This report was written by Tiger Research, analyzing how Plasma aims to become the "Chrome of stablecoins" by revolutionizing blockchain infrastructure just as Chrome transformed web browsing from Internet Explorer's limitations.

1. Do You Really Understand Stablecoins?

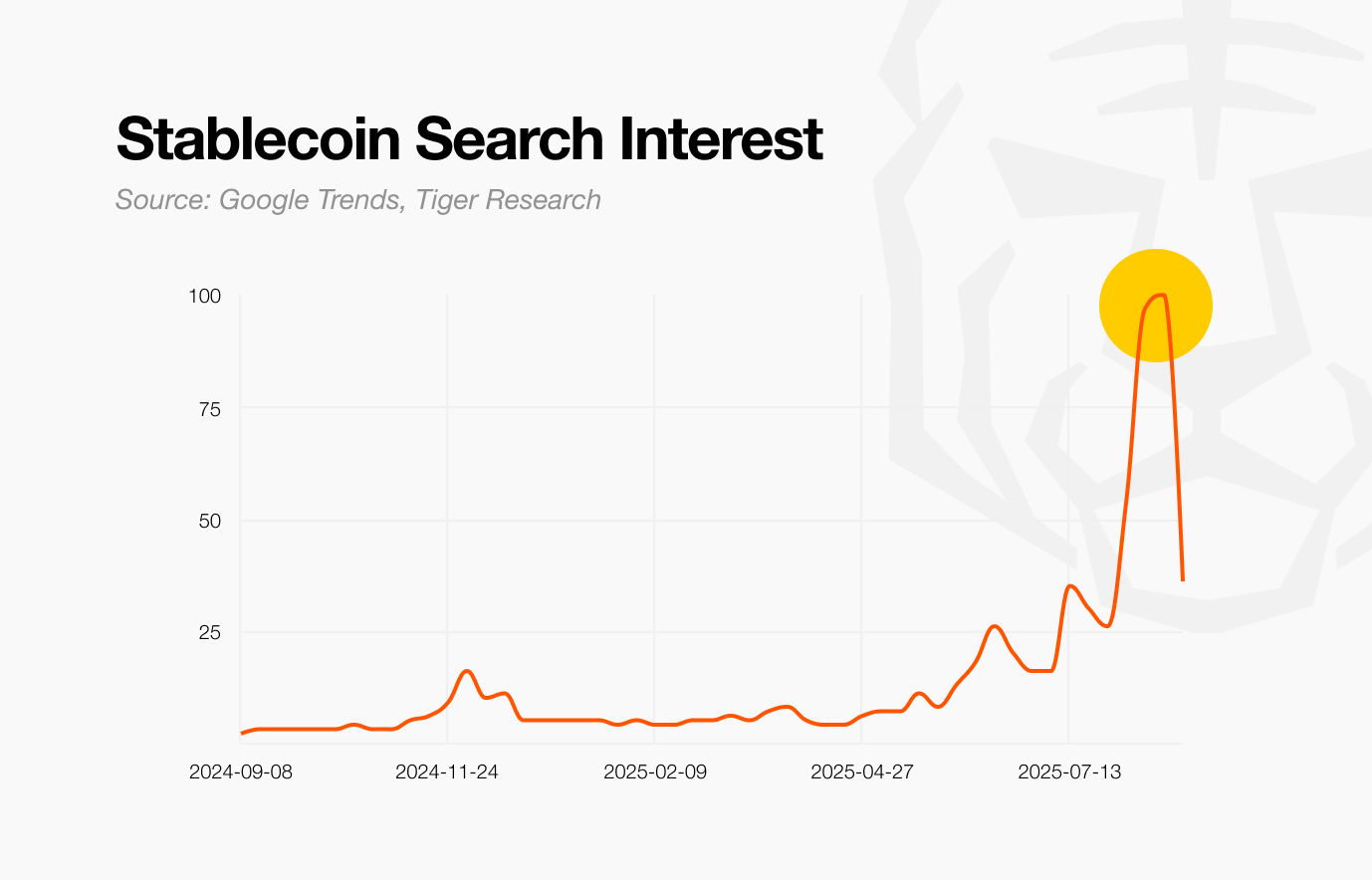

Global interest in stablecoins is rising. However, their distinction from traditional digital payment methods remains unclear to many. This is partly because digital finance systems are already familiar. Credit cards and mobile wallets have long enabled digital transactions.

