This report was written by Tiger Research, analyzing how Pendle are revolutionizing DeFi derivatives by converting volatile funding fees into stable, predictable returns for institutional investors with Boros

TL;DR

Core Problem Solved: Institutions want stable yields but funding fees are volatile - Boros converts volatility into fixed returns

Market Opportunity: First-mover advantage in DeFi derivatives, becoming essential infrastructure for delta-neutral strategies like Ethena's

Expansion Vision: Crypto funding fees to Traditional finance (bonds, equities) to lead on-chain derivatives market

1. Untapped Areas Behind DeFi’s Success

While crypto markets have generated many narratives, decentralized finance (DeFi) and derivatives trading have shown the strongest product–market fit.

DeFi’s initial growth came from lending protocols such as Aave and Compound, decentralized exchanges such as Uniswap, and yield farming mechanisms. These recreated core financial primitives in a permissionless setting, opening access to services previously restricted to institutions.

As these markets matured, DeFi began expanding into derivatives, following a trajectory similar to traditional finance. In traditional markets, derivatives multiplied scale and liquidity far beyond spot trading. A comparable shift is underway in crypto, where permissionless derivatives are emerging as the next driver of growth.

2. Pendle as Financial Engineering in DeFi

Pendle identified this opportunity early, launching in 2021 and positioning itself as a leading project in bringing structured derivatives into DeFi.

