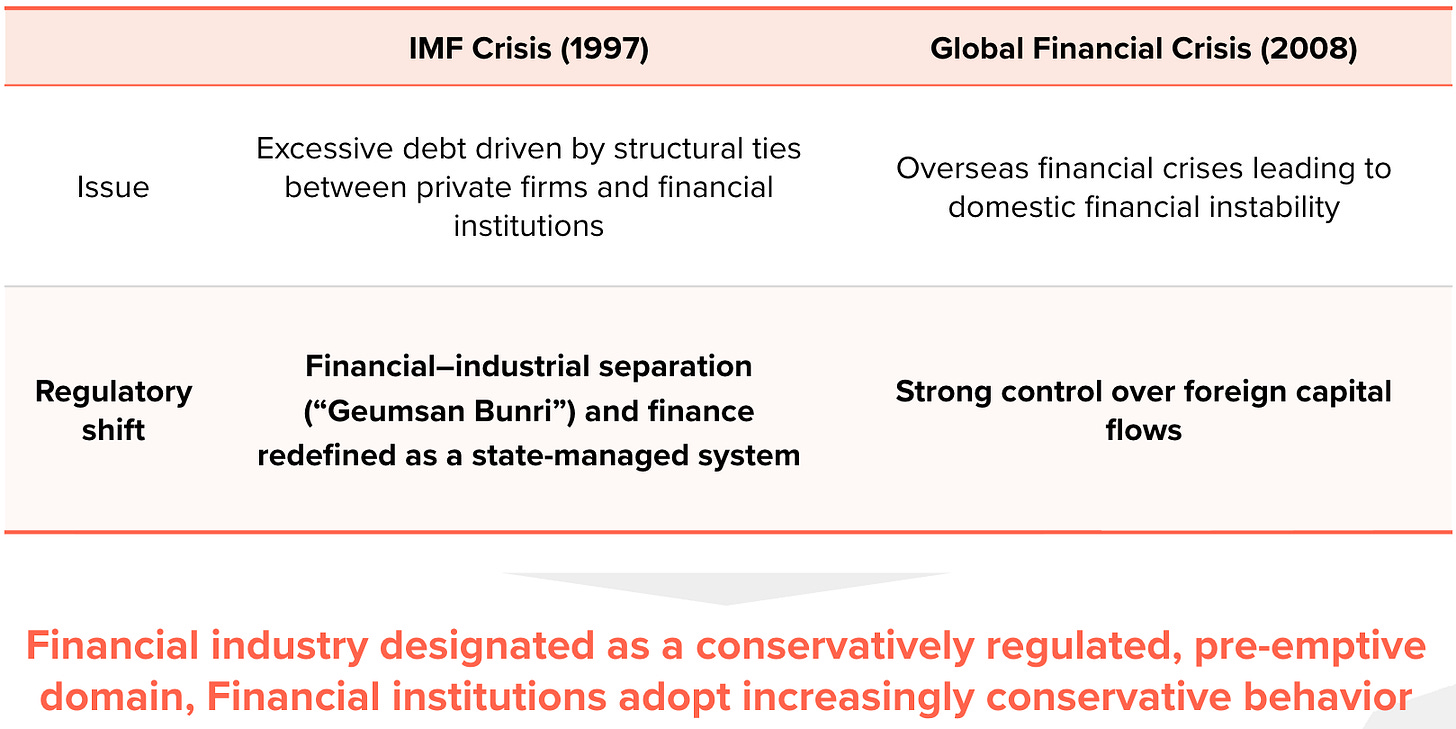

Korea’s pre-emptive regulatory stance shaped by the 1997 IMF crisis and the 2008 global financial crisis

Financial markets viewed less as self-regulating and more as systems requiring state management and control