Against this backdrop, the question arises: Do we really understand stablecoins?

Stablecoins are digital assets pegged to fiat currencies, such as the U.S. dollar, to preserve price stability. Their key distinction is reliance on blockchain rather than traditional financial infrastructure. Blockchain enables peer-to-peer transactions without intermediaries, including banks, payment processors, or card networks.

In fiat-based systems, banks, card companies, and remittance providers act as multiple layers of intermediaries. Each additional layer introduces both time delays and higher costs. Cross-border remittances often require days or weeks to settle, with significant fees. Transactions also depend on banking hours, excluding weekends and holidays.

Stablecoins remove these frictions by connecting users directly on blockchain networks. No approvals or permissions are required. As long as there is internet access, transfers can be made instantly, anytime, anywhere. Functionally, this resembles handing over physical cash, but in a digital, borderless format.

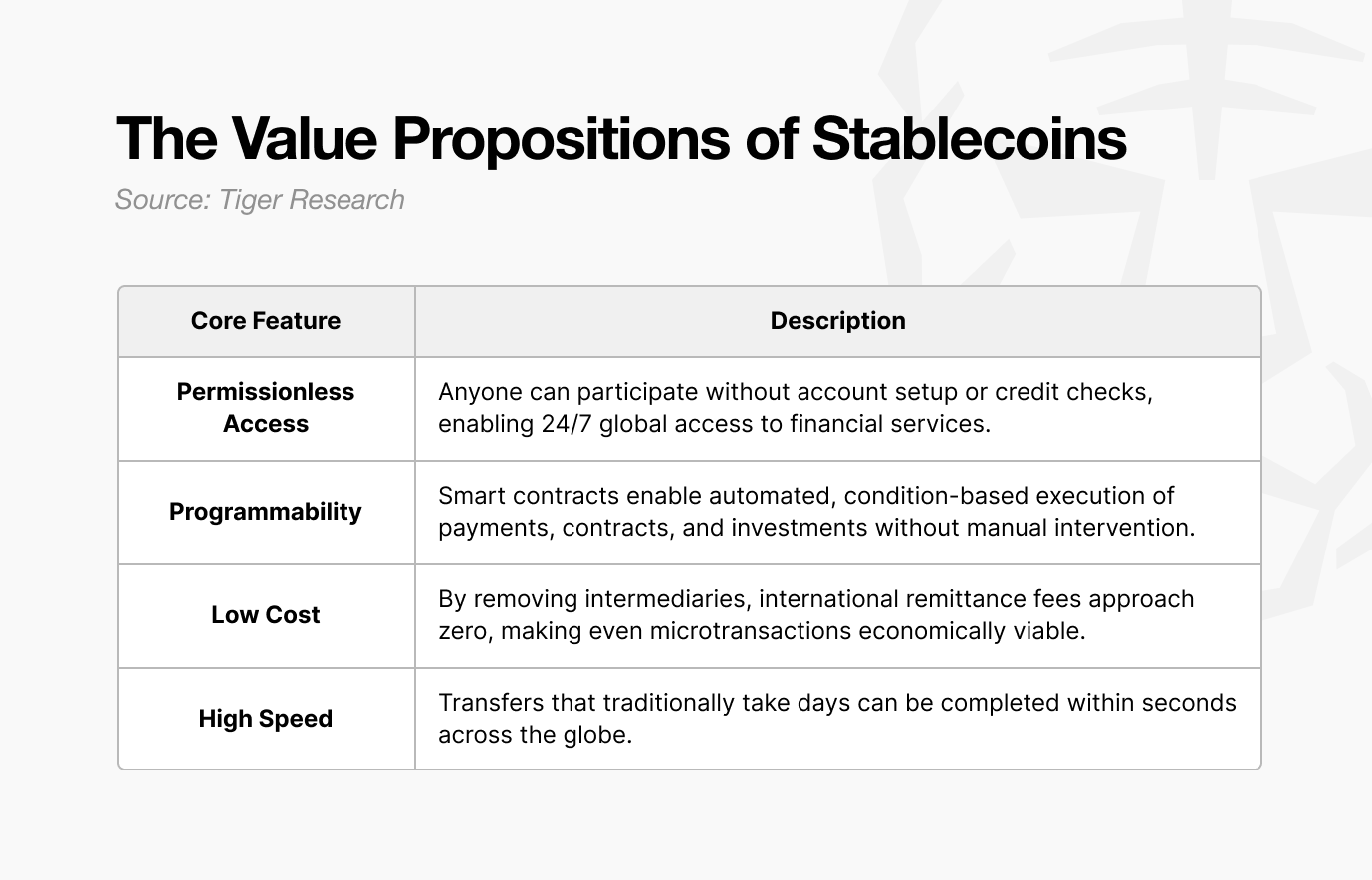

These attributes translate into four core values. Permissionless access supports global financial inclusion. Programmability enables automated financial processes. Low cost enhances efficiency. High speed enables real-time global settlement infrastructure.

