This report was written by Tiger Research, analyzing potential scenarios for Upbit and Bithumb launching their own blockchain.

TL;DR

Global CEXs are launching their own blockchains to secure new revenue streams. Upbit and Bithumb may join this competition.

Four scenarios emerge: OP Stack-based Layer 2, Korean won stablecoin infrastructure, leveraging Korea's unique market liquidity, and Pre-IPO stock tokenization. Each scenario reflects Korea's distinct market conditions.

Regulatory constraints and technical complexity remain significant obstacles. Short-term implementation proves challenging. However, declining trading volumes and intensifying global competition make it clear that both CEXs must seek new growth drivers.

1. READY, SET, LAUNCH: CEX-Led Infra Competition Begins

CEXs are diving into blockchain infrastructure competition. Coinbase launched Base, Kraken introduced Ink, and Robinhood recently joined. Competition grows fiercer.

This fierce competition stems from limitations in fee-based business models. CEXs rely on fee-based models as the most stable revenue source in the cryptocurrency industry. However, these models depend heavily on market conditions. This creates a need for revenue diversification. Additionally, CEXs previously competed within limited regulatory jurisdictions. Now the competitive arena has expanded globally. Decentralized exchanges (DEXs) have also challenged centralized platforms by capturing over 25% market share at their peak.

Meanwhile, crypto mainstream adoption is accelerating. This opens new business opportunities beyond trading for CEXs through blockchain infrastructure. These changes will accelerate CEX competition in launching their own chains.

2. What If: Upbit and Bithumb Launch Their Own Blockchains?

Global CEXs are racing to launch their own chains. This naturally raises the question: "Could Korea's major CEXs, Upbit and Bithumb, follow suit?" To assess this possibility, we need to examine these CEXs' current situations and previous attempts.

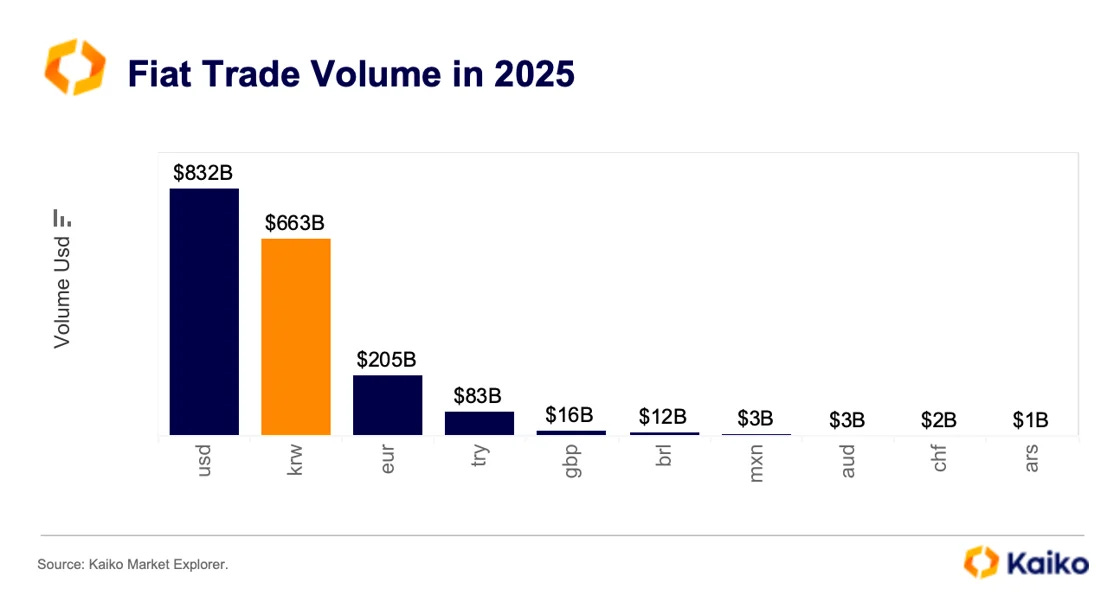

Korea occupies a unique position in the global crypto market. Korean won (KRW) trading volume ranks second globally after the US dollar (USD) among fiat currencies, sometimes even surpassing the dollar. No other single country generates such trading volumes. This market environment enabled Upbit and Bithumb to grow into large corporations (designated as large corporations in Korea for companies with assets over 5 trillion won).

