This report was written by Tiger Research, analyzing Everclear’s clearing infrastructure that transforms multichain fragmentation into opportunity.

TL;DR

The infra war continues. The blockchain ecosystem faces liquidity fragmentation and high fees. Chain abstraction solutions emerged but failed to resolve inefficiencies. They merely shift cost burdens from bridges to solvers to exchanges.

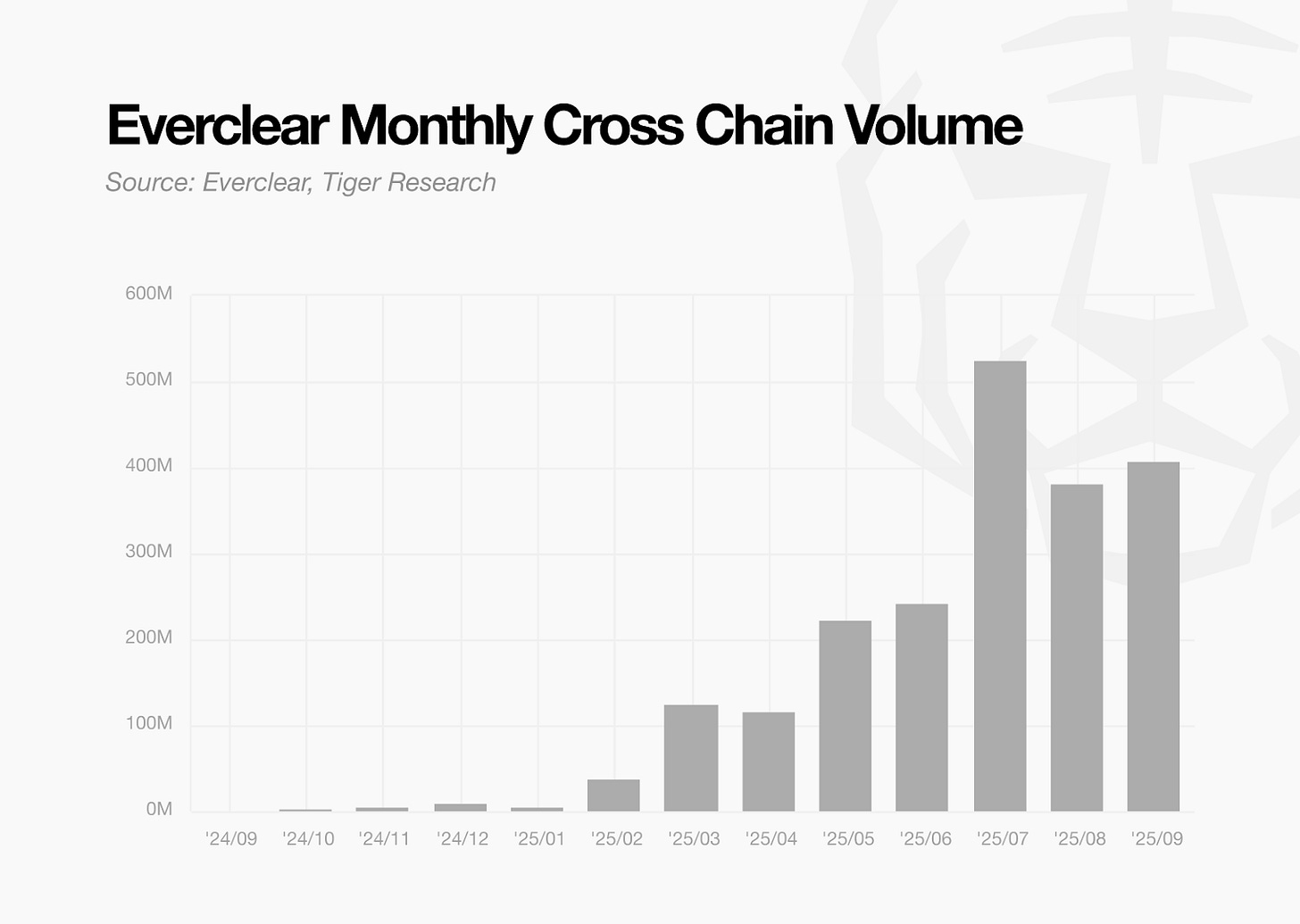

Everclear applies traditional finance clearing methods to net transactions and eliminate unnecessary asset movements. Liquidity solution Rhino.fi cut rebalancing costs by 97% and reduced settlement time from days to 30 minutes. Driven by proven efficiency, Everclear’s volume grew 100x since early this year to cumulatively surpass $2 billion.

