This report was written by Tiger Research, analyzing Canton Network’s approach to bridging blockchain idealism with financial institution reality through selective transparency architecture and regulatory-compliant infrastructure.

TL;DR

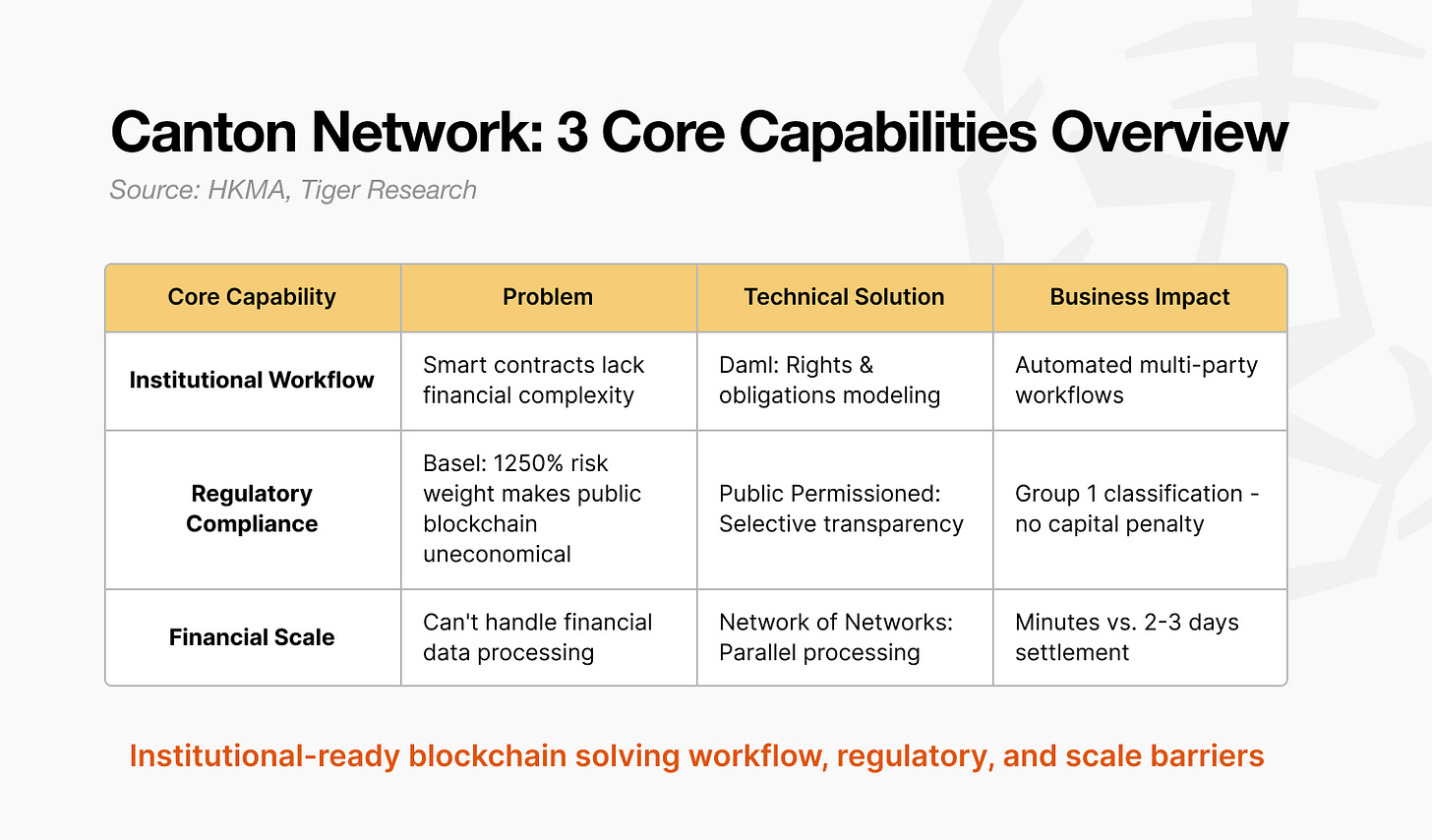

Solves Blockchain-Institution Mismatch: Traditional blockchain’s radical transparency and decentralization conflict with financial institutions’ privacy, regulatory compliance, and control requirements, limiting adoption to pilot stages.

