This report was written by Tiger Research for BlockFesta 2025. We thank Kaiko for valuable data and Blockmedia for their support.

Key Leaders Insights

Korea's Digital Asset Market Institutionalization: Now is the Time

The Korean digital asset market stands at a historic turning point of institutionalization. Comprehensive discussions are underway to establish institutional foundations, including the Digital Asset Basic Act and stablecoin legislation. These developments are expected to drive large-scale capital inflows and market expansion. BlockFesta 2025 has emerged as a significant event to examine the present and future of Korea's digital asset market during this pivotal moment.

BlockFesta 2025 marks its 7th edition this year on September 26 (Friday) at the Textile Center in Gangnam-gu, Seoul. Blockmedia, Korea’s leading media company in the blockchain space, hosts this industrial conference.

The event features distinguished participants across policy and industry sectors. Min Byung-duk from the Democratic Party and Kim Jae-seop from the People Power Party will deliver congratulatory remarks. Other participants include Park Young-sun, former Minister of SMEs and Startups; Yoo Jae-soo, former Busan City Deputy Economic Mayor; and Arthur Hayes, BitMEX co-founder and Maelstrom CIO, among others. These experts will discuss blockchain and digital finance in the institutionalization era.

Korea's market stands at a transformative juncture of institutionalization. Understanding the current status and prospects of the Korean market is essential for the global blockchain industry. Tiger Research has prepared the BlockFesta Report to address this need.

This report analyzes the opportunities, limitations, and conditions for transformation in Korea's digital asset market from multiple perspectives. Participants can leverage this knowledge to communicate and collaborate more effectively regarding the Korean market at events like BlockFesta.

1. Current State of Korea's Digital Asset Market

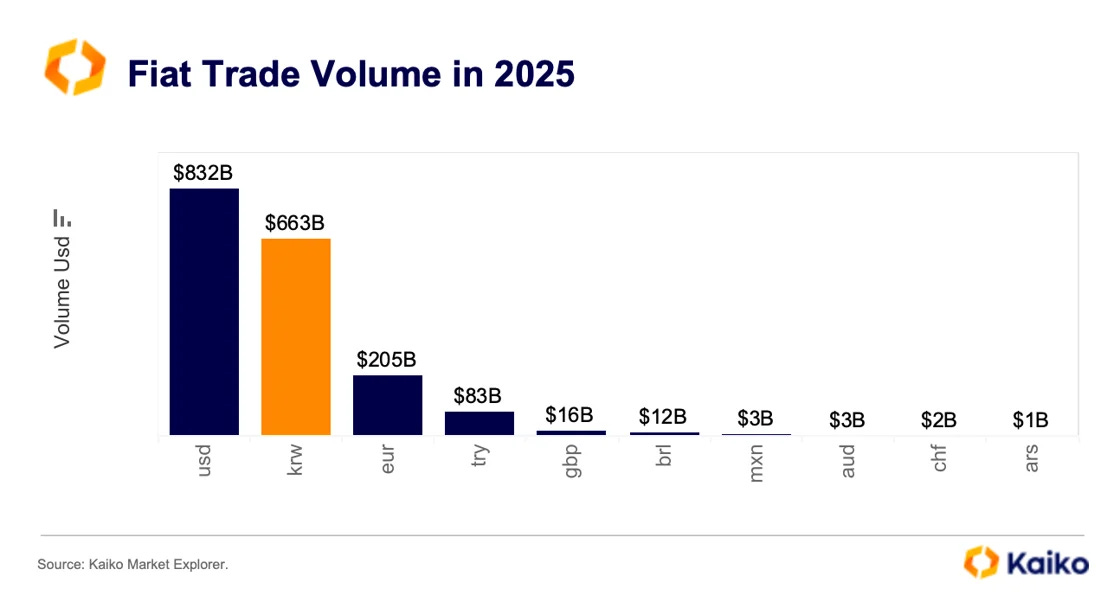

Korea has established itself as one of the most prominent markets in the global digital asset space as of 2025. The country particularly excels in exchange-centered cryptocurrency markets. According to Kaiko, a cryptocurrency data analytics firm, Korean won-denominated trading volume captures a significant share of global market activity and ranks second after the US dollar. This figure substantially exceeds trading volumes in Japanese yen or European euros. In Q1 2025, Korean won trading volume temporarily surpassed US dollar volumes, showcasing the intense interest in Korea's market.

