This report was written by Tiger Research, analyzes Stable's strategy as a USDT-focused blockchain enabling gas-free P2P transfers and sub-second settlement for stablecoin mass adoption.

TL;DR

Stable positions itself as a “Trojan horse” for the stablecoin market, aiming for mass adoption through USDT-focused infrastructure.

It offers gas-free USDT transfers, sub-second settlement, and a simplified interface to address key barriers such as high fees, slow transaction speeds, and user complexity.

The expected plan is to attract users with free, seamless transfers, then expand into payments, DeFi services, and institutional partnerships.

1. Stablecoins: A Trojan Horse Entry into the Market

Stablecoins entered the cryptocurrency market quietly, much like a Trojan horse.

They have since grown into a dominant force in the ecosystem. Initially, they were viewed mainly as a tool to reduce volatility. Over time, they have evolved into a core component of market infrastructure.

The stablecoin market, led by USDT, has a circulating supply exceeding USD 150 billion and more than 350 million users. Transaction volumes surpass those of Visa. This positions stablecoins not only as crypto assets but also as a functioning global payment network.

Their growth reflects a bridging role between traditional and digital finance. On centralized exchanges, they are the main medium for converting between fiat and cryptocurrencies. In decentralized finance (DeFi), they serve as the benchmark asset for liquidity provision and lending. For cross-border remittances, they offer a faster and more cost-effective alternative to traditional banking.

The shift in market behavior is notable. Early crypto trading relied on direct token-to-token exchanges, such as BTC/ETH or BNB/ETH, with value measured relative to Bitcoin. Today, trading pairs like BTC/USDT and ETH/USDT dominate. DeFi yields are commonly denominated in USDT. In parts of Southeast Asia and Latin America, USDT is increasingly used for direct payments instead of physical U.S. dollars.

Where the market once depended on volatile token-based valuations, stablecoins have become the universal unit of account.

Introduced out of necessity, they now serve as the central axis of the cryptocurrency ecosystem.

2. The Shadow of Growth: Emerging Infrastructure Limitations

Rapid expansion has also exposed structural weaknesses. The current stablecoin infrastructure faces three critical constraints.

1. Unpredictably High Transaction Fees

Stablecoins operate across multiple blockchain networks, but when network congestion occurs, gas fees can spike sharply, making small transactions impractical. In some cases, sending USD 10 can incur a USD 20 fee. This undermines the core purpose of stablecoins as a medium for everyday payments.

2. Slow Settlement Times

On Ethereum, stablecoin transactions can take several minutes or longer to confirm, depending on network conditions. For use cases like online checkout or in-person retail, where real-time settlement is critical, such delays are prohibitive.

3. Complex User Experience

Managing gas fees, wallets, and private keys still presents a high barrier to entry for the average user. For consumers accustomed to simple payment interfaces like Paypal, current stablecoin usage remains overly complex.

These infrastructure limitations form a significant barrier to the next phase of stablecoin adoption. The irony is clear: within the crypto ecosystem, stablecoins have already become the de facto benchmark asset, yet for mainstream users, everyday usability remains low.

Stablecoins have fulfilled their initial role as a Trojan horse, bringing stability to a volatile market and establishing themselves at the core of the ecosystem.

The next challenge lies beyond crypto: penetrating traditional financial markets and mainstream consumer payments. Achieving this will require addressing current technical constraints at a fundamental level, which calls for a new “Trojan horse” strategy.

3. The New Trojan Horse: Stable

Creating a new Trojan horse for the market does not require inventing another stablecoin. Stablecoins are merely instruments pegged to the U.S. dollar. The next Trojan horse is dedicated infrastructure for the stablecoins already in use, particularly those that have achieved market dominance.

This is where Stable enters. Unlike general-purpose blockchains, Stable is a chain purpose-built for USDT. Rather than supporting USDT alongside other tokens, it functions as a dedicated high-speed network exclusively for USDT transactions.