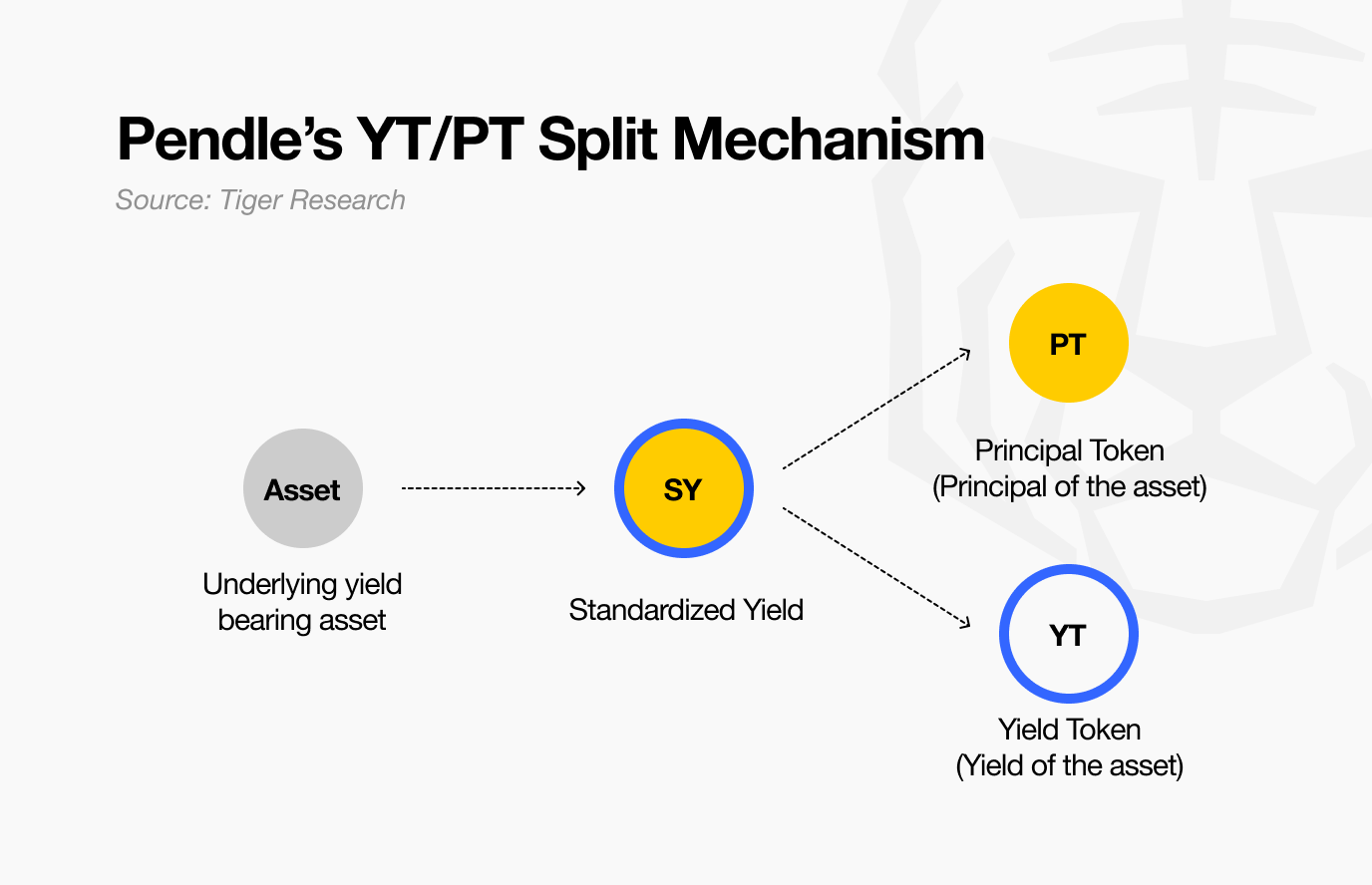

Its entry point was the separation of principal and yield from yield-bearing tokens. The timing was effective: yield staking was becoming mainstream, and by 2023 staking and future airdrop narratives had gained prominence, drawing greater attention to Pendle. Today, many new projects integrate Pendle as a foundational layer for yield-related strategies.

Its core mechanism appears simple but effectively creates two distinct asset classes: a discounted claim on future value (PT) and pure exposure to interest rate volatility (YT).

The impact has been notable. With Pendle, yield-bearing assets such as stETH or rETH are no longer limited to functioning as staking substitutes; they now serve as building blocks for more sophisticated strategies.

Investors seeking to capitalize on rising yields can purchase YT, gaining leveraged exposure that can exceed six times depending on market conditions. Conversely, those pursuing fixed returns can acquire PT, often locking in double-digit discounts to future value.

More importantly, Pendle’s design enhances capital efficiency across DeFi. Strategies that once demanded complex hedging or derivative expertise are now streamlined with their yield splitting mechanism. Investors can now access, trade, and customize yield exposure on-chain.

In doing so, Pendle has not only introduced new yield concepts, but have also laid the groundwork for financial engineering in DeFi, giving users institutional-grade tools in a permissionless format.

3. Boros: Empowering Delta Neutral Yields

As crypto markets expand, institutions are deploying larger capital bases and adopting more sophisticated trading strategies to farm yield. Their priority is stable returns, often achieved through delta-neutral positions that minimize price risk.