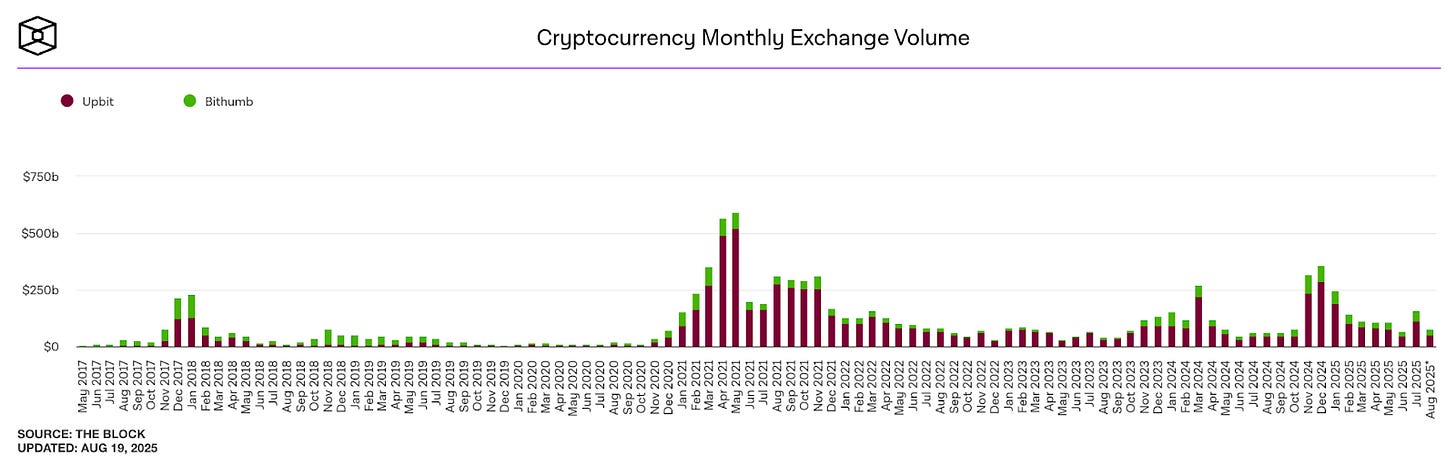

However, this structure is changing. Trading volumes at both CEXs have declined since reaching record highs in 2021. Local users are migrating to global CEXs like Binance and Bybit or to DEXs. This means local CEXs are approaching an environment where they cannot rely solely on Korea's liquidity premium.

The CEXs sensed these changes. Both Upbit and Bithumb attempted global expansion through overseas subsidiaries and business diversification. However, the "Korean CEX" brand alone failed to secure competitive advantages abroad. They launched various platform-based businesses, but most failed. These ventures lacked connection to the CEXs' core unfair advantages. Regulatory sanctions also constrained diversification efforts.

Winds of change are blowing. Trump's pro-crypto policies improved the global regulatory environment. CEXs can now pursue new growth strategies more aggressively. In this context, launching their own chains becomes a viable option for Upbit and Bithumb.

Different results can be expected if they launch chains. They can directly leverage their unfair advantages: large user bases and abundant liquidity. Korea's unique market characteristics add further potential for differentiated value creation.

Expected Scenario 1: Building OP Stack-Based Layer 2

If these CEXs build their own chains, they will likely choose Layer 2 over Layer 1.

