Global corporations are re-entering blockchain.

Unlike the speculative NFT boom of 2021, the current wave focuses on tangible business applications. Regulatory clarity has improved with ETF approvals, the EU’s MiCA framework, and the passage of the FIT21 Act in the US. At the same time, the stablecoin market has surpassed the combined scale of Visa and Mastercard, demonstrating practical utility.

Institutions such as JPMorgan, Goldman Sachs, and BlackRock are pursuing structured strategies rather than opportunistic moves. Their efforts in RWA tokenization, payments, and cross-border transfers are already producing measurable outcomes. A common factor among successful players is adherence to a clear framework.

That framework typically includes business case validation, capability assessment, blockchain selection, phased implementation, and ecosystem integration and expansion. Of these, blockchain selection is the most decisive. The platform chosen often determines whether a project succeeds or fails.

The challenge lies in the breadth of options. Dozens of new blockchains launch every day, each with distinct strengths and weaknesses. Industry-specific requirements further complicate the choice. Institutions must weigh five key criteria: completeness, available expertise, reference cases, security, and cost structure.

Tiger Research outlines a practical methodology for institutional blockchain adoption. Using Avalanche as a focal point, it details how the five-step framework can be applied and provides concrete examples of successful implementations.

1. Accelerating Institutional Entry into Blockchain

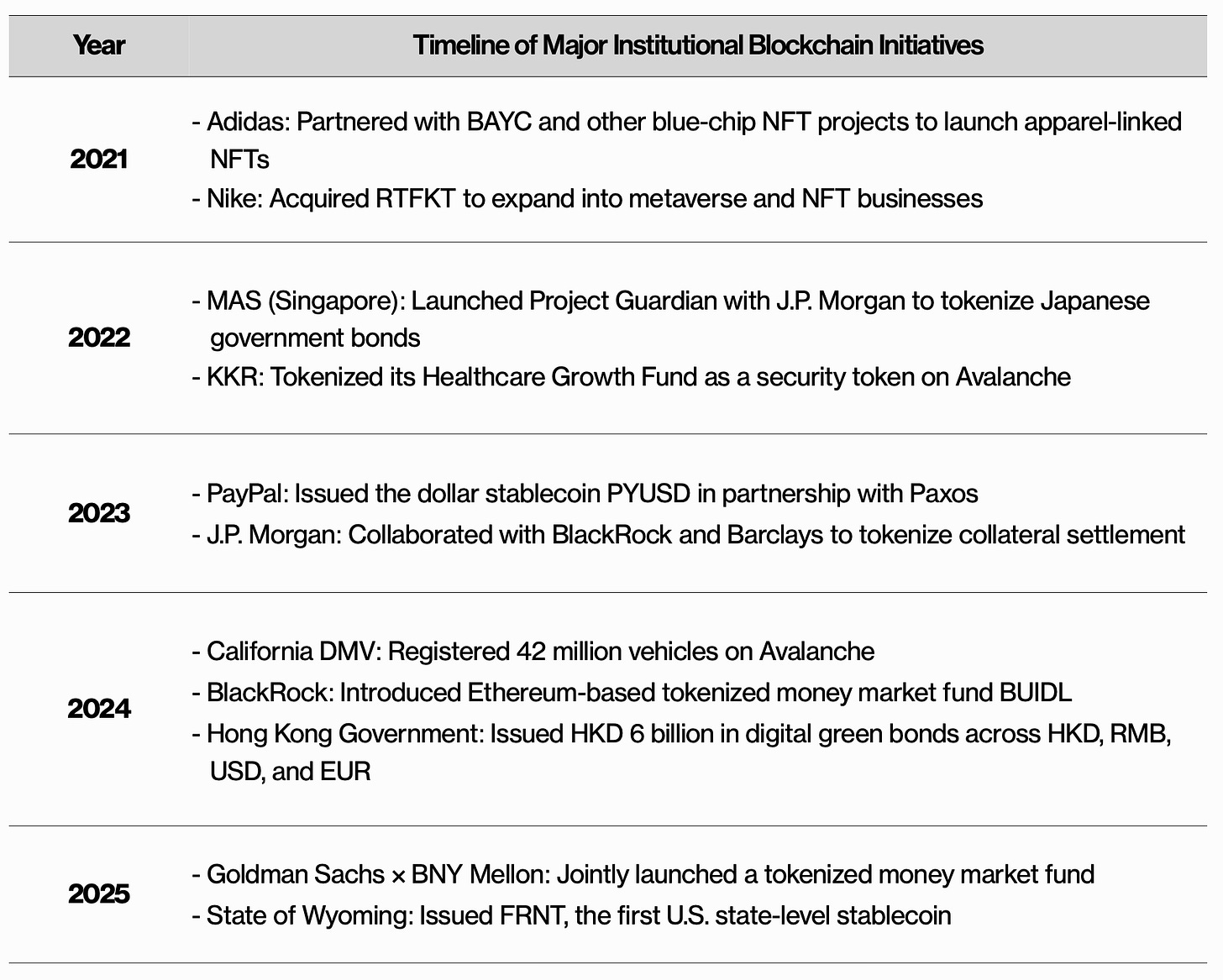

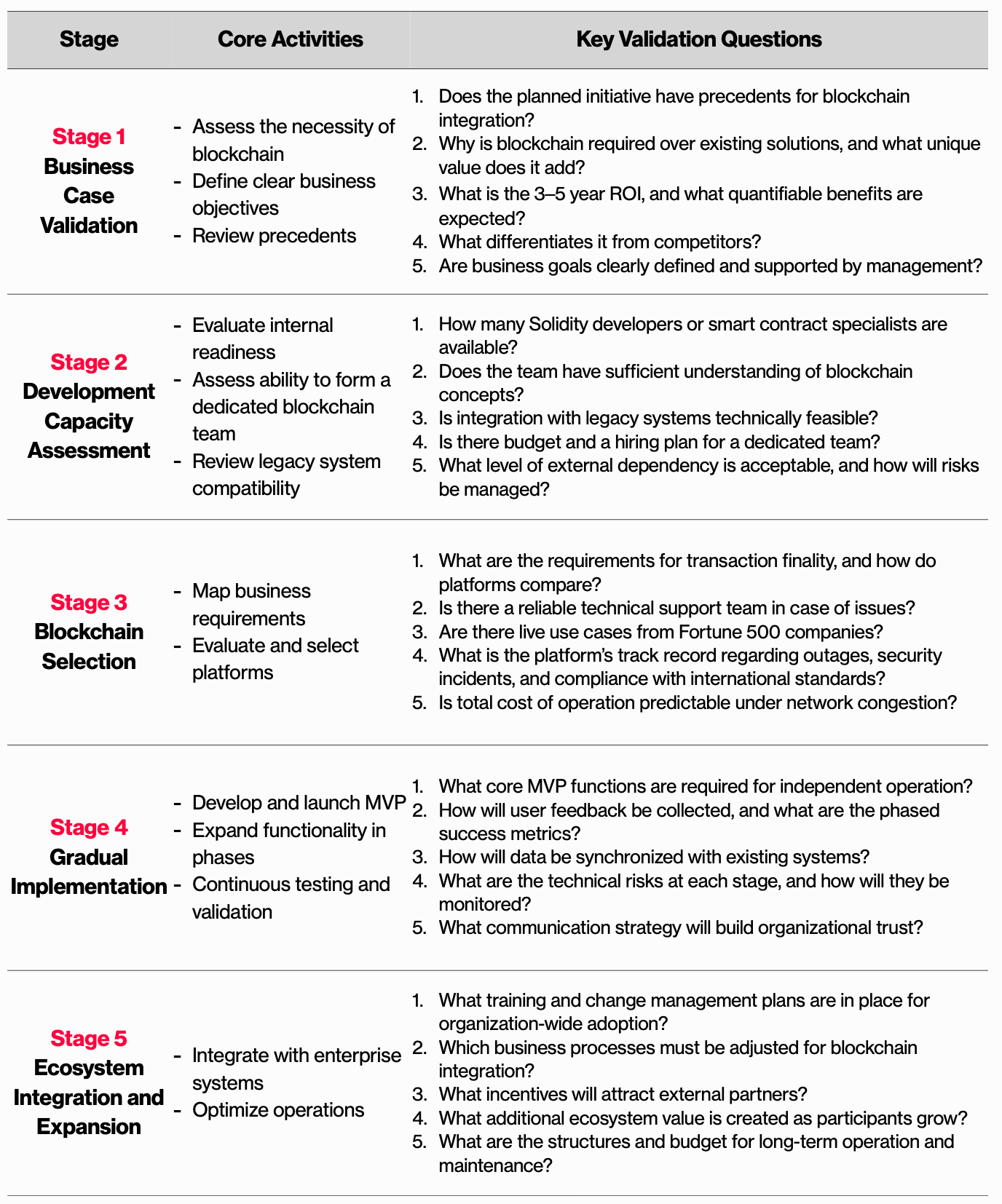

Visa, J.P. Morgan, PayPal, Nexon, and other global corporations have already entered blockchain-related businesses, with other institutions also considering entry. However, institutional engagement with blockchain is not entirely new. Similar activity was observed during the 2020–2021 NFT boom, though with a more speculative focus.

During the NFT boom, major corporations such as Nike, Adidas, LG, and Samsung Electronics entered the space. The NFT market expanded rapidly from USD 17.6 billion to more than 40 billion. Nike alone generated USD 185 million in revenue. However, most of these initiatives stalled, resulting in only short-term success.

The landscape shifted quickly after these initial gains. By late 2022, the sustainability of indiscriminate NFT ventures came into question. The collapse of FTX delivered a decisive blow. While the immediate triggers were high-profile failures such as FTX and Terra-Luna, the deeper issues were regulatory uncertainty and the absence of viable business models. This ushered in the so-called “crypto winter.”

The repercussions extended throughout the blockchain landscape. More than 13,000 employees were let go, and investment in startups plummeted by 80%, dropping from USD 21.2 billion to USD 4.1 billion. Institutional players such as Nike also began to withdraw, signaling that the market had reached the apex of a speculative FOMO cycle.

