99% of Web3 projects earn no cash. Still, many firms spend large sums on marketing and events each month. This report looks at their survival code and the facts behind the burn.

Key Takeaways

99% of Web3 projects lack cash flow, paying costs with tokens and funds, not sales.

Early listings drive high marketing spend and kill the core product edge.

Fair P/E of the top 1% proves the rest lack real value.

Early TGEs let founders exit regardless of success, fueling a distorted loop.

Survival of the 99% stems from a system flaw built on investor loss, not business gains.

1. Survival Requires Proven Revenue

“Survival requires proven revenue.” This is the top warning in Web3 today. As the market matures, investors no longer chase vague visions. If a project fails to gain real users and sales, holders exit fast.

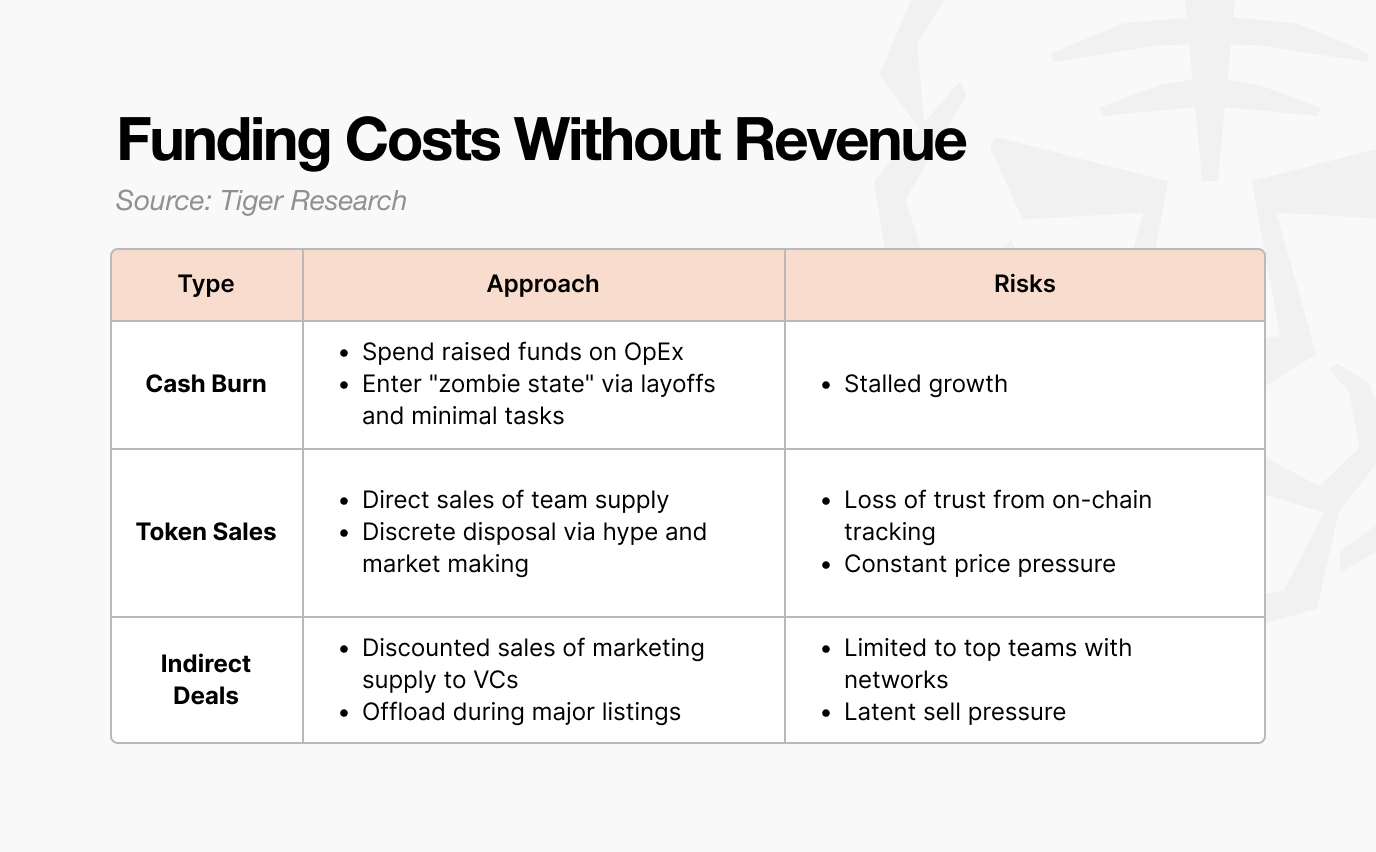

The critical issue is the “Runway,” the time a project can last without profit. Even without sales, costs like payroll and server fees stay fixed each month. Teams with no revenue have few ways to fund their operations.

Yet, this setup is a stopgap. Assets and token supplies have clear limits. In the end, projects that exhaust all means either cease operations or quietly fade from the market.