Enables Selective Transparency Architecture: “Public permissioned” model with Daml smart contracts allows transaction-level privacy control, meets Basel regulatory standards, and supports institutional-grade workflows through rights-and-obligations framework.

Achieves Real Institutional Scale: 400+ institutions, USD 6+ trillion in tokenized assets, 3 million daily transactions, with major players like Bank of America executing 24/7 on-chain Treasury trades since 2024 launch.

1. Between Blockchain Ideals and Reality

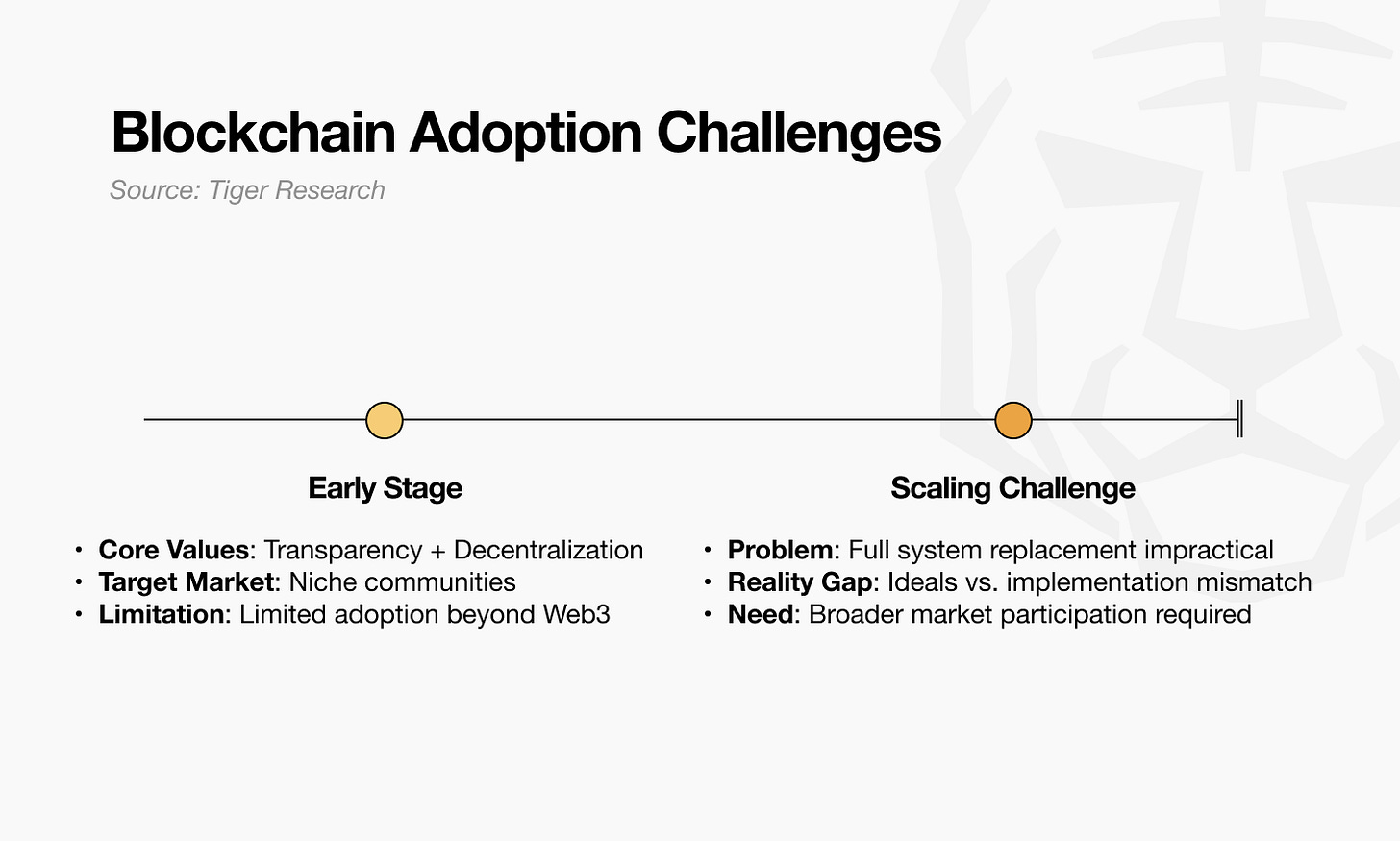

From the beginning, blockchain technology has been built around two core principles: 1) radical transparency where all transactions are publicly visible and 2) decentralization where systems operate without central control. While these ideals shaped the early evolution of blockchain, the reality has diverged significantly.