2025 shows a fundamentally different picture. Institutions are once again moving decisively into blockchain. This time, the movement is underpinned by regulatory clarity. The approval of crypto ETFs, the rollout of the EU’s MiCA framework, and the passage of the FIT21 bill in the U.S. House have provided a stronger foundation. These measures, combined with the Trump administration’s strategic Bitcoin reserve policy and new stablecoin legislation, have given institutions greater regulatory certainty.

On this regulatory foundation, tangible results are emerging—most notably in the RWA sector where the stablecoin market has expanded rapidly. In 2024, stablecoin transaction volume reached USD 27.6 trillion, surpassing the combined volumes of Visa (USD 25.8 trillion) and Mastercard. This scale indicates that blockchain adoption is moving beyond speculation and functioning as practical financial infrastructure.

Participation from leading U.S. financial institutions has also accelerated. A notable example is BlackRock’s BUIDL fund, which grew to USD 2.9 billion in assets within six months. Such growth reflects the direct impact of reduced regulatory uncertainty.

Today’s environment differs sharply from earlier cycles. Institutions have drawn lessons from past experiences, leading them to evaluate sustainable and necessary business models with greater scrutiny. Rather than pursuing opportunistic entry, they are adopting a more deliberate and strategic approach.

This shift is marked by a focus on creating real value. Use cases now include improving payment efficiency, enhancing liquidity through asset tokenization, and reducing costs in cross-border transactions. These concrete business benefits reinforce institutional confidence in blockchain adoption. With regulatory clarity, market maturity, and practical applications converging, institutions increasingly view the present as an opportune moment to enter.

2. A Framework for Institutional Blockchain Adoption

When evaluating blockchain initiatives, institutions should avoid proceeding simply because it is perceived as something that “must be done.” The first step is to validate whether blockchain is an essential next step to its business development by analyzing existing use cases. Institutions must then assess internal capabilities before selecting the appropriate blockchain technology, implementing it gradually, and expanding integration across the organization.

This table outlines a structured framework for institutional blockchain adoption. It has been developed based on accumulated consulting experience with enterprises. The objective of the five-step framework is to minimize risks by validating each stage systematically.

Stage 1: Business Case Validation

The most important part in the first stage is to determine whether blockchain technology is truly necessary for the problem at hand. Applying blockchain to cases that can be resolved with existing solutions only adds unnecessary complexity. Institutions must define clear business objectives and identify specific use cases where blockchain provides unique value.

At the current stage, the most compelling business areas are RWAs and payments. Gaming, customer loyalty programs, and IP or brand-driven applications are also gaining renewed attention. Using these representative cases, organizations should assess how closely their proposed initiatives align with areas where blockchain adoption has proven relevance.

Stage 2: Organizational Capability Assessment

The second stage involves assessing organizational readiness. Institutions must evaluate whether a dedicated blockchain team can be established and whether existing IT systems are compatible with blockchain integration. Conflicts with legacy systems are one of the primary reasons blockchain projects fail.

Blockchain development differs significantly from traditional technology stacks. For example, smart contract development requires Solidity, a programming language that is fundamentally different from widely used languages such as Java or Python. In addition, conventional databases allow administrators to alter or delete data, whereas blockchain is based on immutability. Once a transaction is recorded, it cannot be reversed, and errors must be corrected through new transactions.

These characteristics make it essential to evaluate the internal understanding of blockchain. Depending on the team’s expertise and training needs, institutions may need to consider new hires or external development support.

Stage 3: Blockchain Selection

In the third stage, institutions must select the blockchain that best matches their business requirements. With many platforms available, it can be difficult to identify the most suitable option. Choosing a blockchain to build upon is comparable to selecting AWS or another foundational infrastructure provider. A poor decision at this stage can lead to substantial migration costs later.

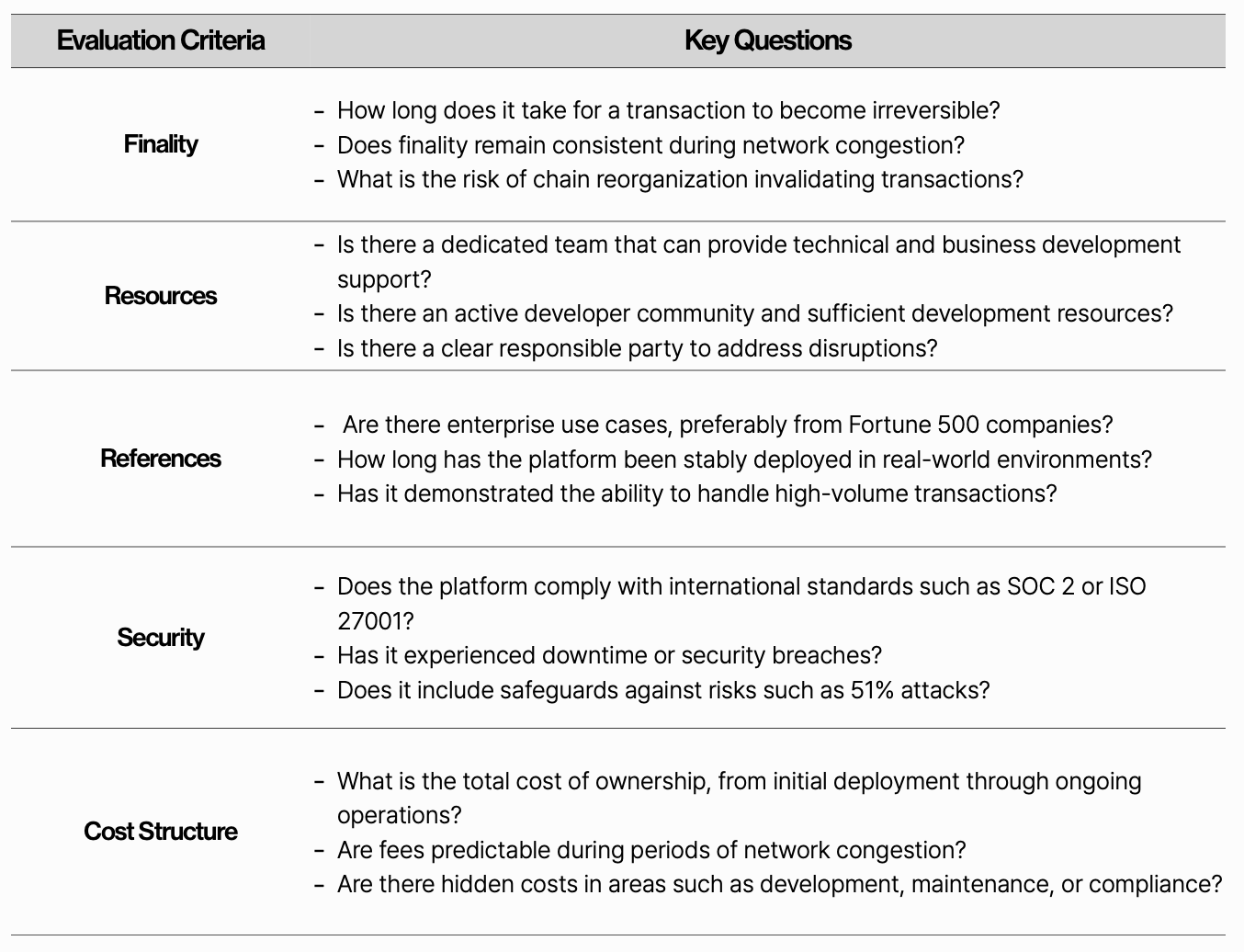

Institutions should weigh multiple factors when deciding which blockchain to use. These five factors are the most integral ones: finality, resources, references, security, and cost structure.

Finality refers to the point when a transaction becomes irreversible. While transactions per second (TPS) measure throughput, finality concerns settlement time, which is a separate and equally important issue. Weak support structures are another risk. Some foundations prioritize decentralization without establishing clear accountability when issues arise. A platform with both a strong developer community and dedicated technical support is therefore essential.

References build trust. When Fortune 500 companies or major financial institutions run production workloads on a platform, its credibility grows substantially.

Security should be assessed by examining the consensus mechanism, fault isolation features, and compliance with international standards. Past incidents of downtime or security breaches are red flags, as such events carry severe reputational risks for institutions.

Finally, cost structures must be evaluated beyond transaction fees. Platforms with fee spikes during congestion create unpredictable operating expenses. Institutions should account for the full cost of ownership, including development, operations, and compliance.

The most prudent long-term choice is a platform that meets all five criteria in a balanced manner, ensuring operational reliability and reducing strategic risk.

Stage 4: Phased Implementation

In the fourth stage, the blockchain system is put into practice. The most important principle is to avoid a “big bang” approach that attempts to deploy all features at once.

The process should begin with a minimum viable product (MVP) that contains only core functionality. For example, in building a supply chain management system, the initial release might focus solely on product tracking. Once this foundation is tested, additional features such as payments and inventory management can be introduced in stages.

Each phase requires rigorous testing. New features must be checked for compatibility with existing systems, and potential security vulnerabilities should be addressed before deployment. This iterative process improves the overall stability of the system.

One of the main reasons blockchain projects fail is the pursuit of a complete solution from the outset. In practice, user needs often differ from what was anticipated during the planning stage. By delivering small but concrete successes, organizations can build internal trust and credibility. This trust then becomes the basis for expanding blockchain adoption across the enterprise.

Stage 5: Ecosystem Integration and Scale

The final stage involves expanding the blockchain system across the organization and optimizing its operations. The key is not to simply add a new system, but to integrate it seamlessly into existing workflows.

A critical step is synchronizing blockchain with legacy databases. For example, a connector can be built so that transactions recorded in the accounting system are automatically written to the blockchain. At the same time, business processes should be redesigned to help employees adapt to the new environment.

Once internal alignment is achieved, external partners and customers can be brought into the network. The full value of blockchain emerges when multiple organizations participate. On its own, a blockchain may not differ significantly from a traditional database. As participation grows, however, transparency and trust increase exponentially.