Greater fragmentation increases Everclear’s value. More chains create more netting opportunities. Stablecoin fragmentation across chains amplifies this need.

1. Too Many Chains, Not Enough Efficiency

Blockchain infrastructure competition remains intense in 2025. Recent entrants like Stripe’s Tempo and Circle’s Arc have joined the race. Major cryptocurrency exchanges including Upbit and Robinhood are also building their own infrastructure. This has intensified the competition. However, structural inefficiencies across the ecosystem are growing alongside this fierce rivalry.

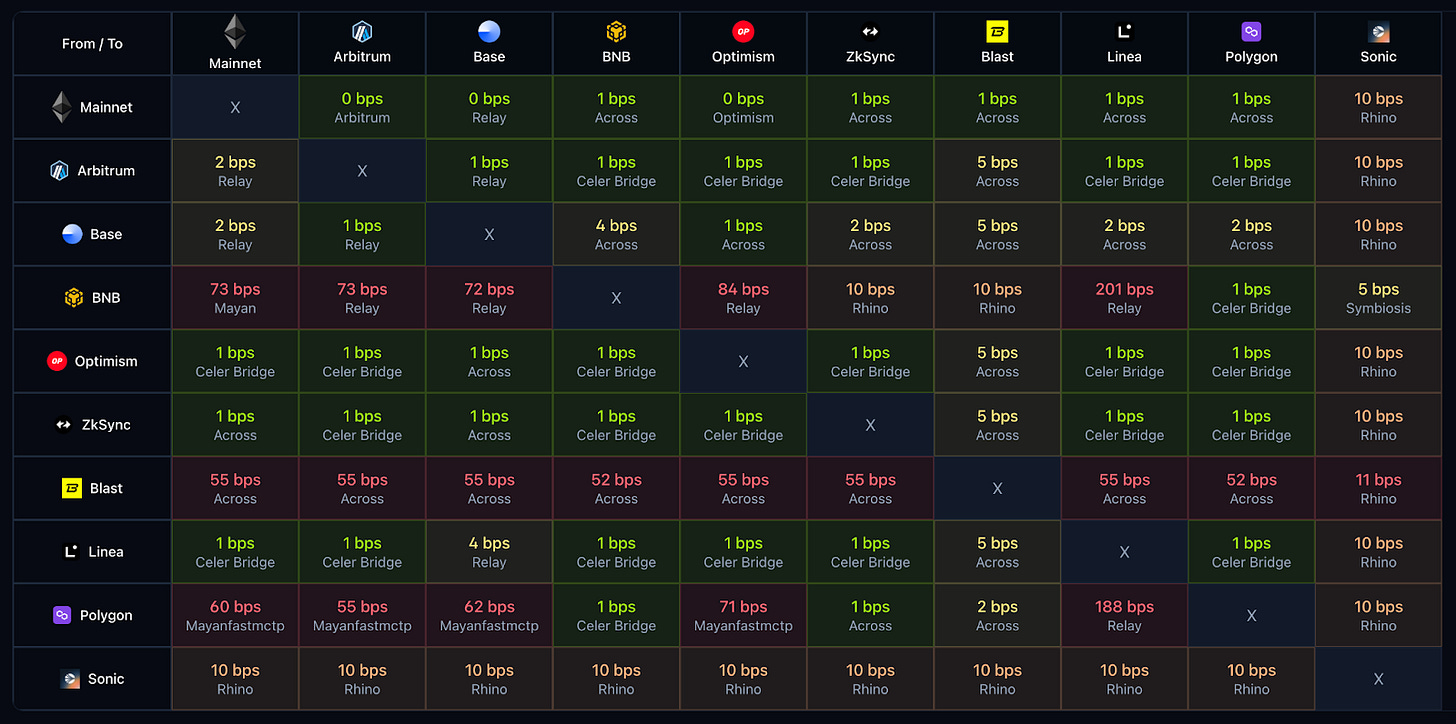

Fragmentation poses the biggest problem. Each player builds different chains. The blockchain industry now has over 400 chains in existence. This fragmented environment creates three simultaneous problems. First, liquidity disperses across individual chains and reduces capital efficiency. Second, operational complexity increases exponentially. Third, cross-chain asset transfers require bridges that generate high fees. According to the Everclear team’s rebalancing dashboard, fees for certain cross-chain transfers reach up to +300bps.