In the early stage, early adopters developed services around transparency and decentralization. But adoption was limited to niche communities. As broader participation became necessary, it became clear that fully replacing existing systems with blockchain infrastructure was impractical.

For financial institutions, the challenges were even more pronounced. Radical transparency meant that trading strategies and corporate financial data could be exposed. Decentralization conflicted with the need for control and governance.

As a result, the foundational ideals of blockchain clashed with institutional requirements for privacy, oversight, regulatory compliance, and scalability. Institutions recognized clear benefits—such as real-time settlement and capital efficiency—yet most remained at the pilot stage.

Sustained growth, however, cannot rely on a small base of ideological supporters. Institutional adoption and broader market expansion require approaches that prioritize practical needs over philosophical purity.

2. Canton Network: A Pragmatic Approach

The Canton Network emerged to address the tension between blockchain’s ideals and institutional realities. Unlike earlier blockchains that relied on absolute models, it introduces flexibility that allows institutions to choose how information and control are managed.

This approach reflects the practical needs of financial institutions. Some information must be fully transparent to regulators but shielded from competitors. Client privacy must be protected while still enabling internal audits. Traditional blockchains, with their binary model of full disclosure or complete opacity, could not accommodate these nuanced requirements.

Canton Network differentiates itself through the Canton protocol, which enables institutions to meet regulatory requirements and manage risk while preserving blockchain’s benefits of real-time settlement and capital efficiency. This positions it as infrastructure that supports the transition from pilot projects to large-scale institutional adoption.

At its core, the Canton protocol enables independent control over applications and transactions, configurable privacy through a unique ‘proof of stakeholder’ consensus model, and interoperability across separately operated systems.

2.1. Institutional-Grade Workflow Design

This is enabled with Daml, a functional programming language designed specifically to automate multi-party financial workflows securely and efficiently. By leveraging Daml, Canton Network offers an alternative to existing smart contract frameworks such as Ethereum’s Solidity, delivering an architecture tailored to institutional use cases.