The ultimate objective of blockchain adoption is therefore not limited to improving efficiency within a single enterprise. Its broader impact lies in reshaping collaboration across entire industries and generating new value. Only when these ecosystem-level transformations occur can a blockchain project be considered fully successful.

3. Blockchain for Enterprise Adoption: Avalanche

As outlined above, most stages in the blockchain adoption framework depend on internal organizational capabilities, with the exception of selecting the blockchain. Unless an institution chooses to build a blockchain from scratch, it will rely on an existing platform. Developing a proprietary blockchain requires years of work and hundreds of millions of dollars in investment, making it comparable to establishing an entirely separate business.

For this reason, most institutions adopt a blockchain that is already available in the market. The challenge is that blockchain functions as foundational infrastructure, so the choice of platform directly affects both the completeness of the project and its scalability. Selecting a platform with weak support structures slows development, while using one without proven security undermines service reliability.

From an institutional perspective, identifying the right blockchain is highly complex. The number of available platforms continues to expand, with new chains launching almost daily. The abundance of options has made the decision more difficult rather than easier.

Against this backdrop, a growing number of institutions are adopting Avalanche. Notable examples include Wyoming’s public stablecoin issuance, Toyota Blockchain Lab’s initiative to record vehicle lifecycle data and tokenize ownership, and Nexon’s development of MapleStory Universe on Avalanche.

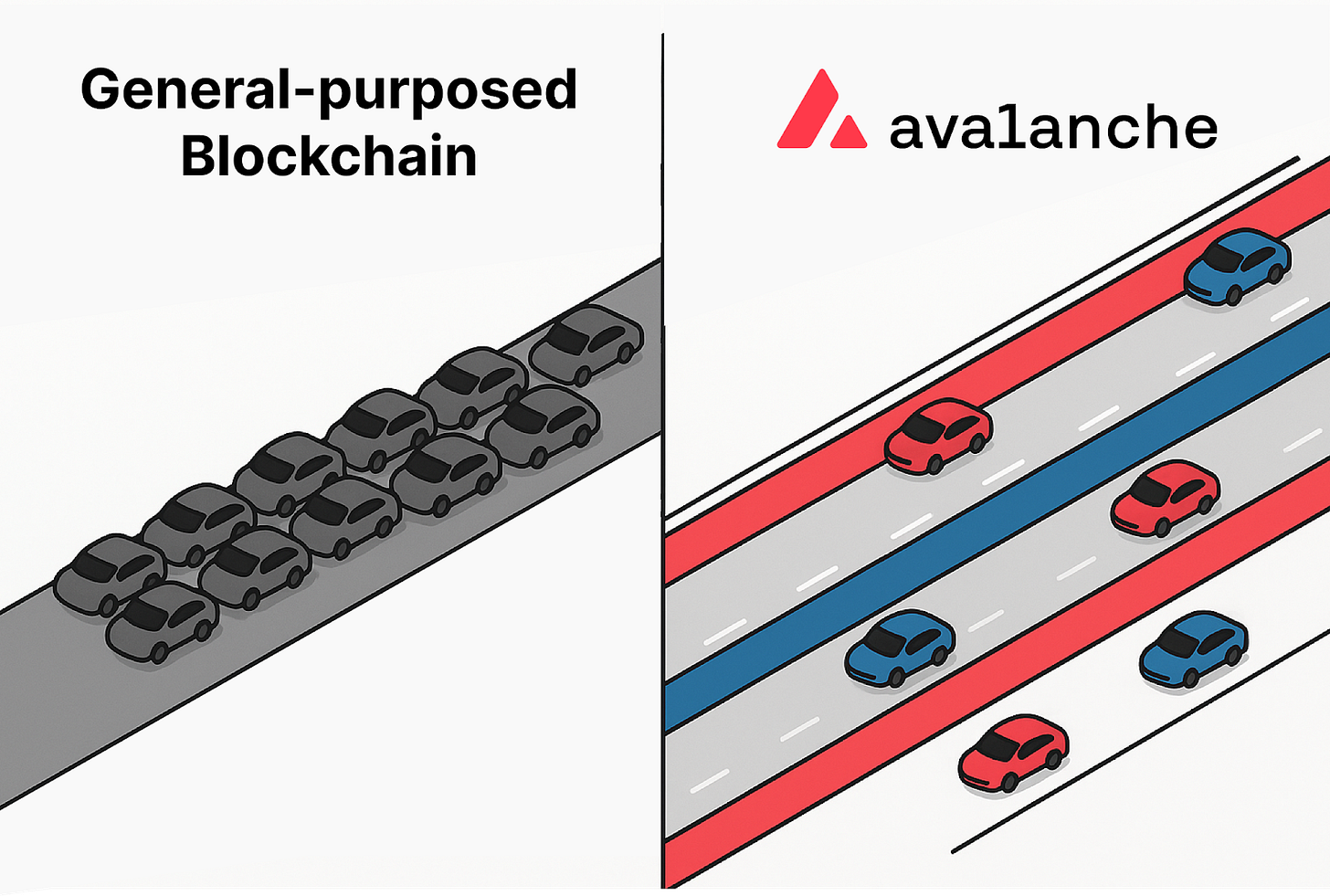

The reason institutions across diverse sectors are turning to Avalanche lies in its structural differentiation. Most blockchains process all activity on a single chain, which leads to performance bottlenecks and scalability constraints. Avalanche addresses these limitations with a novel architectural approach.

A simple analogy illustrates the difference. Traditional blockchains function like a single highway where all vehicles must travel. As traffic increases, congestion inevitably occurs. Avalanche, by contrast, operates multiple independent highways in parallel. Each highway has its own rules and toll system and does not share lanes or rest stops with others. As a result, congestion on one highway does not affect traffic on the others.

This parallel structure is why Avalanche is often described as a “network of networks.” It goes beyond simply running multiple independent chains. Each chain can be designed with different purposes and rules, yet they can still interconnect when needed. The architecture simplifies complex blockchain infrastructure while allowing institutions to adapt flexibly to their specific requirements.

Avalanche can be compared to a large urban transportation system. Multiple highways (individual chains) operate independently while remaining interconnected. Each institution can run its own chain while still communicating with others when needed.

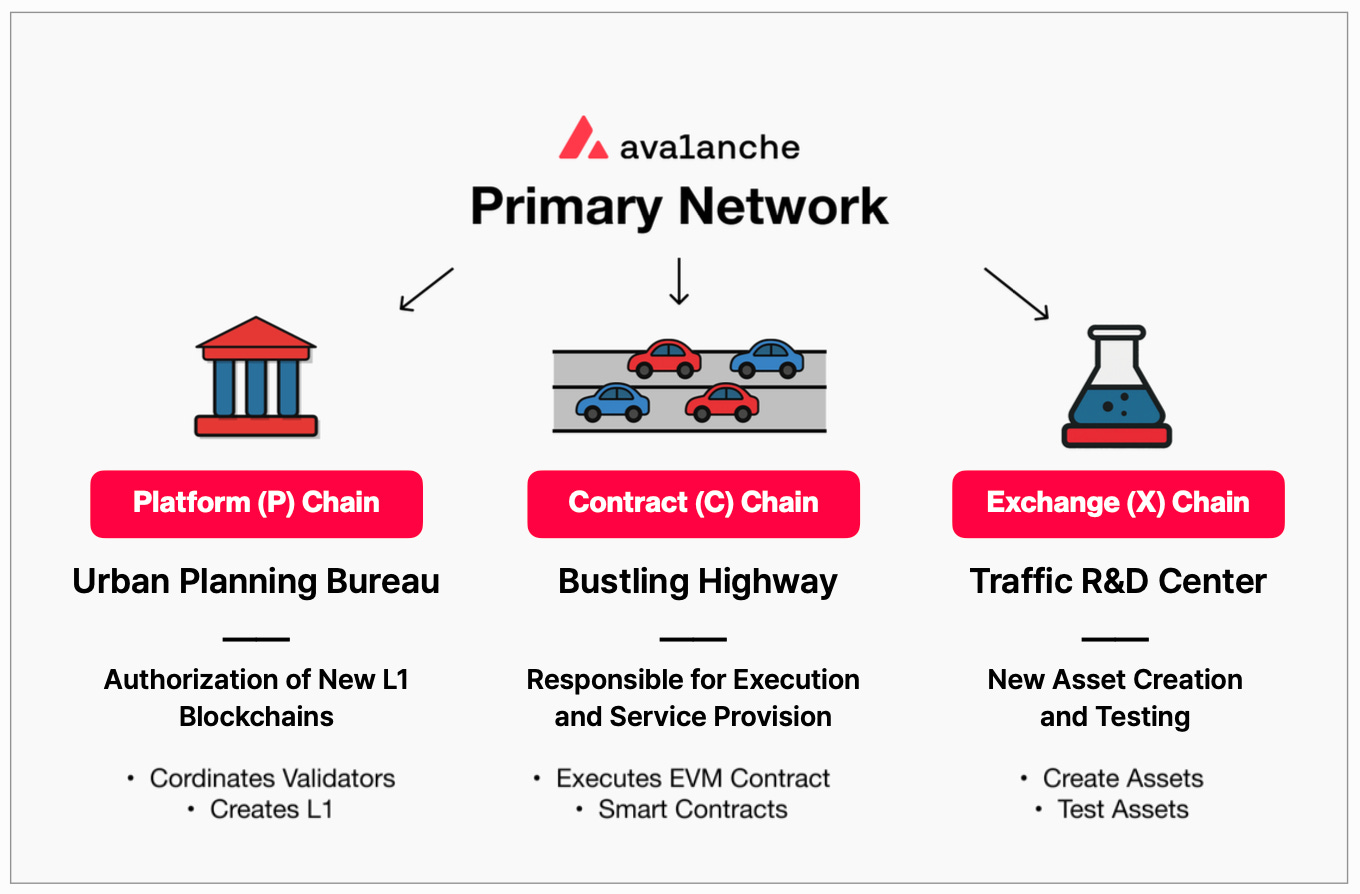

At the center of this system is the Primary Network, which acts as the central hub. It is composed of three core components:

P-Chain functions like a city planning department, responsible for creating and managing new blockchains.