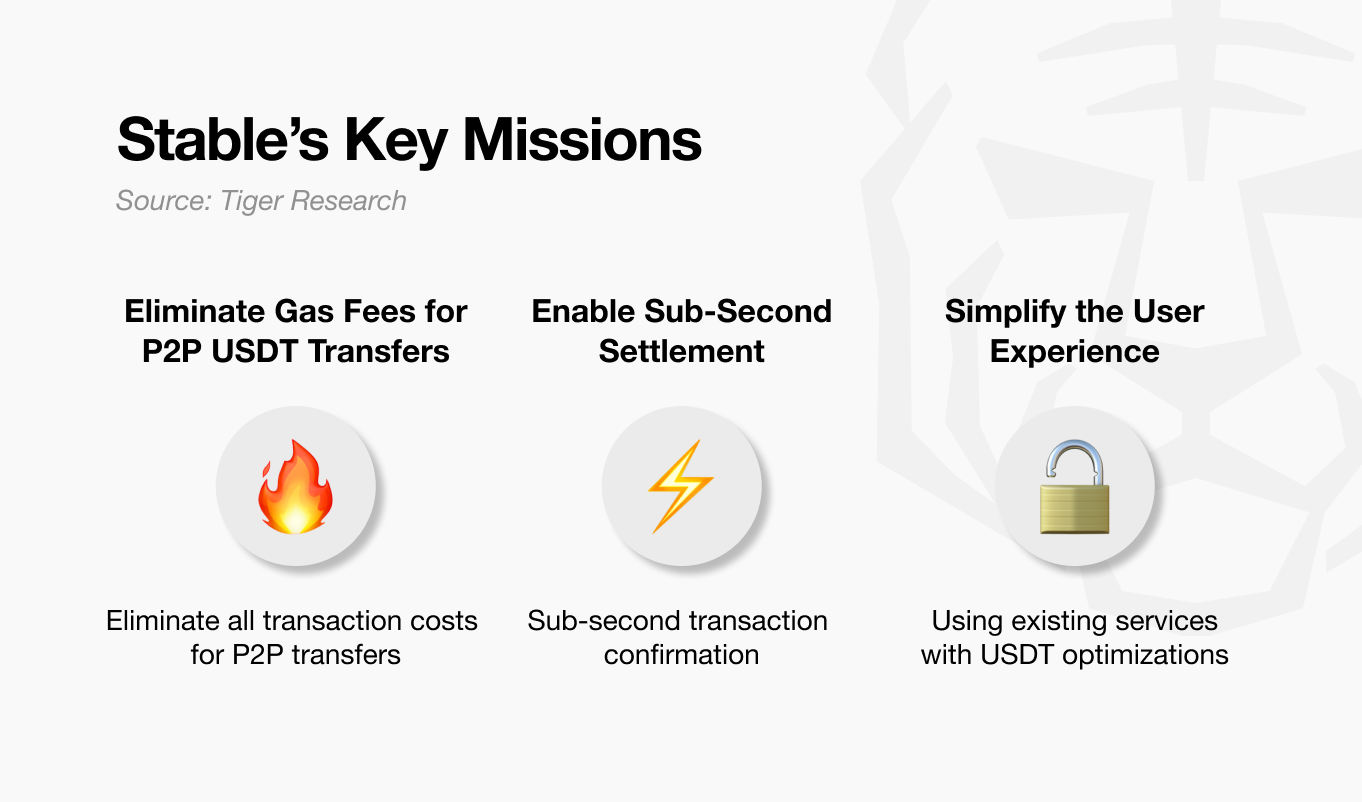

Stable’s mission is threefold:

Eliminate Gas Fees for P2P USDT Transfers: Remove gas costs entirely for P2P USDT transfers, addressing the inefficiency where even a USD 10 transfer could incur disproportionately high fees on existing networks.

Enable Sub-Second Settlement: All transactions settle in under one second, removing the waiting time common in both physical and online retail payments.

Simplify the User Experience: Abstract away gas fee calculations and wallet management, enabling intuitive use without technical overhead.

A key point is that these improvements are interconnected. Eliminating gas fees simplifies the user experience, while faster transaction processing increases utility in real-world commerce. Together, these factors create a foundation for stablecoins to expand beyond the cryptocurrency ecosystem into mainstream payment markets.

Stable’s vision is not simply to become another blockchain, but to serve as core infrastructure supporting the USDT ecosystem, which has a market size of USD 160 billion.

It aims to address structural limitations in existing stablecoin infrastructure, including unpredictable fees, slow settlement speeds, and complex user interfaces. This approach moves away from the fragmented model in which each chain independently supports USDT, toward a unified environment optimized specifically for USDT operations.