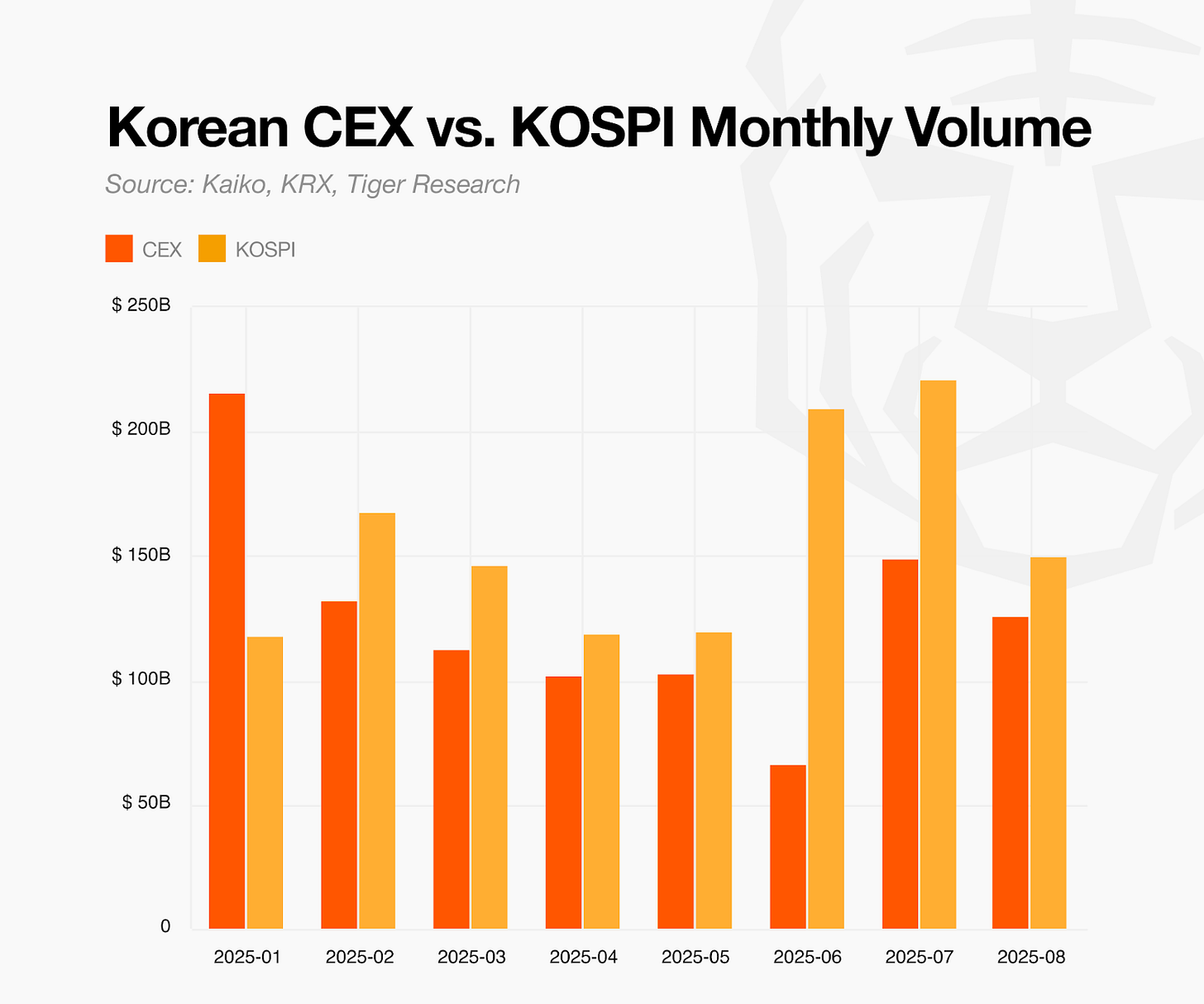

Korea's cryptocurrency market has formed a unique ecosystem centered around Korean won-based exchanges such as Upbit and Bithumb. The market has reached a scale comparable to traditional financial markets. Cryptocurrency exchanges generate monthly trading volumes that match or exceed KOSPI's monthly trading volumes in 2025.

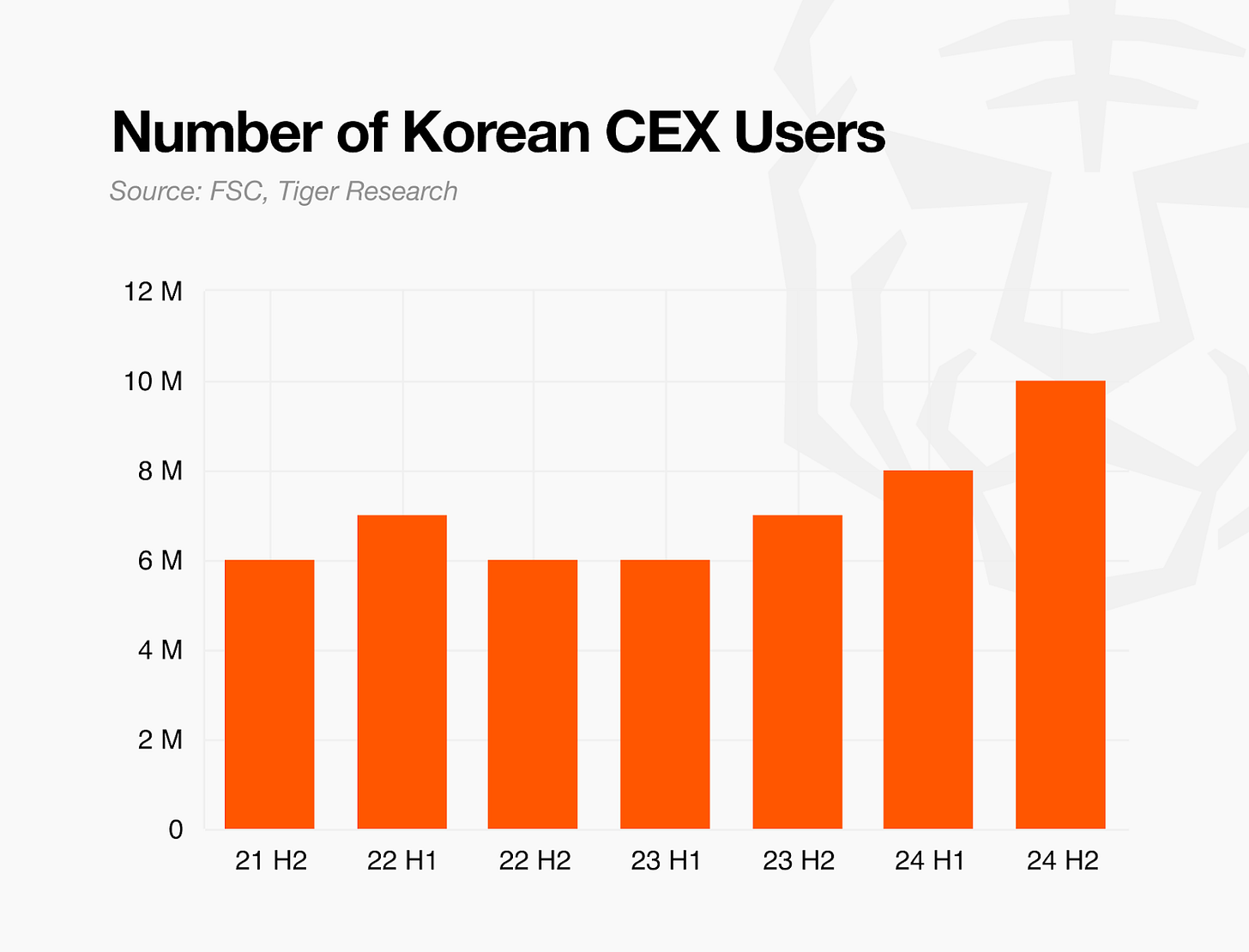

Korea demonstrates an outstanding retail investor base globally. Approximately 10 million Koreans invest in cryptocurrencies, representing over 20% of the total population. This participation rate significantly exceeds other major countries and demonstrates the market's solid investor foundation.