Chain abstraction technology may appear to solve this problem. User experience has improved, but inefficiencies have not disappeared. They have simply been transferred elsewhere like a hot potato. Bridges shift burdens to solvers. Solvers then pass them to exchanges or market makers. All these costs ultimately return to end users as fees or slippage. Infrastructure competition may have stimulated short-term innovation. However, excessive fragmentation now constrains sustainable industry-wide growth.

2. Everclear: Stop Moving, Just Netting It

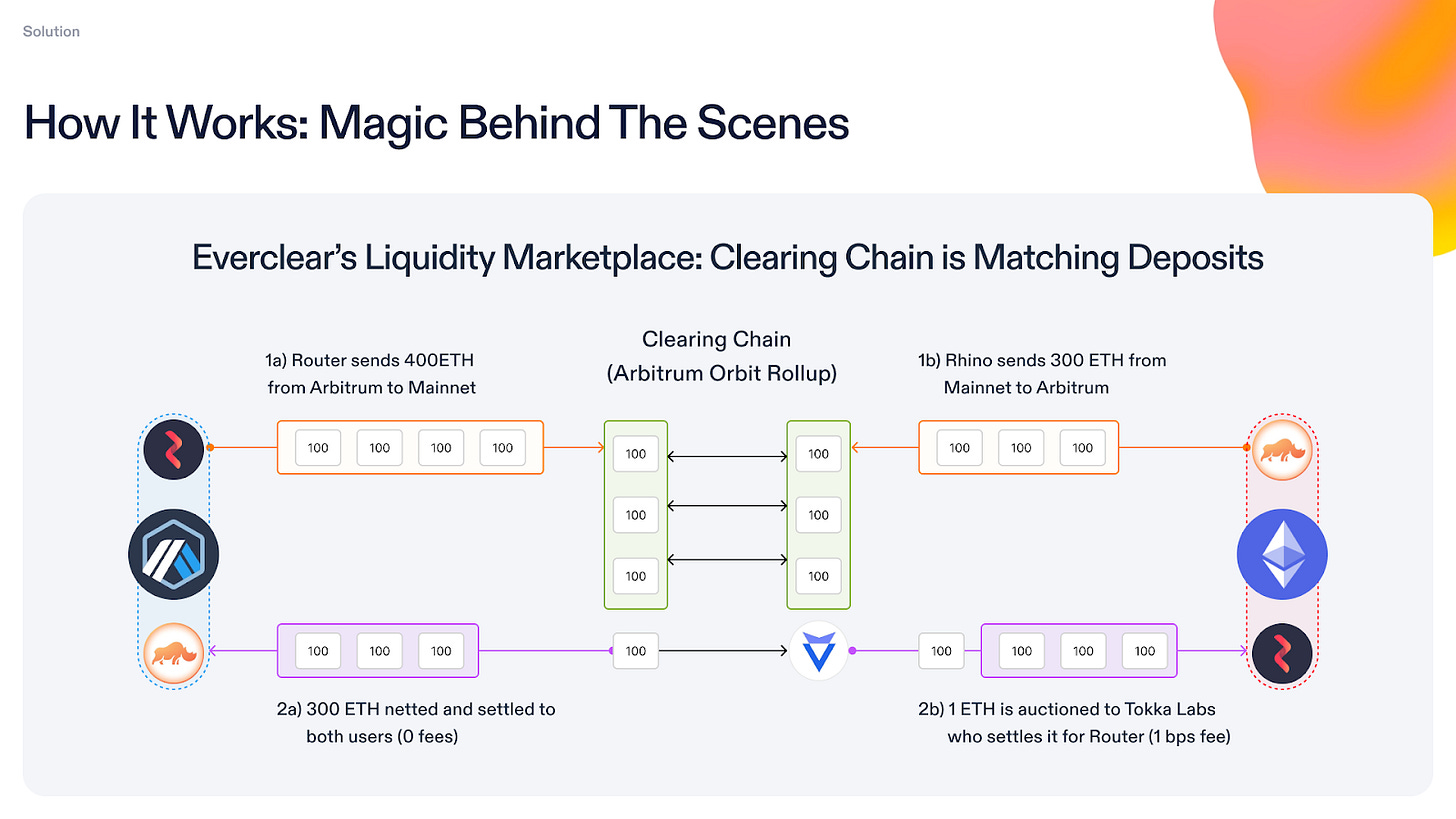

Everclear provides the most direct and effective solution to the structural inefficiencies of the current multi-chain environment. As introduced in previous reports, the core concept involves bringing traditional finance clearing mechanisms to blockchain. Clearing minimizes actual asset movement by netting multiple transactions, reducing costs and improving operational efficiency. Simply put, it “nets out” numerous fund movements rather than processing each individually.

Everclear’s clearing addresses liquidity challenges across the crypto ecosystem. Solvers, bridges, and market makers rebalance funds through Everclear. In current cross-chain transactions, intent bridges receive the user’s intents. Solvers then fill them. Solvers manage assets across individual chains and must continuously rebalance based on demand changes. When USDC exchange requests from Ethereum to Solana increase, Solana-side inventory depletes. Solvers must then move assets to Solana. Everclear helps with rebalancing, netting out unnecessary asset movements during this process.

CEXs and market makers face identical problems. CEXs must support deposits and withdrawals across various chains. Binance alone supports over 17 chains just for USDT withdrawals. When specific chains lack assets, they must pull from other chains. Market makers also continuously rebalance to maintain positions across multi-chain environments.