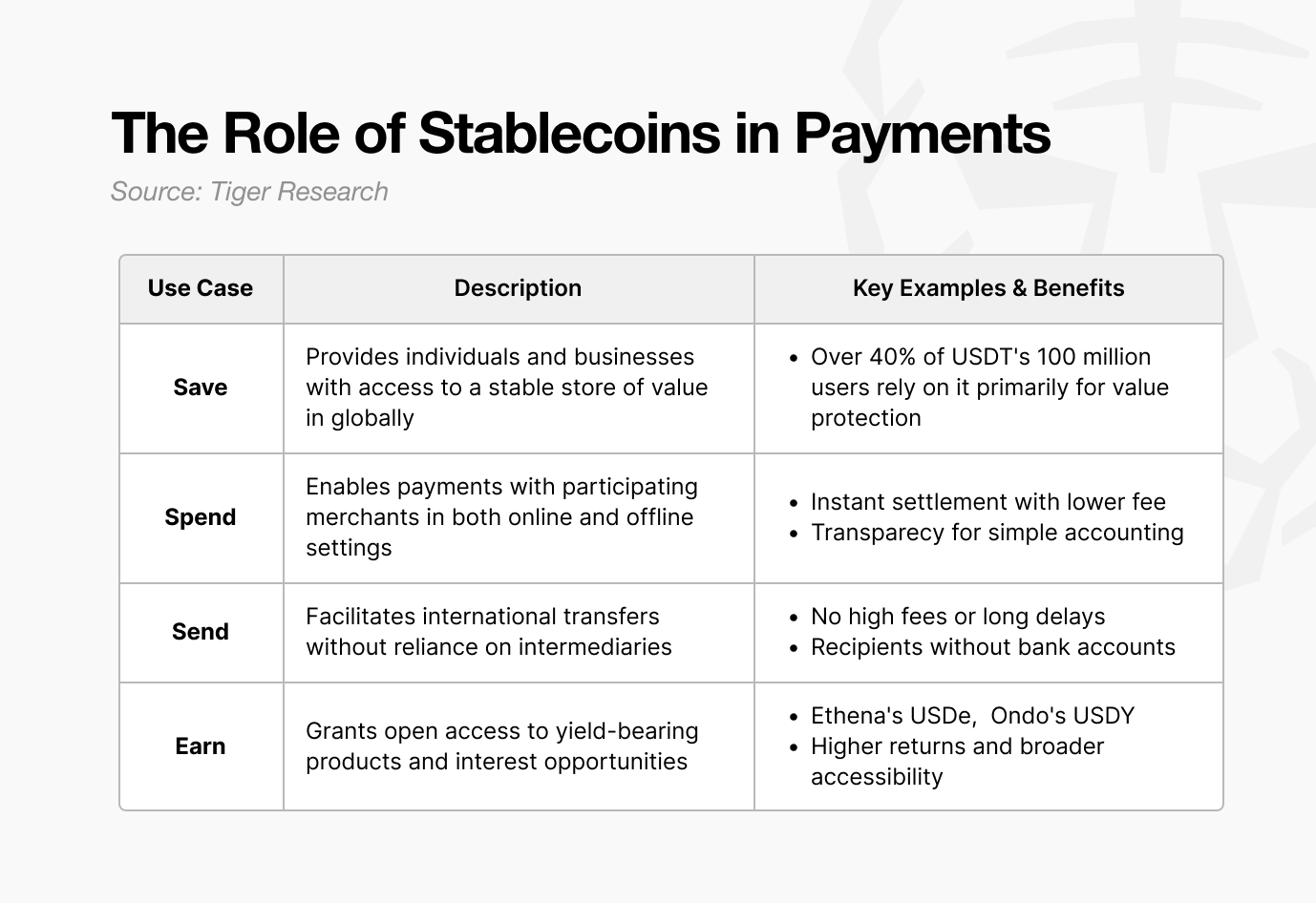

Consider an illustrative example. A freelancer in Argentina can open a digital wallet without bank approval to save in dollars. Smart contracts then enable automatic monthly deposits. Currency exchange costs decline from $10 to $0.10. Within seconds of receiving payment, earnings convert into stable dollars, protecting income from inflation.

Together, these applications show how stablecoins move beyond traditional financial limits. They offer new ways to save, spend, send, and earn.

However, barriers to adoption remain high. Users must navigate multiple blockchains, manage wallet addresses, secure private keys, and bridge assets. Each task requires technical expertise that most users lack.

For stablecoins to reach their full potential, simplified infrastructure is essential. Just as Chrome streamlined web access, stablecoins need a comparable service layer to achieve broad usability.

2. Plasma as the “Chrome” of Stablecoins

Internet Explorer (IE) popularized web access but suffered from slow speed, weak security, and poor standards support despite initially holding a 95% share of the market. Users tolerated complex plugin installs, frequent crashes, and slow performance because no viable alternatives existed.

In 2008, Google Chrome changed everything. It delivered performance nearly ten times faster and used multi-process architecture for stability. Automatic updates improved security. Complex technology disappeared behind the browser, leaving users with a fast, reliable web experience. Within five years, Chrome surpassed IE as the global leader.

The stablecoin market faces a similar situation. Existing blockchains support stablecoins but, like IE, fail to unlock their full potential. Users accept high fees, complex processes, and frequent network congestion as unavoidable.

Plasma enters this environment as a dedicated, high-performance Layer-1 blockchain for stablecoins. Just as Chrome redefined the web browser, Plasma aims to redefine stablecoin infrastructure.