Korea's market demonstrates importance across multiple dimensions. Global Web3 projects typically structure their Go-to-Market strategies around three key regions: the English-speaking world, Chinese-speaking regions, and Korea. Korea holds an exceptionally high position as a single-country market within this framework.

Many Asian countries benchmark Korea's cryptocurrency market development model. Foreign projects continuously invest in business development to enter the Korean market. This widespread participation and global attention provide strong momentum for policy decisions and market development. These factors serve as a crucial driving force in the ongoing institutionalization process.

2. Structural Limitations Behind Overwhelming Trading Volumes

Korea's cryptocurrency market attracts global attention with its overwhelming trading volumes. However, the exchange-centric market structure and regulatory uncertainty challenge the long-term sustainability of this position.

2.1. Exchange-Centric Ecosystem Limitations and Weakened Influence

CEX generate substantial revenue as cash cows in the crypto market. However, their nature as intermediary service businesses forces them to focus solely on expanding short-term trading volumes through fee-based models. Strict regulations from authorities further restrict their entry into cryptocurrency-related derivative businesses. Korean CEX consequently pursue diversification into areas unrelated to their core business, such as real estate investment and lending, instead of expanding within the cryptocurrency ecosystem like Coinbase. They ultimately fail to fulfill their role as industry leaders by pursuing business diversification that deviates from the core value chain.

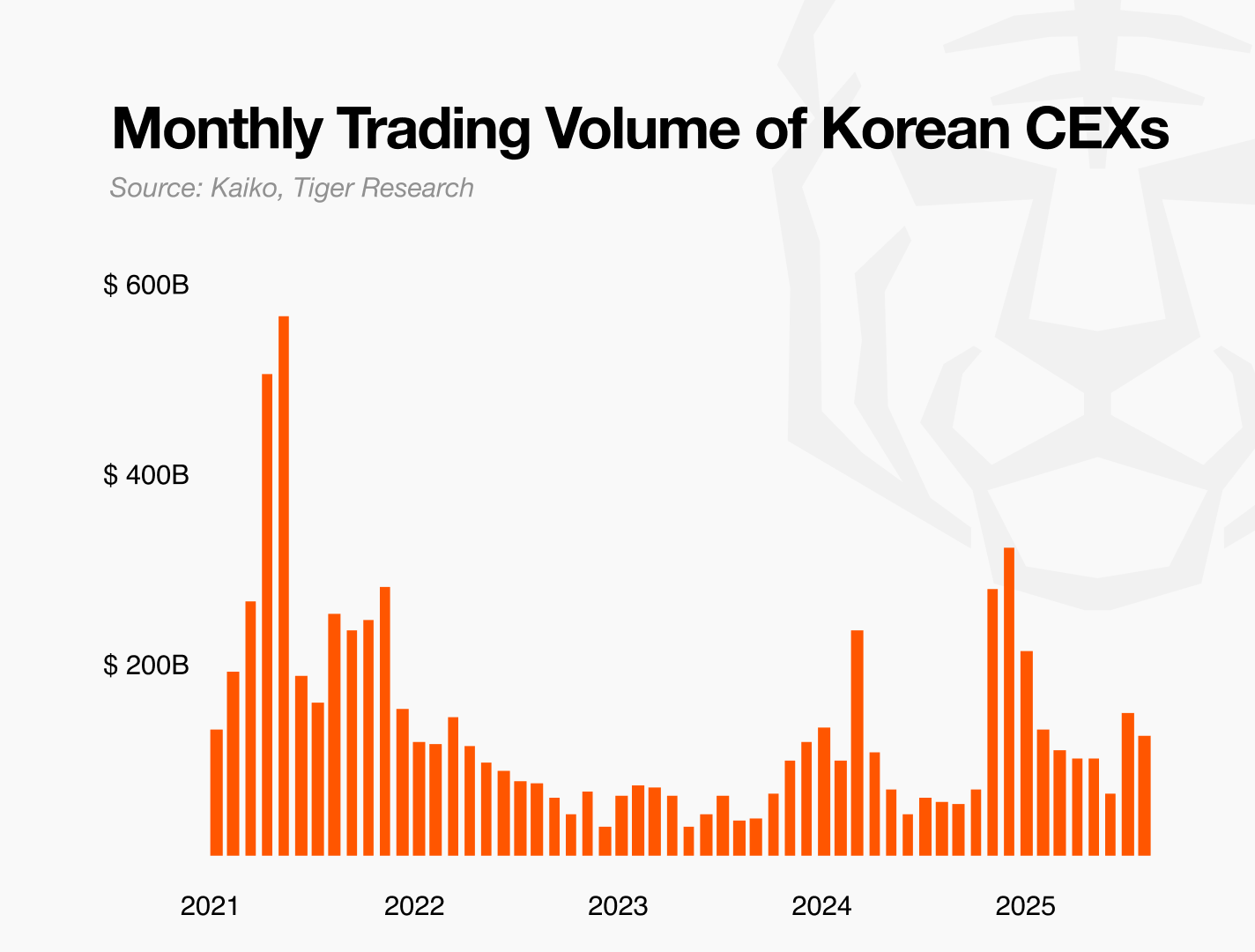

The situation worsens as Korean CEX experience declining trading volumes and lose their existing influence. Monthly trading volumes at their 2025 peak decreased by 62% compared to 2021 levels. Korean CEX lose competitiveness due to their relatively low attractiveness compared to major global exchanges and decentralized exchanges (DEX).