The primary reason is development complexity and required resources. Layer 1 development and operation demand massive resources. Layer 2 requires substantial expertise despite lowered barriers through rollup services. Kraken's Ink project involved around 40 developers. For CEXs, building and operating such infrastructure independently creates significant burden. Their purpose lies in platform business expansion through infrastructure, not building high-performance infrastructure itself.

Regulatory risks further complicate the situation. Layer 1 blockchains require native token issuance, but Korea's regulatory environment makes token issuance virtually impossible with significant regulatory penalties. This makes Layer 2 models that can operate without native tokens the most practical alternative, following Coinbase's approach.

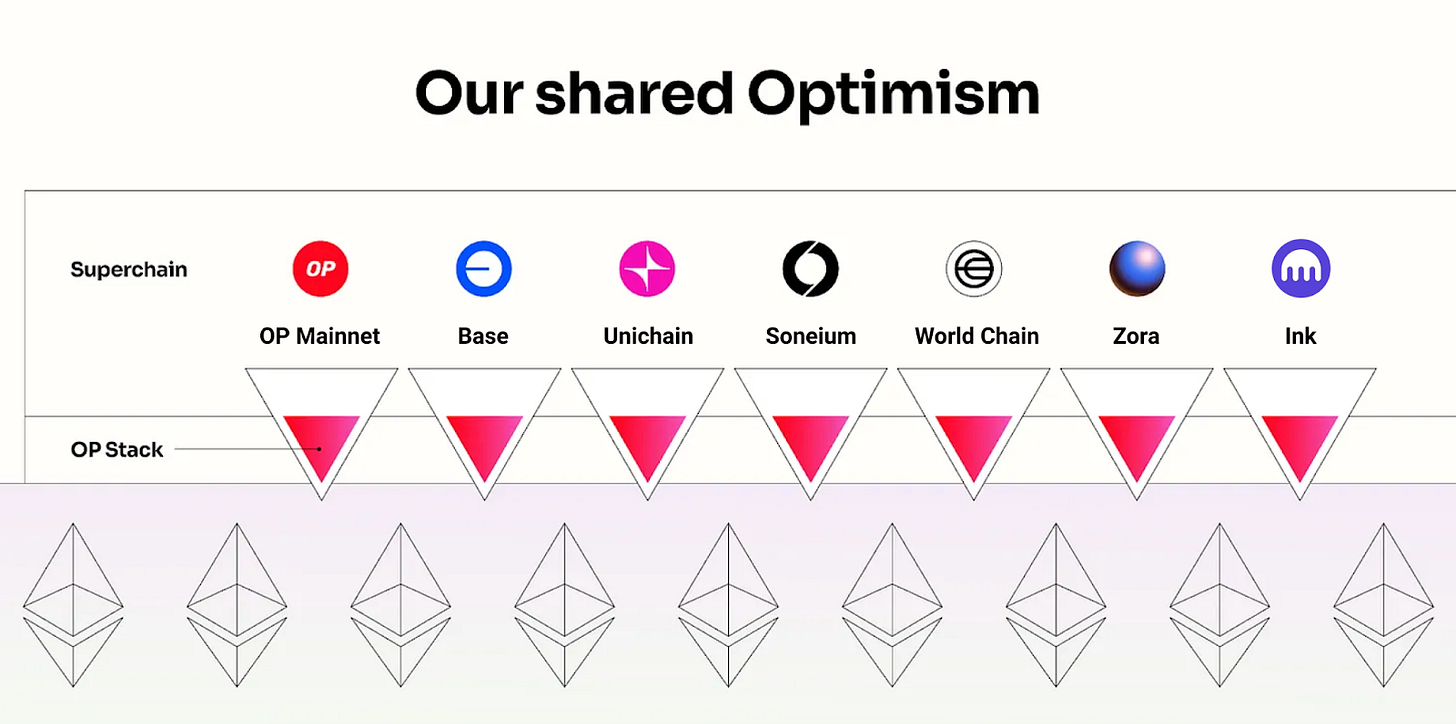

Multiple stacks exist for Layer 2 development, but global CEXs have adopted Optimism (OP) Stack as the de facto standard. Coinbase's Base and Kraken's Ink both built on this foundation and established themselves as CEX reference models. Robinhood exceptionally chose Arbitrum due to different strategic purposes. While Coinbase and Kraken pursued broad ecosystem expansion through interoperability, Robinhood focused on bringing its financial services on-chain. Arbitrum's greater customization flexibility likely suited this approach better.