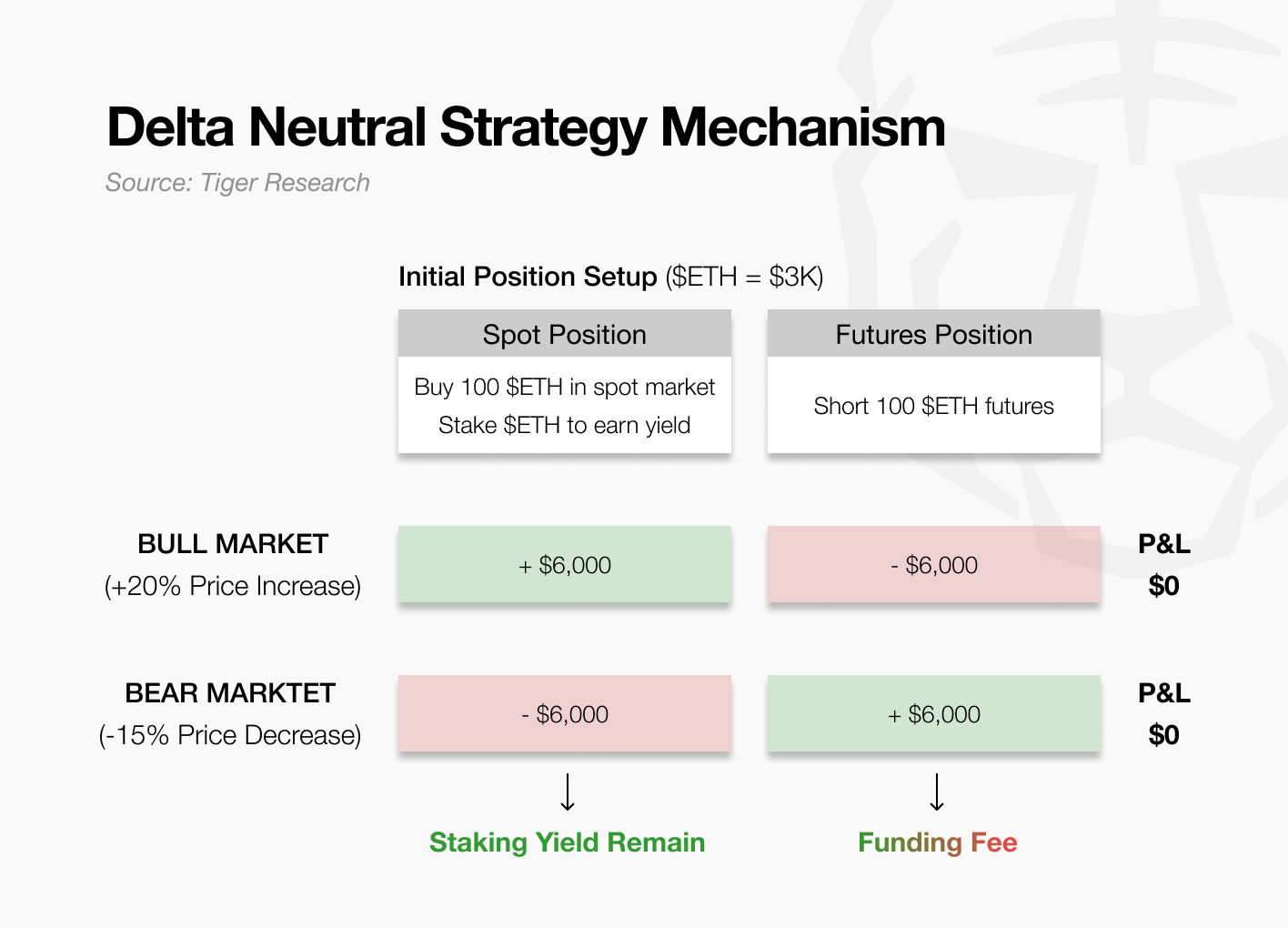

Ethena demonstrates this by holding spot ETH while simultaneously shorting an equivalent amount in futures. Gains on one side offset losses on the other, keeping portfolio value stable regardless of price direction (see Figure).

In bullish markets, longs pay funding fees to shorts, allowing Ethena to collect income. In bearish markets, the reverse occurs, and Ethena must pay.

The challenge is that funding flows are inherently unstable—sometimes generating income, other times requiring payouts. This volatility undermines protocols such as Ethena, which depend on delta-neutral strategies to back their stablecoin USDe.