4. How This Architecture Works

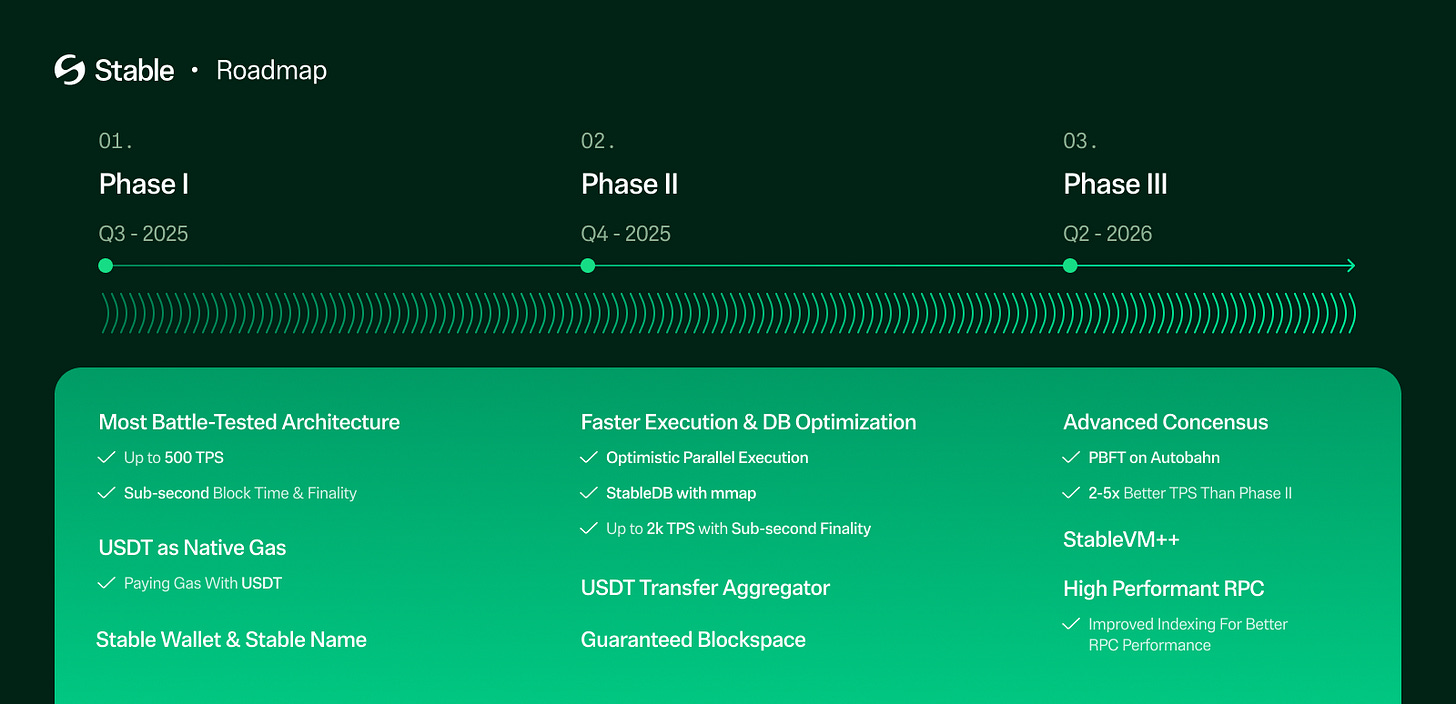

For Stable’s core vision to operate in practice, multiple technical elements must align. Stable remains in testnet as the team builds toward mainnet launch. The intended architecture provides a clear view of how the system is structured to operate.

4.1 Gas-Free USDT0 Transfers: EIP-7702 and Account Abstraction

The Stable network operates with two token types.

USDT0 represents USDT bridged from external networks via cross-chain bridging. gasUSDT is a network fee payment token with a 1:1 value peg to USDT0, used exclusively for transaction fees. Both are redeemable 1:1 for actual USDT.