2.2. US Institutional Advantage and Korea's Regulatory Dilemma

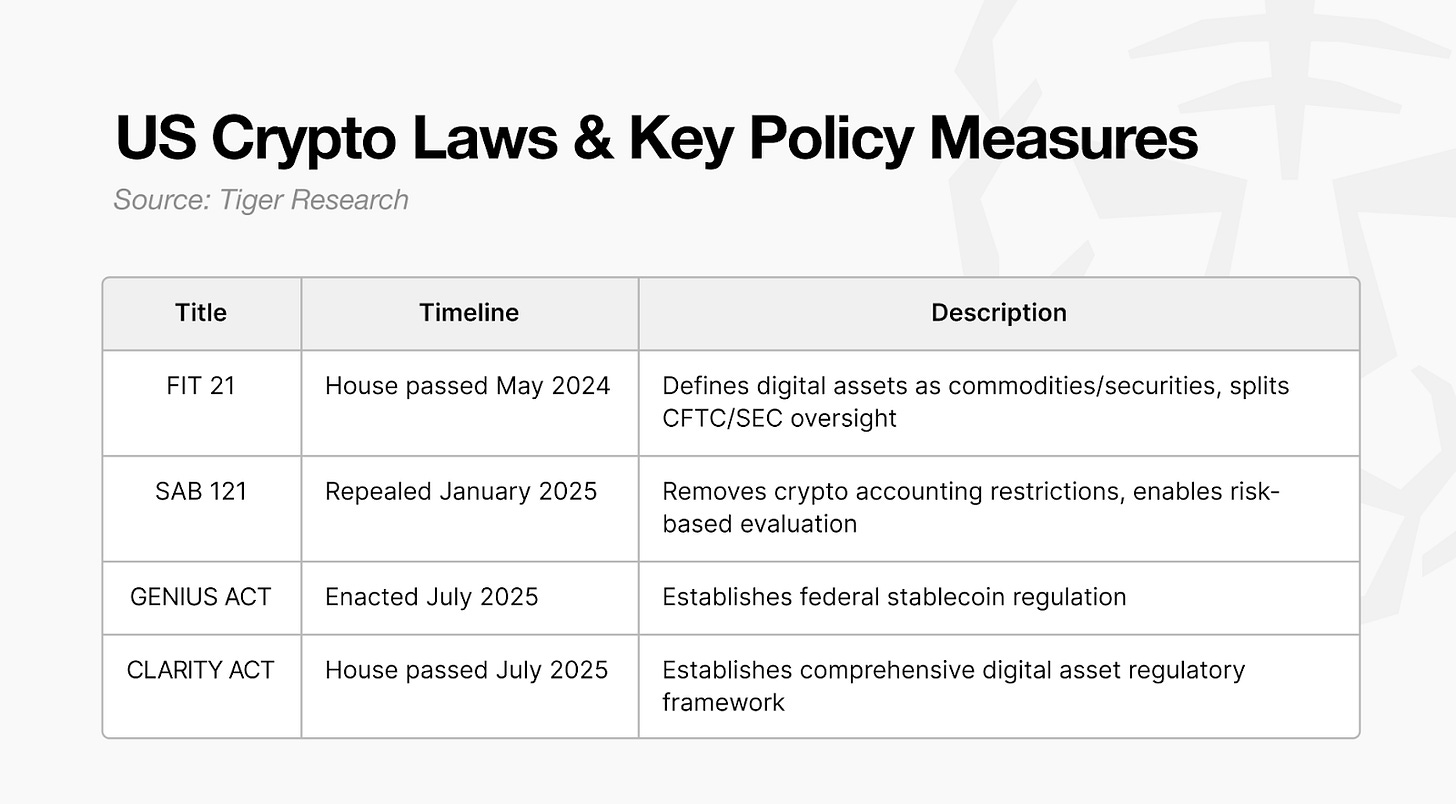

The bigger concern centers on how global crypto market leadership rapidly reorganizes around the United States. Following Trump's second-term inauguration, the US accelerates cryptocurrency adoption into the institutional framework through legislation such as the GENIUS and CLARITY Acts. Korea faces a different situation. Korea introduced Virtual Asset Service Provider (VASP) regulations faster than other Asian countries and responded proactively. However, the focus remained on defensive regulations centered on anti-money laundering and investor protection. Korea's positive regulatory framework operates under the principle that anything not permitted is prohibited. This approach structurally constrains new business models and innovative services.