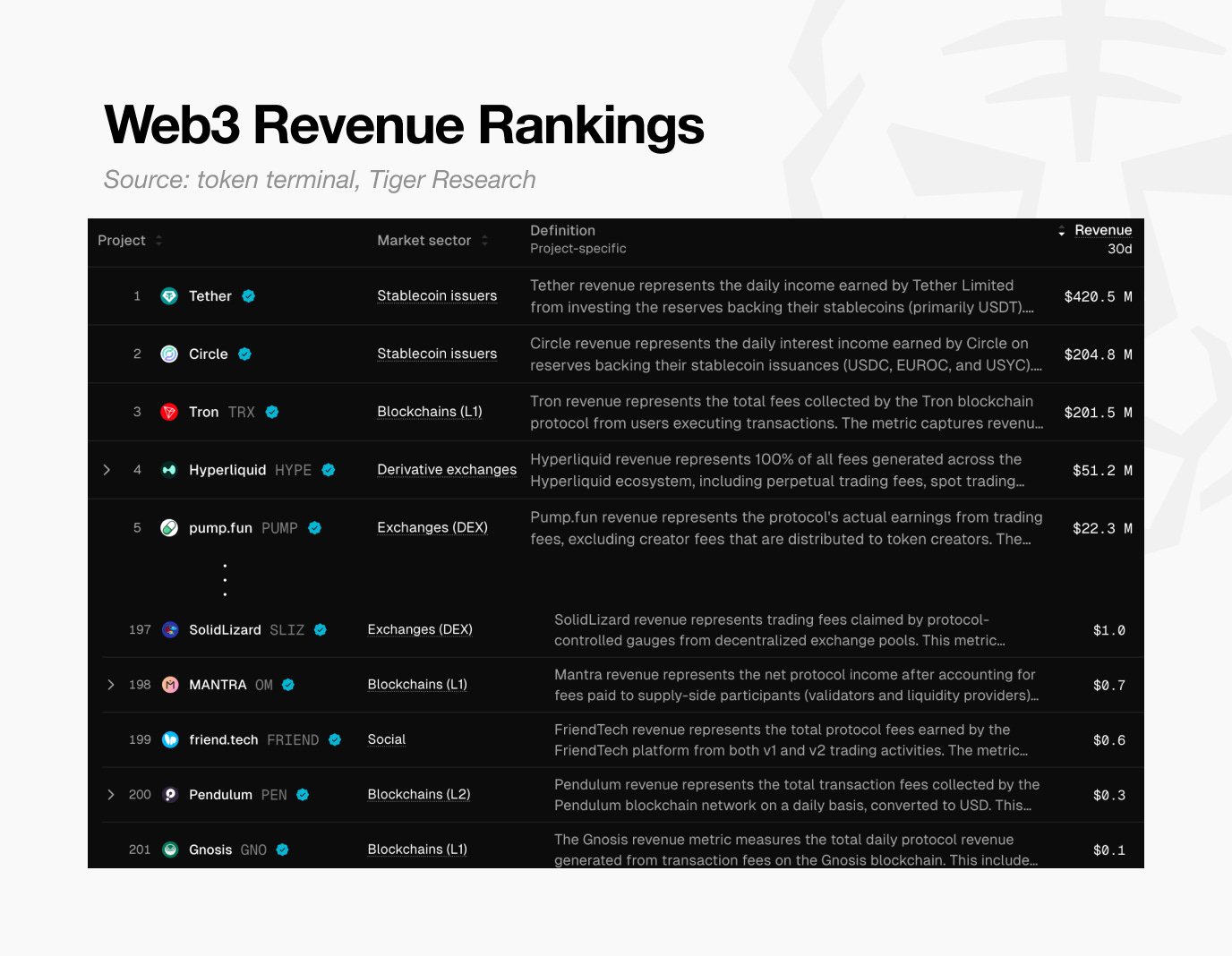

This threat is widespread. According to Token Terminal, only about 200 projects worldwide earned even $0.10 in the last 30 days.

This means 99% lack the basic means to pay their own costs. In short, almost all crypto projects are failing to prove a business model and are being slowly eroded.

2. The High Valuation Trap

This crisis was largely set. Most Web3 projects list on vision alone, without a real product. This contrasts with traditional firms that must prove growth before an IPO. In Web3, teams must justify high valuations only after the listing (TGE).

But holders do not wait. As new projects launch daily, they leave if hopes are not met. This puts pressure on the price and threatens survival. Thus, most projects spend more on short-term hype than on long-term development. Naturally, marketing fails if the product lacks strength.

Here, projects face a “no-win” trap. Focusing only on the product takes time, which drains the runway as interest fades. Focusing only on hype makes the project hollow. Both paths lead to failure. In the end, they fail to justify their initial high value and collapse.

3. Judging the 99% Through the Top 1%

Yet, a top 1% exists that proves viability with massive revenue.