Upbit and Bithumb share similar goals with Coinbase. Both CEXs must expand into on-chain services using their large user bases to overcome fee-based model limitations and create new revenue streams. Openness and interoperability are crucial for this expansion. Therefore, if Upbit and Bithumb launch their own chains, the most likely choice would be OP Stack-based public Layer 2.

Expected Scenario 2: Korean Won Stablecoin Infrastructure

Another scenario for Upbit and Bithumb launching their own chains involves building dedicated infrastructure centered on Korean won stablecoins.

Both CEXs show active movements in the stablecoin market. Upbit and Bithumb have filed stablecoin-related trademarks. Upbit officially announced plans to enter the Korean won stablecoin market through collaboration with Naver Pay, Korea's leading mobile payment service. Focusing on Upbit as the most likely candidate, the realistic scenario involves Naver Pay issuing Korean won-based stablecoins while Upbit provides the blockchain infrastructure. This structure addresses the Virtual Asset User Protection Act, which prohibits CEXs from trading virtual assets issued by themselves or related parties.

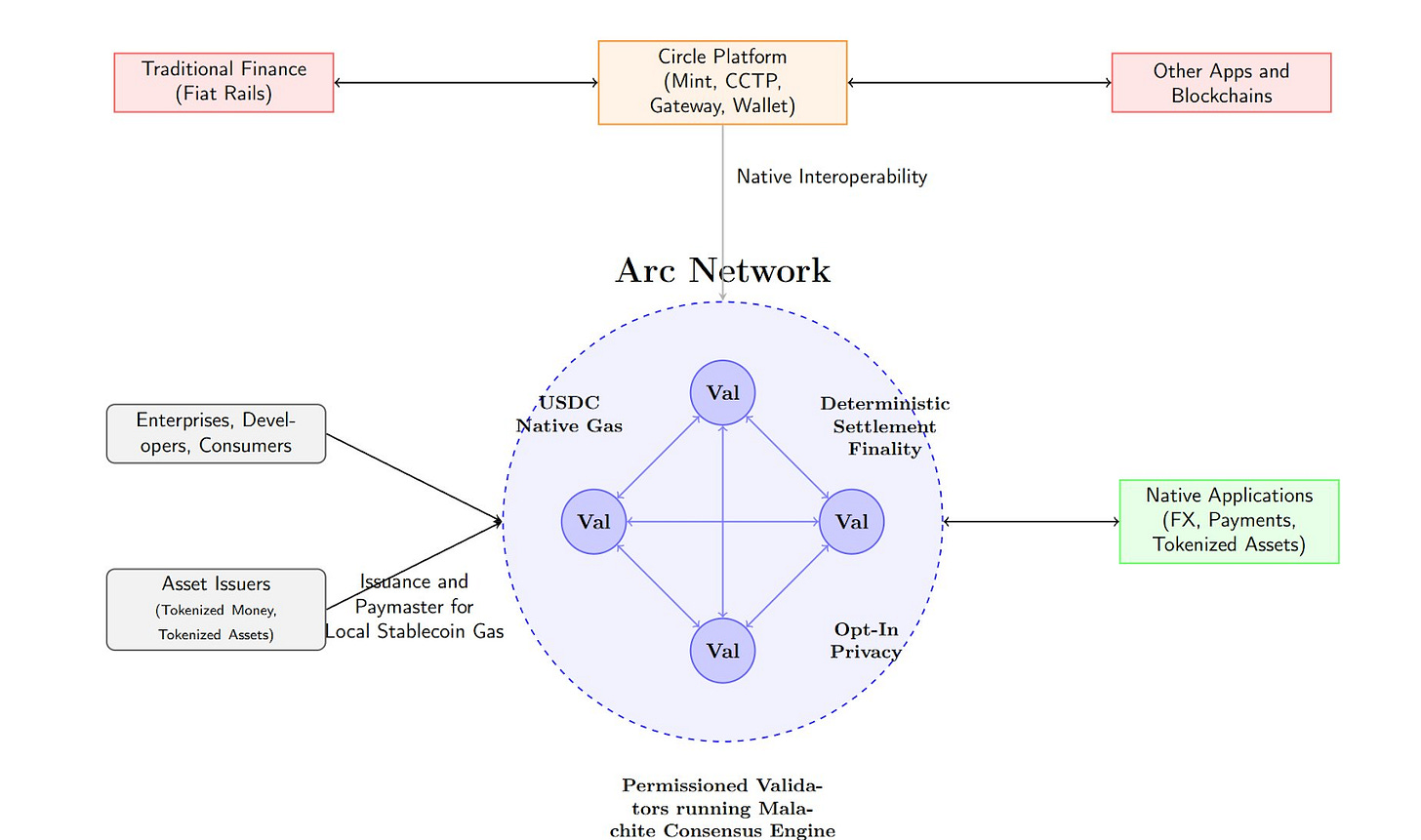

The key in this case involves building dedicated infrastructure optimized for stablecoins. They can implement differentiated services by adding real-world payment and privacy protection features. The network can be designed to pay gas fees with Korean won stablecoins. This resembles USDC's Arc Network model. It aims for ecosystems where all transactions center on stablecoins. These aim for ecosystems where all transactions center on stablecoins. This structure provides users with stable costs while creating sustainable demand for Korean won stablecoins.

Technical constraints exist. Optimism uses Ethereum for gas fees by default and ended support for custom gas tokens. Therefore, Arbitrum-based Layer 2 with customization capabilities or Layer 1 using Korean won stablecoins as native tokens may be more suitable choices.

Expected Scenario 3: Strategy Leveraging Korea's Liquidity Premium

One play Upbit and Bithumb can attempt involves leveraging Korea's liquidity premium. Korea currently holds massive liquidity, ranking second globally by fiat currency. However, this liquidity remains confined within CEX internal systems.