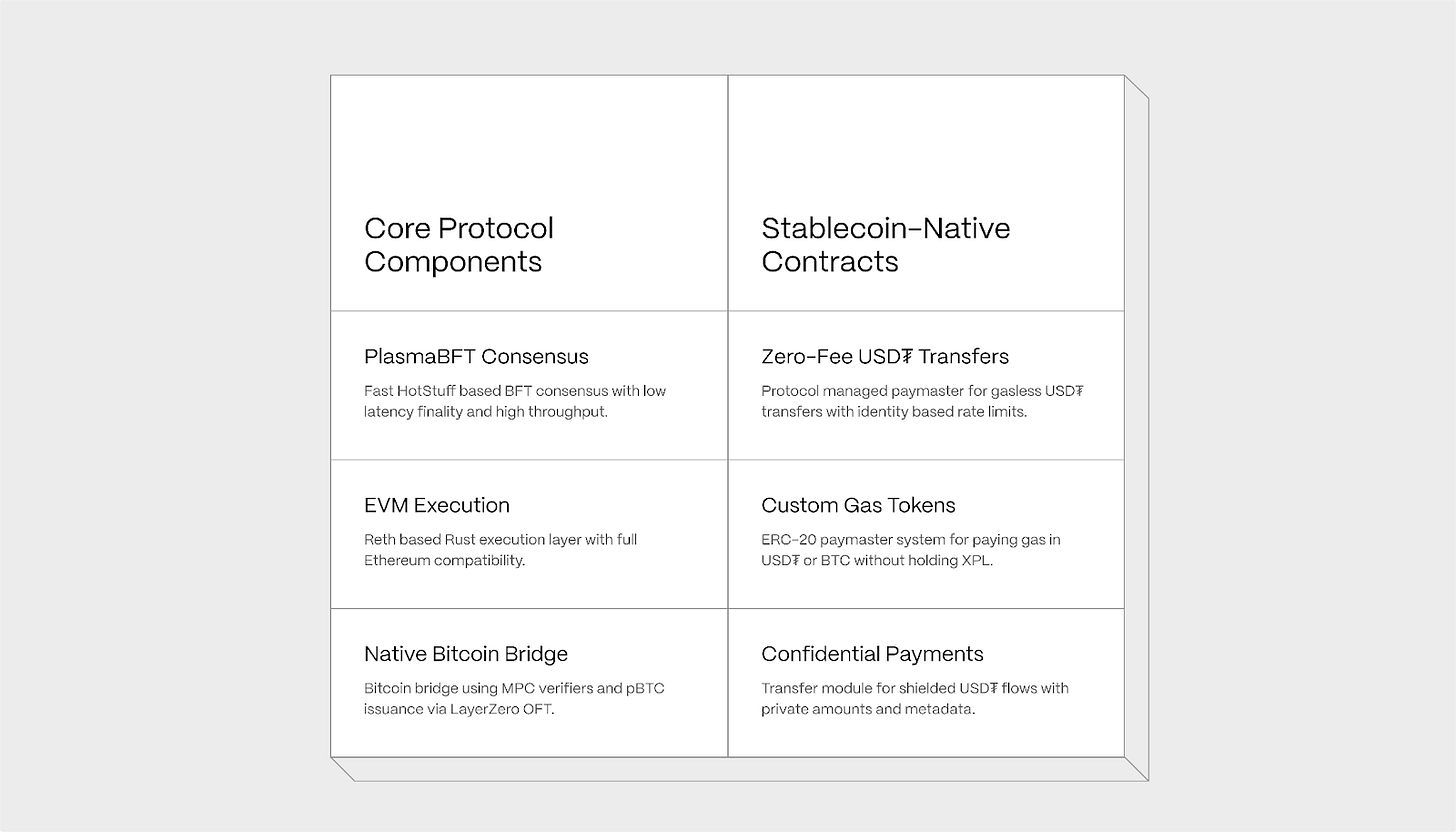

2.1. PlasmaBFT

Traditional blockchains often required minutes or even hours for transaction finality. On Ethereum, sending USD₮ during congestion could involve long delays. Plasma addresses this problem fundamentally. With its new consensus mechanism, PlasmaBFT, transactions finalize within a second.

The Fast HotStuff algorithm accelerates consensus. In simple terms, it secures agreement among participants with fewer steps. Multiple node signatures are aggregated, simplifying verification. The number of messages exchanged per step is also reduced. New block proposals can start without waiting for prior block completion. As a result, overall throughput increases. Under optimal conditions, only two consecutive proofs are needed for finality.

The parallel with browsers is instructive. In Internet Explorer, one frozen tab could crash the entire application. Chrome resolved this with independent processes for each tab, enhancing stability. Similarly, Plasma optimizes transaction processing, improving stability across the entire network.

2.2. EVM Compatibility

For developers, the most critical factor is using existing knowledge and tools without modification. Chrome fully supported web standards, freeing developers from Internet Explorer’s compatibility issues. Similarly, Plasma supports all Ethereum applications and tools without code changes.

Developers can work in a familiar environment. Plasma delivers full EVM compatibility by building on Reth, a high-performance Ethereum client written in Rust. Smart contracts can migrate to Plasma without altering a single line of code, removing major barriers to entry.

The browser parallel is clear. When users moved from IE to Chrome, websites functioned without adjustment. Likewise, Plasma integrates seamlessly with the existing Ethereum ecosystem.