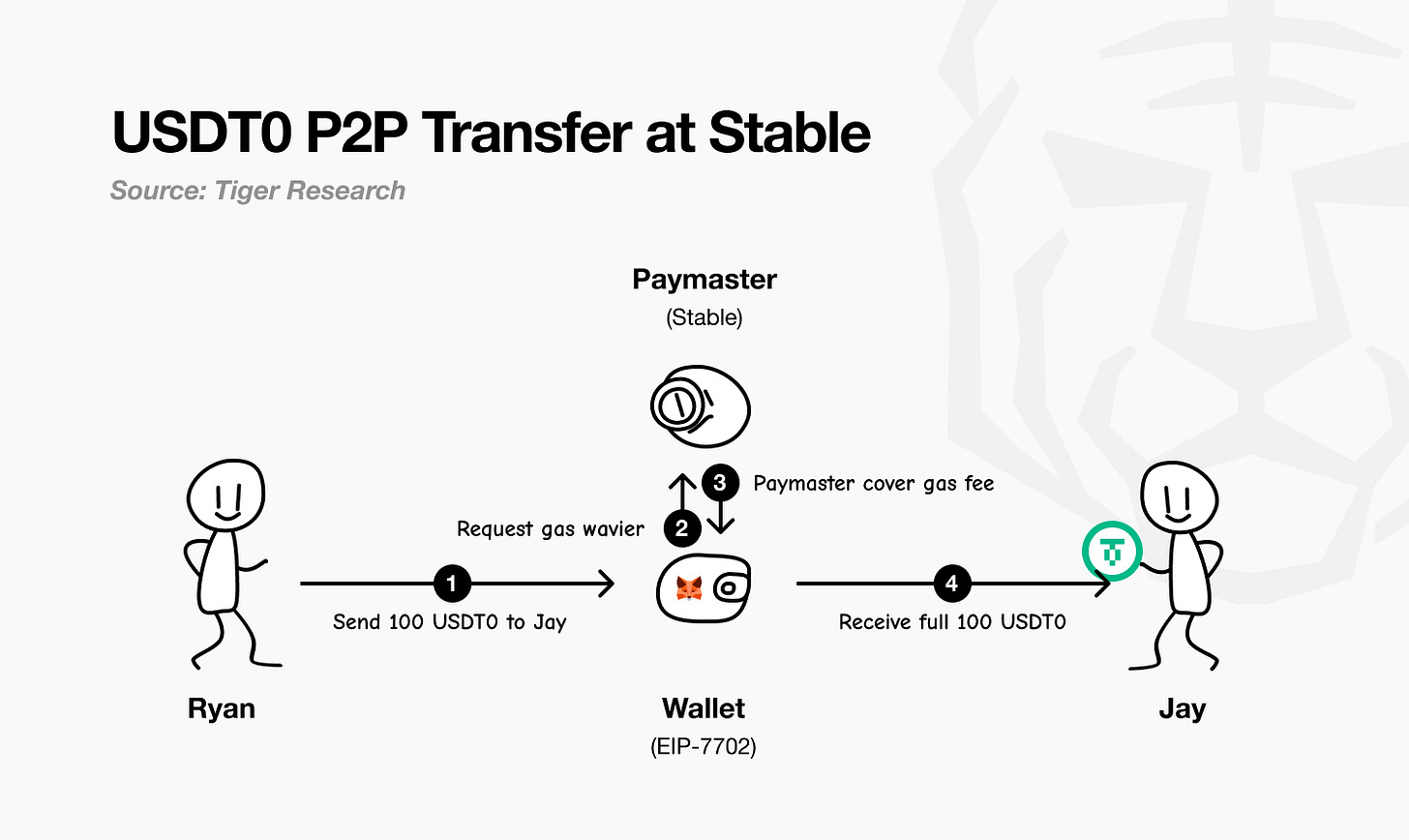

To enable gas-free P2P transfers, Stable leverages EIP-7702 and Account Abstraction. The key outcome is that users can conduct all transactions while holding only USDT0.

In current blockchain systems, two account types exist separately:

Externally Owned Accounts (EOA): standard wallets (e.g., MetaMask) controlled by a private key, capable of signing transactions but limited in functionality.

Contract Accounts (CA): smart contracts capable of executing complex logic but unable to initiate transactions independently.

Account Abstraction merges these account types, enabling standard wallets to operate with smart contract functionality. This allows users to specify, for example, “pay gas fees in USDT” or “request a gas fee waiver.”