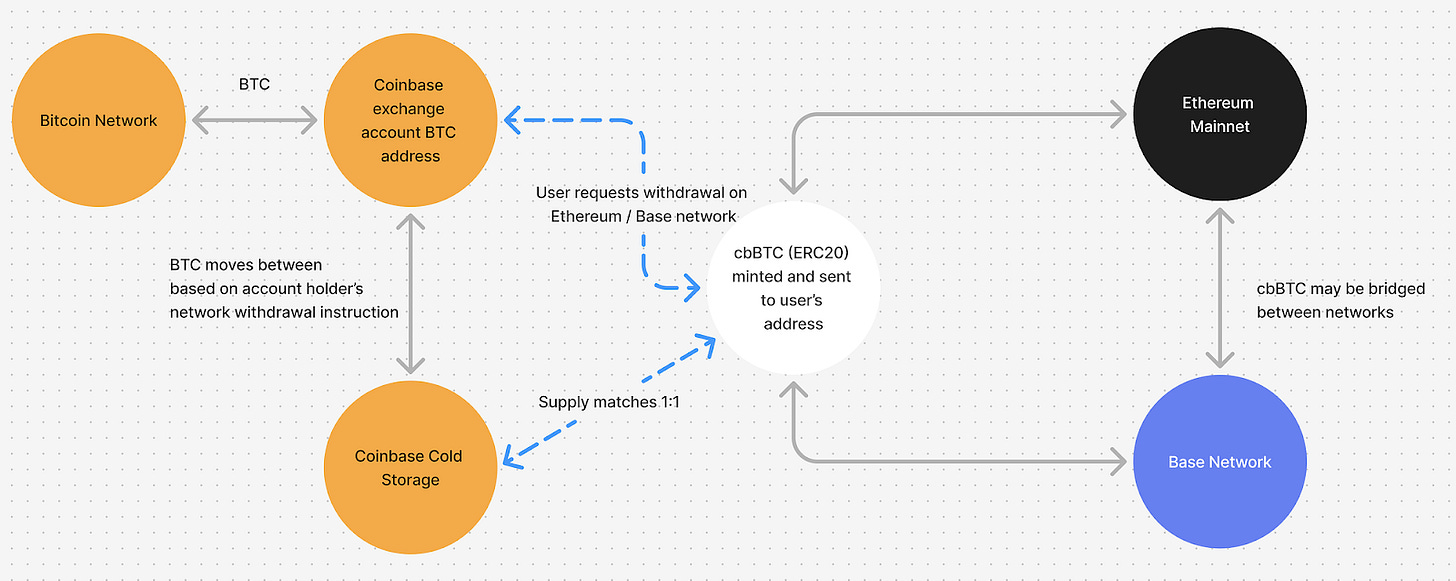

CEXs can issue wrapped tokens like upBTC and bbBTC based on deposited assets. Coinbase's cbBTC serves as a prime example. These wrapped tokens can be utilized on other chains, but users will likely remain within CEX-built chains if the platforms provide convenience features like one-click integration within their apps. This attracts project teams to build within these ecosystems for liquidity access. Activated ecosystems enable CEXs to secure infrastructure-based revenue. CEXs can also directly test additional business models like lending using wrapped tokens.