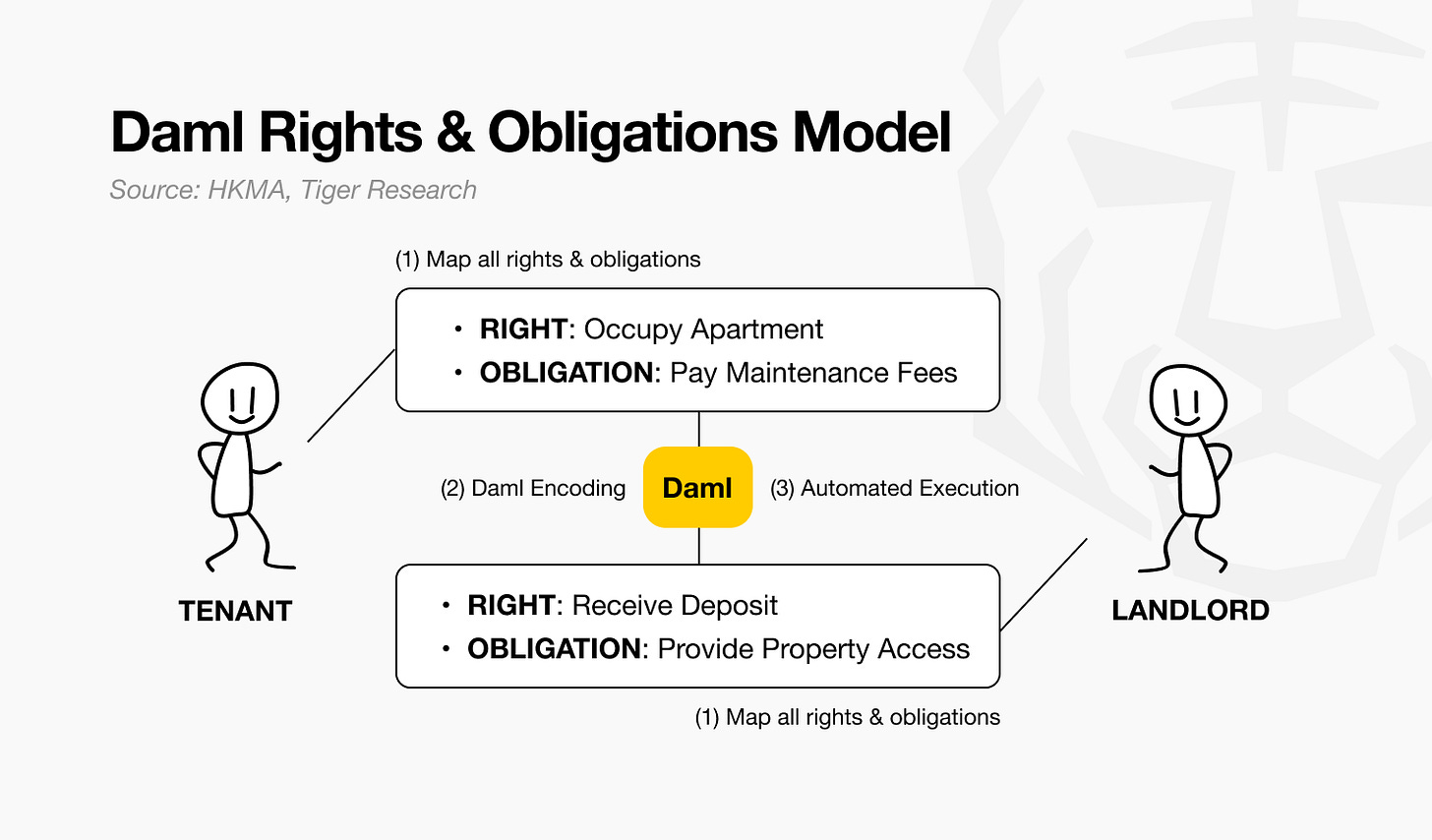

Daml structures contracts around rights and obligations, aligning directly with the nature of financial transactions. Every financial agreement can be broken down into a transfer of rights and a set of obligations.

For example, in a lease contract, the tenant has the right to occupy the apartment but the obligation to pay maintenance fees, while the landlord has the right to receive the deposit but the obligation to provide access to the property. Daml encodes such relationships precisely in executable form.

In unison Daml and Canton link disparate systems into a single automated workflow through smart contract-level atomic composability. In this model, all interdependent steps succeed together or fail together, ensuring transactional integrity.

A real estate transaction illustrates this: once the buyer deposits funds, the loan review begins automatically; upon approval, title transfer proceeds. Each stage is bound by clearly defined rights and obligations, and the entire process is treated as one indivisible transaction. If any step fails, the system reverts to its original state.

Equally important is the system’s flexibility and controllability. Contracts can be modified with mutual consent, allowing adaptation to unexpected changes such as regulatory shifts or court rulings.

By leveraging Daml, the Canton Network delivers the operational conditions institutions require: explicit definition of rights and obligations, workflows tailored to practice, and built-in adaptability and governance. This enables institutions to meet compliance and privacy demands without compromising efficiency.

2.2. Regulation and Privacy

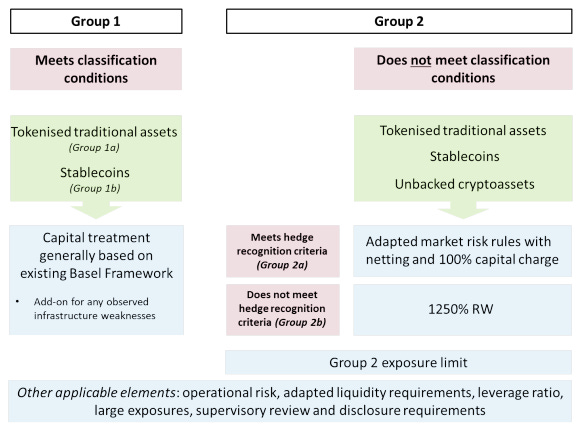

The primary obstacle for financial institutions adopting blockchain is regulation, which is closely tied to data privacy and operational control. Among the most significant barriers is the Basel Accords, the international standards developed by the Basel Committee on Banking Supervision under the Bank for International Settlements. Although not legally binding, these standards are typically implemented through national legislation, giving them practical force.