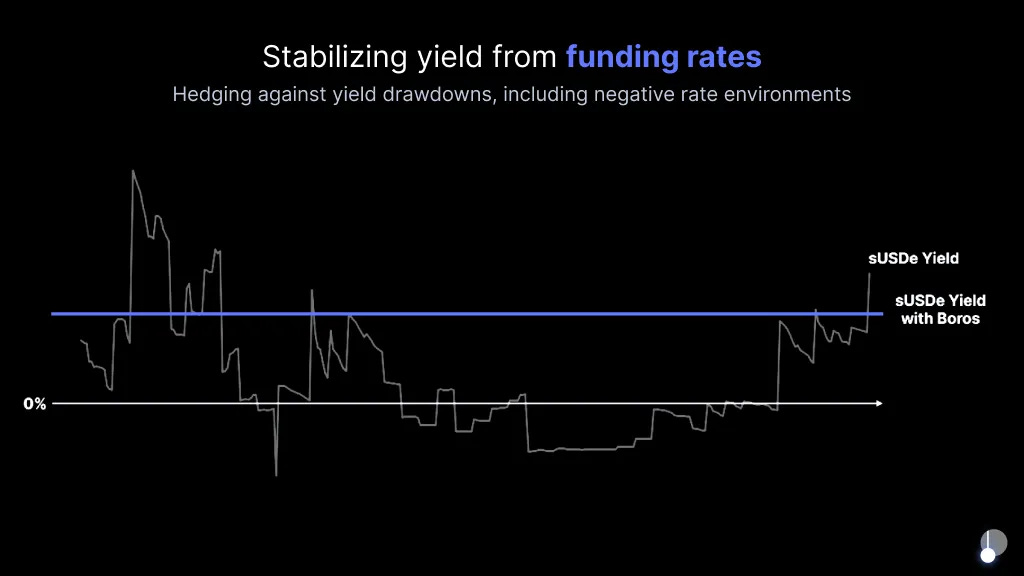

Boros addresses this gap by transforming unstable funding fee flows into fixed, predictable returns. In doing so, it offers institutions the consistency they require to scale capital deployment in crypto markets.