The first standard to address this was ERC-4337. It required creating a new smart wallet and moving funds from the existing wallet, a process vulnerable to user error.

Previous approach: Create new smart wallet → Transfer funds from existing wallet → Use new address

EIP-7702: Retain existing wallet → Add smart contract functionality → Keep the same address

EIP-7702 removes the migration step by enabling smart features on an existing wallet address without moving funds. Users can continue using their existing MetaMask wallet with added smart capabilities.

In Stable, all wallets natively support EIP-7702, enabling smart wallet functions without additional setup. This includes features such as gas fee sponsorship, which are available directly in existing wallets.

Example:

Ryan sends 100 USDT0 to Jay via MetaMask.

The EIP-7702–enabled wallet requests a gas fee waiver

Paymaster service covers the fee.

Ryan’s balance decreases by exactly 100 USDT0, and Jay receives the full amount.

No gas is deducted, and Ryan does not need to hold or calculate fees, similar to sending money via PayPal. This eliminates the need for separate gas holdings or manual fee calculations.

4.2. Sub-Second Transaction Finality

Stable uses the StableBFT consensus algorithm, which produces blocks roughly every 0.7 seconds and finalizes transactions after a single confirmation. This eliminates the “pending” stage familiar in many blockchain transactions and provides an experience similar to instant approval at a payment terminal.

To further improve speed, Stable is developing Block-STM parallel processing, enabling simultaneous execution of independent transactions, which make up an estimated 60 to 80 percent of network activity. This approach is comparable to operating multiple checkout counters in a store to reduce wait times.

Over the longer term, Stable plans to upgrade to an Autobahn DAG-based consensus. This structure allows multiple blocks to be proposed at the same time and separates data propagation from ordering, reducing bottlenecks. Internal tests have recorded throughput of up to 200,000 transactions per second, though this remains pre-production.

4.3. Simplified User Experience

Stable removes the need for gas fee calculations and the management of separate gas tokens, building on existing Ethereum compatibility. This allows users to continue using familiar tools such as MetaMask and Etherscan without additional learning requirements.

Beyond simple compatibility, these tools operate more smoothly with USDT-optimized features: MetaMask enables gas-free USDT0 transfers, while Etherscan presents USDT transaction history in a more intuitive format.

This is comparable to upgrading to a new smartphone while retaining all existing apps. Users keep their familiar environment but gain enhanced capabilities.

And USDT from other networks can be imported seamlessly through the existing LayerZero cross-chain bridge. USDT0 uses LayerZero’s OFT (Omnichain Fungible Token) standard, which removes the complexity of traditional bridging. In conventional models, each network maintained a separate USDT version, fragmenting liquidity.

With the OFT standard, a single USDT0 functions identically across all networks. Whether bridged from Ethereum or Arbitrum, the resulting token is the same USDT0, eliminating liquidity fragmentation and simplifying asset transfer.

Planned developments include the Stable Name System, which will further improve usability by replacing complex wallet addresses with human-readable names. Similar to email addresses, users could send funds to identifiers such as “ryan.stable” or “jay.stable.” While still in the planning stage, implementation and adoption may take time. Technically, it is expected to follow a structure similar to Ethereum Name Service (ENS), with added features optimized for USDT transactions.

4.4. Additional Technical Components

The network is also developing StableDB, a dedicated database architecture that separates state commit from state storage.

In most blockchains, new blocks must be fully written to disk before the next block can be processed, and slow disk writes create processing delays. StableDB removes this bottleneck by confirming execution results in memory first, then writing them to disk in parallel.

This structure is enhanced with memory-mapped file I/O (mmap), which links files stored on disk directly to the operating system’s memory space. This allows frequently accessed data to be read and written as if it were in memory, bypassing slower disk access and significantly improving processing speeds. The effect is similar to a busy restaurant where staff quickly jot down orders before entering them into the POS system later, allowing the kitchen to begin work immediately.

For enterprise clients, Stable plans to introduce Guaranteed Blockspace, a dedicated allocation of transaction capacity that ensures consistent throughput regardless of network congestion, akin to a bus-only lane on a highway. A Confidential Transfer feature is also under development to conceal transaction amounts while still meeting AML and KYC compliance requirements. Looking further ahead, the execution engine, currently written in Go, will be replaced with a C++-based version called StableVM++. This upgrade will allow for lower-level memory control and performance optimizations, with a target of up to six times greater execution speed.