Under Basel rules, uncollateralized assets issued on public blockchains fall into “Group 2,” carrying a risk weight of up to 1250 percent. In practice, this means holding blockchain assets worth 100 million KRW requires regulatory capital of 1.25 billion KRW, rendering large-scale use uneconomical.

The Canton Network addresses this issue through a “public permissioned” architecture. Like the internet, which is open but restricts access to sensitive platforms such as banking websites, Canton combines openness with granular access control.

This is achieved through the aforementioned feature of sub-transaction level privacy. Only the parties directly involved in a transaction can view and record the specific data relevant to them, while other participants see nothing beyond what they need to know. In a delivery-versus-payment (DvP) transaction, for example, the bank would only view the cash transfer, while the securities depository would only view the securities transfer.

Daml smart contracts allow fine-grained control over data access and actions, ensuring that tokenized traditional assets can qualify as “Group 1” exposures and avoid punitive capital charges. The same mechanism also supports selective disclosure for auditors, enabling oversight without compromising confidentiality.

Canton thus resolves a key trade-off that constrained earlier blockchains. Full transparency on public chains undermines confidentiality, while full opacity on private chains impedes interoperability. By offering selective transparency, Canton enables institutions to comply with regulation and protect privacy at the same time.

2.3. Performance at Financial System Scale

For blockchain to be viable in capital markets, it must operate at the scale of existing financial infrastructure. Daily turnover in foreign exchange alone exceeds USD 7.5 trillion, and combined volumes across equities, bonds, and derivatives reach tens of trillions. Institutions therefore require blockchain systems that can match existing performance benchmarks, remain stable during peak periods, and support continuous 24/7 operation.