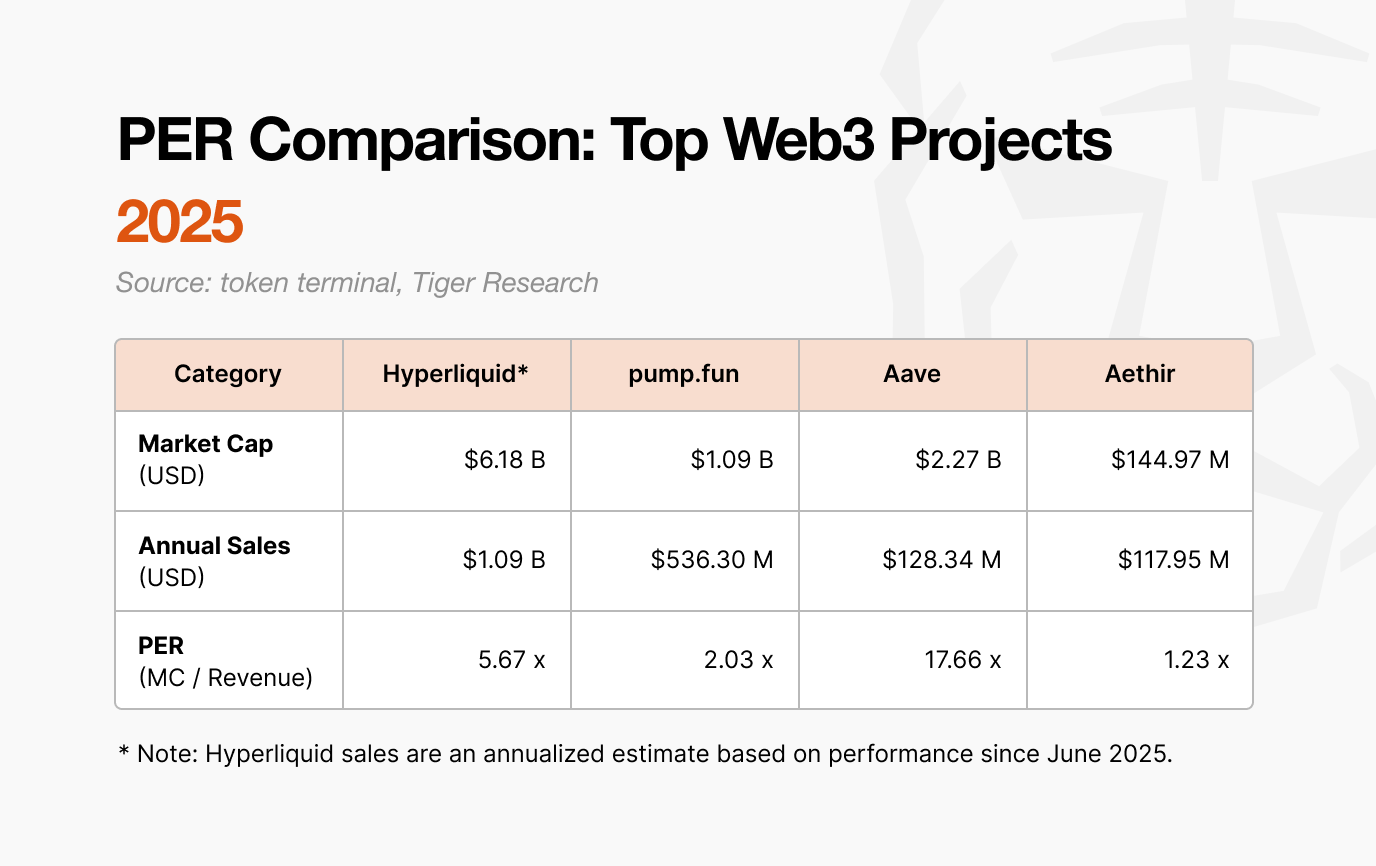

We can judge their value through the Price-to-Earnings Ratio (PER) of major earners like Hyperliquid and pump.fun. PER, found by dividing Market Cap by annual revenue, shows if a valuation is fair relative to actual income.

As shown, PERs for profitable projects range from 1x to 17x. Compared to the S&P 500 average PER of roughly 31x, these projects are either undervalued relative to sales or are earning cash well.

The fact that top-tier projects with real earnings maintain fair PERs paradoxically calls the valuations of the other 99% into doubt. It proves that most projects in the market lack a base for their high value.

4. Can This Distorted Cycle Be Broken?

Why do billion-dollar valuations persist without sales? For many founders, product quality is secondary. The distorted structure of Web3 makes a fast exit much easier than building a real business.