4. Boros Mechanics: Stabilizing Funding Rates

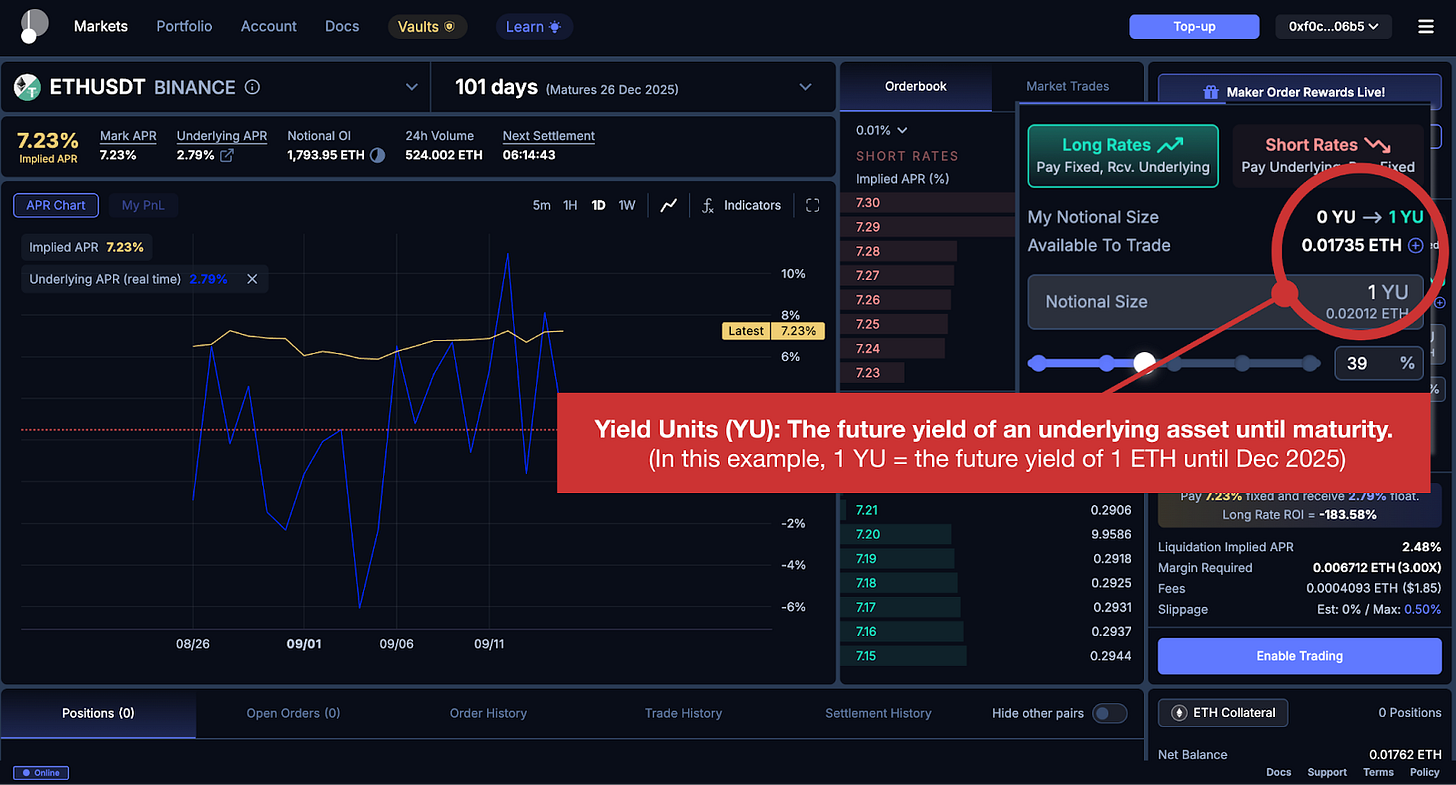

Boros introduces Yield Units (YU), a derivative instrument that isolates funding fee volatility from underlying asset prices. YU allows two things at once: directional bets on funding rates and the transformation of unstable funding flows into predictable income streams. The following sections explain its mechanics.

4.1. Yield Units (YU): Structure and Purpose

Consider an investor seeking an 8 percent fixed annualized return over three months, regardless of whether Bitcoin funding fees move positive or negative. Conversely, another investor may prefer direct exposure to funding fee fluctuations, willing to pay a fixed yield in exchange.

YU connects these two sides by isolating and trading only the volatility of funding fees, independent of underlying asset price movements.

For example, the product '1 YU-ETHUSDT-Binance' represents the returns from the funding fee on a notional position of one ETH in perpetual futures on Binance until the expiry date. Purchasing this product allows an investor to gain or lose based on funding fee changes tied to that position—without holding ETH itself. In this way, YU turns funding fees from specific exchange-asset pairs into standalone, tradable instruments.