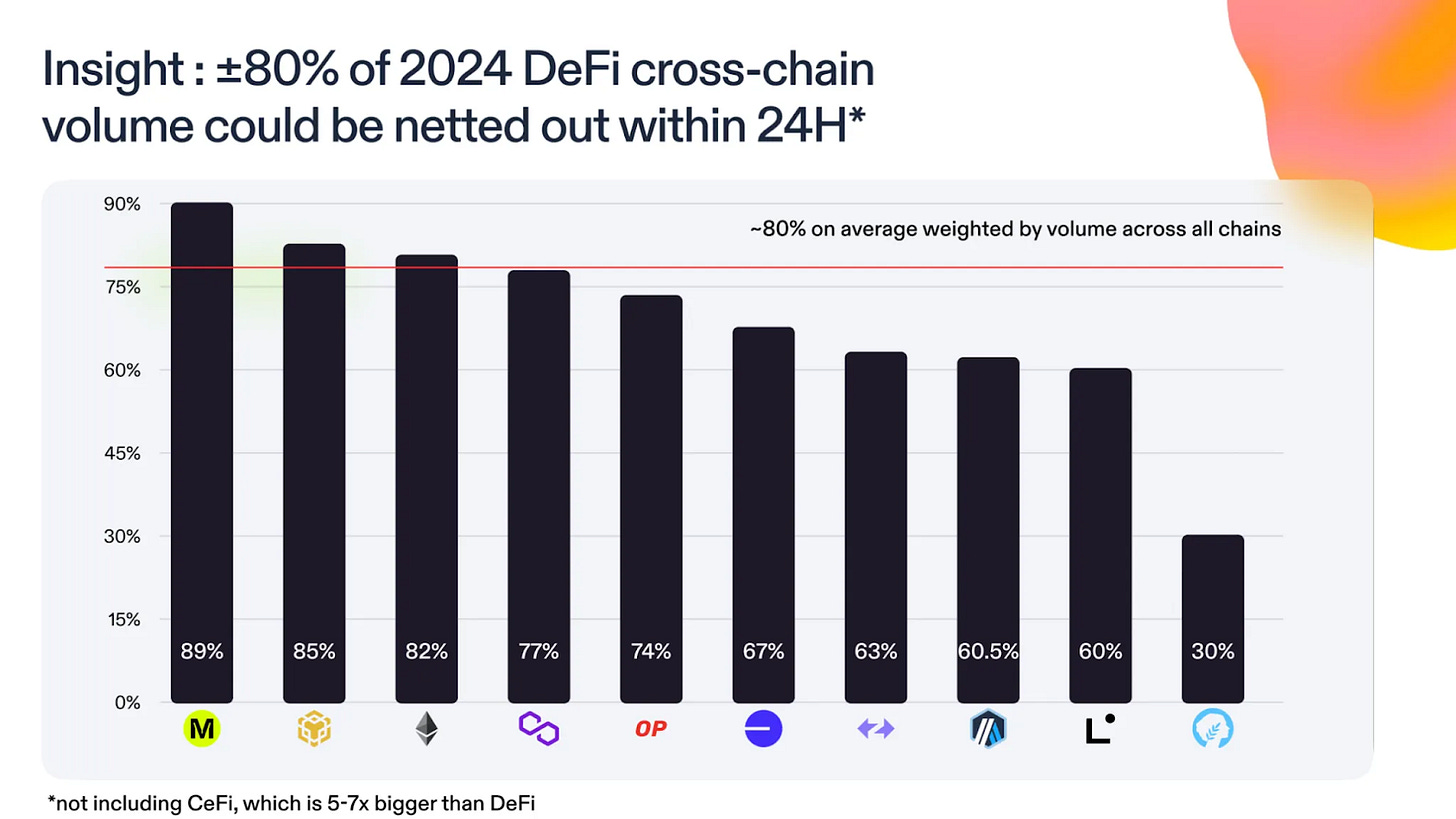

Data proves the potential. According to Everclear, over 80% of 2024 DeFi cross-chain transaction volume was nettable. This means clearing can replace most asset movements. Netting simultaneously reduces both frequency and scale of rebalancing. It also lowers the need for excess capital deployment across chains.

Real-world results are already verified. Cross-chain liquidity solution Rhino.fi adopted Everclear and processed $12.9 million in transactions within five weeks. It reduced rebalancing costs by 97%. Settlement time shortened from 8 hours-7 days to 30 minutes. The clearing fee of only 0.2 basis points enabled this dramatic efficiency improvement.

Market adoption is progressing rapidly. Multiple services have adopted Everclear as their clearing layer. Beyond Rhino.fi, several major protocols have transitioned to Everclear-based systems. The industry anticipates up to 10x operational cost savings. Everclear is establishing itself as core infrastructure that simultaneously solves capital efficiency and operational stability in the multi-chain era.

3. Everclear in the Stablecoin Era, As VISA Did

Everclear’s potential extends beyond current applications. The stablecoin era creates new opportunities as it gains momentum. Institutional foundations for stablecoins establish a framework that expands their use beyond trading intermediaries to real-world payment methods. Transaction frequency and volume for stablecoins will increase rapidly.

The problem intensifies as stablecoin adoption deepens fragmentation. Dollar-based stablecoins alone include USDT, USDC, USAT, PYUSD, and MUSDC from various issuers. Each circulates on different blockchains. Local stablecoins in euros, yen, and won complicate the situation further.