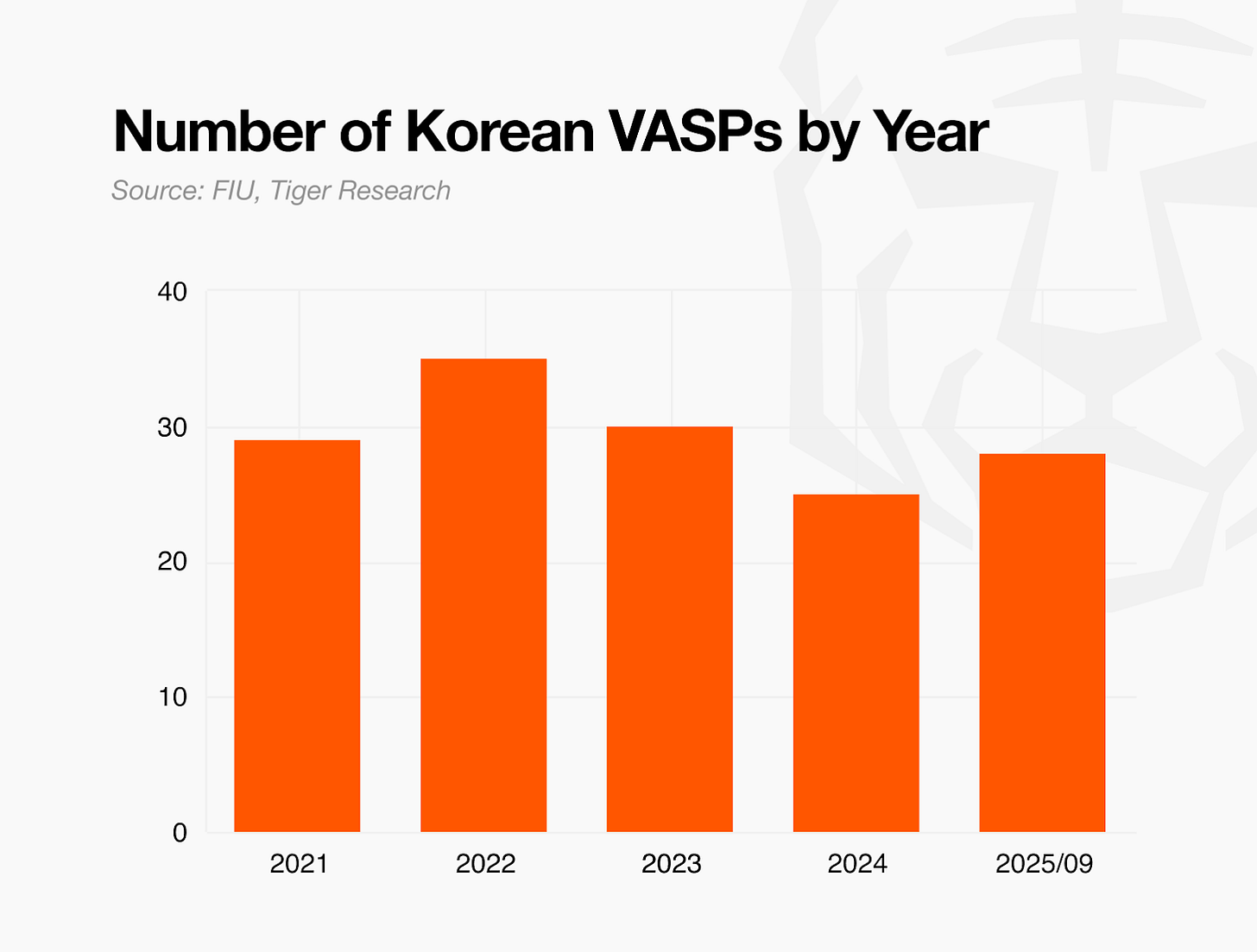

These regulatory differences produce tangible results. Despite the cryptocurrency industry's continuous growth, Korea's VASP count remains at 2021 levels. Business areas experiencing rapid growth overseas such as institutional investment, custody, and stablecoins face development challenges in Korea. The US draws innovation into its institutional framework and expands its ecosystem, while Korea focuses solely on securing safety within existing structures.

Korea ultimately maintains its position as a global leader in trading volumes but reveals vulnerabilities in the innovation foundation that determines the industry's future. This imbalance signals a critical turning point. Korea's crypto market must transition from a "trading volume-centered past" to an "institutionalization and innovation-based future."

3. Changes Emerging with Institutionalization

Korea demonstrates substantial momentum toward institutional transformation in 2025. This represents an attempt to overcome accumulated structural limitations and restore global competitiveness. The National Assembly actively discusses legislation including the Digital Asset Basic Act, Innovation Act, and stablecoin-related bills.

This institutionalization will bring changes beyond simple regulatory framework establishment. The approach signals a shift from anti-money laundering and investor protection focus toward a regulatory paradigm for industry development. This foundation may broaden the spectrum of market participants, introduce new infrastructure and service models, and create multilayered changes that impact the broader economy simultaneously.

3.1. Institutional Investors Enter the Market

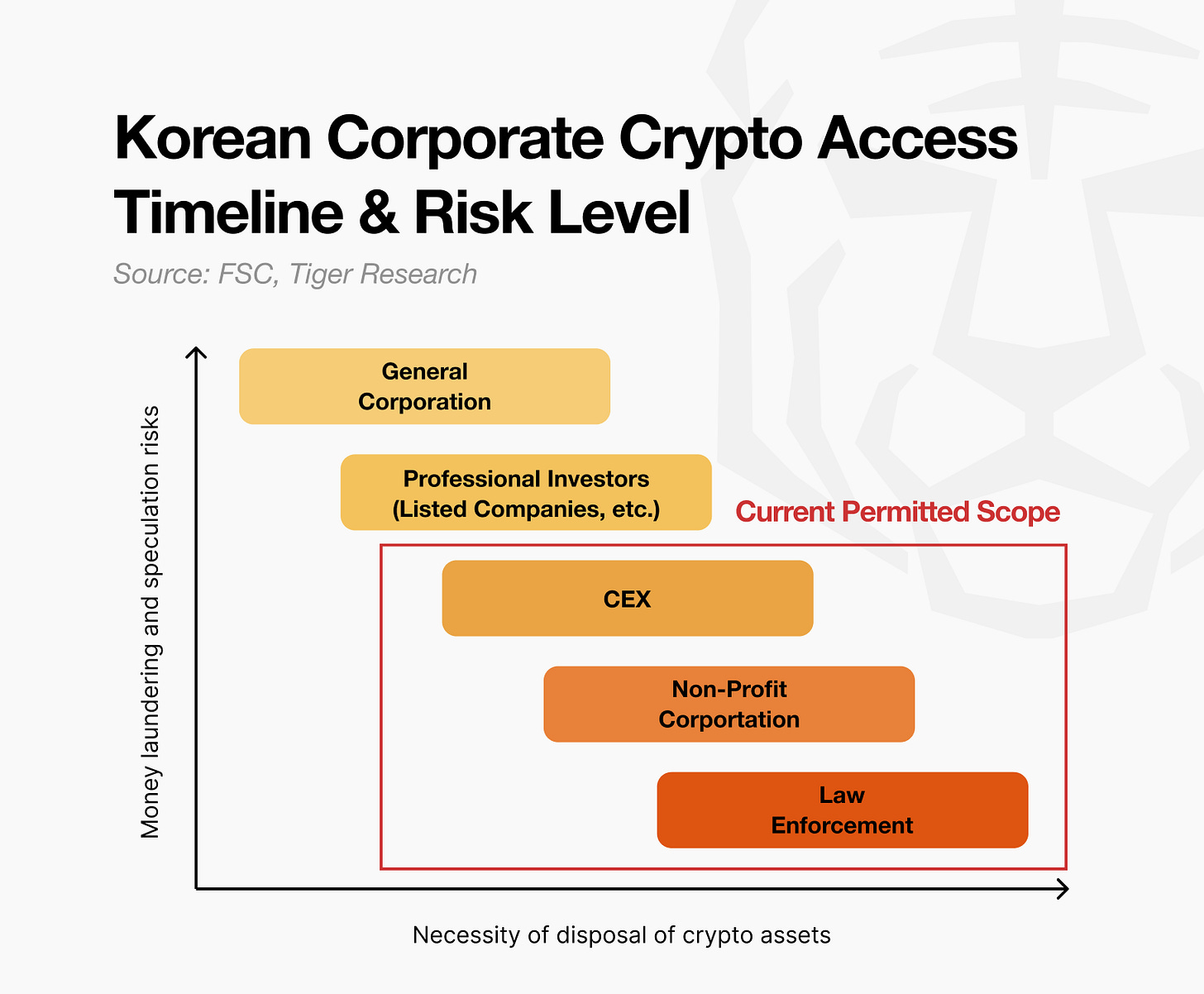

Korea restricts institutional participation in the crypto market. Institutional funds flowed into the US market following Bitcoin ETF approval. Korea prohibited such investments due to capital market law concerns and conservative government stance. The government banned Korean securities firms from intermediating overseas-listed Bitcoin spot ETF products. In July 2025, the Financial Supervisory Service(FSS) advised Korean asset management companies and institutions to limit ETF exposure to crypto investment firms like Coinbase and Strategy. Korean CEX block institutional corporate account creation entirely.