Expected Scenario 4: Entering Pre-IPO Stock Tokenization Market

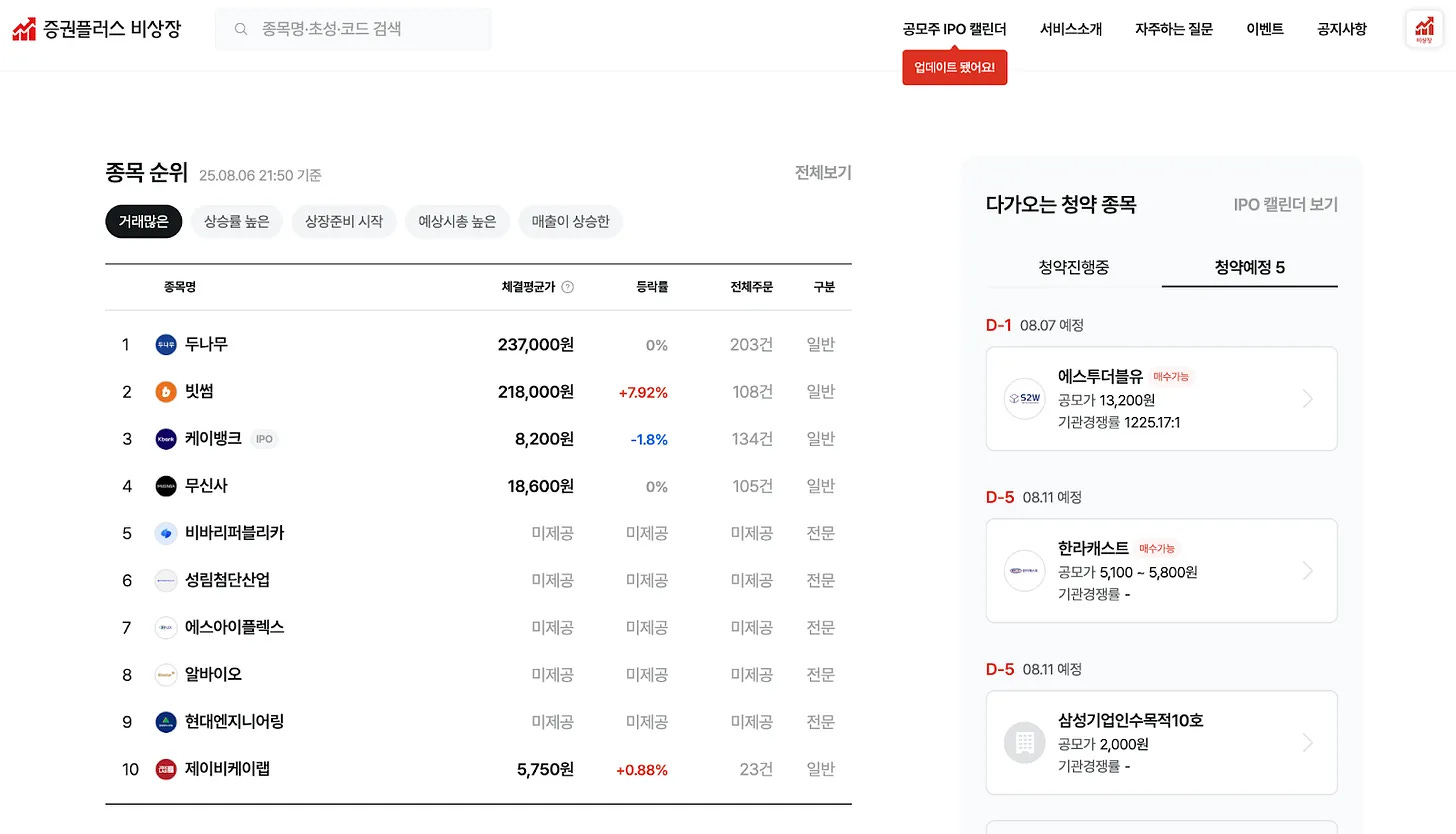

Another strategy Upbit and Bithumb can choose involves entering the pre-IPO stock tokenization market. Upbit already operates a pre-IPO stock trading platform through Ustockplus and has gained experience. However, this remains a P2P matching model where buyers must respond to sell orders. Without counterparties, transactions cannot be completed. This model suffers from low liquidity and unpredictable execution.

Tokenizing pre-IPO stocks on their own chains changes the situation. Tokenized stocks can be traded continuously through liquidity pools or market makers. Ownership transfers are automated and processed transparently through smart contracts. Beyond simple trading efficiency improvements, functions like automatic dividends, conditional trading, and programmable shareholder rights can be implemented on-chain. This enables financial product designs impossible with existing securities systems.

Naver's recent pursuit of acquiring stakes in Dunamu's Ustockplus is noteworthy. Upbit could provide chain infrastructure while Naver handles platform operations and physical stock management. This structure works well within current regulatory constraints. The approach separates trading infrastructure from securities management roles and reduces institutional risks. It enables entry into the tokenization market while addressing existing service limitations.

3. Closing Thoughts

We examined various scenarios for what Upbit and Bithumb's own chains might look like. However, many barriers remain in reality. The biggest constraint is regulation. Korea follows a positive regulatory approach. This makes it difficult to launch services not explicitly outlined in laws. Both CEXs face increased regulatory burden after being designated as large business groups. They also lack Web3 native leadership like Base's Jesse Pollak. Technical complexity adds another layer of difficulty. The likelihood of chains materializing in the short term remains low.

Nevertheless, sufficient possibility exists for these attempts. Domestic trading volumes have declined since peaking in 2021. Global competition continues to intensify. Fee-based models alone show clear growth limitations. Previous revenue diversification attempts have failed to deliver significant results. Sustained growth requires new drivers. Bold experiments in building their own chains could serve as one pillar. This represents the most realistic business diversification strategy that leverages their competitive advantages: user bases and liquidity.

Moreover, these possibilities require regulatory attitude changes to become reality. With policy support for healthy market development and institutional flexibility, Upbit and Bithumb could pursue various business experiments more actively. This could become an opportunity to enhance the competitiveness of Korea's entire blockchain ecosystem beyond the growth of these two CEXs.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.