C-Chain serves as the busiest highway, where most blockchain applications are executed.

X-Chain operates like a traffic R&D center, where new asset formation is tested.

Each component specializes in its own domain while remaining organically connected to the others. This allows institutions to leverage only the functions they need without having to master the underlying technical complexity. The intuitive and flexible design of this architecture is a key reason why many institutions choose Avalanche.

3.1. P-Chain (Platform Chain): The City Planning Department

The P-Chain functions as the central management office of the Avalanche network. In the city transportation analogy, the planning department that grants permits and oversees the construction of new highways. One of the reasons institutions adopt Avalanche is this structured governance layer.

The P-Chain’s most critical role is authorizing and creating new L1 blockchains. When an institution requires a dedicated chain, it can deploy a customized L1 through the P-Chain. Here, an L1 refers to an independently operated blockchain. This means institutions can build chains tailored to their own characteristics and requirements, similar to authorizing the construction of roads for logistics, passenger vehicles, or public transport in a city.

3.2. C-Chain (Contract Chain): The Busiest Highway

The C-Chain is where blockchain applications are executed. In the analogy, it is the busiest highway in the city, where traffic flows and commercial activity takes place. While the P-Chain handles management and authorization, the C-Chain delivers execution and services.

Its main advantage is Ethereum compatibility. The C-Chain fully supports the Ethereum Virtual Machine (EVM), which allows smart contracts developed for Ethereum to run without modification. For institutions, this compatibility reduces development time and cost, as existing Ethereum-based solutions can be directly deployed.

In practice, any smart contract written in Solidity, the most widely used programming language in blockchain, can operate on the C-Chain. This is akin to providing a new, wider, and faster highway that follows the same traffic rules and lane structures as Ethereum.

3.3. X-Chain (Exchange Chain): The Research and Development Center

The X-Chain is the environment for experimentation and innovation within Avalanche. It can be compared to a research and development center for testing new transportation systems and vehicle technologies. While the P-Chain provides management and the C-Chain handles execution, the X-Chain focuses on future development.

Its unique capability lies in the creation and testing of “smart assets.” Unlike conventional cryptocurrencies, assets on the X-Chain can be programmed with complex rules. Examples include tokens that cannot be transferred until a specific date or assets that can only be used under certain conditions. Such features are particularly valuable when digitizing traditional financial instruments such as stocks or bonds. Institutions exploring tokenization of complex financial products can use the X-Chain to design and test them.

3.4. ICM (Interchain Messaging): The Highway Interchange Network

Avalanche’s full potential is realized when its chains interact. This is enabled by Interchain Messaging (ICM), which functions like interconnecting roads that link separate highways.

Through ICM, an institution’s dedicated blockchain can operate as part of a larger integrated system. For example, digital currency issued on a bank’s chain could be used directly on a corporate partner’s chain. Each chain runs independently but can connect seamlessly when required.

This interoperability is critical because of network effects. As new institutions join Avalanche, they can immediately leverage the infrastructure and services already built by others. Much like a newly constructed highway becomes instantly useful once it connects to the existing road network, every additional participant strengthens the overall ecosystem.

4. Advantages of Avalanche

The P-Chain, C-Chain, and X-Chain form the technical foundation of Avalanche. The question for institutions, however, is how this architecture translates into concrete advantages. While the Primary Network’s three chains provide a strong technical foundation in and of itself, institutions choose Avalanche because of the practical benefits built on top of this foundation.

A central strength is that institutions can deploy customized blockchains (L1s) optimized for their business needs, while still leveraging the security and interoperability of the broader Avalanche ecosystem. This combination offers both independence and connectivity: institutions can design specialized features while maintaining seamless interaction with other chains and services.

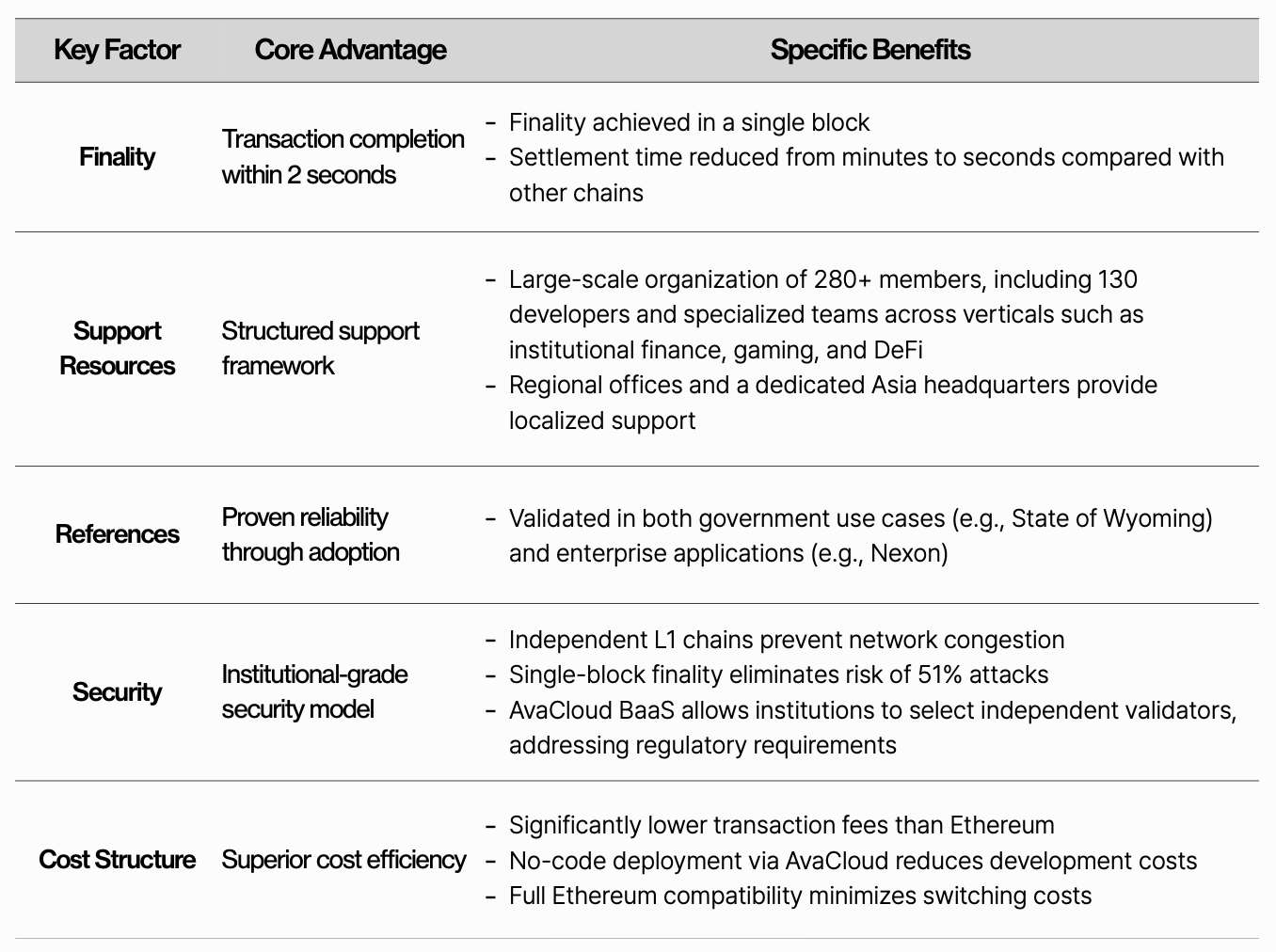

Beyond these design features, Avalanche should be evaluated using the five key selection criteria outlined in Chapter 2: finality, resources, references, security, and cost structure. Across each of these dimensions, Avalanche demonstrates specific advantages that align with institutional requirements. The following sections examine these strengths in detail.

4.1. Finality: Transaction Completion in Two Seconds

One of the most important considerations for institutions adopting blockchain is the point at which they can notify customers that a transaction is final. While many focus on TPS, finality is far more critical. TPS reflects how many transactions a system can process at once, but finality determines when a transaction becomes irreversible.

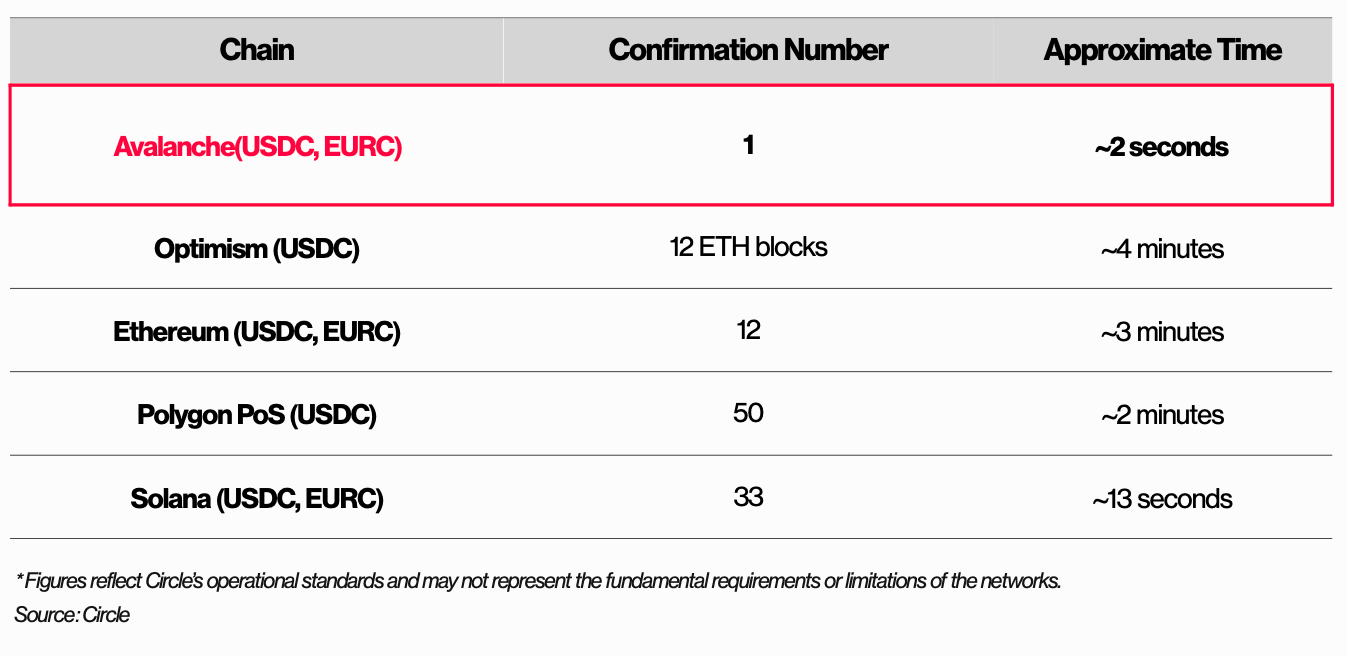

Avalanche achieves finality in a single block, or roughly two seconds. According to Circle’s API platform, both USDC and EURC transactions on Avalanche require only one confirmation, compared with minutes on most other chains.