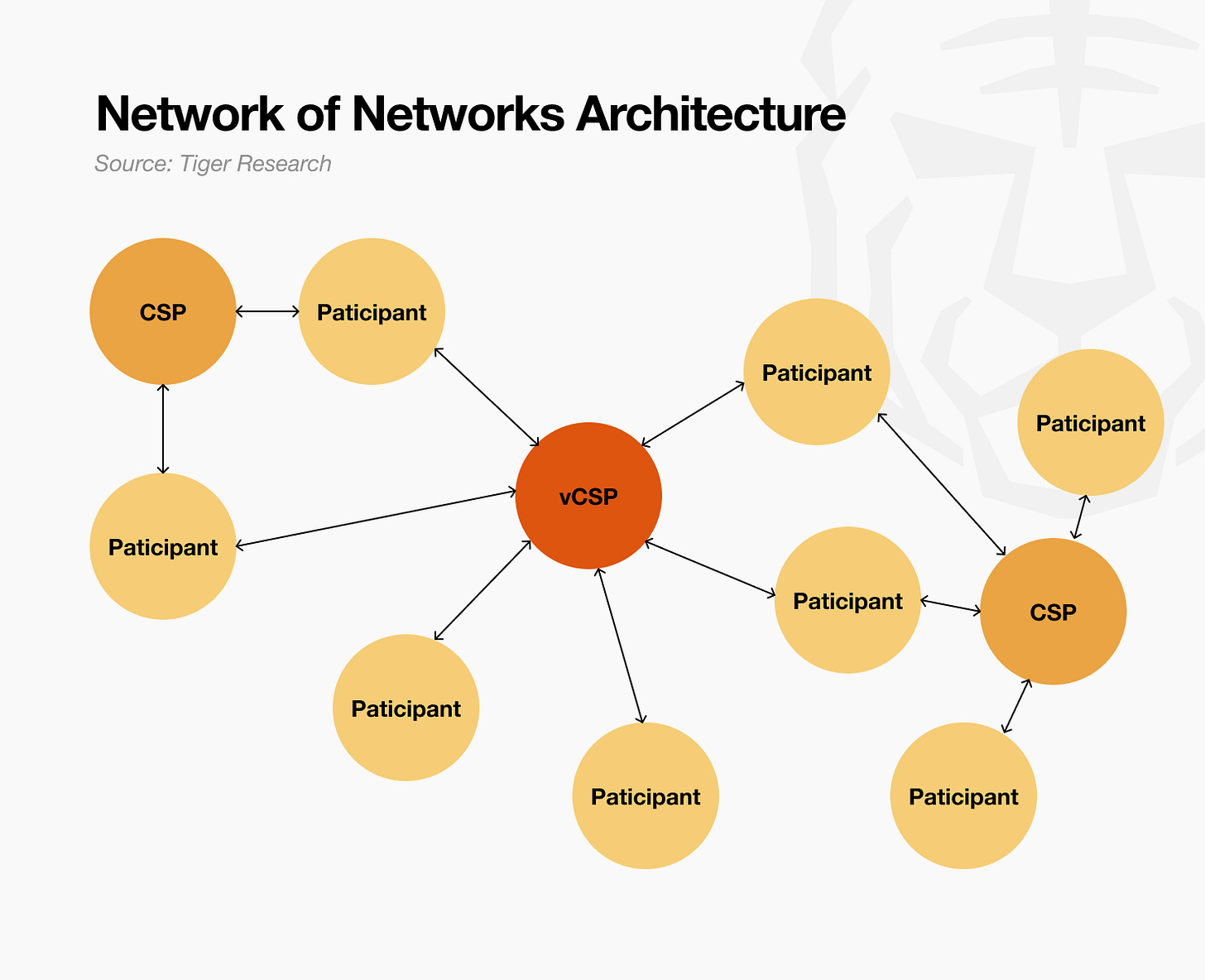

Canton Network addresses this requirement through a “network of networks” architecture. Unlike traditional blockchains that operate as a single monolithic system, Canton is structured like a transportation grid, where multiple subnetworks interconnect to balance load and ensure resiliency.

Participant Nodes: Nodes representing institutions, validating only their own transactions, and able to host multiple parties securely.

CSPs (Canton Service Providers): Regional infrastructure providers that connect participant nodes and deliver services aligned with local regulatory requirements.

vCSP (Virtual CSP): A global synchronization layer that provides the common backbone for cross-application and cross-regional settlement, with the first production example currently operated by over 30 major institutions.

This layered design functions like an urban transport system. Participant nodes resemble buildings, CSPs serve as regional road networks, and the vCSP acts as the highway connecting regions. Nodes can connect to multiple CSPs, transactions can reroute if one path is congested, and capacity expands by adding new CSPs.

A cross-border transaction between Samsung and Apple illustrates this process.

Samsung’s node connects to a Korean CSP holding digital KRW, while Apple’s node connects to a U.S. CSP holding digital USD. Both are also linked to the global vCSP. When Apple places an order, a smart contract escrows USD 100,000. Once Samsung confirms shipment, the escrow automatically releases funds to Samsung. The process completes within minutes, compared to the two to three days typical for international wire transfers.

Here, the Korean CSP validates Samsung’s KRW activity, the U.S. CSP validates Apple’s USD activity, and the vCSP ensures atomic settlement across the two networks. In parallel, other CSPs can process unrelated transactions (e.g., LG–Sony or Google–Microsoft trades), multiplying system throughput. Because CSPs operate independently, overall capacity scales with the number of providers.

