This report was written by Tiger Research, analyzing Plume’s DeFi-native Real World Assets (RWA) strategy, its regulatory positioning across the U.S. and Asia, and the integration of Real World Bitcoin to unlock programmable capital opportunities.

TL;DR

Market Dominance: Plume captured 50%+ of crypto RWA investors through DeFi-native strategy focused on yields vs. traditional finance’s cost efficiency approach

Regulatory Moats: Direct engagement with SEC/Trump administration and Asian regulators creates competitive barriers while mitigating regulatory risk

Bitcoin Expansion: Targeting $2.18T idle Bitcoin market through “programmable capital” strategy with 15+ partnerships to unlock BTC yield opportunities

1. The RWA Market Has Entered the Mainstream

Discussions around Real World Assets (RWA) have been ongoing for years, but the market has now moved beyond the conceptual stage into a phase of measurable adoption. RWA is no longer a niche topic within crypto; it has become a mainstream agenda involving financial institutions and governments.

The clearest signal comes from the U.S. government. Since Paul Atkins’ appointment as SEC Chair in 2025, asset tokenization has been elevated to a top regulatory priority. Atkins compared the shift of securities from off-chain to on-chain systems to the transition of audio from analog vinyl records to cassettes and ultimately digital formats, framing it as a necessary paradigm shift.

This policy direction has been operationalized through ‘Project Crypto’, an initiative aimed at modernizing securities regulation and transitioning U.S. capital markets to an on-chain environment. The project underscores the government’s commitment to supporting RWA adoption at scale.

Momentum is also visible in market infrastructure. In September 2025, Nasdaq submitted a rule change proposal to the SEC to enable stock tokenization. The framework would preserve equal value and rights between traditional equities and their tokenized counterparts, creating a dual system designed to integrate tokenization into existing market structures.

These moves, from government policy to exchange-level implementation, illustrate that RWA is no longer an experimental theme confined to crypto markets. It is becoming a core agenda of mainstream finance, with parallel development driven by both Web2 and Web3 participants. The pace of adoption is accelerating.

2. Plume’s Distribution & DeFi-First Strategy

As discussed in earlier research, Plume is a DeFi-native RWA project designed as a full-stack blockchain specialized in real-world asset tokenization. Its strategy is not limited to digitizing traditional assets; it combines them with crypto-native instruments, creating a hybrid model that is purpose-built for institutional participation in RWAs.

For example, Plume integrates tokenized U.S. Treasuries with crypto carry funds and yield products to create composite assets such as $nBASIS.

These structures leverage both traditional securities and crypto mechanisms, expanding beyond simple tokenization into services that intersect with DeFi. $nBASIS, for instance, can be used as collateral to borrow through protocols like Morpho.

This approach differs fundamentally from Web2-driven models. In an interview with Rebank, Plume co-founder and CEO Chris Yin emphasized that contrast.

Companies such as Figure, a representative Web2 case, focus on institutional adoption by moving existing financial products on-chain. Their starting point is off-chain assets such as HELOCs, with blockchain applied to streamline issuance and lifecycle management within the traditional system.

Plume, by contrast, begins from DeFi-native principles. Instead of attempting to repair inefficiencies in legacy finance, it prioritizes the features crypto users value most: high yields, fast execution, open accessibility, and in many cases, direct exposure to crypto assets themselves.

The key distinction lies in user motivation. As Yin stated, “Nobody comes into crypto to save money. People come to make money. That is why BTC exists, and why meme coins exist—they represent attempts to capture upside and income.” This highlights a structural divergence: Web2 players emphasize cost efficiency, while Web3 projects focus on profitability. The contrast is less about incremental upgrades to an existing city, and more akin to planning an entirely new settlement on Mars.

3. The Regulatory Foundation Cannot Be Overlooked

Although Plume is a DeFi-native project, the nature of RWA requires engagement with Web2 regulatory and policy environments. Plume recognizes this constraint and has pursued a multi-pronged strategy to mitigate regulatory risk and ensure scalability. As noted in earlier research, its efforts extend beyond the U.S. to Asia, where regulatory frameworks are rapidly evolving.

Plume has adopted the “Plumerica” branding to highlight its U.S. focus. Headquartered in New York from inception, the firm has built direct channels with policymakers. It has met with the SEC’s crypto task force and even with President Donald Trump to discuss tokenization, crypto regulation, and the future of RWA in the U.S.