From a business perspective, the implications are significant. A payment service built on Circle’s USDC using Avalanche can notify customers of payment completion in two seconds. On other chains, merchants may need to keep customers waiting minutes at the point of sale. This not only degrades the customer experience but also reduces throughput, directly affecting revenue.

4.2. Support Resources: Structured Organizational Backing

One of the biggest concerns for institutions entering blockchain is the lack of reliable support. Many blockchain projects emphasize decentralization but provide no clear support entity. As a result, institutions often cannot expect the level of service they receive from traditional IT infrastructure providers.

Avalanche has taken the opposite approach. Its developer, Ava Labs, operates a large-scale organization of more than 280 staff, far larger than most blockchain development teams. This reflects a clear commitment to providing systematic, professional support for institutions.

The breakdown of its workforce underscores this strategic focus. Nearly half of the staff, about 130 people, are developers dedicated to ensuring technical stability and continuous improvement. For institutions, this translates into confidence that immediate support is available when issues arise.

The ecosystem growth team, numbering around 40, is not a conventional sales function but is divided into specialized groups: Institutions and Capital Markets, Gaming, Consumer, DeFi, and International. Each team provides tailored services with deep expertise in their respective domains.

The marketing and PR function, also about 40 people, is similarly specialized. It includes a dedicated press relations group managing communication with major media outlets, ensuring institutions receive comprehensive communication support. Ava Labs also maintains legal and compliance specialists, human resources staff, and other corporate functions that reinforce institutional engagement.

Ava Labs’ real point of differentiation lies in its localized support structure. Among major mainnets, it is the only one with a dedicated Asia headquarters, staffed with around 15 personnel including regional leads. This team covers six markets: Korea, Japan, Singapore, Hong Kong, Vietnam, and Malaysia–Indonesia. Beyond Asia, Ava Labs has also placed dedicated business development staff in India, the Middle East, Türkiye, the broader MENA region, and Latin America, ensuring global reach.

The core of this localization strategy is a tailored approach to each country’s regulatory and business environment. Regional leads engage directly with institutions, applying local knowledge to address specific needs. As projects mature, they are supported by Ava Labs’ central institutional finance and marketing teams, combining global expertise with localized execution.

For institutions, this structured support transforms Avalanche from a purely technical platform into a trusted partner capable of providing both global standards and market-specific solutions.

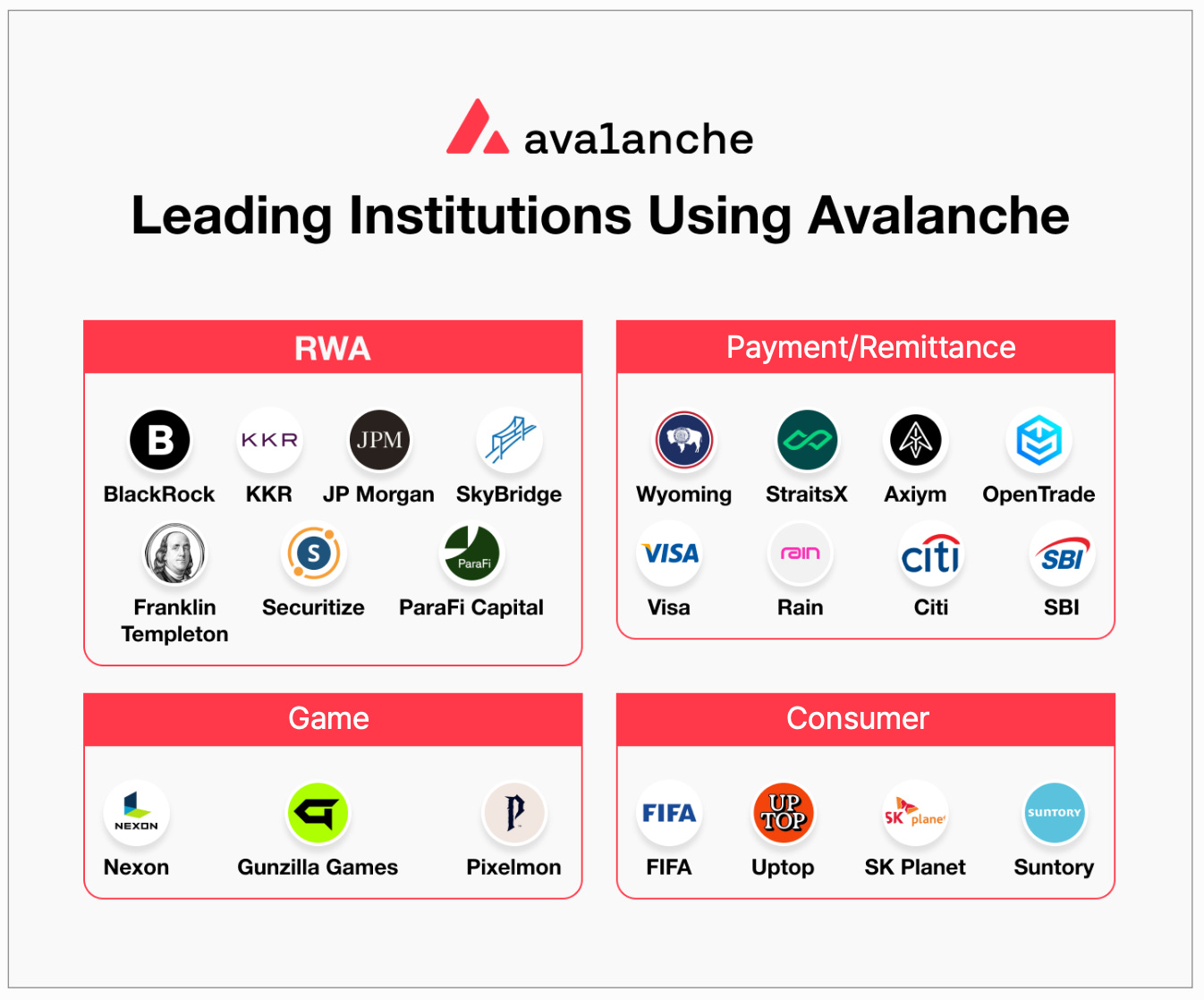

4.3. References: Trust Proven Through Adoption

When evaluating blockchain platforms, institutions often ask a simple question: “Which platforms are other institutions using?” For enterprises and regulators, proven reliability in real-world operations outweighs theoretical performance metrics. In practice, trust is king.