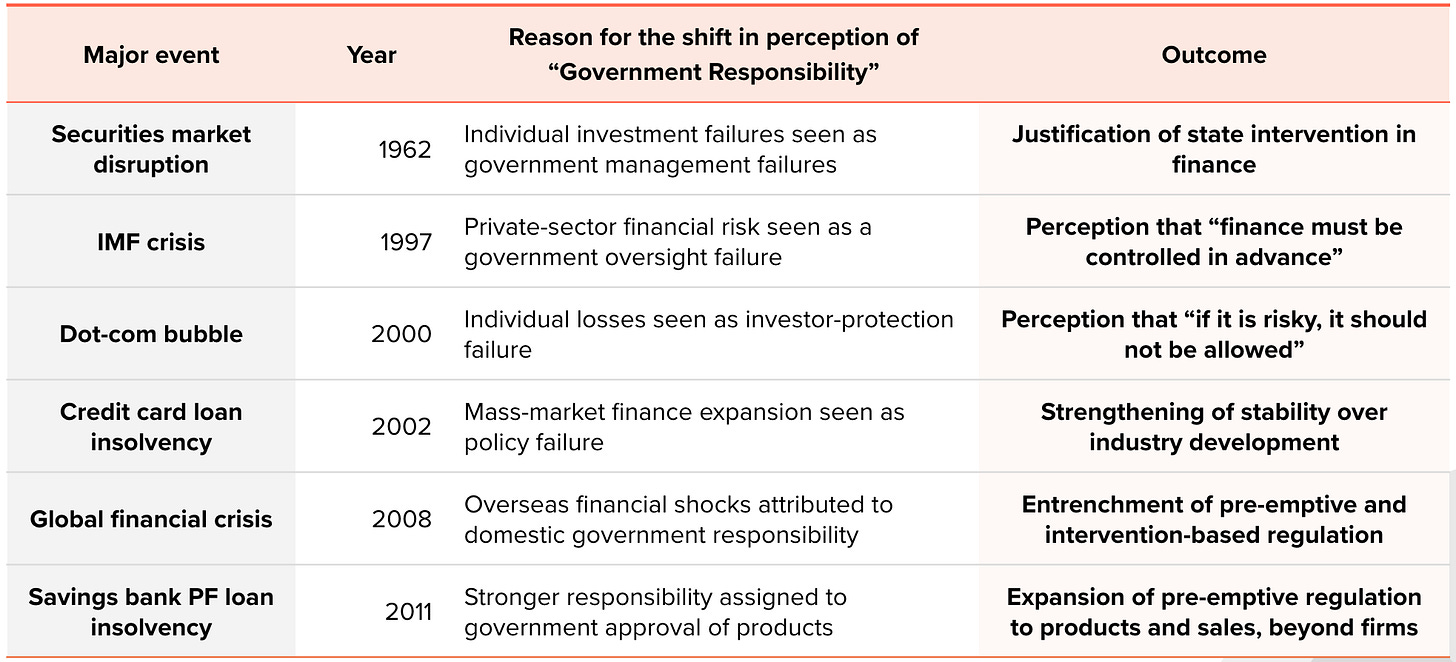

Culture of attributing failure to the government

Under a state-led growth model, failure framed as government mismanagement rather than individual judgment

Financial incidents shift loss responsibility to the state, creating political and regime risk

In response, the government strengthens preventive regulation to limit public choice

1) Specified financial transactions Act: Limited spillover effects

2021 hacking and money-laundering incidents at smaller exchanges led to revisions reinforcing exchange-centered regulation

KRW trading conditioned on bank real-name account partnerships, triggering closures of small and mid-sized exchanges unable to secure partnerships amid negative industry sentiment

Resulting oligopolistic market dominated by five major exchanges, including Upbit and Bithumb

Business licenses confined to trading functions, constraining ecosystem spillovers and preventing the formation of a native Web3 ecosystem

Essential 2026 Crypto Regulations in South Korea. From the debate on Spot ETF approval to the conflict between the FSC and BOK over KRW-stablecoins, stay ahead with the must-know issues shaping the Korean market in 2026.

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.