In addition, Plume has partnered with the World Liberty Financial Initiative (WLFI), aligning itself with the Trump family’s broader crypto agenda. These steps go beyond lobbying. They position Plume to influence U.S. regulatory priorities directly, creating structural advantages over competitors.

In Hong Kong, Plume has advanced its Asia strategy under the “Plume Kong” initiative. The centerpiece is a bridge program developed with Web3Labs and Cyberport, the government-owned digital technology hub. The program aims to attract up to $100 million in RWA capital, supported by incentives of up to $1 million.

Building from this base, Plume has tokenized Asia-recognized assets, including UBS products, through CMBI MMF and DigiFT. This demonstrates validation of Plume’s tokenization model and compliance framework by regulators in Singapore and Hong Kong.

Plume’s regulatory positioning is strategically significant in two ways. First, it proactively addresses regulatory uncertainty, the most material risk in the RWA sector. Second, by embedding itself within regulatory and policy frameworks, Plume creates barriers to entry that competitors cannot easily replicate. As the RWA market enters a phase of accelerated growth, this positioning offers a durable competitive advantage.

4. Plume’s Key Achievements and Ecosystem Expansion

In 2025, Plume secured significant traction in the RWA sector. It completed listings on major exchanges, including Bithumb and Upbit in Korea as well as Binance, expanding investor accessibility.

User adoption highlights its scale. The number of RWA holders rose from 167,000 in June to over 200,000 by September. More notable than the growth rate is market concentration: Plume accounts for over 50% of all crypto RWA investors, meaning one out of every two individuals investing in real-world assets through crypto does so via Plume.

The drivers of this growth can be traced to three core factors, beginning with ecosystem expansion through Nest.

4.1. Expansion Through Nest

Nest, with a TVL of about $60 million, anchors the Plume ecosystem by offering tokenized RWA products. Initially, access to Nest products required direct interaction through its website. In 2025, integration with major wallets such as OKX Wallet, Gate, and Bitget simplified the user experience and broadened reach.