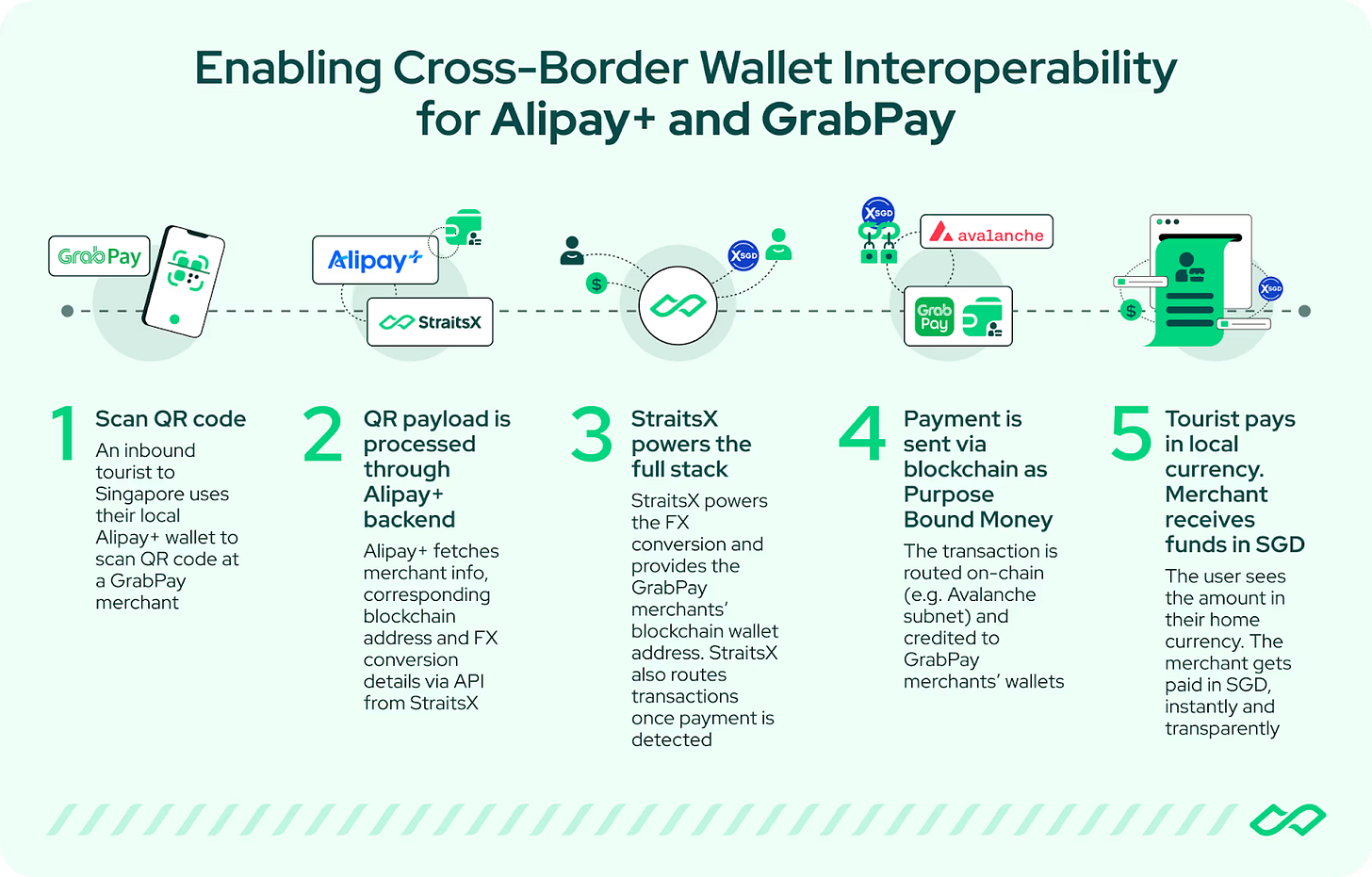

Avalanche has earned that trust through government-level approvals. In Singapore, the Monetary Authority of Singapore (MAS) approved a cross-border payment system developed by StraitsX in partnership with Grab and Alipay. The system uses the stablecoin XSGD and is already integrated into daily consumer services. Regulatory approval following rigorous review indicates that Avalanche meets institutional standards of technical maturity and security.

In the United States, trust has been validated at an even higher level. The State of Wyoming selected Avalanche as the development platform for its public stablecoin FRNT. After pilot testing, Avalanche was confirmed as the final network for issuance. Being chosen as the infrastructure for a state-backed digital currency represents one of the strongest signals of credibility available.

Enterprises have demonstrated similar confidence. Nexon launched MapleStory Universe (MSU) on a dedicated Avalanche chain. This was not a limited experiment but the integration of a major game IP with tens of millions of users. Success required both high transaction throughput and reliable service stability. Nexon’s choice of Avalanche for such a critical project is a direct endorsement of its technical reliability.

Across these examples, the common theme is clear. Avalanche has passed stringent regulatory reviews, been deployed in live commercial services, and been adopted by large enterprises for core businesses. These precedents create a strong signal that provides confidence to subsequent institutional adopters.

In the end, institutions are choosing Avalanche not only for theoretical advantages but also for trust demonstrated in practice. Its proven stability and reliability in production environments form the foundation on which broader adoption continues to build.

4.4. Security: Institutional-Grade Safeguards

Security remains one of the main barriers to institutional blockchain adoption. A single breach can undermine trust in the entire enterprise. Risks manifest in multiple forms, including network outages, 51% attacks, and regulatory compliance failures.

1) Network Outages

The most common operational risk is network congestion that leads to outages. In many blockchains, all services share a single network, so a disruption in one service can halt the entire system.

Avalanche resolves this structurally by enabling institutions to operate independent L1 blockchains. For example, traffic surges on a gaming L1 do not affect a financial institution’s chain. Each institution can define its own gas token and validator requirements, achieving full security isolation.

2) 51% Attacks

A more severe risk is the 51% attack, where an attacker gains majority control of the network to reverse confirmed transactions. For instance, an attacker might deposit crypto into an exchange, withdraw fiat, then invalidate the deposit to double-spend assets.

Avalanche makes such attacks structurally unfeasible through permissioned validator sets where network owners control validator membership. Attackers cannot gain majority control because they cannot insert their own validators into the approved set. This sovereign control over the validator set eliminates the fundamental attack vector entirely.

3) Regulatory Risk

Unlike the previous two risks, regulatory compliance is a legal and institutional challenge. Many enterprises hesitate to use public blockchains because their open, permissionless design conflicts with jurisdictional requirements. For example, if individual retail participants validate transactions or if everyone can view bank transfers, compliance with financial regulations becomes impossible. Key management also raises concerns, as institutional keys require strict custodial standards.

AvaCloud’s Blockchain-as-a-Service (BaaS) addresses these issues directly. Institutions can select independent validators and configure requirements such as geographic location, KYC/AML procedures, or specific licenses. This allows them to operate private or semi-private blockchains that comply with national regulations while still benefiting from Avalanche’s security model.

In addition, AvaCloud incorporates the proprietary eERC (Encrypted ERC) token standard. This masks transaction details and participant information from public view while enabling independent auditors to access masked data through designated auditor accounts.

Finally, AvaCloud offers Wallet-as-a-Service (WaaS) with institutional-grade, non-custodial key management. Institutions can retain full control of their cryptographic keys while remaining compliant with regulatory standards.

Taken together, these layered safeguards provide a level of security and compliance flexibility that is difficult to match among other blockchain platforms.

4.5. Cost Structure: Superior Efficiency

The final consideration in blockchain adoption is cost. No matter how advanced the technology, adoption is difficult if expenses are excessive. Institutions in particular demand clear ROI, making economic viability essential. Avalanche addresses this requirement with an efficient cost structure.

1) Transaction Fees: Cent-Level Competitiveness

The most direct operating expense is transaction fees. Avalanche maintains fees at a significantly lower level compared with major competitors. While Ethereum’s fees can surge to tens of dollars per transaction during periods of congestion, Avalanche typically processes transactions at only a few cents.

For real-world businesses, the savings are substantial. Payment services or tokenization platforms that process tens of thousands of transactions daily can save hundreds of thousands of dollars annually in operating costs purely from lower transaction fees.

2) Operating Costs: Reduced Management Burden with AvaCloud

Avalanche also offers AvaCloud, an AWS-like service that enables institutions to build customized blockchains with no-code deployment. This shortens time-to-market and reduces upfront development expenses.

Equally important, AvaCloud manages the operational complexity of running a blockchain, including node management, upgrades, and 24-hour monitoring. Institutions do not need to establish their own internal operations teams, which eliminates significant costs related to hiring specialized staff and building management systems.

This allows organizations to focus on their core business while still operating a reliable blockchain service. For large-scale adoption, AvaCloud also offers tailored pricing policies, further easing the cost burden. By optimizing both initial deployment and ongoing operations, Avalanche maximizes cost efficiency throughout the lifecycle.

3) Switching Costs: Leveraging Existing Skills and Tools

Reduced switching costs also lower overall development expenses. The key factor is that the C-Chain is fully compatible with Ethereum. Institutions can utilize existing Solidity developers without retraining or hiring new specialists.

Organizations already operating on blockchain benefit even more. Smart contracts and development tools built for Ethereum can be deployed on the C-Chain without modification. This allows institutions to reuse proven code, accelerating development while maintaining security. Shorter migration periods and lower conversion costs are natural outcomes of this compatibility.

5. Institutional Adoption of Avalanche

Avalanche is currently the blockchain platform with the largest number of institutional deployments. More than 100 adoption cases have been recorded to date, a figure that carries significance beyond its scale. It demonstrates that Avalanche’s technical strengths and cost efficiency have been validated in practice.

This strong track record directly translates into institutional trust. In recent platform selection processes, Avalanche has emerged as a top priority for many enterprises. Adoption is particularly strong in RWA tokenization, but extends across a range of sectors, underscoring the platform’s versatility.

5.1. RWA

Avalanche has become a preferred platform for global financial institutions in RWA tokenization because it satisfies the stringent requirements of traditional finance. Institutions adopting blockchain must remain fully compliant with existing regulatory standards, and Avalanche provides the flexibility to meet those needs.

Through dedicated blockchains, Avalanche allows institutions to combine public and private features. For example, validators can be restricted to control data access, and whitelisting mechanisms can ensure that only users meeting specific requirements, such as completing KYC, are permitted to transact.

From a functional perspective, transaction finality is critical in trading real assets such as real estate or bonds. Avalanche delivers settlement in one to two seconds, with capacity for high-volume processing comparable to conventional financial systems.

Cost efficiency is another advantage. Transaction fees remain predictably low, enabling large-scale institutions to tokenize multimillion-dollar funds or real estate assets while maintaining economic viability and operational security.

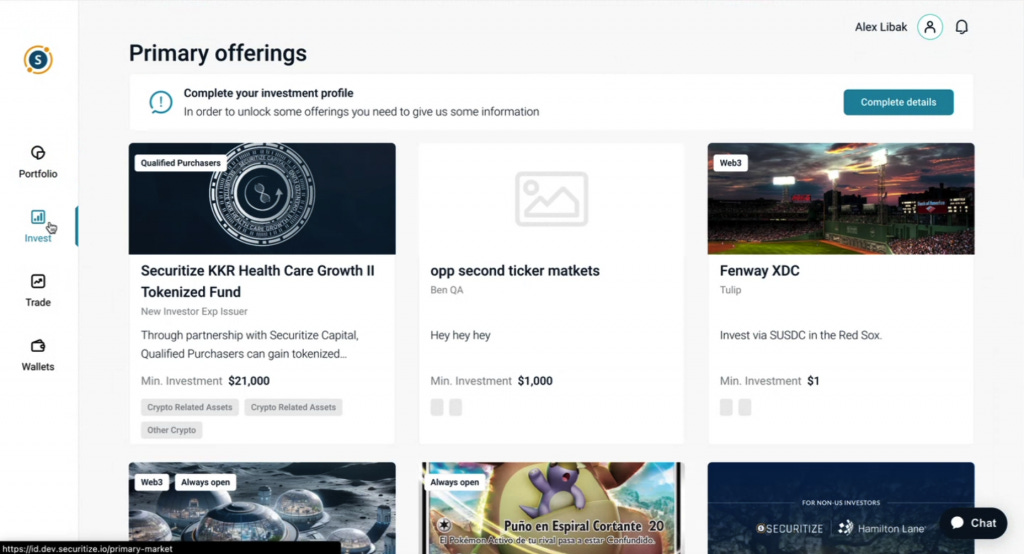

Among the many examples of RWAs, one of the most notable is the tokenization of KKR’s healthcare fund. Founded in 1976, KKR is a U.S.-based global investment firm and a heavyweight in the private equity industry, managing over USD 500 billion in assets.