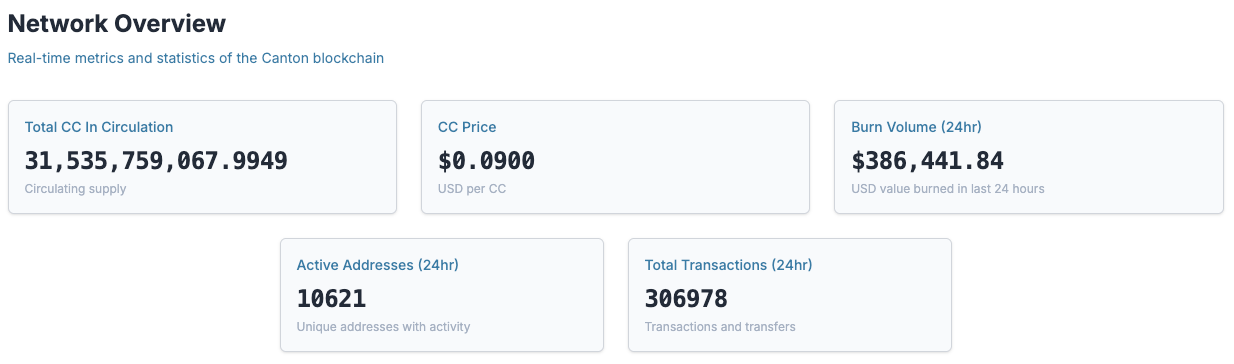

This parallelized approach enables concurrent execution across synchronization domains. Today, Canton processes over four transactions per second and has recorded more than 3.5 million Canton Coin–related events in a single day. Digital Asset and its institutional partners have successfully executed on-chain U.S. Treasury transactions and repo trades, demonstrating continuous settlement capability even over weekends.