4.2. Implied APR: Market Expectations as Price Signal

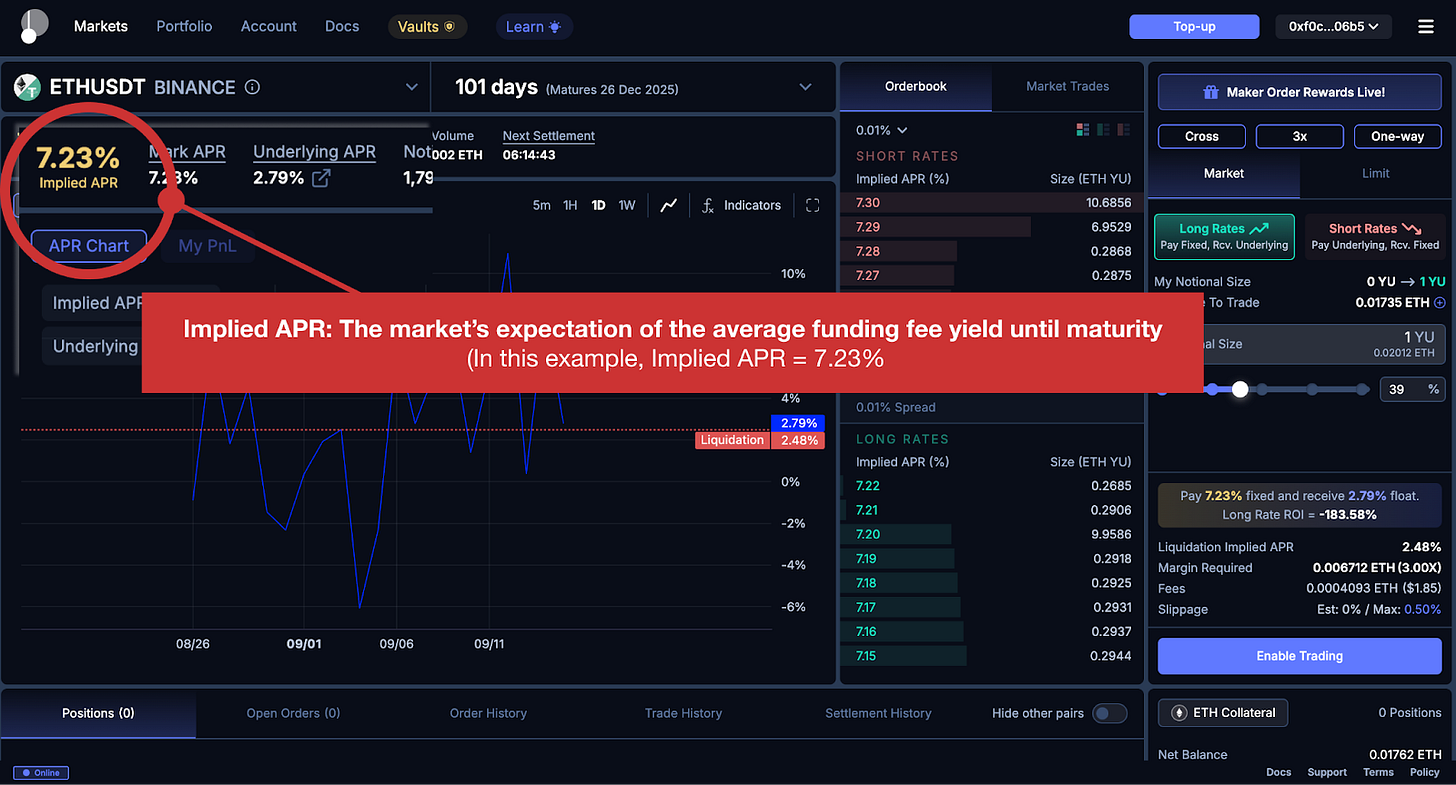

A central concept in YU trading is the Implied APR. This represents the market’s expectation of the average funding fee yield until maturity, as reflected in the current price of YU.

Just as a Bitcoin price of $80,000 reflects the market’s valuation of the asset, an Implied APR of 8 percent on YU-BTCUSDT signals that participants expect Bitcoin funding fees to average 8 percent annually over the relevant period.

In simple terms, the Implied APR functions much like a futures market’s market price: it reflects the market’s consensus view at the present moment.

4.3. Long/Short Positions: Trading Implied vs. Realized Yields

YU positions resemble futures trading, with different motivations for longs and shorts.

Bitcoin futures long: Mark price $50,000 → Target price $60,000 = $10,000 profit

YU long: Implied APR 8% → Underlying APR 10% = 2% profit (Longs pay the Implied APR and receive the Underlying APR)

A YU long position reflects the belief that “the actual funding rate will be higher than the market’s current expectation of 8%, say 10%.” In this case, longs pay funding at the Implied APR(8%) and receive funding at the Underlying APR(10%). This is equivalent to saying “Bitcoin futures are at $50,000 now, but I expect them to rise to $60,000,” and going long.