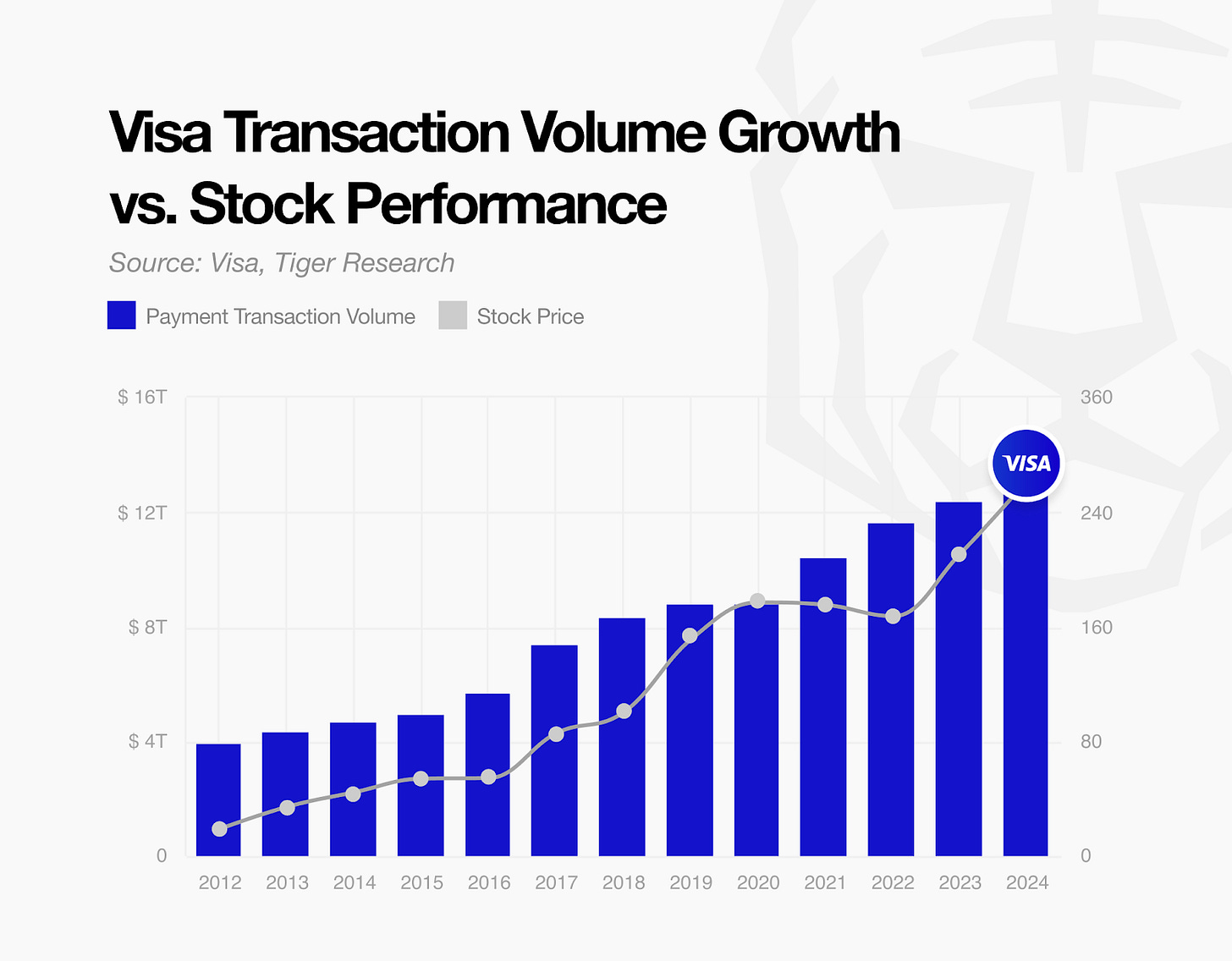

Everclear’s value emerges at this exact point. VISA revolutionized the payments industry by integrating fragmented payment systems through VisaNet. Similarly, Everclear can handle netting and clearing in the fragmented stablecoin ecosystem. The platform can move beyond simply aggregating and netting transactions. It could settle transactions through major stablecoins like USDC or USDT or issue consortium-based tokens to solve these challenges.

Everclear positions itself to become core infrastructure for the stablecoin payment ecosystem. VISA created massive value by leading global payment innovation. Everclear demonstrates potential to follow a similar growth trajectory.

4. More Fragmentation Makes Everclear More Powerful

Multi-chain ecosystem fragmentation creates opportunity for Everclear. As chain numbers increase, cross-chain movements become more complex. The need for coordination grows accordingly. Everclear currently supports 23 chains and plans to expand to over 40 within the year. As fragmentation intensifies, Everclear’s role in coordinating and settling asset movements will inevitably expand.

Growth trends prove this. Everclear’s monthly transaction volume increased 100-fold compared to early 2025, reaching $2B in total volume. Adoption currently centers on bridges and DeFi protocols. Everclear is already working with several market makers and is starting to work with CEXs to help them rebalance funds.

Market potential is substantial. Current estimated annual cross-chain transaction volume reaches approximately $600 billion. Processing even a portion creates meaningful revenue opportunities. Stablecoin payments will accelerate further. RWA (Real World Asset) will transition on-chain. Market opportunities will then become much larger than today.

As chains and assets multiply, liquidity becomes more fragmented. However, the need for clearing infrastructure to organize it grows proportionally. Fragmentation itself increases Everclear’s value. This network effect demonstrates Everclear’s strategic advantage.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report was partially funded by Everclear. It was independently produced by our researchers using credible sources. The findings, recommendations, and opinions are based on information available at publication time and may change without notice. We disclaim liability for any losses from using this report or its contents and do not warrant its accuracy or completeness. The information may differ from others’ views. This report is for informational purposes only and is not legal, business, investment, or tax advice. References to securities or digital assets are for illustration only, not investment advice or offers. This material is not intended for investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo following brand guideline. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.