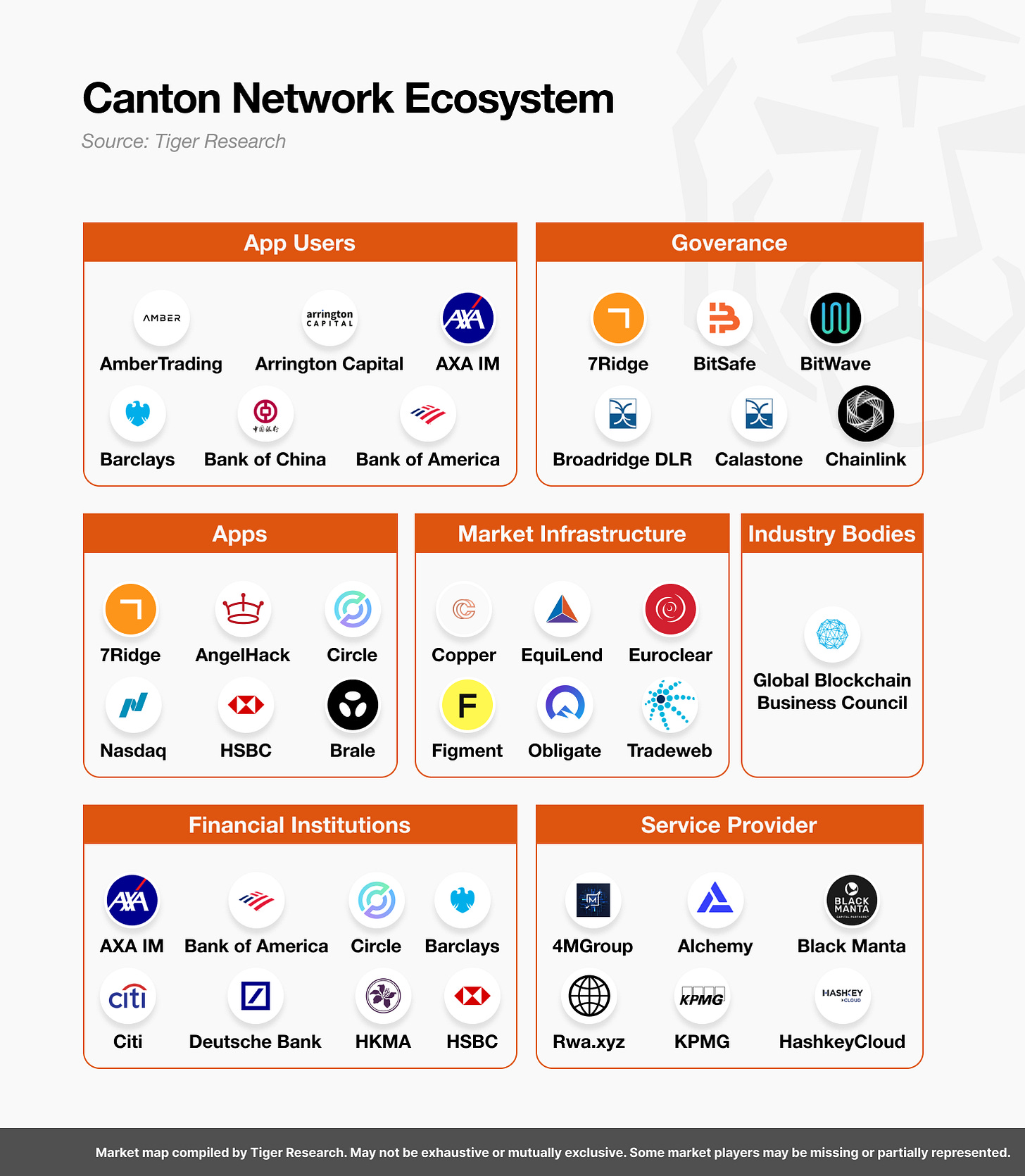

3. Building the Canton Ecosystem

Canton Network addresses the classic “chicken-and-egg” problem in blockchain adoption, where services do not emerge without users, and users do not join without services. It does so through a distinctive incentive and distribution model.

At the center is the Canton Coin, the network’s native digital currency. Unlike many blockchain projects where tokens are pre-mined and allocated disproportionately to founders or venture investors, Canton Coins are distributed solely on the basis of contribution to the network. There are no pre-allocations to venture capital or foundations. Participants earn coins only by providing tangible value—whether by operating infrastructure, developing applications, or conducting transactions. In effect, distribution resembles wages paid for work performed.

A second feature is the burn-and-mint equilibrium mechanism. Transaction fees paid by users are burned, permanently reducing supply, while new coins are minted as rewards for contributors. This creates a balance between usage-driven scarcity and contribution-driven issuance.

Reward allocation also evolves over time. In the early phase, higher rewards go to super-validators responsible for establishing the network’s infrastructure. As the system stabilizes, the share of rewards shifts toward developers building applications and services. This mirrors the development of a new city, where initial investment focuses on roads and utilities, followed by growth in retail and service providers.

4. Canton Network’s Path Forward

Since its official launch in July 2024, Canton Network has demonstrated strong growth by proving practical value to financial institutions, beyond technical milestones.

This progress is reflected in capital raising. In June 2025, Canton secured USD 135 million in a round led by DRW Trading and Tradeweb, with broad participation from major traditional finance firms. These institutions are not only investors but also active contributors to service development and operations.

The value of assets processed is even more striking. Tokenized assets on Canton exceed USD 6 trillion, larger than the GDP of most countries. The network also processes more than USD 280 billion in daily U.S. Treasury repo trades.

Concrete adoption cases are emerging. On August 12, 2025, Bank of America, Circle, Citadel Securities, DTCC, Société Générale, and Tradeweb executed the first weekend on-chain funding transaction involving U.S. Treasuries and USDC, signaling the emergence of a 24/7 capital market.

Stablecoin settlement is another area of traction. Circle integrated USDC with Canton, emphasizing the role of privacy controls, while Paxos joined as a validator. Institutions highlight the ability to meet regulatory requirements while keeping transaction details confidential in intercompany payments.

Looking ahead, broader adoption is expected, particularly in RWA tokenization. Real estate, commodities, and art are likely to follow, enhancing liquidity well beyond the current USD 6 trillion already tokenized.

Long term, Canton points toward a blockchain-based global capital market operating around the clock, unconstrained by time zones or borders. Developments such as Nasdaq’s application to support tokenized equities underscore this shift.

Canton thus positions itself as infrastructure optimized for the transition underway—bridging blockchain’s advantages with institutional requirements. Its trajectory will be shaped by how effectively it continues to balance ideals with real-world demands.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report was partially funded by Canton Network. It was independently produced by our researchers using credible sources. The findings, recommendations, and opinions are based on information available at publication time and may change without notice. We disclaim liability for any losses from using this report or its contents and do not warrant its accuracy or completeness. The information may differ from others’ views. This report is for informational purposes only and is not legal, business, investment, or tax advice. References to securities or digital assets are for illustration only, not investment advice or offers. This material is not intended for investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo following brand guideline. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.