Bitcoin futures short: Mark price $50,000 → Target price $40,000 = $10,000 profit

YU short: Implied APR 20% → Underlying APR 15% = 5% profit (Shorts receive the implied APR and pay the Underlying APR)

A YU short position reflects the belief that “the actual funding rate will be lower than the market’s current expectation of 20%, say 15%.” Here, shorts receive funding at the Implied APR(20%) and pay funding at the Underlying APR(10%). This parallels saying “Bitcoin futures are at $50,000 now, but I expect them to fall to $40,000,” and going short.

In short, Bitcoin futures represent a bet on “current price vs. future price,” while YU represents a bet on “current market expectation (Implied APR) vs. realized funding outcome (Underlying APR).” Since funding rates reset every eight hours, returns are determined by whether each realized rate comes in above or below the market’s expectation at that time.

5. Applying Boros in Delta-Neutral Strategies

What are the practical uses of YUs for institutions? To illustrate, consider how Boros addresses Ethena’s challenge with volatile funding fees.

Assume Ethena operates a delta-neutral strategy with 100 ETH. It holds 100 ETH in spot while shorting 100 ETH in the futures market. The core issue with this setup is funding fee volatility: in bull markets the short position collects funding, but in bear markets it must pay funding continuously.

To stabilize this exposure, Ethena takes an additional short position of ‘100 YU-ETHUSDT-Binance’ at an Implied APR of 10 percent. This means it receives a fixed 10 percent on the notional equivalent of 100 ETH, while paying out the realized funding fees.

As the table shows, the variable funding income from futures is offset by the variable funding payments in Boros. In practice, even if positive funding is received, an equivalent funding payment is made through the Boros contract, so the net effect is fixed at zero. What remains is the fixed 10 percent return provided by Boros. Combined with staking yield (4%), Ethena achieves a predictable total return of 14 percent.

However, this approach has trade-offs. Institutions must allocate additional margin to maintain these positions, and sharp price swings can carry liquidation risk. For this reason, investors such as Ethena need to apply YU within robust risk management frameworks.

6. Pendle’s Next Target: Traditional Finance

While Ethena’s case shows how YU can be applied within a single delta-neutral strategy, the potential of Boros reaches much further.

The scope of Boros extends well beyond funding rates. Currently, it operates on Arbitrum and supports BTC and ETH perpetual markets from Binance and ETH from Hyperliquid. Institutions, however, do not restrict delta-neutral strategies to a single exchange. To manage risk and capture arbitrage opportunities, they diversify across assets and venues. Expansion is therefore essential.

Boros plans to add support for assets such as Solana and BNB, and to integrate exchanges including Bybit. This will broaden investor access to funding rate markets. Yet Pendle’s ambitions reach further.

These strategies are unlikely to remain confined to institutions. As Boros matures and diversifies, we expect that sophisticated individual investors will also be able to participate. Even for those who do not directly employ such strategies, funding rates are set to remain a widely observed market indicator for sentiment and positioning, shaping the trading environment across both institutional and retail participants.

The larger vision is to bridge into traditional finance. Pendle has outlined plans to incorporate benchmarks and instruments such as LIBOR, mortgage rates, bonds, and equities. Unlike the familiar path where traditional finance absorbs crypto, Pendle conversely applies crypto’s technical architecture to reframe traditional instruments on-chain.

Overall, Pendle’s expansion can be viewed positively. The growing participation of institutions and their demand for more advanced strategies are likely to further elevate its role in the market. More importantly, Pendle is not merely following shifts in traditional finance; it shows the potential to emerge as a leader shaping the future of global markets — a vision that deserves recognition.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report was partially funded by Pendle. It was independently produced by our researchers using credible sources. The findings, recommendations, and opinions are based on information available at publication time and may change without notice. We disclaim liability for any losses from using this report or its contents and do not warrant its accuracy or completeness. The information may differ from others' views. This report is for informational purposes only and is not legal, business, investment, or tax advice. References to securities or digital assets are for illustration only, not investment advice or offers. This material is not intended for investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn't harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research's reports, it is mandatory to 1) clearly state 'Tiger Research' as the source, 2) include the Tiger Research logo following brand guideline. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.