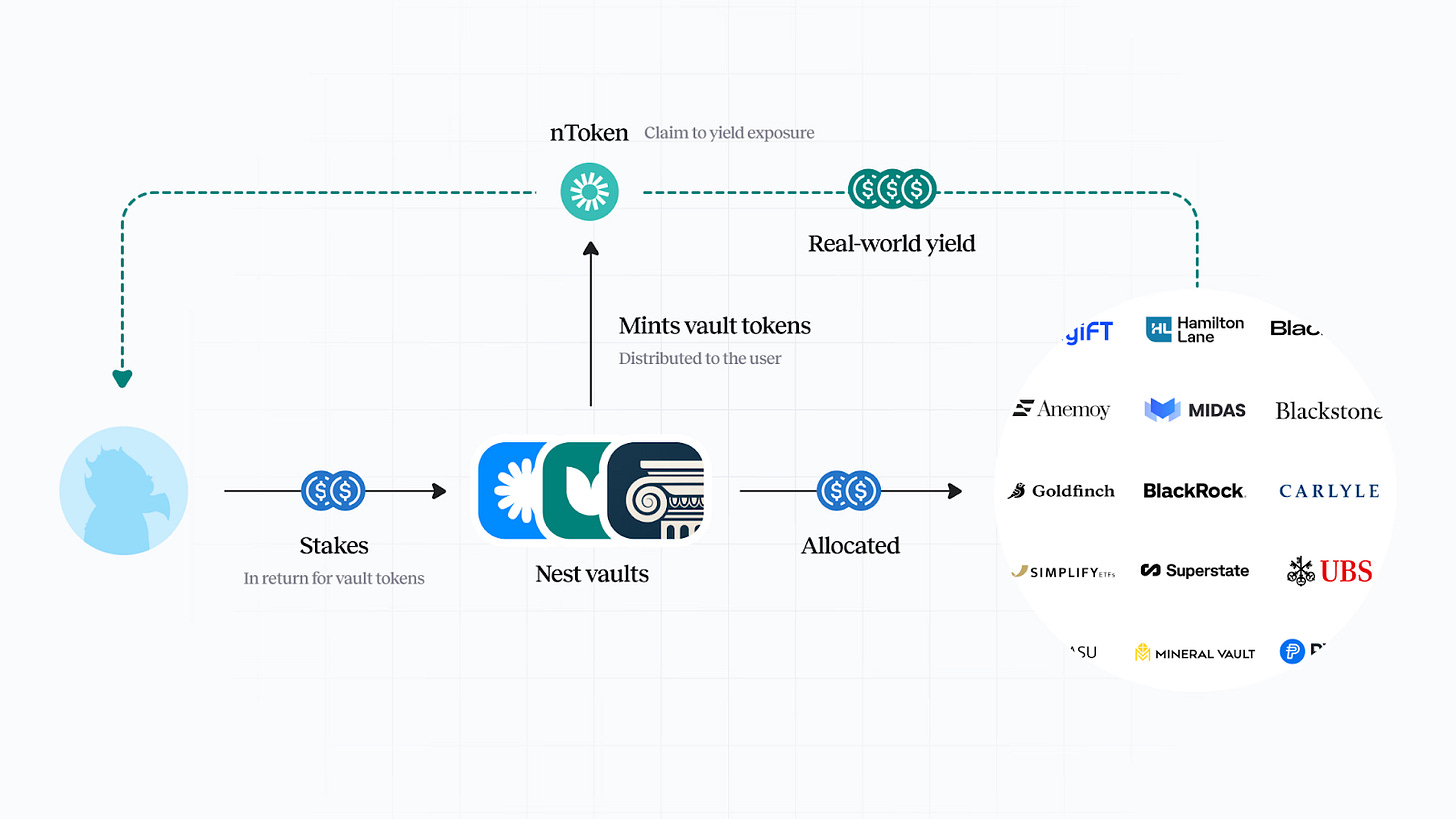

Additionally, Plume is the only public chain with AML at the sequencer level, and Nest onboarding comes with full compliance and accreditation. Nest is the flagship staking protocol on Plume enabling users to earn institutional-grade yields through real world assets.

This wallet integration was not only about convenience. It enabled Plume to distribute products directly to large existing user bases. For instance, a joint campaign with OKX Wallet in January 2025 onboarded substantial new users to Nest.

The most strategic partnership, however, has been with TopNod, an RWA-focused wallet backed by Ant Group. Positioned with the tagline “redefining how users connect with real-world value in Web3,” TopNod extends Nest’s reach into a much larger potential audience. Given Ant Group’s role as the operator of Alipay, the collaboration has the potential to drive mass adoption beyond the traditional crypto-native community.

4.2. Strengthening Infrastructure Through Ecosystem Expansion

After broadening user access through Nest, Plume shifted focus to building a robust infrastructure for stable and efficient RWA trading. A solid technical foundation is essential for user confidence and scalability.

One milestone was the integration of Circle’s USDC stablecoin. With CCTP V2 enabled, capital can move seamlessly across connected ecosystems, allowing users to transfer USDC faster and at lower cost for investment.

To improve payment convenience, Plume integrated Holyheld’s BRRR (Blockchain Reconciliation and Remittance Record) protocol, adding PayFi capabilities. BRRR bridges blockchain networks with traditional payment systems, enabling real-time global settlement. Users can now spend crypto with the ease of a credit card while simultaneously accessing RWA investment yields.

Plume also deployed its proprietary Skylink protocol in partnership with TRON. Skylink goes beyond standard cross-chain connectivity by enabling direct, secure investment into institutional-grade financial products across multiple blockchains. A key feature is the automatic distribution of investment yields directly to user wallets. Expansion to additional blockchains is planned.

4.3. Securing RWA Assets Through Institutional Partnerships

Alongside infrastructure development, Plume prioritized the supply side by securing investable RWA assets through partnerships with global asset managers and tokenization specialists.

On the asset management front, Plume collaborated with firms such as WisdomTree, Apollo Global, and CMBI. Apollo’s credit fund ACRDX was listed on Plume in September 2025 with $50 million in assets, covering corporate loans and real estate-backed lending.

With CMBI, Plume achieved a milestone by launching the world’s first on-chain money market fund approved by regulators in Hong Kong and Singapore. This represents a landmark case of blockchain integration within existing financial regulation.

In tokenization, Plume partnered with DigiFT, Singapore’s first licensed RWA exchange, to onboard uMINT, UBS Asset Management’s tokenized money market fund. This partnership demonstrated the viability of bringing regulated, institution-grade assets fully on-chain.