2.3 Native Bitcoin Bridge

Plasma is developing a Bitcoin bridge alongside its stablecoin infrastructure. The initiative has two primary goals: issuing BTC-collateralized stablecoins and building a Bitcoin-centered financial ecosystem.

In stablecoin systems, the reliability of collateral assets is critical. Bitcoin, proven over 15 years, is the most secure digital asset available. However, its lack of native smart contract functionality has limited its use as direct collateral.

Traditionally, centralized custodians have held Bitcoin and issued wrapped tokens. This model introduced two persistent issues: single points of failure and high transaction costs.

Plasma’s native bridge addresses these constraints by enabling Bitcoin to be transferred directly into EVM environments, where it can function as programmable collateral.

This approach expands Bitcoin’s role in financial applications while preserving its security guarantees. It also integrates Bitcoin into DeFi ecosystems, allowing users to save in BTC while transacting in stablecoins such as USDT, thereby advancing a Bitcoin-driven financial environment.

2.4 Zero-Fee USD₮ Transfers

Zero-fee USD₮ transfers are a core feature enabling Plasma to function as stablecoin infrastructure. As Chrome disrupted browsers with free access, Plasma targets stablecoin adoption through free transfers.

Users only need to hold USD₮. A system-level paymaster covers transaction fees on their behalf. This applies only to official USD₮ token transfers. Basic identity checks and transfer limits prevent abuse.

In practice, the Plasma Foundation allocates a fee budget to cover gas costs. Users can complete all transactions with USD₮ alone, without any gas fee.

2.5 Custom Gas Tokens

Traditional blockchains restrict fees to native tokens. Ethereum requires $ETH, Polygon requires $POL, and Tron requires $TRX. Users must manage additional tokens beyond USD₮.

Plasma removes this friction. Users can pay fees directly with familiar assets such as USD₮ or BTC. From an approved list, they select a token, and a trusted oracle sets fees based on real-time exchange rates.

2.6 Confidential Payments

A core feature of blockchains is transaction transparency. Anyone can view amounts, senders, and recipients. While this ensures openness, it limits privacy. By contrast, traditional finance protects privacy but relies on regulatory oversight.

Plasma is researching a confidential payment module, selectively applied when needed. Like Chrome’s choice between normal and incognito modes, transactions can remain public or private depending on context.

Technically, recipient identities are hidden using one-time addresses, and transaction details are encrypted within memos. The system operates in the EVM environment, ensuring DeFi compatibility.

Importantly, regulators can still access information when required for anti-money laundering or tax compliance. This balance enables privacy without sacrificing regulatory standards.

3. Plasma: Today and the Future

Plasma is currently receiving strong market attention. The XPL token sale closed within minutes. Binance Earn’s campaign reached $1 billion and attracted over 30,000 participants before closing quickly. However, sustaining growth requires more than technical advantages. A broader strategic approach is essential.

Chrome’s success offers useful parallels. Initially, Chrome attracted users with superior speed and performance. However, its true growth engine was the extension ecosystem. Everyday tools like MetaMask and DeepL ran seamlessly on Chrome, transforming it from a browser into a digital platform.

Plasma follows a similar trajectory. At present, it is focused on core infrastructure ahead of mainnet launch. Zero-fee transfers and EVM compatibility are comparable to Chrome’s speed advantage. Yet the decisive stage comes next.