However, signals of institutional transformation emerged in 2025. The FSS announced a roadmap to gradually allow corporate participation in the crypto market. The plan permits corporations to obtain accounts for cash-out sales starting in the first half of the year. In the second half, selected institutional investors with risk tolerance can access pilot accounts for investment and treasury purposes. Specifically, approximately 3,500 companies qualify as targets, including listed companies and registered professional investors under the Capital Markets Act, excluding financial firms.

Bitcoin spot ETF launch discussions accelerate. President Lee Jae-myung pledged to allow issuance, listing, and trading of spot ETFs based on Bitcoin and other assets during his campaign. The FSS and Korea Exchange (KRX) have begun institutional preparations. Industry experts anticipate Bitcoin ETF launches in the second half of 2025 or around 2026, coinciding with corporate account permissions.

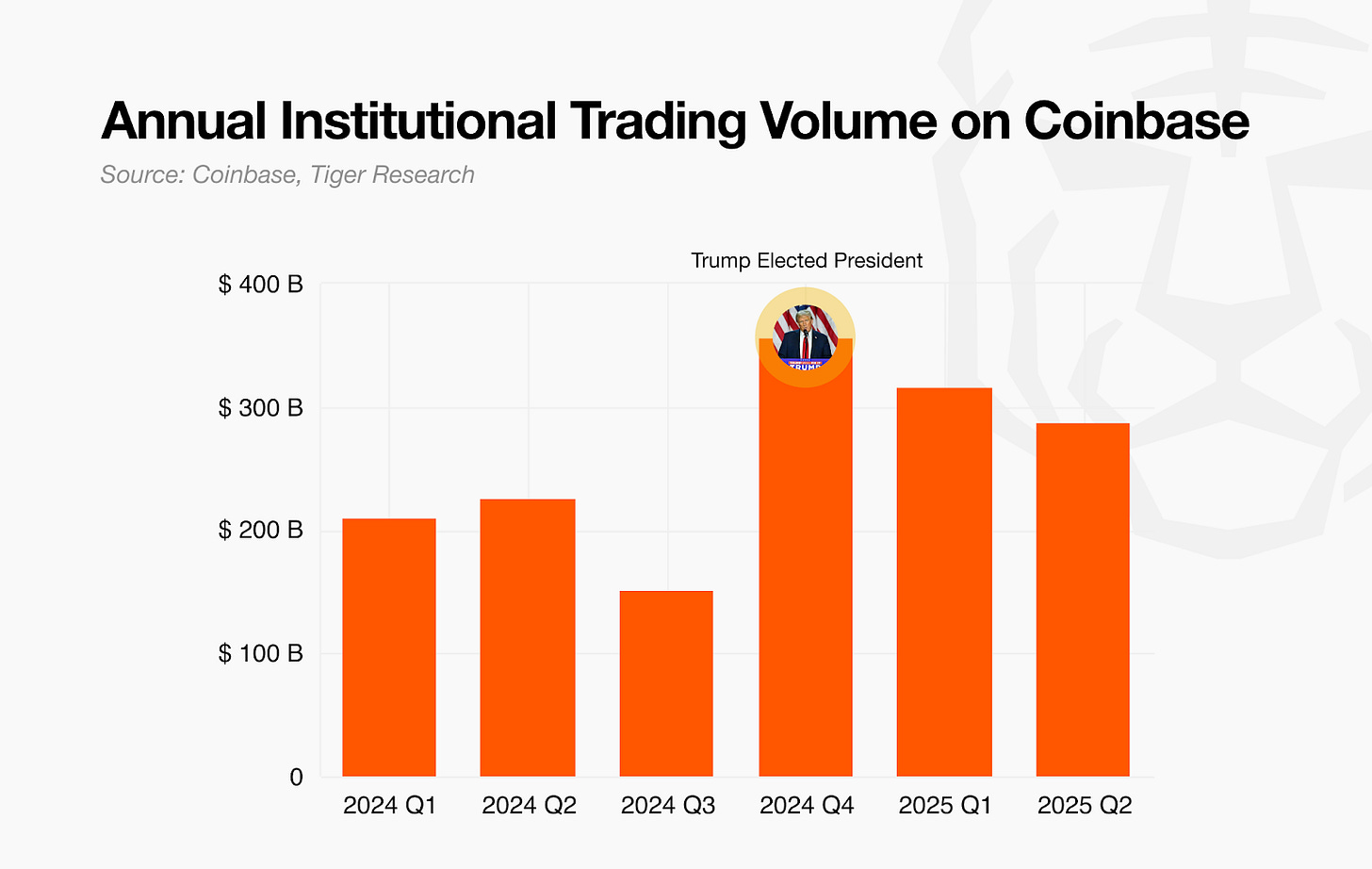

When these institutional changes complete, the retail investor-centered market structure will fundamentally transform. Pension funds, asset management companies, and large corporations will bring long-term stable capital into the market. This development should reduce current high volatility and stabilize liquidity supply. Coinbase demonstrates this trend, with institutions generating over 70% of trading volume as of 2025. Korea will likely experience similar patterns.

Corporate treasury strategies show notable changes. Korean companies may adopt crypto assets as strategic holdings, following Strategy and Metaplanet's example. This approach offers a reference model for Korean companies facing won weakness and inflation pressure. Mid-sized companies and startups with limited foreign currency access could use Bitcoin to hedge currency risks and secure asset stability. Companies could also generate additional revenue through staking and DeFi activities.