KKR tokenized its Healthcare Strategic Growth Fund II on the Avalanche blockchain. This fund is a traditional private equity vehicle that provides growth capital to healthcare companies across North America, Europe, and Israel. The tokenized version, issued on the RWA platform Securitize under the ticker SKHC, represents a portion of the fund.

This case demonstrates Avalanche’s ability to meet the complex regulatory requirements of large financial institutions while still delivering the benefits of tokenization. The adoption of Avalanche by a top-tier traditional financial institution such as KKR underscores the platform’s credibility and practical utility for institutional-grade applications.

5.2. Payments/Remittances

Traditional cross-border payment systems face structural limitations. Transactions often take three to five days to settle because they must pass through multiple correspondent banks. High SWIFT fees and opaque foreign exchange markups make it difficult for recipients to know the final amount in advance.

Blockchain-based payment systems are increasingly seen as a solution, but to succeed they must satisfy three key conditions: fast settlement, predictable low costs, and full regulatory compliance. Avalanche meets all three.

Avalanche reduces settlement time to just two seconds, transforming processes such as payroll or trade settlement by freeing capital almost instantly. Because transactions achieve irreversible finality with minimal risk of reorganization, recipients can use funds immediately upon transfer.

Cost efficiency is equally critical. Avalanche offers a fee structure more than 90 percent cheaper than conventional bank transfers. This advantage is especially significant for frequent small-value transactions, such as global payroll, freelancer payments, or recurring cross-border commerce.

Regulatory compliance remains the decisive factor in real-world deployment. Avalanche’s differentiator is its ability to build customized blockchains that embed compliance requirements. Institutions can configure validators to operate within specific jurisdictions or restrict transactions to users who have completed KYC. This allows regulatory rules covering foreign exchange, anti-money laundering, and tax reporting to be applied automatically. The result is reduced compliance workload while ensuring adherence to jurisdictional standards.

A notable example is StraitsX’s collaboration with Alipay+ and GrabPay. In November 2024, they launched a cross-border payment system on Avalanche in Singapore. Overseas tourists can pay at GrabPay merchants using their domestic payment apps, while merchants are instantly settled in StraitsX’s XSGD stablecoin. This eliminates the long settlement delays of traditional systems and establishes a real-time payments model.

Avalanche plays a central role in this model due to its fast settlement speed, low cost, and compatibility with other blockchains. With sub–two-second finality and full EVM compatibility, Avalanche is optimized for real-time payments and integration with existing systems. This makes it a representative case of Avalanche’s suitability in the payments and remittances sector.

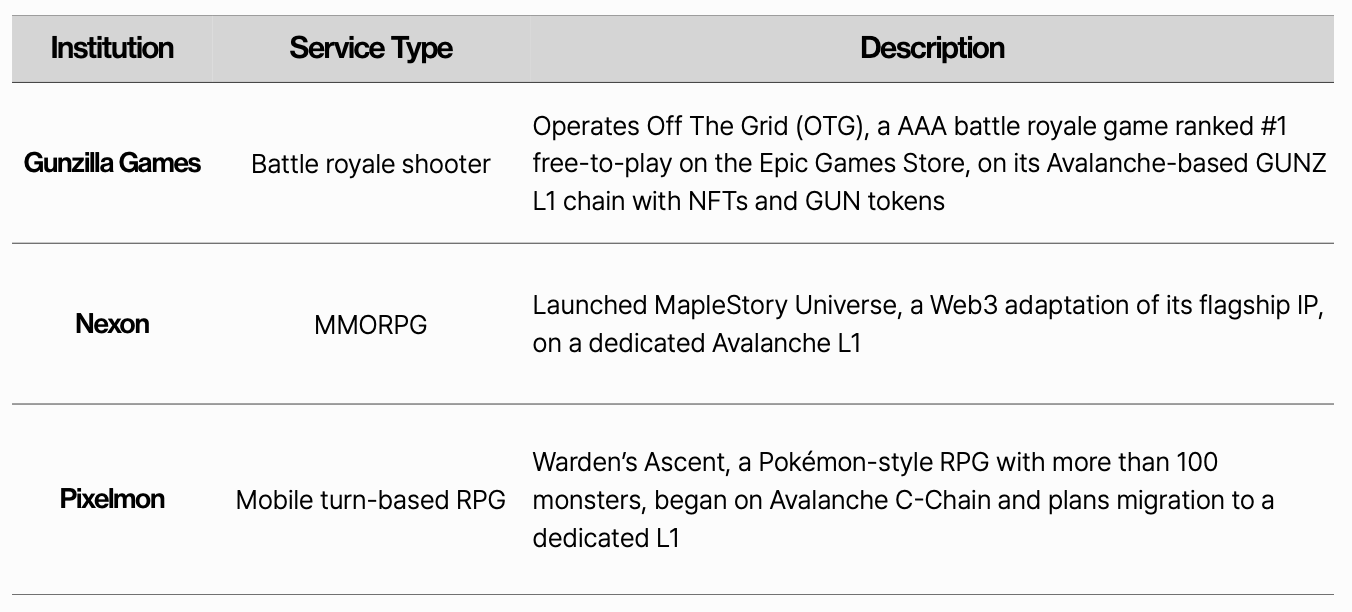

5.3. Gaming

Legacy blockchain platforms faced critical limitations in gaming, including slow processing speeds, high fees, and complex development environments. In games, where real-time interaction is essential, even seconds of delay degrade the user experience. Avalanche addresses these issues with features designed specifically for gaming.

Avalanche’s rapid finality meets the industry’s core requirements. When a player purchases an item or activates a skill, the transaction is reflected instantly. In tournaments or competitive gameplay, transactions are processed almost simultaneously, eliminating latency-driven unfairness. Instant settlement also prevents fraudulent activity such as post-payment reversals.

The multi-chain structure allows each game to operate on a dedicated blockchain. Even if traffic surges on a popular title or during a large NFT release, other games remain unaffected. This design enables developers to focus on gameplay without concerns about network congestion. ICM further connects games across different blockchains, allowing tokenized items to be exchanged freely and supporting concepts such as metaverses and cross-game economies.

Developers can also tailor blockchain parameters to the needs of each game genre. High-throughput settings suit action games, while stability-focused configurations are better for strategy games. Independent fee models keep transaction costs predictable, unaffected by mainnet price fluctuations. Games can even design their own tokens for transaction fees, staking, or reward mechanisms, providing additional incentives to players while strengthening in-game economies.

Through ICM, multiple games share liquidity and assets, forming an integrated economy. With external links to financial services and data providers, developers can also incorporate advanced DeFi functions. The result is an ecosystem that extends beyond individual titles to create a broader blockchain-enabled gaming economy.

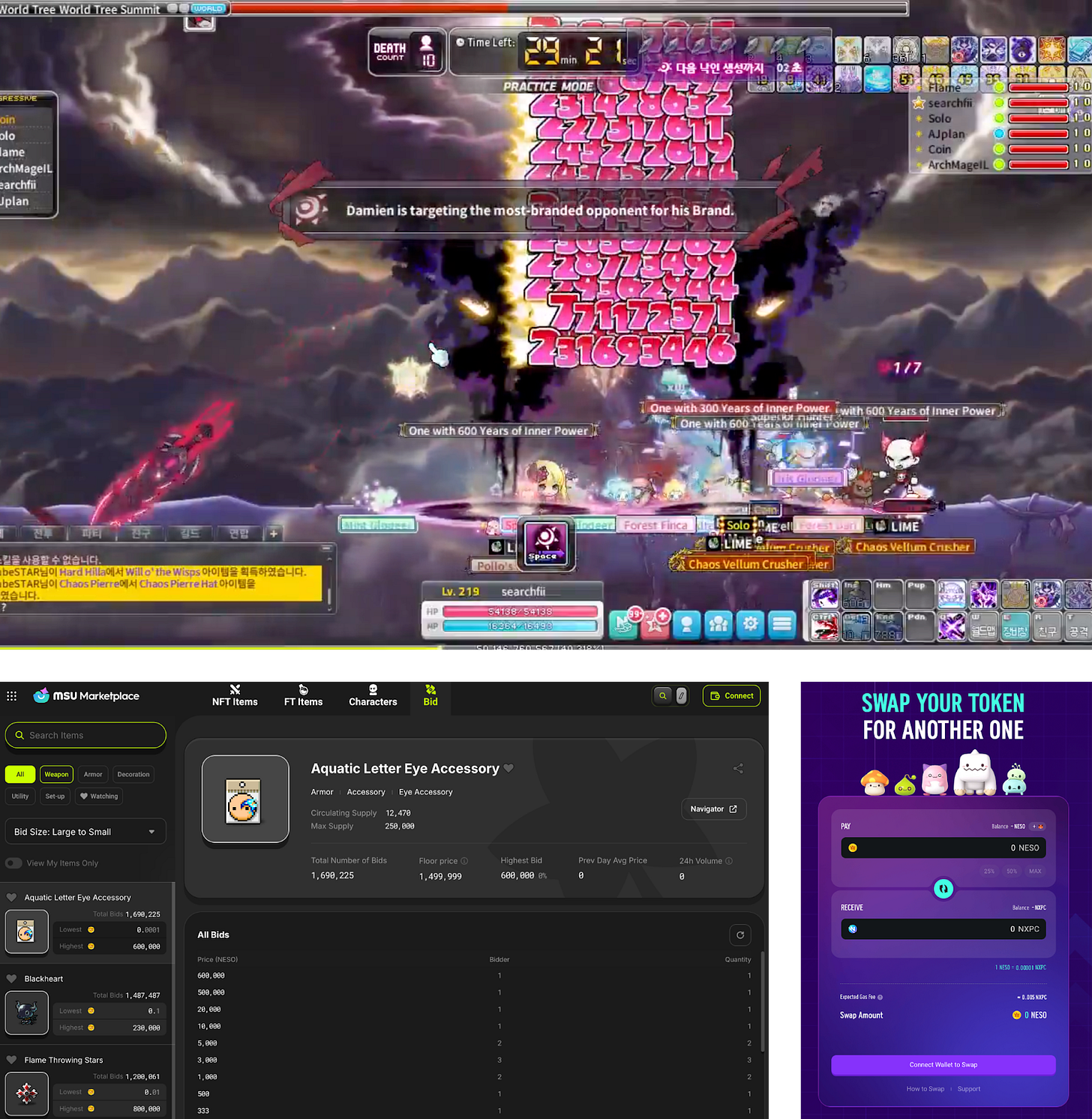

Of the various gaming projects on Avalanche, MapleStory Universe by Nexon is the most prominent. Given that MapleStory has been one of Nexon’s flagship IPs for more than two decades, the choice to adapt it into a blockchain-based game reflects a carefully considered strategic move.