To strengthen institutional adoption, Plume also worked with service providers. Custody firm Cobo extended secure access to Plume’s RWA products for over 500 institutional clients. In addition, Plume engaged with EY at the Ethereum Denver conference to explore pathways for blockchain adoption within traditional institutions.

5. Moving into the Next Phase: Plume and Real World Bitcoin

Having established its RWAfi ecosystem, Plume’s next growth driver is entry into Real World Bitcoin. Real World Bitcoin seeks to transform Bitcoin from a passive store of value into “programmable capital” capable of generating yield.

The rationale is clear. Globally, approximately $2.18 trillion worth of Bitcoin remains idle without generating returns. Plume aims to unlock this dormant capital by linking Bitcoin with RWA and DeFi, thereby creating yield opportunities while reinforcing blockchain security.

The integration of Real World Bitcoin and RWA can take several forms. Bitcoin can be used as collateral to finance RWA investments, allowing holders to access assets such as real estate or Treasuries without liquidating their BTC.

Bitcoin-backed stablecoins can serve as settlement instruments for RWA transactions, offering transparency and efficiency beyond dollar-based systems. Cross-chain technology extends this further, enabling BTC to flow into tokenized assets across multiple blockchains—such as investing in Ethereum-based real estate tokens or purchasing Solana-issued Treasuries using Bitcoin collateral.

Plume’s approach is operationalized through its Bitcoin At Work partnership series, which engages projects across staking, restaking, credit strategies, stablecoin issuance, and cross-chain payments. These collaborations allow BTC holders to generate returns without relinquishing custody of their assets.

The Bitcoin at Work series highlighted 15 partners, including Arkis, Avalon, Babylon, BIMA, BitFi, BounceBit, Cobo, CIAN Finance, DeSyn, exSat, MaxBTC, Pell, SatLayer, SOLV, and Yala.

Plume’s ‘Real World Bitcoin’ strategy is more than product expansion. By connecting Bitcoin’s deep liquidity with the RWA ecosystem, Plume positions itself to expand the overall addressable market substantially. Its long-standing technical expertise within Web3 enables this integration in ways that traditional finance or purely RWA-focused platforms cannot easily replicate.

6. Outlook: Plume’s Strategic Positioning

The trajectory of Web3 RWA projects depends on building distinct market positions rather than competing head-on with traditional institutions. Plume exemplifies this principle. Its strategy is rooted in maintaining a Web3-native perspective: not repairing inefficiencies in legacy finance but focusing on what crypto users value most—yield, speed, and accessibility. The emphasis is on creating a new ecosystem rather than modifying the old one.

At the same time, Plume systematically manages regulatory risk. By engaging directly with policymakers in the U.S., Hong Kong, and Korea, it embeds itself in the policy formation process. Given that regulatory uncertainty is the most significant risk in RWA markets, this is less lobbying than a survival strategy.

As a result, Plume has achieved a balanced position. For Web3 users, it delivers profitability and liquidity. For institutions, it opens new asset classes and investment channels. This dual positioning is possible precisely because Plume began from within Web3 rather than attempting to retrofit traditional finance.

Growth prospects remain strong. The RWA market itself is accelerating under government and institutional support, and BTCFi adds another engine by mobilizing trillions in idle Bitcoin capital. Plume is not operating within either traditional finance or Web3 alone, but carving out a new domain that bridges both. This places it at the forefront of an ongoing paradigm shift in global finance, underpinning its potential for sustained growth.

🐯 More from Tiger Research

Read more reports related to this research.Disclaimer

This report was partially funded by Plume. It was independently produced by our researchers using credible sources. The findings, recommendations, and opinions are based on information available at publication time and may change without notice. We disclaim liability for any losses from using this report or its contents and do not warrant its accuracy or completeness. The information may differ from others’ views. This report is for informational purposes only and is not legal, business, investment, or tax advice. References to securities or digital assets are for illustration only, not investment advice or offers. This material is not intended for investors.

Terms of Usage

Tiger Research allows the fair use of its reports. ‘Fair use’ is a principle that broadly permits the use of specific content for public interest purposes, as long as it doesn’t harm the commercial value of the material. If the use aligns with the purpose of fair use, the reports can be utilized without prior permission. However, when citing Tiger Research’s reports, it is mandatory to 1) clearly state ‘Tiger Research’ as the source, 2) include the Tiger Research logo following brand guideline. If the material is to be restructured and published, separate negotiations are required. Unauthorized use of the reports may result in legal action.