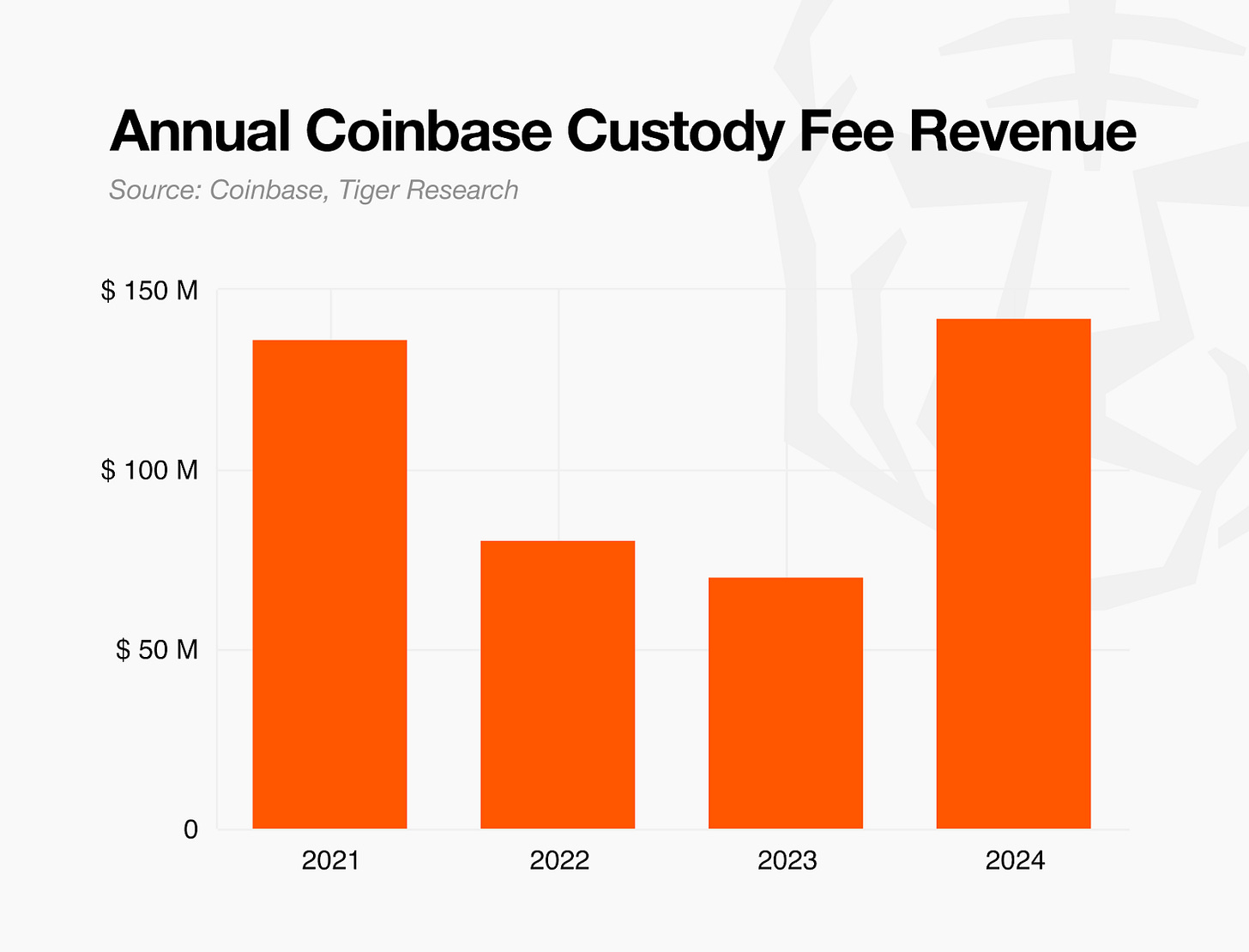

Institutional capital inflow requires secure custody services. Global CEXs already generate billions in annual custody revenue. Korea expects substantial custody market formation when institutional investor participation becomes active. This development could provide new growth opportunities for related service providers. Institutional investor market entry will drive comprehensive structural changes in Korea's crypto market beyond simple participant expansion.

3.2. Diversification of Crypto Business Sectors

Corporate crypto account authorization creates changes beyond simple investment expansion. Companies can legally store, trade, and convert crypto assets to cash. This enables blockchain infrastructure, digital wallets, custody, and payment services to grow substantially on institutional foundations.

The absence of corporate accounts posed the biggest obstacle. Even validator businesses struggled with cash-out(off ramp) difficulties, and payment services could not process settlements properly. The blocked off-ramp process for converting crypto to won constrained accounting, tax processing, and business operations. Crypto payment businesses need conversion processes to receive crypto from consumers and settle with merchants in won. Without corporate accounts, this procedure becomes impossible. This structurally blocked legal business expansion.

Korea classified crypto businesses as speculative industries alongside adult entertainment and casinos, excluding them from venture company certification. This blocked institutional support and weakened innovation momentum. However, the Ministry of SMEs and Startups recently pursues plans to grant venture company status to crypto businesses. Recognition as "technology-based startup companies" opens access to startup investment, technology guarantees, and policy financing benefits. Corporate account authorization and venture certification will enable crypto industries to join the venture ecosystem after seven years.

Market participants also demonstrate emerging changes. Dunamu, Korea's largest CEX, faced business expansion restrictions under regulatory oversight and constraints. Recently, the company revealed "GIWA Chain," an Optimism-based Layer 2 blockchain, demonstrating new momentum. This suggests regulatory authorities have somewhat relaxed their stance, proceeding through consultations. Bithumb reviews mainnet launches, while Korbit operates its own mainnet and expands blockchain-based services. CEXs actively attempt to lead the entire blockchain infrastructure ecosystem beyond simple revenue diversification.

Corporate account authorization, venture system integration, and active market responses will generate positive economic effects including job creation, technology accumulation, and tax revenue expansion. This demonstrates that Korea's crypto industry establishes foundations to evolve from trading-centered structures to multilayered industrial ecosystems.