In MapleStory Universe, NFTs and native tokens underpin the game economy. Players hunt monsters and complete quests to acquire items, which are recorded as on-chain assets. These can be converted into tokens or traded on P2P marketplaces. The game also supports user-generated content, allowing players to build worlds and earn rewards.

The economic design mirrors traditional game economies, with blockchain integration kept in the background to preserve immersion. This “gameplay-first” approach required a blockchain infrastructure that delivers high performance without disrupting the user experience.

Following the launch, Avalanche’s daily transaction count exceeded one million on two occasions, with MapleStory-related transactions alone surpassing 850,000. The case demonstrates empirically that Avalanche can support mainstream gaming without compromising player experience, while enabling true digital asset ownership and sustainable player-driven economies.

5.4. Consumer

Traditional consumer services such as loyalty programs and IP-based offerings face scalability challenges. Each brand often operates its own system, resulting in limited interoperability. Not every consumer service requires blockchain, however. The real value of blockchain in consumer-facing services lies in two areas: improving user experience and enabling new forms of data collection.

Blockchain adds clear benefits where cross-brand data or point transfers are needed, or where proof of ownership and product authenticity are critical, such as for limited-edition goods. In these cases, blockchain enhances transparency and provides users with a better experience.

On the data side, blockchain allows for the collection of new forms of information. Product lifecycles can be recorded, tracking goods from production through consumption. For companies, this creates opportunities to capture customer behavior data that was previously inaccessible.

Yet most blockchain-based loyalty programs have been cumbersome, with slow transaction times and complex user flows. Avalanche overcomes these barriers with fast finality, delivering a user experience comparable to Web2 services.

Suntory’s Bowmore case illustrates how this approach works in practice. In the premium whisky market, the company faced two challenges: rising counterfeits and difficulty proving ownership. For high-value products such as the 30-year-old Bowmore, authenticity issues could damage brand equity.

To address this, Suntory deployed an NFT-based authentication system on Avalanche. Each bottle is linked to a unique NFT that serves as a digital certificate of ownership, secured against forgery. An NFC tag attached to the bottle is the key mechanism: once opened, the tag tears and automatically issues a “consumption NFT.” This directly links the physical product with a digital asset.

For Suntory, the benefits extend to data collection. Previously, the company could only access sales data. Now, it can track who purchased the bottle, when it was opened, and how it was consumed. Such end-to-end lifecycle data provides rare and valuable consumer insights for the beverage industry.

From the customer perspective, the system remains simple. Users do not need a crypto wallet; they can log in with an email and scan the NFC tag with a smartphone to receive their NFT. Avalanche’s fast settlement ensures the process feels identical to a conventional e-commerce experience.

As a result, Suntory achieved three goals without exposing customers to technical complexity: preventing counterfeits, verifying ownership, and collecting new customer data. This case demonstrates blockchain used not as a showcase technology but as a practical tool to solve business problems.

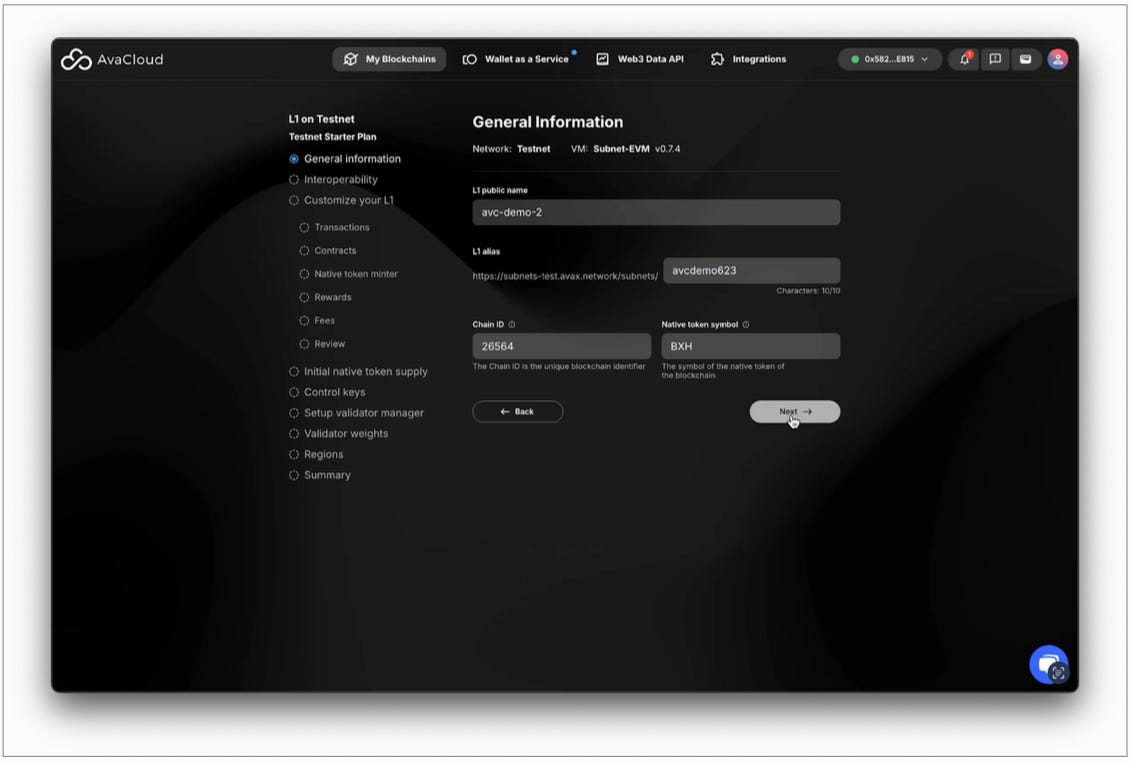

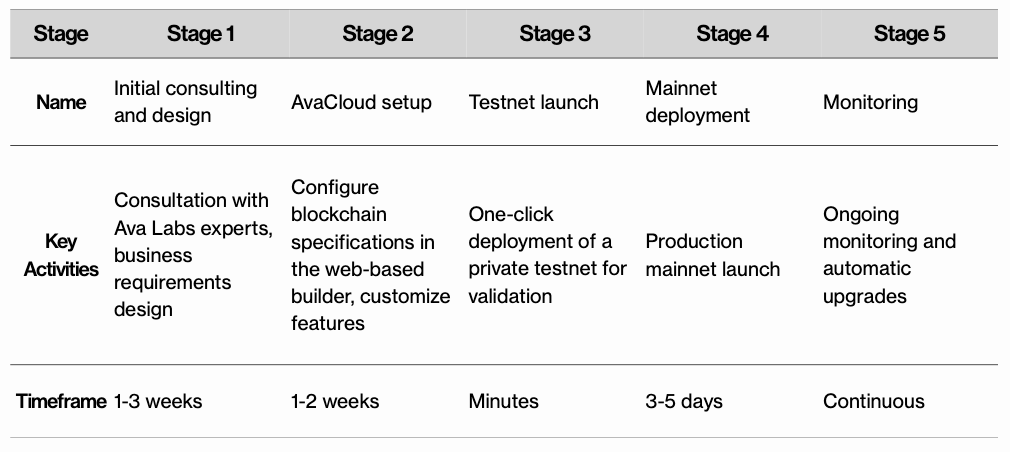

6. How Institutions Build Dedicated Chains (L1) on Avalanche

A striking fact is that most institutions using Avalanche build their chains through AvaCloud, a no-code blockchain service launched in 2023 and often described as the “AWS of blockchain.” With only a few clicks in a web browser, institutions can deploy their own L1 blockchains. No specialized blockchain engineers are required, and no in-house server infrastructure needs to be managed—AvaCloud handles it all. Operating under a monthly subscription model, AvaCloud reduces upfront costs and makes blockchain deployment accessible in the same way cloud computing transformed IT infrastructure.

Enterprises such as FIFA, SK Planet, and Suntory chose AvaCloud for this reason. Their focus was not on blockchain technology itself, but on solving business challenges. AvaCloud provided a solution aligned with this priority.

As a result, AvaCloud has shifted the paradigm of blockchain adoption: the question has moved from “How do we build a blockchain?” to “What do we build with blockchain?” This reflects blockchain’s evolution from a domain for technical specialists into a practical tool for mainstream enterprises.

From expert consultation and no-code configuration, to one-click testnet and mainnet deployment, the entire process can be completed within weeks. What once required years and significant capital investment is now achieved with a subscription model comparable to AWS.

For institutions considering blockchain, Avalanche adoption has never been easier. With proven business outcomes and a growing track record of trust, Avalanche offers an environment uniquely suited for institutional entry. For enterprises evaluating blockchain today, the conditions are in place to move from planning to execution.

Key Leaders Insights

Disclaimer

This report was partially funded by Avalanche(Ava Labs). It was independently produced by our researchers using credible sources. The findings, recommendations, and opinions are based on information available at publication time and may change without notice. We disclaim liability for any losses from using this report or its contents and do not warrant its accuracy or completeness. The information may differ from others' views. This report is for informational purposes only and is not legal, business, investment, or tax advice. References to securities or digital assets are for illustration only, not investment advice or offers. This material is not intended for investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo following brand guideline. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.