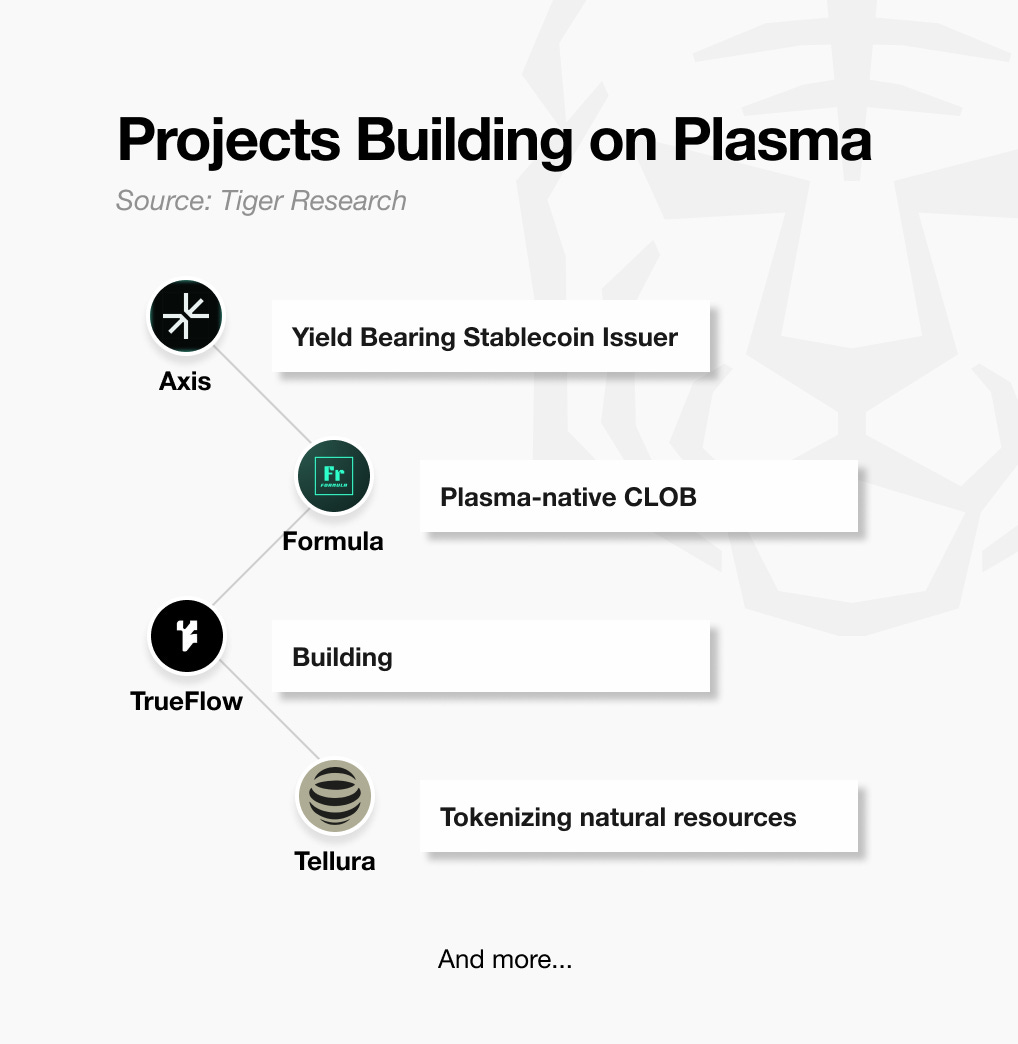

Plasma understands the importance of ecosystem growth. Partnerships with leading DeFi protocols such as AAVE, Pendle, and Ethena demonstrate this commitment. Through community builder programs, developers are actively recruited. These early investments create the foundation for diverse services, much like Chrome’s extension ecosystem.

The real potential lies in unlocking new service domains. High fees previously blocked use cases such as microfinance, real-time payroll, and micropayment-based content services. With Plasma, these become economically viable. As such services emerge, both Plasma’s utility and user base can expand significantly.

Ultimately, Plasma seeks to deliver the same transformation Chrome brought to the internet. Complex technology remains hidden, while users experience simple, intuitive functionality. For stablecoins to mature into true digital money, usability rather than technical sophistication will be decisive.

Plasma aims to be the “Chrome of stablecoins” at precisely this point.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report was partially funded by Plasma. It was independently produced by our researchers using credible sources. The findings, recommendations, and opinions are based on information available at publication time and may change without notice. We disclaim liability for any losses from using this report or its contents and do not warrant its accuracy or completeness. The information may differ from others' views. This report is for informational purposes only and is not legal, business, investment, or tax advice. References to securities or digital assets are for illustration only, not investment advice or offers. This material is not intended for investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo following brand guideline. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.