5. Expansion Scenarios for the Stable Ecosystem

Stable positions itself as a new Trojan horse.

Gas-free USDT transfers, sub-second settlement, and a simplified user experience act as entry-point incentives. This loss-leader strategy is designed to drive large-scale adoption. Once a user base is established, revenue can be generated through a broad set of ancillary services.

From this foundation, three primary expansion paths appear likely.

5.1. Scenario 1: Expansion of Institutional Services and Partnerships

Stable can expand its ecosystem by growing institutional services and partnerships. A key factor is premium offerings such as Guaranteed Blockspace, which ensure low cost and high reliability.

This strategy is effective in corporate cross-border settlement. Using Stable instead of traditional international transfers can significantly reduce time and cost. However, during peak periods such as month-end, processing speed becomes critical. Dedicated blockspace ensures consistent speed, and enterprises are willing to pay a premium for this reliability.

The same logic applies to fintech partnerships. Remittance companies such as Limitless and Wise can deliver better services to their customers by integrating Stable’s infrastructure. In turn, Stable earns transaction volume–based fees.

The same applies to cryptocurrency exchanges. By using Stable for USDT deposits and withdrawals, exchanges gain a reliable partner. While individual users access the service for free, the real business target is high-volume institutional traders.

5.2. Scenario 2: Rapid Growth of the On-Chain Service Ecosystem

Free transfers and high speed will sharply increase the use of on-chain services. On Ethereum today, even a USD 10 DeFi transaction requires high gas fees. On Stable, small-scale DeFi activity becomes economically viable.

Users can provide USD 100 in liquidity or stake without significant cost, which will expand the DeFi user base. Stable captures smart contract execution fees from these activities, and as transaction volumes grow, so does total scale.

A more notable change is the emergence of new on-chain services. Real-time micropayments will enable direct blockchain-based transactions for content subscriptions, game items, and tipping. Sending USD 1 to a YouTube creator or paying USD 0.10 for a single news article becomes possible.

Once such a micropayment ecosystem forms, the number of transactions will increase exponentially. Individual fees may be small, but aggregate transaction volume will reach significant levels.

5.3. Scenario 3: Deep Integration with the Real Economy

The most ambitious scenario is for stablecoins to become a standard payment method in the real economy. In Southeast Asia and Latin America, USDT payments are already on the rise, but high fees and slow speed have limited adoption.

If Stable solves these issues, offline commerce could change rapidly. Paying USD 2 for coffee in a Vietnamese café or buying daily necessities in a Philippine convenience store with USDT could become routine.

This would transform Stable’s business model, shifting from a blockchain network to a global payment infrastructure provider. It could supply merchants with payment terminals and consumers with digital wallets, earning fees from both.

By charging a minimal fee on every USDT transaction that passes through the Stable network, it can build a stable revenue base alongside transaction growth.

Delays in central bank digital currency (CBDC) rollouts also present an opportunity. If private stablecoins are more convenient and accessible than government-issued digital currencies, users will naturally opt for the former.

6. Stable’s True Strategy

Stable’s strategy is clear: attract users through free USDT transfers and ease of use. As the ecosystem grows, build business models around the diverse services that emerge.

Individual transactions may not generate large revenue, but rapid growth in transaction volume creates substantial aggregate scale. This is similar to Amazon’s early strategy of selling books near cost to acquire customers, then generating significant profits later through cloud services and advertising.

Free transfers are the bait. The real objective is to become the central hub of the USDT ecosystem so that all transactions flow through Stable. Once network effects take hold, users will find it difficult to switch to other platforms.

Ultimately, Stable secures a defensible market position. This is the true strength of the new Trojan horse.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report was partially funded by Stable. It was independently produced by our researchers using credible sources. The findings, recommendations, and opinions are based on information available at publication time and may change without notice. We disclaim liability for any losses from using this report or its contents and do not warrant its accuracy or completeness. The information may differ from others' views. This report is for informational purposes only and is not legal, business, investment, or tax advice. References to securities or digital assets are for illustration only, not investment advice or offers. This material is not intended for investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo following brand guideline. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.