3.3. Korean Won Stablecoin

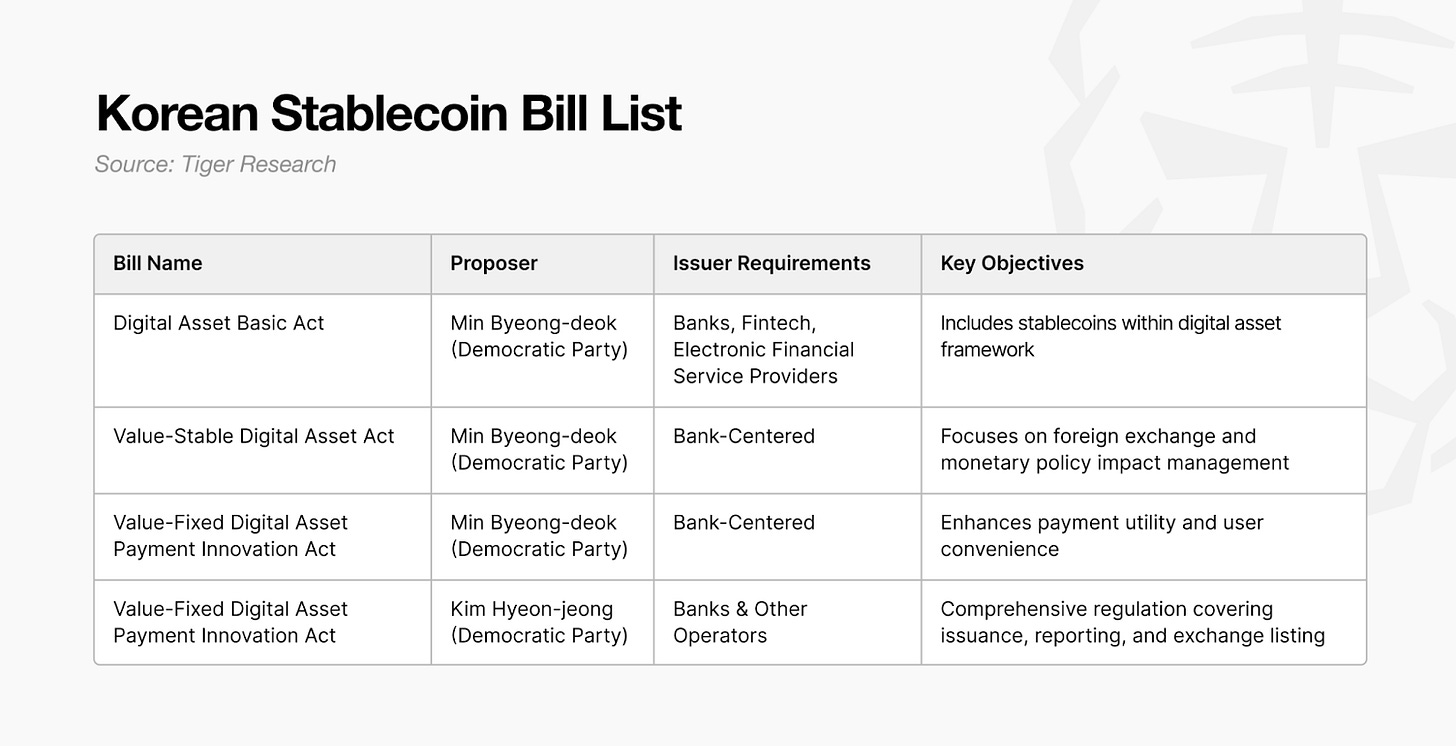

Stablecoins represent an area where expectations rapidly spread alongside institutionalization discussions in Korea. In June 2025, the Democratic Party proposed the "Digital Asset Basic Act," which presents a basic framework for licensing KRW stablecoin issuers. The bill includes specific regulatory requirements such as minimum capital of 500 million won, mandatory 100% reserves (high-stability assets), and segregated custody of customer assets in banks. Subsequently, the Financial Services Commission prepared a dedicated KRW stablecoin bill in October as part of the second phase of the "Act on Protection of Virtual Asset Users." This legislation will specify issuance procedures, collateral management, and internal control requirements in greater detail.

However, the Bank of Korea(BOK) maintains a cautious stance. The central bank argues that KRW stablecoin issuance should initially focus on commercial banks through gradual authorization. It raises concerns that increased convertibility could boost dollar demand and burden foreign exchange market stability. The bank also clearly opposes non-bank issuance, citing violations of the separation of industrial and financial capital principle.

Nevertheless, various players show enthusiastic interest. Danal, Wemade, and BDACS actively participate in issuance discussions. Traditional financial institutions also advance initiatives. Woori Bank launched KRW stablecoin issuance with Danal and BDACS. KB Kookmin Bank actively reviews business opportunities through USAT collaboration. Stablecoins have evolved from experimental projects to infrastructure initiatives that institutional finance monitors closely.

4. Change Has Begun, But Challenges Remain

Korea's crypto market presents institutionalization discussions and new blueprints, but reality remains challenging. Conflicting interests among regulatory authorities and fragmented policy approaches create the biggest obstacles.

Stablecoins illustrate this clearly. The FSS seeks to allow qualified non-banks to participate, while the BOK maintains that authorization should limit to commercial banks. Clear differences exist regarding licensing and supervision authority. Korea uniquely lacks short-term government bonds among developed countries, creating structural constraints for reserve asset procurement. Unclear demand for KRW stablecoins exists given Korea's already developed financial infrastructure.

Obstacles extend beyond stablecoins across the entire crypto industry. Different regulatory agencies handle major issues including corporate account authorization, spot ETF introduction, and tax system reforms, creating difficulties in securing policy consistency. Institutional blueprints emerge, but execution complexity and uncertainty continue to constrain Korea's crypto market development.

Korea's crypto market lags behind global trends. The US and Europe expand markets through institutionalization, while Korea focuses on basic legal frameworks. Government authorities prioritize urgent tasks: economic recovery, real estate stabilization, and low birth rate responses. December's martial law crisis created political turmoil and postponed agenda items. Limited resources remain for crypto policy. Meaningful changes require substantial time, potentially weakening Korea's global competitiveness.

However, signs of progress emerge gradually. CEXs develop infrastructure, companies enter stablecoin businesses, and institutions make pilot entries. These show genuine market evolution. Both parties recognize digital innovation necessity. Political stability could revitalize crypto policy. Change may be slow, but sustained improvement remains possible.

🐯 More from Tiger Research

Read more reports related to this research.Malaysia Crypto Market 2025: The Hidden Force Behind Global Web3 Giants

Vietnam Crypto Market 2025: Complete Analysis of 21 Million Investor

Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.