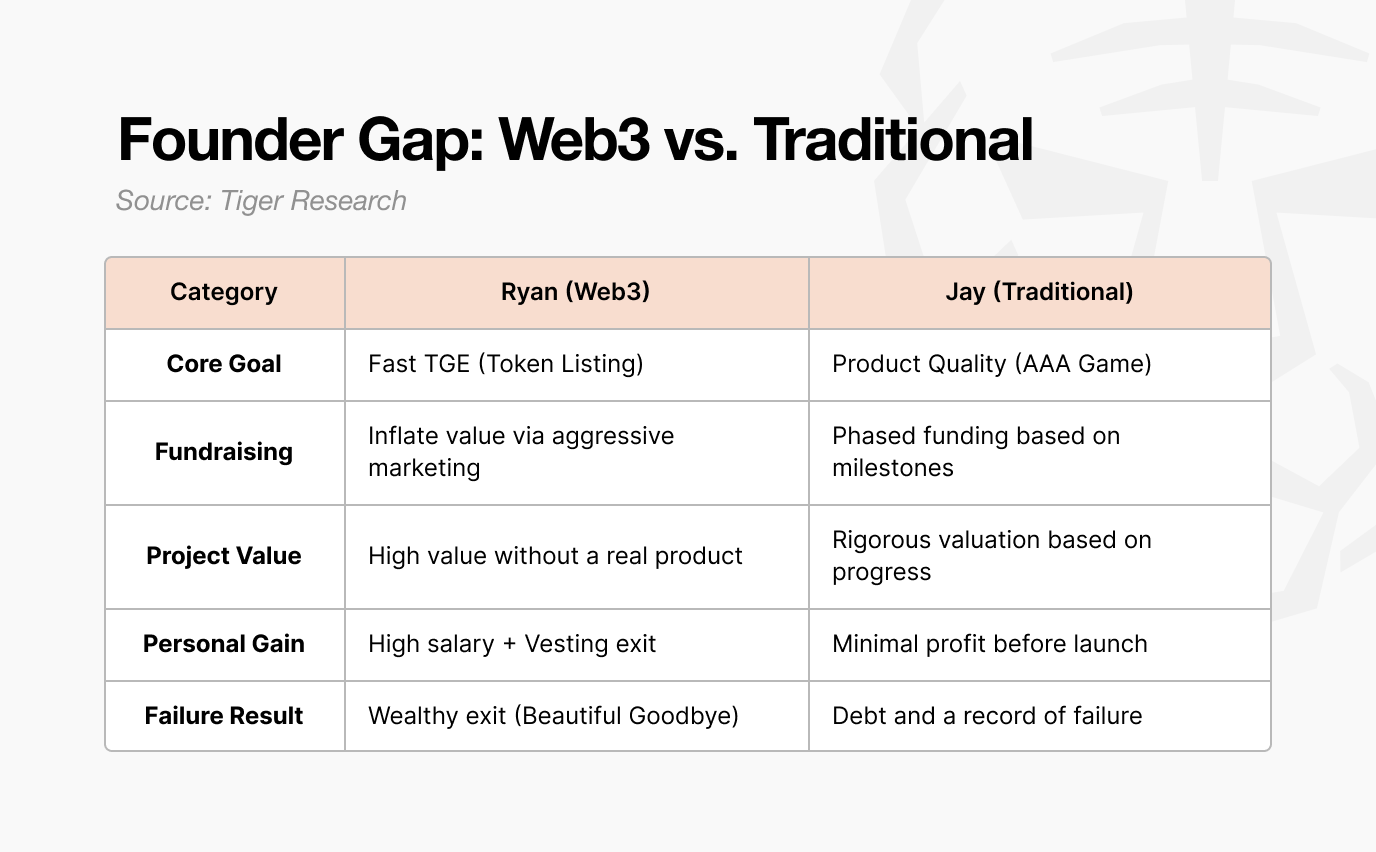

The cases of Ryan and Jay show why. Both started AAA game projects but met very different ends.

Ryan chose a TGE over development.

He took a path built for profit. He sold NFTs before the game launch to get early cash. He then held a TGE and listed on mid-tier exchanges using a bold roadmap while the work was still raw.

Post-listing, he used hype to defend the price and buy time. He launched the game late, but the quality was poor and holders left. Ryan quit to “take blame,” but he was the real winner.

While he kept a facade of work, he took high pay and sold his vested tokens for a large gain. He grew rich and left the market fast regardless of the game’s success.

In contrast, Jay followed a standard path focused only on the work.

He sought quality over hype. But AAA games take years to build. In this span, his funds ran dry, causing a runway crisis.

Under old models, founders have no way to gain meaningful profit until a product is launched and sold. Jay raised funds through a few rounds, but he shut down with an unfinished game due to a cash crunch. Unlike Ryan, Jay earned no profit but was left with large debt and a record of failure.

Who Actually Win?

Neither case resulted in a successful product. However, the winner is clear: Ryan built wealth by exploiting the distorted valuation structures of Web3, while Jay lost everything attempting to build a quality product.

This is the harsh reality of the current Web3 market. It is far easier to exit early by leveraging overvaluation than it is to establish a sustainable business model. Ultimately, the burden of this failure falls on the investors.

Returning to the original question: “How do 99% of unprofitable Web3 projects survive?”

This bitter reality serves as the most honest answer to that question.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report has been prepared based on materials believed to be reliable. However, we do not expressly or impliedly warrant the accuracy, completeness, and suitability of the information. We disclaim any liability for any losses arising from the use of this report or its contents. The conclusions and recommendations in this report are based on information available at the time of preparation and are subject to change without notice. All projects, estimates, forecasts, objectives, opinions, and views expressed in this report are subject to change without notice and may differ from or be contrary to the opinions of others or other organizations.

This document is for informational purposes only and should not be considered legal, business, investment, or tax advice. Any references to securities or digital assets are for illustrative purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not directed at investors or potential investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.